Waves (WAVES) surfing higher on Vostok second fund raise and Blockpass KYC integration #cryptocurrency

St Petersburg-based Waves blockchain platform is catching headlines at the moment.

The price has been on a declining trajectory since the beginning of April after being previously supported by the fundraising of the Vostok project and associated airdrop, which is rolling out a private blockchain service for enterprise.

The first fund raise which closed at the end of last year pulled in $120 million from investors around the world, notably Europe, China and Southeast Asia, according to the company.

Vostok lights a fire

A second funding round, beginning on 31 May aims to raise a further $120 million and with Russia’s state-owned Sberbank among the companies known to be testing the project’s permissioned platform, Waves is getting some traction in enterprise.

This second round, when completed, will value Vostok at $1.2 billion.

200 million of the 1 billion supply of the VST token is being sold across the two funding rounds. Owners of Waves are entitled to a 1:1 drop of 4% of the total VST supply.

Waves timing is fortuitous given the current buoyant state of the crypto market, which could see investors look to get in on the action.

Even if its international roll out proves to be not as quick as the company marketing would have it, its Russian penetration alone makes Vostok and parent Waves definitely ones to watch this month.

Vostok’s Russian deals in addition to Sberbank include transport and logistics outfit Transmashholding, VEB.RF, a development bank, tech conglomerate Rostec’s subsidiary National Center Informatization and Kazakhstan’s Transtelecom.

Blockpass KYC will help drive dev adoption

Waves already has a unique position as the go-to platform for those who want to quickly create a digital asset.

It also has a decentralised exchange which it launched two years ago.

Other news that could help to drive adoption by devs is the integration of Blockpass’s KYC Connect tool. The start-up is a leader in digital identification management.

As regulatory demands increase, compliance with Know Your Customer rules is a complication that the integration should make dealing with a breeze.

After Waves has integrated KYC Connect there will be an airdrop of the PASS token which is then used in conjunction with the Blockpass app to verify profiles. Once verified and a certificate has been issued, the user’s identity is added to the Waves PASS whitelist.

Take A RIDE with the incubator

Last month also saw the launch of the Waves Incubator in a further statement of intent.

In a build-out from Waves Grants that began at the start of the year, the project will see selected projects able to access up to 100,000 in WAVES tokens.

Submitting projects must use Waves’s RIDE programming language and the RIDE for dApps which is still on a Testnet but already attracting developers, according to Waves.

That ease of use had its downside as the platform began to attract scammers and low-quality projects.

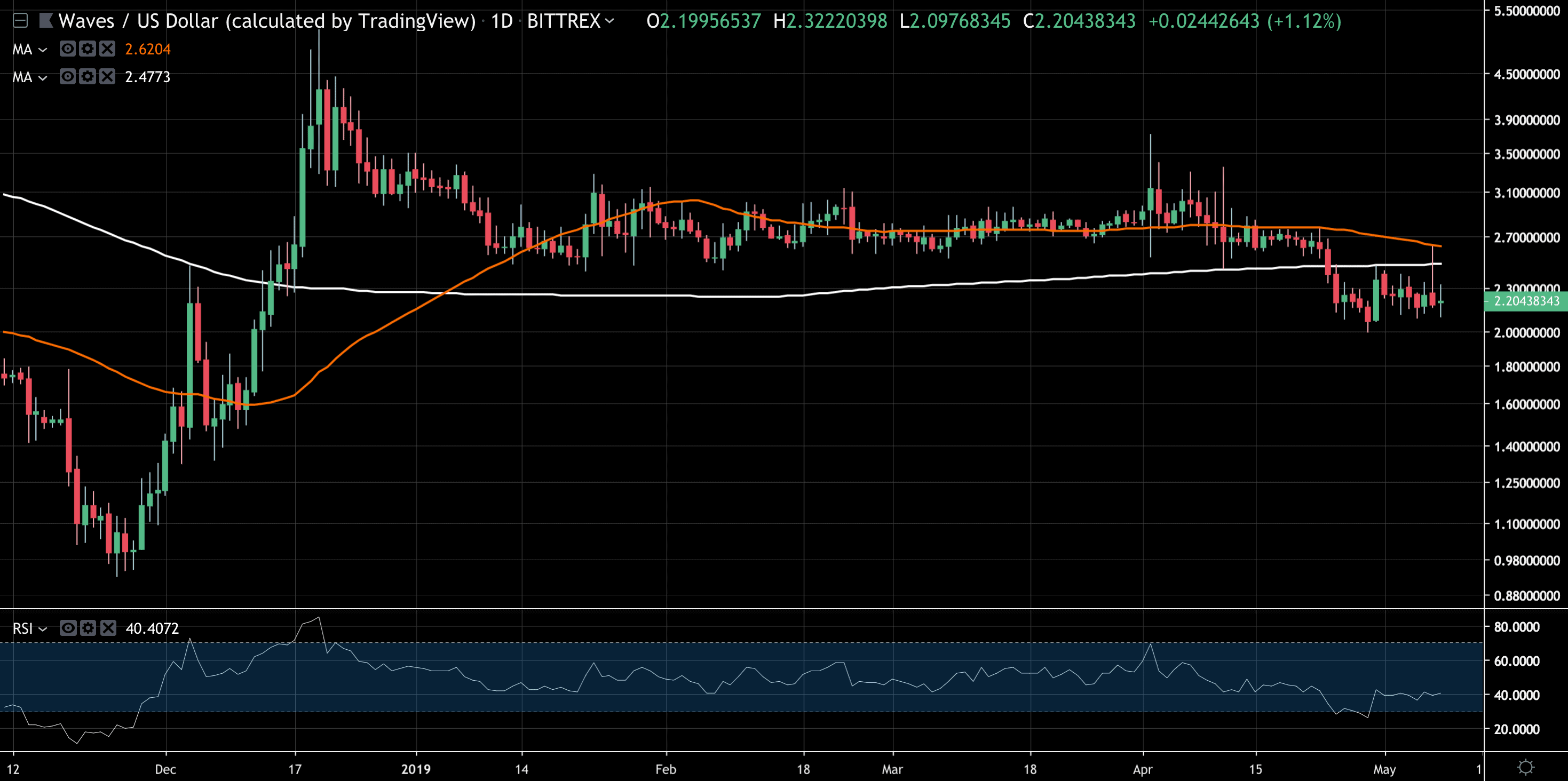

From an all-time high of $18 the price is currently trading at $2.19, according to coinmarketcap, up 4% in the past 24 hours.

In the chart below, the red line is the 50-day moving average and the white line the 200-day moving average.

The price has been chugging along uninspiringly and on the one-day is near the bottom of its trading range for the year, presenting a good entry point.

The post Waves (WAVES) surfing higher on Vostok second fund raise and Blockpass KYC integration appeared first on InsideBitcoins.com.

OhNoCrypto via http://bit.ly/2FUbkJa @Gary McFarlane, @Khareem Sudlow