Ethereum Classic Price Analysis - Atlantis protocol upgrade scheduled for September

#crypto #bitcoin

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow

Ethereum Classic (ETC) is a distributed ledger and decentralized computing platform with smart contract capabilities, created in 2016 after a fork in the original Ethereum (ETH) project. The crypto asset is currently 18th on the BraveNewCoin market cap table, at US$1.06 billion, with US$490.73 million in trade volume over the past 24 hours. The ETC spot price is down 80% from the all-time high set in mid-January 2018.

ETC was created by a contentious hard fork, following the Decentralized Autonomous Organization (DAO) hack in June 2016, which lead to approximately US$50 million being drained from the DAO through recursive call attacks. The DAO was originally established as a venture capital fund built on Ethereum and launched with a crowd sale in April 2016. As of May 2016, the fund held ~14% of the Ethereum total supply, roughly ~US$150 million, from 11,000 investors.

To recoup the lost funds, a hard fork of the original Ethereum chain quickly followed the hack. The original chain survived, in large part due to exchange listings, and was renamed Ethereum Classic. ETC proponents questioned the immutability of the ETH ledger after the hard fork solution was implemented. Additionally, the ETC developers and community agreed to cap issuance and decrease the block reward. Annual inflation on the network currently stands at 7.76% compared to ETH’s 4.56%.

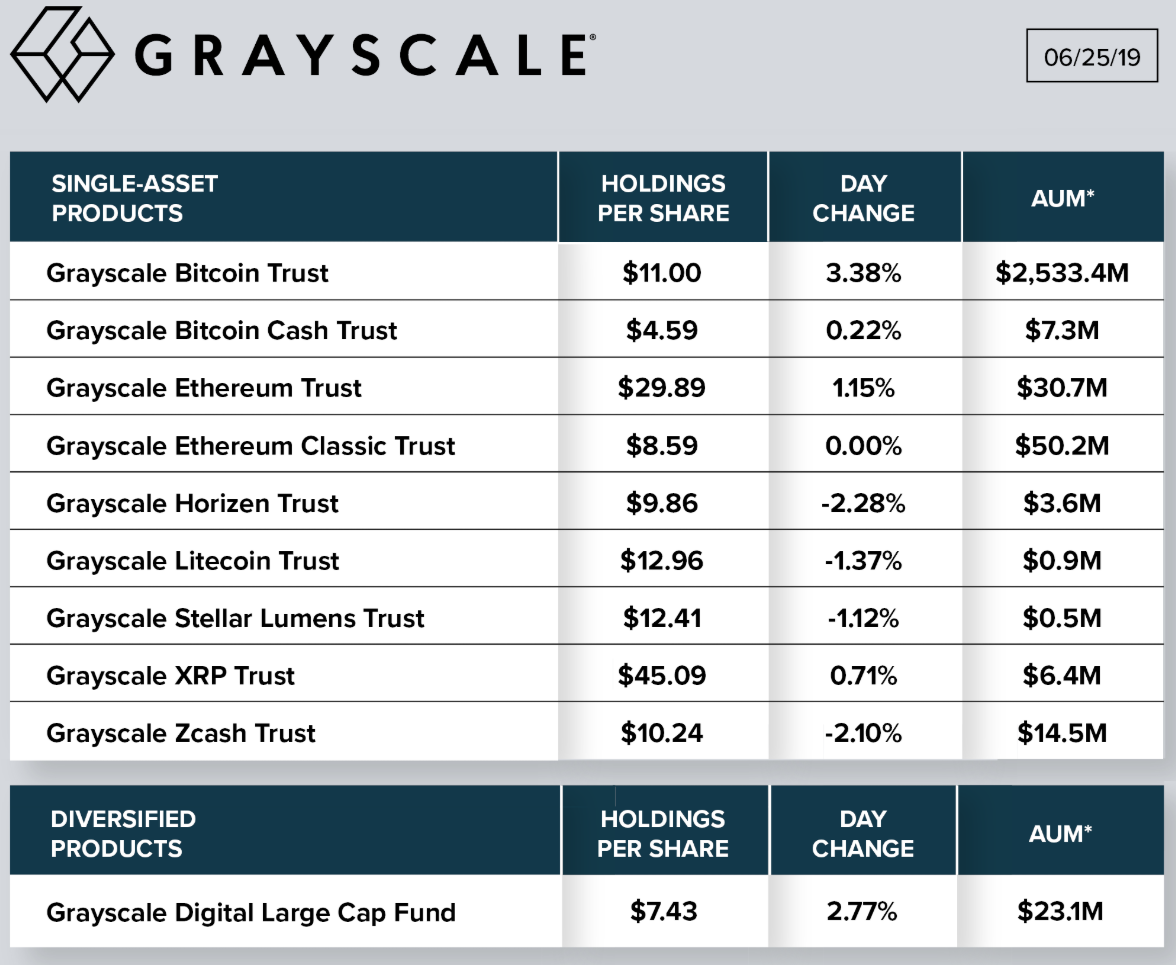

Barry Silbert, founder and CEO of Digital Currency Group (DCG), was one of the most prominent members of the community embracing ETC and encouraging future development, through Hong Kong-based IOHK.

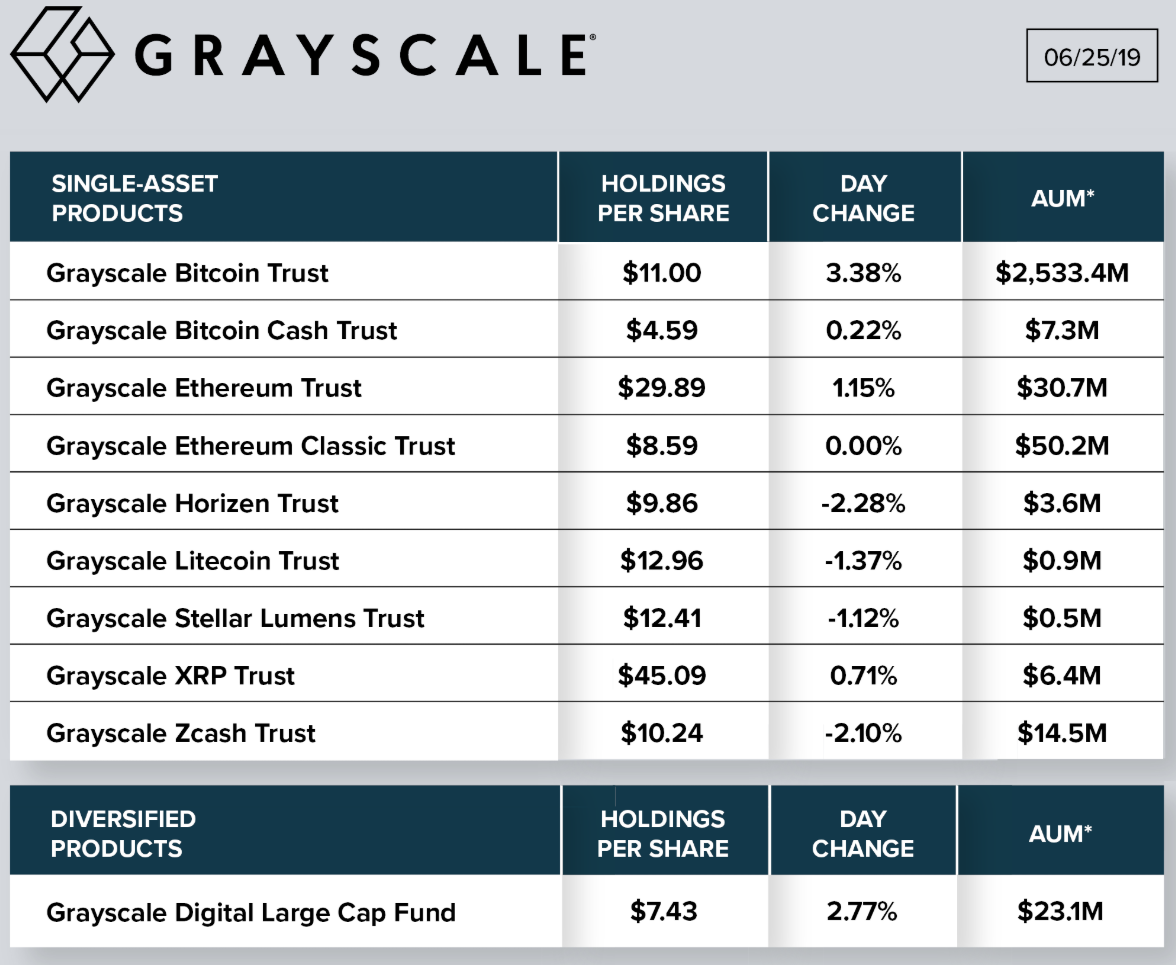

A subsidiary of DCG, Grayscale, is comprised of several funds which issue shares backed by crypto. The trust issues shares for an ETC product which currently has US$50.2 million in assets under management, representing 5,477,762 ETC, or 4.91% of the circulating supply. The trust intends to direct up to one-third of the Annual Fee, for the first three years of the trust's operations, towards the Ethereum Classic Cooperative, whose initiatives support development, marketing, and community activities of the Ethereum Classic Network.

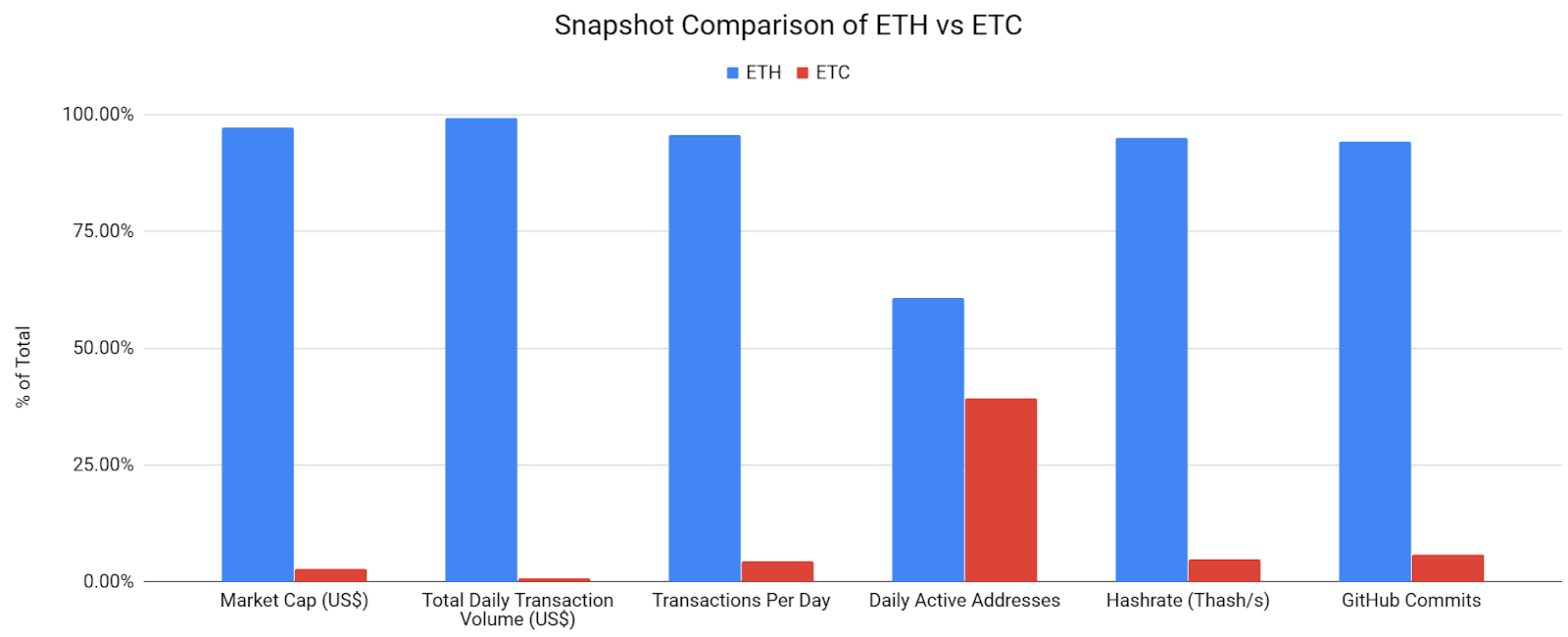

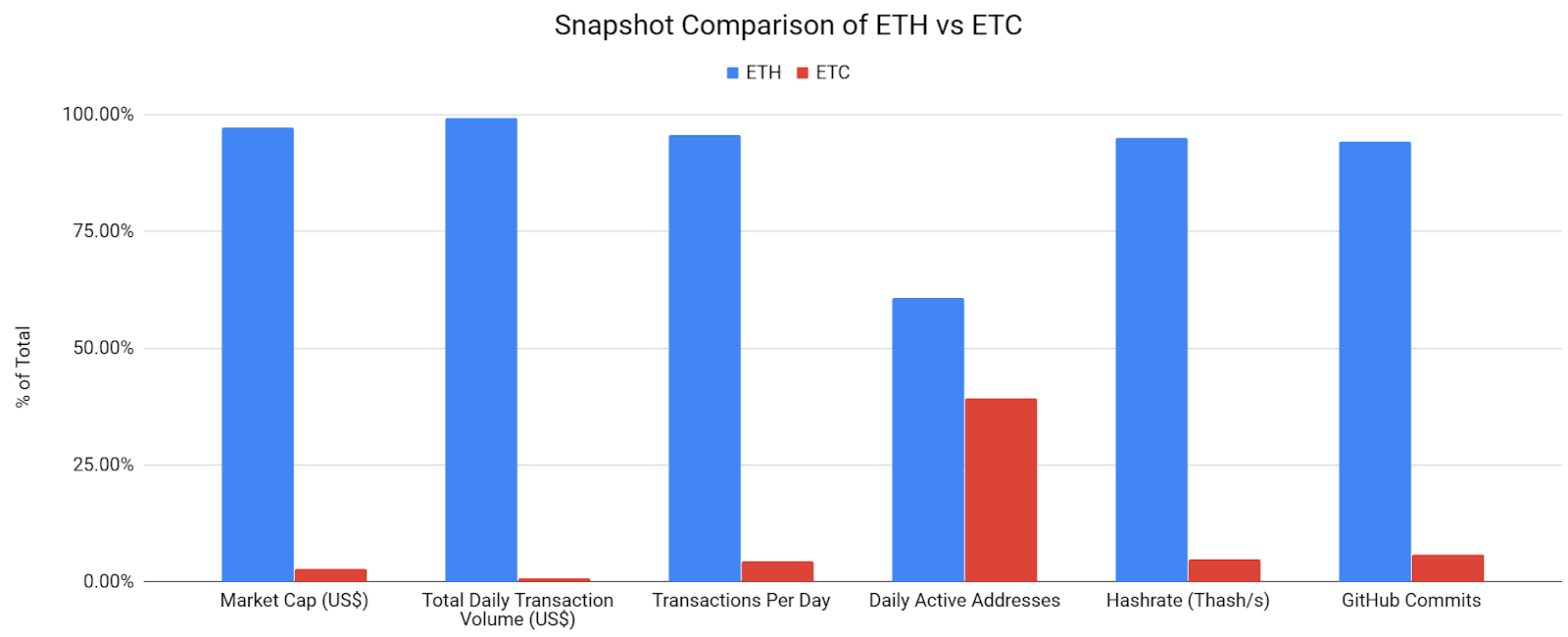

A quick comparison between Ethereum and Ethereum Classic shows Ethereum dominating by every metric, including; market cap, transactions per day, hashrate, and GitHub commits on the main repo over the past year. Daily active addresses on ETC have increased dramatically since November 2018, closing the gap between ETH significantly. However, total daily transaction volume suggests these transactions have very little value.

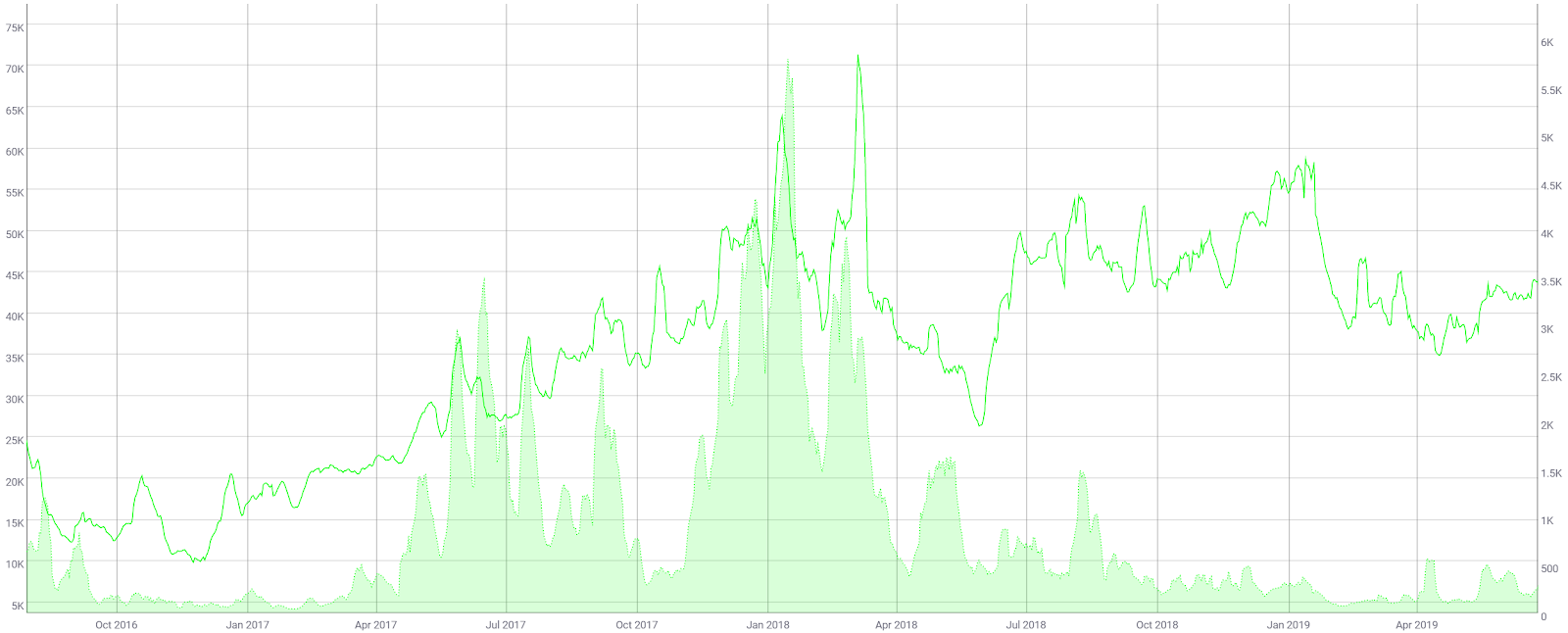

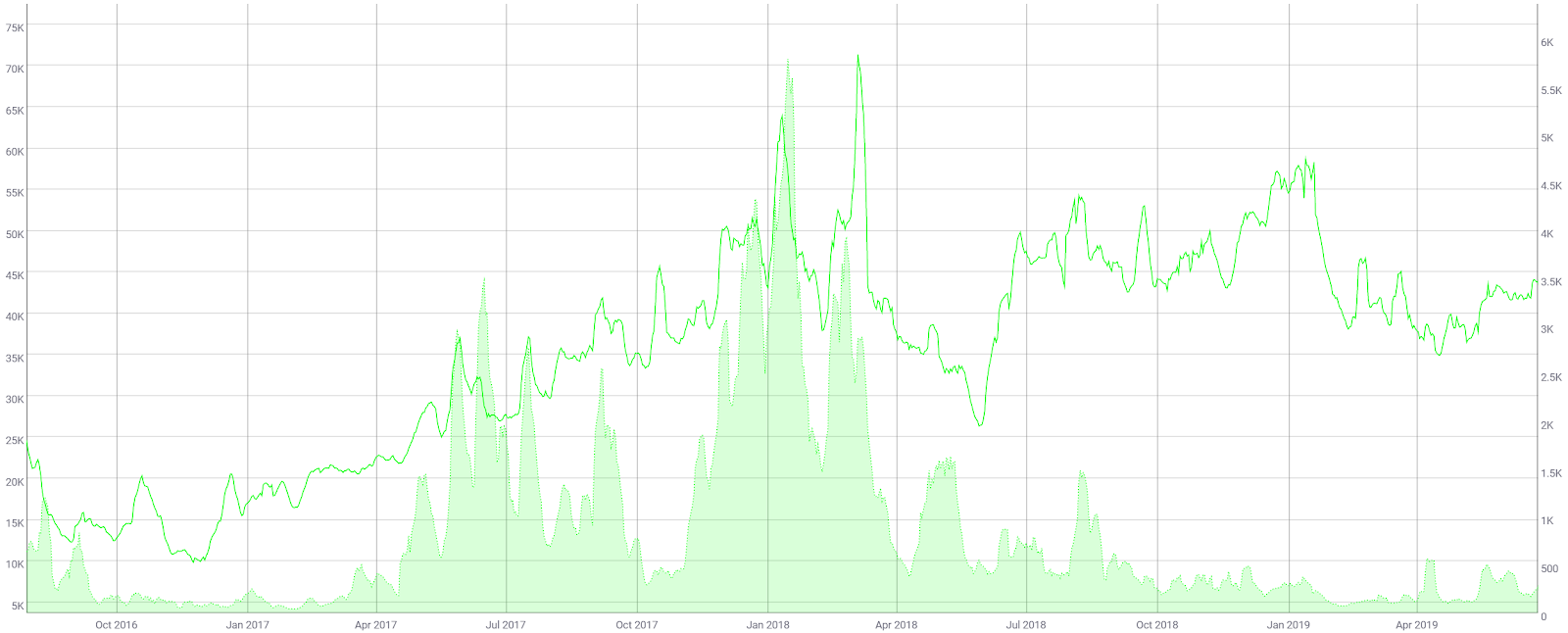

The number of ETC on-chain transactions per day (line, chart below) has ranged from 35,000 to 46,000 since mid-January. Transactions per day hit an all-time high in March 2018 after breaching the 70,000 mark. A significant uptick in transactions per day should be seen as a bullish indicator.

The average transaction value per day (fill, chart below) has increased dramatically since February 2018 and has held below US$600 since August 2018. Average transaction value hit an all-time high in mid-January 2018 at nearly US$6,000, also corresponding with an all-time high in ETC token price.

Source: coinmetrics

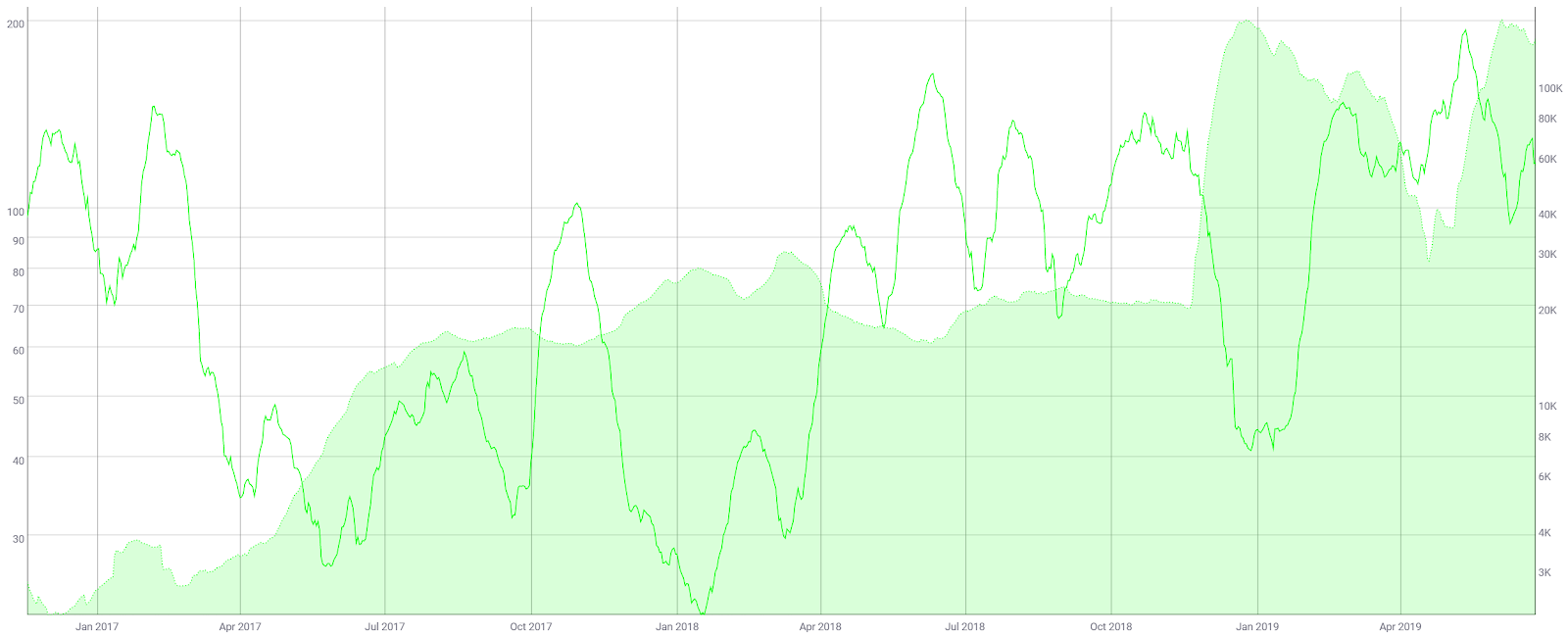

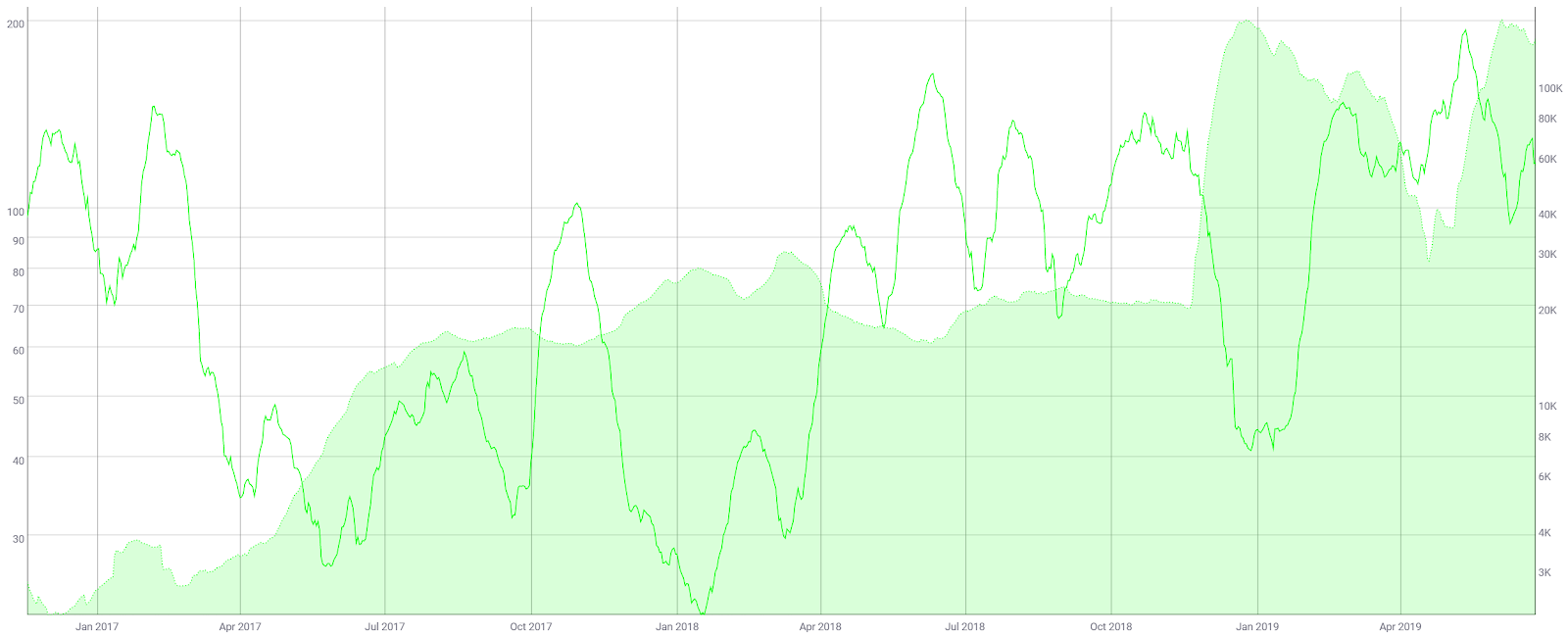

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has mostly held above 70 since April 2018. NVT dropped to around 40 in December 2018 and January 2019 before quickly rising again. NVT hit an ATH of nearly 60 in mid-May.

A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite. An increasing NVT with a new uptrend in price suggests the asset is currently overbought or that the NVT metric may need to be retooled to better understand market variables.

Monthly active addresses (MAA) spiked dramatically in late 2018 and have held at ATH levels throughout 2019 (fill, chart below). These addresses may represent a mixing service or a type of network test. These addresses likely do not represent additional miners being added to the network, as hash rate has declined since this time period. In general, a sustained uptick in MAA should be seen as a bullish indicator as this indicates increased blockchain use and interest.

Source: coinmetrics

Mining activity over the past few years has increased substantially thanks to ASICs developed by Innosilicon, Bitmain, and PandMiner for the Ethash consensus algorithm. Hash rate peaked in September 2018 and is currently sitting within the previous multi-year range set from October 2017 to July 2018. As opposed to ETH, ETC is unlikely to ever implement Proof of Stake (PoS) and will likely remain a Proof of Work (PoW) chain for the indefinite future. As ETH mining becomes more and more unprofitable with successive changes to the ETH block reward, miners will likely point their Ethash ASICs towards the ETC chain.

Source: bitinfocharts

In early January this year, ETC suffered a 51% attack via “deep chain reorganization.” Mark Nesbitt, a security engineer at Coinbase, alerted the community of the attack with a blog post explaining the matter. Coinbase disabled ETC transfers at that time, and subsequently re-enabled them on March 11th. The trading platform now requires 5676 confirmations for ETC deposits, which would take about 24 hours in normal conditions.

The attack resulted in double-spends for 219,500 ETC, or US$1.1 million at that time, according to the blog post. Shortly after the attack, a site to monitor the status of potential 51% attacks was released by ETC Labs. Hashrate has remained relatively stable since the incident.

Exchanges are typically the most vulnerable and biggest targets during a 51% attack. Gate.io reported the theft of 40,000 ETC, or US$200,000 at that time. A few days later, US$100,000 in ETC was returned to the exchange with no explanation. Bittrue also announced there was an attempt to withdraw 13,000 ETC during the 51% attack, but the withdraw was stopped by exchange-side countermeasures.

Source: https://blog.coinbase.com

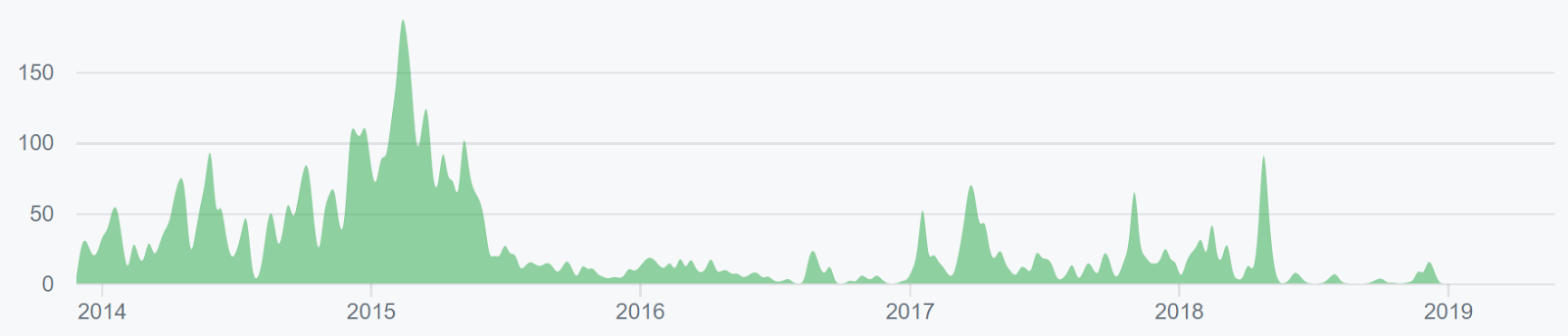

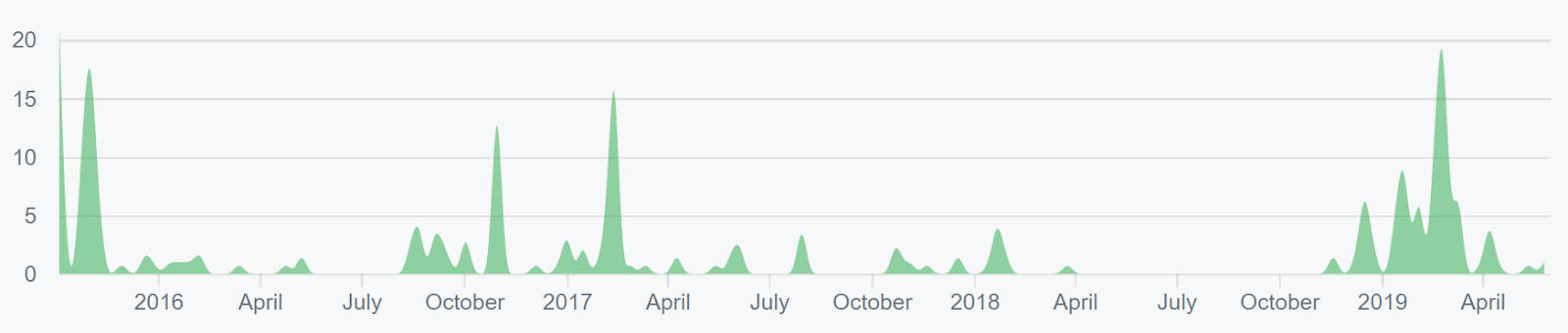

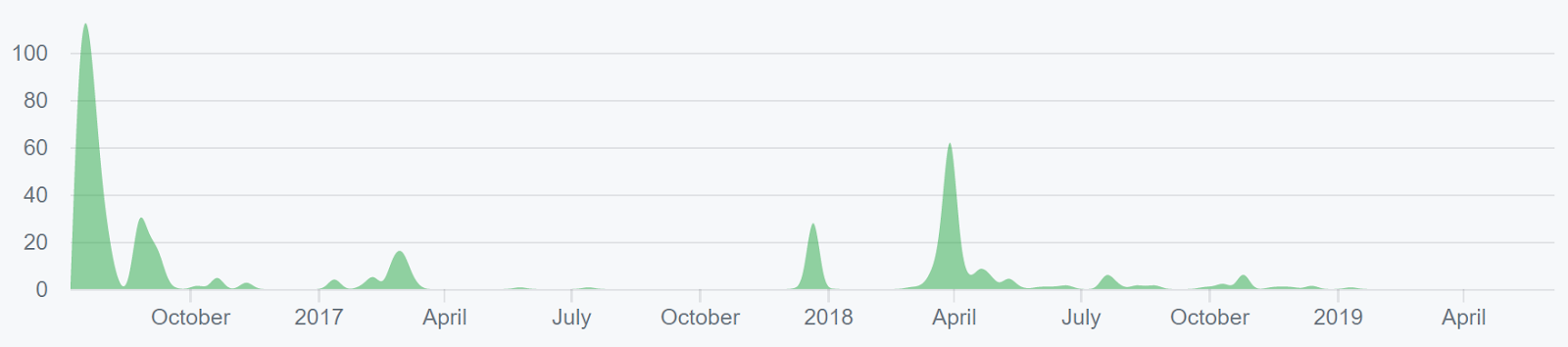

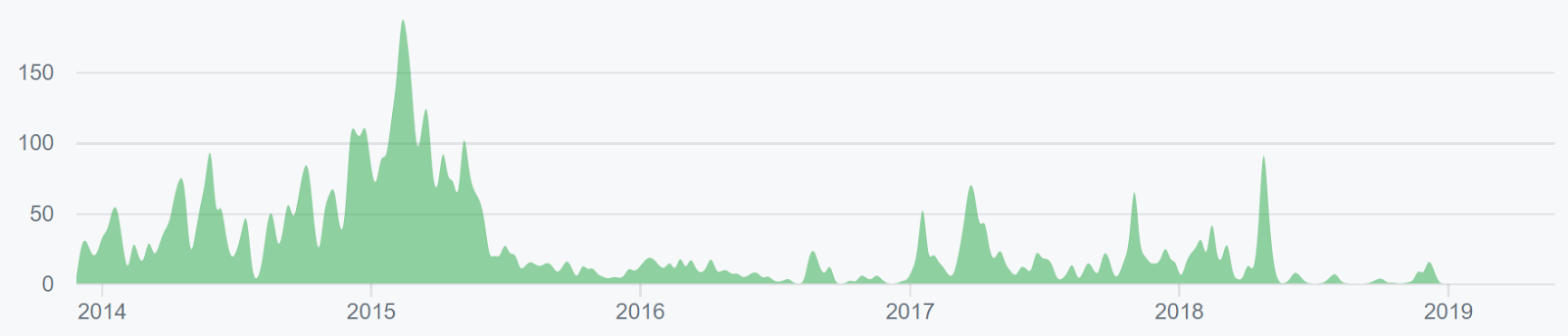

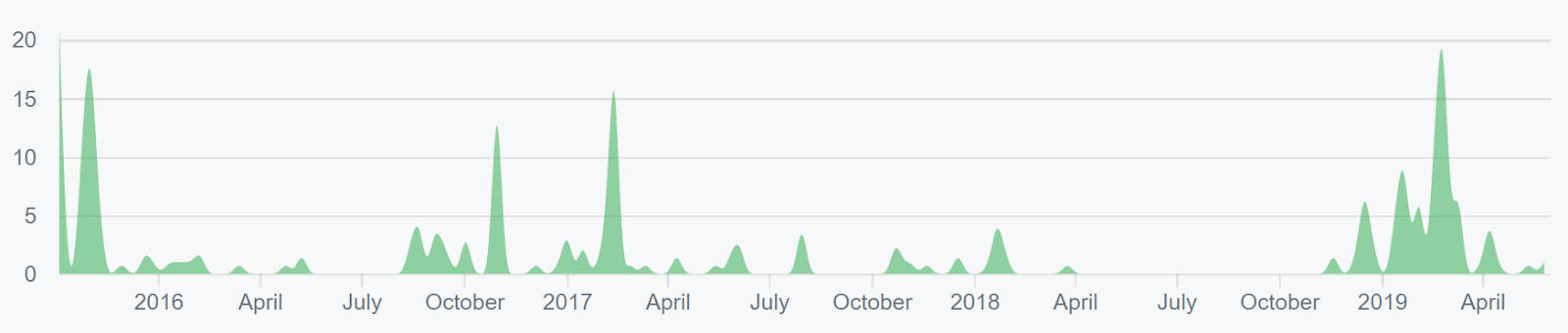

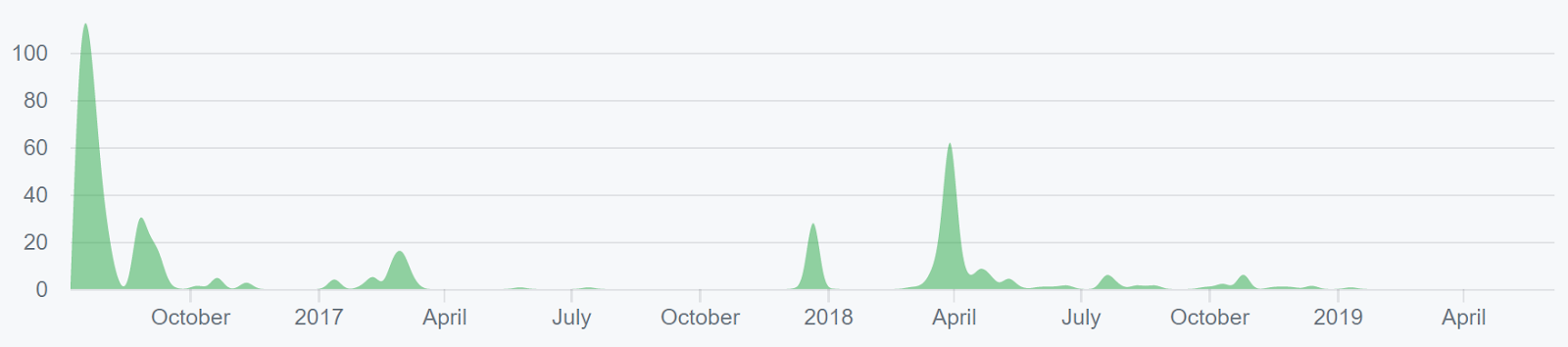

Turning to developer activity, the ETC project has 60 repos on GitHub. Overall, the most active repos historically, have had relatively few commits over the past year (shown below). The Ethereum Classic Improvement Protocol (ECIP) repo has been the most active over the past few months.

Most coins use this development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

On January 8th, after the 51% attack, ECIP-1049 was introduced by Alexander Tsankov. The proposal centers on changing the ETC PoW algorithm from Ethash to Keccak256. Tsankov believes that this algorithm would be less vulnerable to 51% attacks. Keccak256 is used in Solidity for ETH smart contracts. Discussions regarding the possible change are currently ongoing, and includes a wider discussion around implementing ProgPoW, which is likely to be released on ETH later this year.

In April, the ETC Labs dev team released plans to implement ECIP-1054, Atlantis, which will enable the Spurious Dragon and Byzantium network protocol upgrades currently active on the ETH network. The protocol changes will increase interoperability between the ETC and ETH chains. Atlantis main-net implementation is slated for inclusion at block 8,772,000 in September 2019.

The _Constantinople _protocol changes will be included in the ECIP-1056, Agharta, which currently has no set date currently for release. Both ECIPs will occur via a hard fork and aim to increase ETC and ETH compatibility.

Source: https://github.com/ethereumclassic/go-ethereum/graphs/contributors

Source: https://github.com/ethereumclassic/ECIPs/graphs/contributors

Source: https://github.com/ethereumclassic/explorer/graphs/contributors

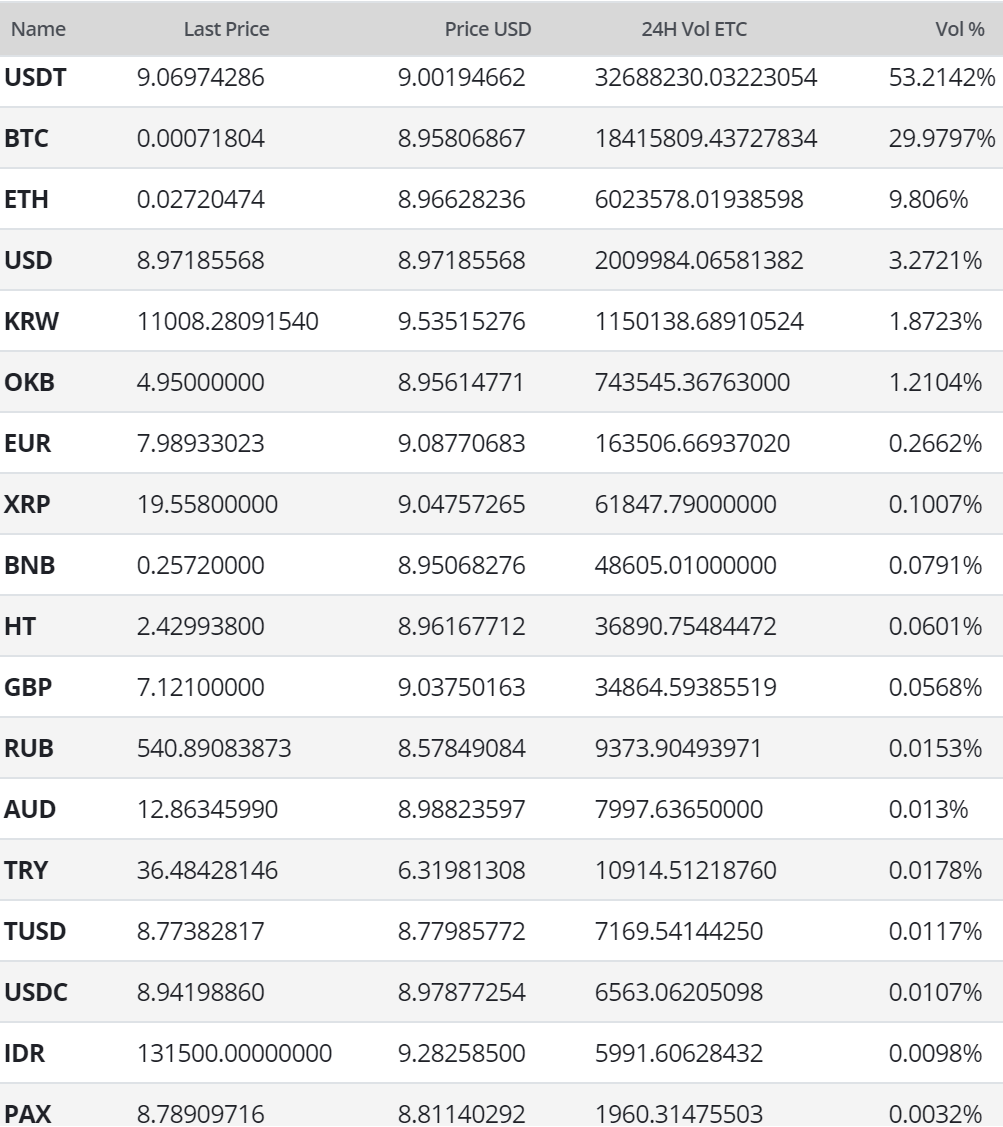

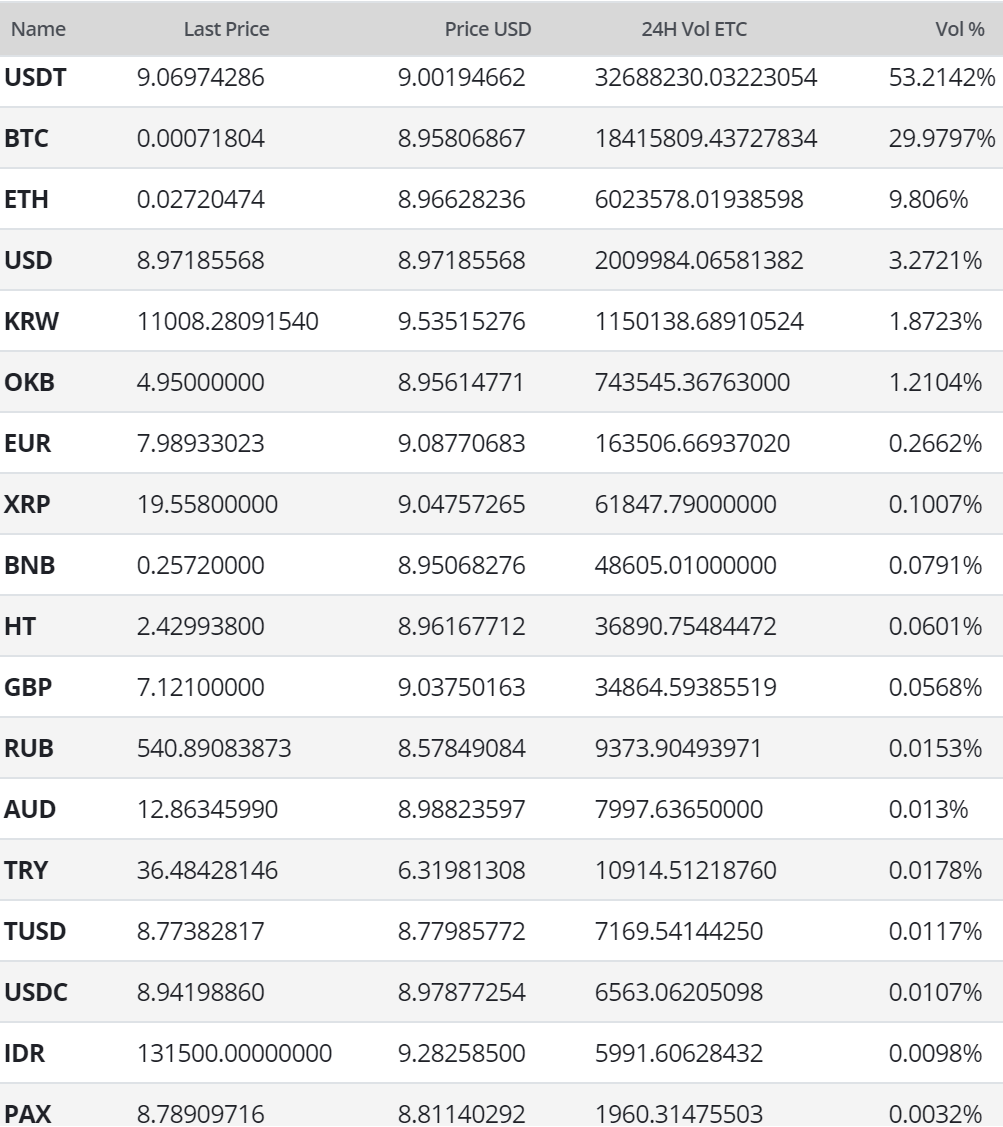

In the markets, ETC exchange traded volume over the past 24 hours has predominantly been led by the Tether (USDT), Bitcoin (BTC), and Ethereum (ETH) pairs. The Korean Won (KRW) pair currently holds a 5.8% premium over the USD pair.

Although many exchanges paused ETC deposits and withdrawals in January, during the 51% attack, they have since resumed trading as normal. In April, Poloniex enabled ETC/BTC margin trading up to 2.5x leverage for non-U.S. customers. ETC/BTC and ETC/USD pairs were added to ETHfinex in May.

On the daily chart, the 50-day and 200-day exponential moving averages (EMAs) have been bullishly crossed since late May, ending the 427-day bear market. The 200-day EMA at US$7.20 should now act as support. Significant volume resistance (horizontal bars) sits between the US$13.50 to US$16.50 zone. There are currently no active RSI or volume divergences although RSI has consolidated since April.

The long/short open interest on Bitfinex (top panel, chart below) since April 2018 has been heavily net long, with long positions currently accounting for 70% of open interest. A significant price movement downwards will result in an exaggerated move further, as the long positions will begin to unwind. This is known as a “long squeeze.”

Price also remains bound by a multi-year bearish Pitchfork (PF) with anchor points in May and September 2017 and May 2018. Price broke out from a falling wedge in November 2018, to the down side, breaching the PF median line (yellow) with significant bearish momentum. Based on this PF, the macro trend will remain bearish until a break above US$11.82. The US$10 level represents significant psychological resistance.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, have remained bullish since May; price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and above price. The Kijun support currently sits at US$7.72.

Additionally, a potential bearish reversal pattern has formed, the rising wedge. The hallmarks of this pattern include a series of higher highs and higher lows in a tighter and tighter range. Measured move targets bring price to US$6.90, which is also Cloud support. Over the past few months, rising wedges have represented bullish continuation on several other coins.

Lastly, on the daily ETC/BTC chart, trend indicators suggest a bearish trend with oversold metrics with price at an all-time low. The 50-day and 200-day EMAs have been bearishly crossed for 344 days. There is a large bullish divergence on RSI with price significantly below the 200-day EMA. Open interest on Bitfinex is currently 52% short (not shown). A mean reversion target of 11,500 sats is suggested both by the 200-day EMA and a high volume node (horizontal bars).

Technicals for the ETC/USD pair suggest a strong bullish trend, based on daily Cloud and high timeframe moving averages. Prices above the psychological resistance of US$10 should see significant bullish momentum. The ETC/BTC pair has reached for fresh all-time lows over the past week with a bullish divergence, which is suggestive of market capitulation. Knife-catchers will likely continue to slowly move back into the pair based on the risk/reward profile of a mean reversion to 11,500 sats.

ETC was created by a contentious hard fork, following the Decentralized Autonomous Organization (DAO) hack in June 2016, which lead to approximately US$50 million being drained from the DAO through recursive call attacks. The DAO was originally established as a venture capital fund built on Ethereum and launched with a crowd sale in April 2016. As of May 2016, the fund held ~14% of the Ethereum total supply, roughly ~US$150 million, from 11,000 investors.

To recoup the lost funds, a hard fork of the original Ethereum chain quickly followed the hack. The original chain survived, in large part due to exchange listings, and was renamed Ethereum Classic. ETC proponents questioned the immutability of the ETH ledger after the hard fork solution was implemented. Additionally, the ETC developers and community agreed to cap issuance and decrease the block reward. Annual inflation on the network currently stands at 7.76% compared to ETH’s 4.56%.

Barry Silbert, founder and CEO of Digital Currency Group (DCG), was one of the most prominent members of the community embracing ETC and encouraging future development, through Hong Kong-based IOHK.

A subsidiary of DCG, Grayscale, is comprised of several funds which issue shares backed by crypto. The trust issues shares for an ETC product which currently has US$50.2 million in assets under management, representing 5,477,762 ETC, or 4.91% of the circulating supply. The trust intends to direct up to one-third of the Annual Fee, for the first three years of the trust's operations, towards the Ethereum Classic Cooperative, whose initiatives support development, marketing, and community activities of the Ethereum Classic Network.

A quick comparison between Ethereum and Ethereum Classic shows Ethereum dominating by every metric, including; market cap, transactions per day, hashrate, and GitHub commits on the main repo over the past year. Daily active addresses on ETC have increased dramatically since November 2018, closing the gap between ETH significantly. However, total daily transaction volume suggests these transactions have very little value.

The number of ETC on-chain transactions per day (line, chart below) has ranged from 35,000 to 46,000 since mid-January. Transactions per day hit an all-time high in March 2018 after breaching the 70,000 mark. A significant uptick in transactions per day should be seen as a bullish indicator.

The average transaction value per day (fill, chart below) has increased dramatically since February 2018 and has held below US$600 since August 2018. Average transaction value hit an all-time high in mid-January 2018 at nearly US$6,000, also corresponding with an all-time high in ETC token price.

Source: coinmetrics

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has mostly held above 70 since April 2018. NVT dropped to around 40 in December 2018 and January 2019 before quickly rising again. NVT hit an ATH of nearly 60 in mid-May.

A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite. An increasing NVT with a new uptrend in price suggests the asset is currently overbought or that the NVT metric may need to be retooled to better understand market variables.

Monthly active addresses (MAA) spiked dramatically in late 2018 and have held at ATH levels throughout 2019 (fill, chart below). These addresses may represent a mixing service or a type of network test. These addresses likely do not represent additional miners being added to the network, as hash rate has declined since this time period. In general, a sustained uptick in MAA should be seen as a bullish indicator as this indicates increased blockchain use and interest.

Source: coinmetrics

Mining activity over the past few years has increased substantially thanks to ASICs developed by Innosilicon, Bitmain, and PandMiner for the Ethash consensus algorithm. Hash rate peaked in September 2018 and is currently sitting within the previous multi-year range set from October 2017 to July 2018. As opposed to ETH, ETC is unlikely to ever implement Proof of Stake (PoS) and will likely remain a Proof of Work (PoW) chain for the indefinite future. As ETH mining becomes more and more unprofitable with successive changes to the ETH block reward, miners will likely point their Ethash ASICs towards the ETC chain.

Source: bitinfocharts

In early January this year, ETC suffered a 51% attack via “deep chain reorganization.” Mark Nesbitt, a security engineer at Coinbase, alerted the community of the attack with a blog post explaining the matter. Coinbase disabled ETC transfers at that time, and subsequently re-enabled them on March 11th. The trading platform now requires 5676 confirmations for ETC deposits, which would take about 24 hours in normal conditions.

The attack resulted in double-spends for 219,500 ETC, or US$1.1 million at that time, according to the blog post. Shortly after the attack, a site to monitor the status of potential 51% attacks was released by ETC Labs. Hashrate has remained relatively stable since the incident.

Exchanges are typically the most vulnerable and biggest targets during a 51% attack. Gate.io reported the theft of 40,000 ETC, or US$200,000 at that time. A few days later, US$100,000 in ETC was returned to the exchange with no explanation. Bittrue also announced there was an attempt to withdraw 13,000 ETC during the 51% attack, but the withdraw was stopped by exchange-side countermeasures.

Source: https://blog.coinbase.com

Turning to developer activity, the ETC project has 60 repos on GitHub. Overall, the most active repos historically, have had relatively few commits over the past year (shown below). The Ethereum Classic Improvement Protocol (ECIP) repo has been the most active over the past few months.

Most coins use this development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

On January 8th, after the 51% attack, ECIP-1049 was introduced by Alexander Tsankov. The proposal centers on changing the ETC PoW algorithm from Ethash to Keccak256. Tsankov believes that this algorithm would be less vulnerable to 51% attacks. Keccak256 is used in Solidity for ETH smart contracts. Discussions regarding the possible change are currently ongoing, and includes a wider discussion around implementing ProgPoW, which is likely to be released on ETH later this year.

In April, the ETC Labs dev team released plans to implement ECIP-1054, Atlantis, which will enable the Spurious Dragon and Byzantium network protocol upgrades currently active on the ETH network. The protocol changes will increase interoperability between the ETC and ETH chains. Atlantis main-net implementation is slated for inclusion at block 8,772,000 in September 2019.

The _Constantinople _protocol changes will be included in the ECIP-1056, Agharta, which currently has no set date currently for release. Both ECIPs will occur via a hard fork and aim to increase ETC and ETH compatibility.

Source: https://github.com/ethereumclassic/go-ethereum/graphs/contributors

Source: https://github.com/ethereumclassic/ECIPs/graphs/contributors

Source: https://github.com/ethereumclassic/explorer/graphs/contributors

In the markets, ETC exchange traded volume over the past 24 hours has predominantly been led by the Tether (USDT), Bitcoin (BTC), and Ethereum (ETH) pairs. The Korean Won (KRW) pair currently holds a 5.8% premium over the USD pair.

Although many exchanges paused ETC deposits and withdrawals in January, during the 51% attack, they have since resumed trading as normal. In April, Poloniex enabled ETC/BTC margin trading up to 2.5x leverage for non-U.S. customers. ETC/BTC and ETC/USD pairs were added to ETHfinex in May.

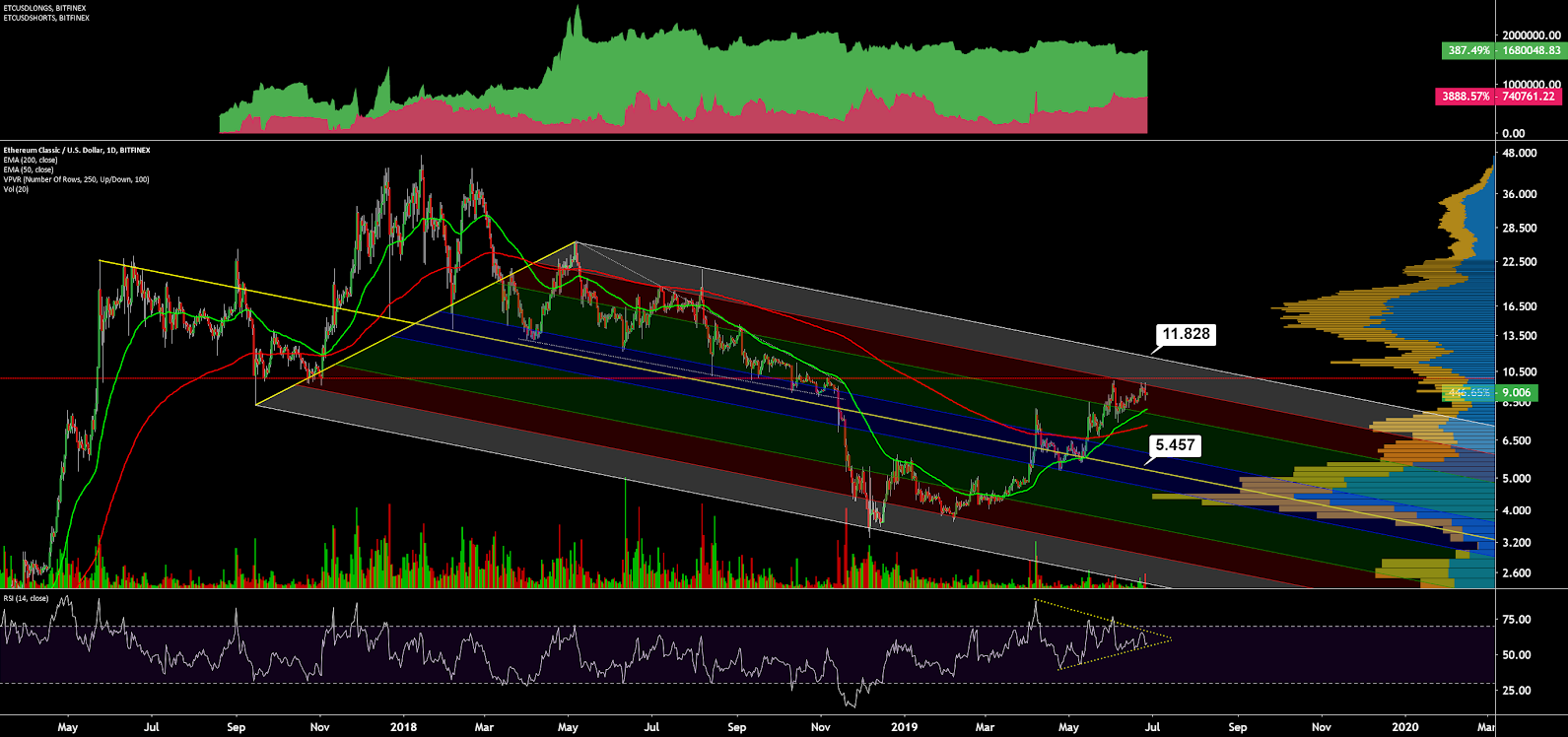

Technical analysis

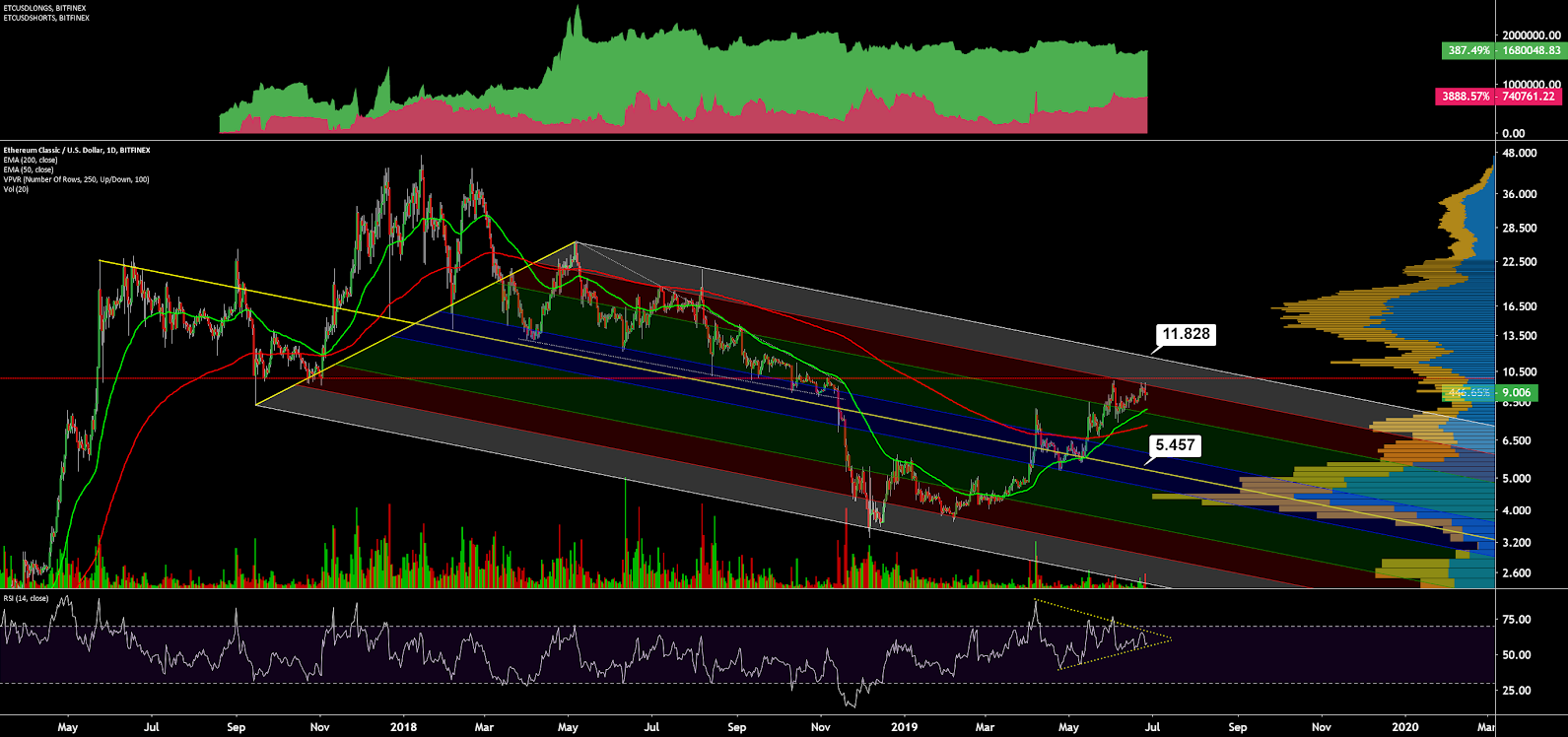

The 51% attack in early January had almost no impact on ETC price. Since the December lows, ETC has moved in line with the broader crypto market. Potential roadmaps for upcoming price movements can be found on high timeframes using Exponential Moving Averages, volume profiles, Pitchforks, chart patterns, and Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.On the daily chart, the 50-day and 200-day exponential moving averages (EMAs) have been bullishly crossed since late May, ending the 427-day bear market. The 200-day EMA at US$7.20 should now act as support. Significant volume resistance (horizontal bars) sits between the US$13.50 to US$16.50 zone. There are currently no active RSI or volume divergences although RSI has consolidated since April.

The long/short open interest on Bitfinex (top panel, chart below) since April 2018 has been heavily net long, with long positions currently accounting for 70% of open interest. A significant price movement downwards will result in an exaggerated move further, as the long positions will begin to unwind. This is known as a “long squeeze.”

Price also remains bound by a multi-year bearish Pitchfork (PF) with anchor points in May and September 2017 and May 2018. Price broke out from a falling wedge in November 2018, to the down side, breaching the PF median line (yellow) with significant bearish momentum. Based on this PF, the macro trend will remain bearish until a break above US$11.82. The US$10 level represents significant psychological resistance.

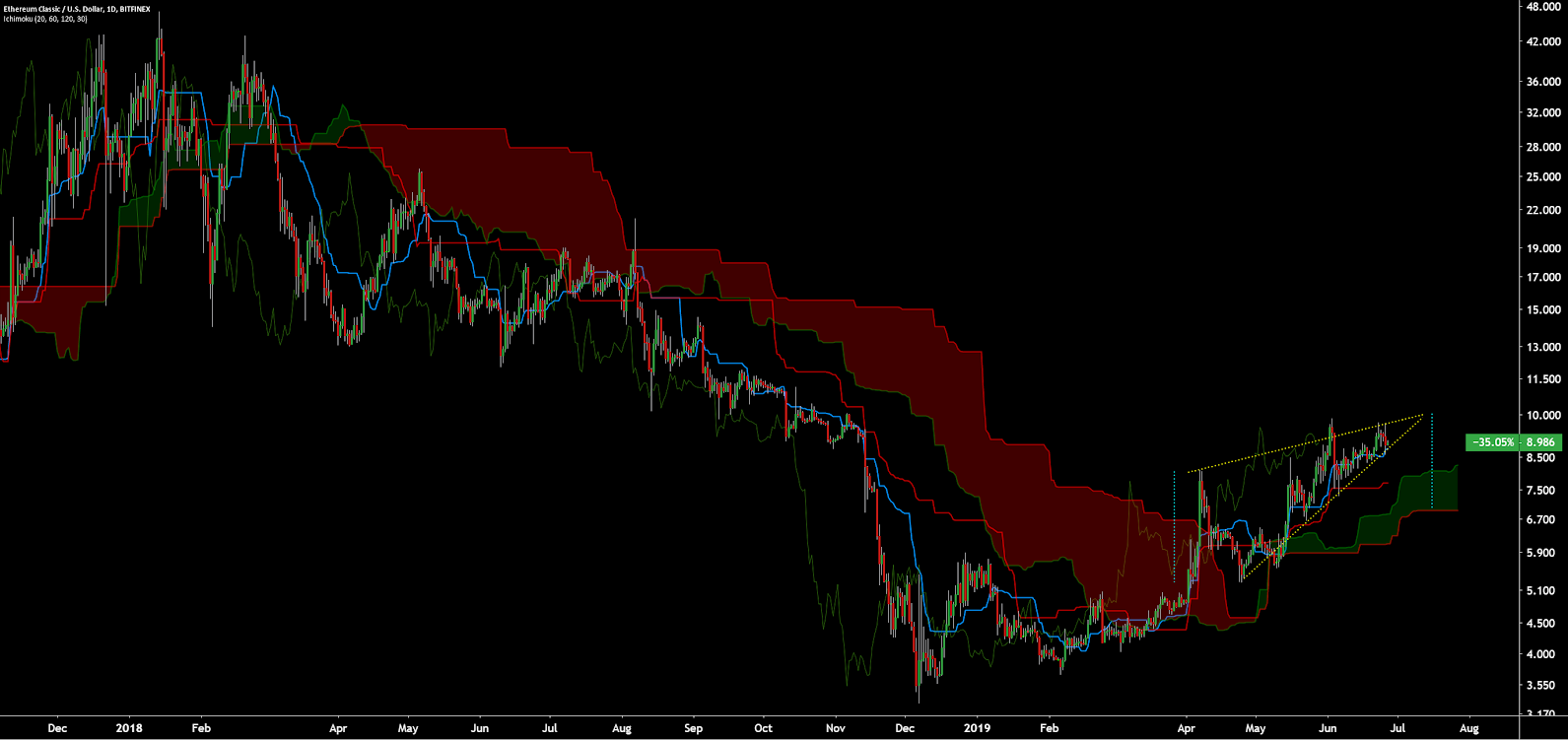

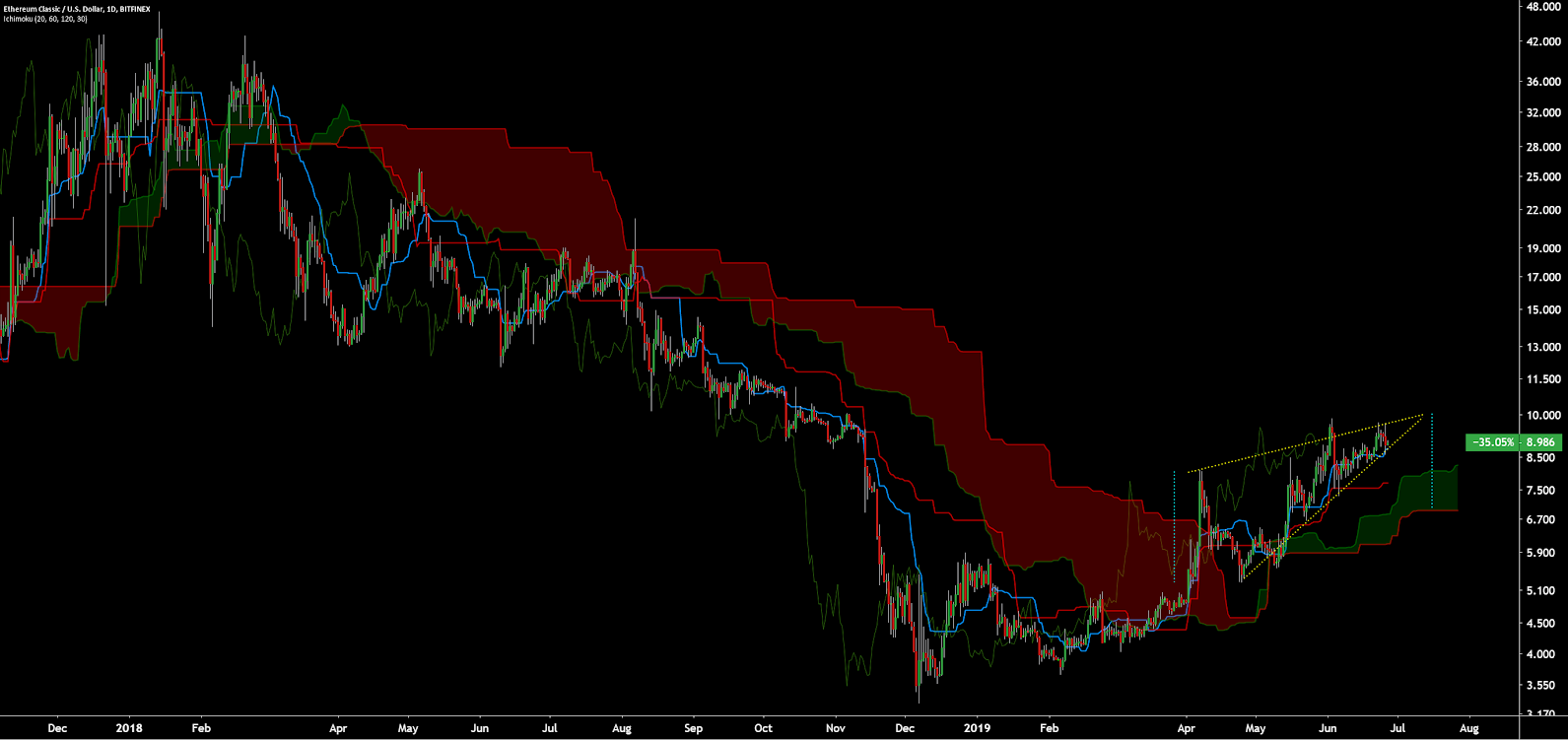

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, have remained bullish since May; price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and above price. The Kijun support currently sits at US$7.72.

Additionally, a potential bearish reversal pattern has formed, the rising wedge. The hallmarks of this pattern include a series of higher highs and higher lows in a tighter and tighter range. Measured move targets bring price to US$6.90, which is also Cloud support. Over the past few months, rising wedges have represented bullish continuation on several other coins.

Lastly, on the daily ETC/BTC chart, trend indicators suggest a bearish trend with oversold metrics with price at an all-time low. The 50-day and 200-day EMAs have been bearishly crossed for 344 days. There is a large bullish divergence on RSI with price significantly below the 200-day EMA. Open interest on Bitfinex is currently 52% short (not shown). A mean reversion target of 11,500 sats is suggested both by the 200-day EMA and a high volume node (horizontal bars).

Conclusion

ETC fundamentals remain in a holding pattern since the 51% attack in January. Development on the ETC chain is currently several months behind ETH, but some ETH protocol improvements are set to be implemented on the ETC chain in September. Also in stark contrast to ETH, ETC’s value-add is a hard cap on total coins, and no plans to change from PoW to PoS. There is a pending proposal to change the consensus algorithm in an attempt to increase ASIC resistance.Technicals for the ETC/USD pair suggest a strong bullish trend, based on daily Cloud and high timeframe moving averages. Prices above the psychological resistance of US$10 should see significant bullish momentum. The ETC/BTC pair has reached for fresh all-time lows over the past week with a bullish divergence, which is suggestive of market capitulation. Knife-catchers will likely continue to slowly move back into the pair based on the risk/reward profile of a mean reversion to 11,500 sats.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow