Ethereum (ETH) Price Turns Short Term Bearish: Sell Rallies?

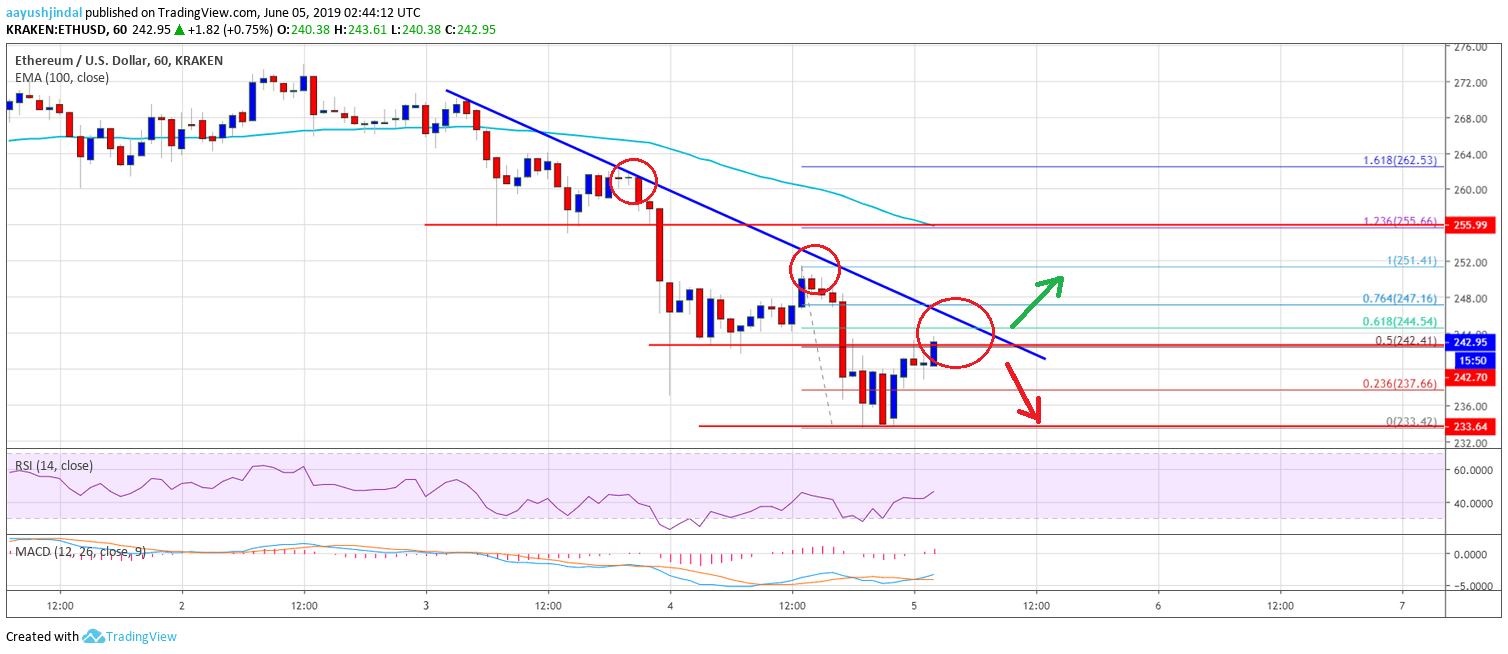

- ETH price started a steady decline and broke the $252 support area against the US Dollar.

- The price traded towards the $230 level and formed a new swing low at $233.

- There is a major bearish trend line forming with resistance near $246 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could either recover above $250 or decline again towards the $230 level.

Ethereum price moved into a bearish zone versus the US Dollar, but was stable vs bitcoin. ETH price is currently recovering higher, but it might face sellers near $250.

Ethereum Price Analysis

In the past two days, Ethereum price remained in a bearish zone below $265 against the US Dollar. The ETH/USD pair formed a couple of swing lows and declined below the $260 and $250 support levels. There was even a close below the $250 level and the 100 hourly simple moving average. The price traded below the $246 support level and formed a new weekly low near the $233 level. Recently, it started an upside correction above the $235 level and the 50% Fib retracement level of the downward move from the $252 high to $233 low.

However, there are many hurdles near the $244, $246 and $250 levels. Moreover, there is a major bearish trend line forming with resistance near $246 on the hourly chart of ETH/USD. The 61.8% Fib retracement level of the downward move from the $252 high to $233 low is also near the $244 level. Besides, the main resistance for the bulls is near the $250 level. Therefore, if there is an upside break above the trend line and $250, the price could recover further towards the $255 and $260 levels.

Conversely, if the price fails to break the $250 resistance, there is a risk of a fresh decline. An initial support is near the $240 level. If there is a downside break below $240, the price could move back towards the $233 swing low in the near term. Below $233, the price might continue to slide towards the $225 support area.

Looking at the chart, Ethereum price is clearly trading with bearish moves below the $250 level. Therefore, a proper close above the $250 barrier is needed for the bulls to gain control. The next key resistance is near the $255 level and the 100 hourly SMA, where sellers may emerge. Above $255, the price might test $260.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly moving back in the bullish zone, with a few positive signs.

Hourly RSI – The RSI for ETH/USD is currently moving higher towards the 50 level.

Major Support Level – $240

Major Resistance Level – $250

The post Ethereum (ETH) Price Turns Short Term Bearish: Sell Rallies? appeared first on NewsBTC.

via https://www.ohnocrypto.com/ Aayush Jindal, Khareem Sudlow