GRIN Price Analysis: A new paradigm for privacy coins

Grin is an early implementation of the MimbleWimble protocol. GRIN is a robust privacy coin that has no addresses, no amounts and a more efficient blockchain with higher transactional capacity than other privacy coins such as Monero.

Grin’s roots can be traced back to August 2016 when a whitepaper for MimbleWimble was posted to a Bitcoin development forum by an anonymous developer. A few months later in October 2016, another anonymous developer posted on the same forum and said they were working on a practical implementation of MimbleWimble called Grin.

Grin became the first live MimbleWimble project with the launch of a testnet in November 2017. On January 15th, 2019, Grin was released on mainnet and the blockchain was publicly launched.

The GRIN coin has had a turbulent price history since release. This reflects the nascent nature of the project and issues surrounding the price discovery and valuation of the experimental payment network solution. The coin began trading on exchanges at an expensive ~USD $261, before falling almost ~98% in a day to USD ~7.5.

Grin was heavily hyped prior to its mainnet release which meant demand far outstripped the early supply of the token. The nature of proof-of-work coins means that supply expands very quickly following initial issuance as the public begins mining it. In Grin’s case, the supply rose very quickly in the first few days of trading and the price leveled out as it arrived at a more stable equilibrium between demand and supply. After the chaos of the project’s launch, the price has gone as high as ~USD 12.56 and as low as ~USD 1.89 over the last 6 months.

The Grin blockchain is programmed using the Rust language, which is noted for its speed and scalability when used to build network applications. Grin uses the proof-of-work (PoW) consensus mining model and the cuckoo cycle hashing algorithm. Grin is ASIC-resistant and minable on GPUs. This along with the high early issuance rate gives Grin some appeal as a crypto ‘you can still mine at home.’

Trading newly launched, fair (no ICO, no pre-mine) PoW coins is notoriously difficult. Price changes, already affected by a rapidly changing supply schedule, are further accentuated by wider market conditions because of a lack of historical context and price discovery.

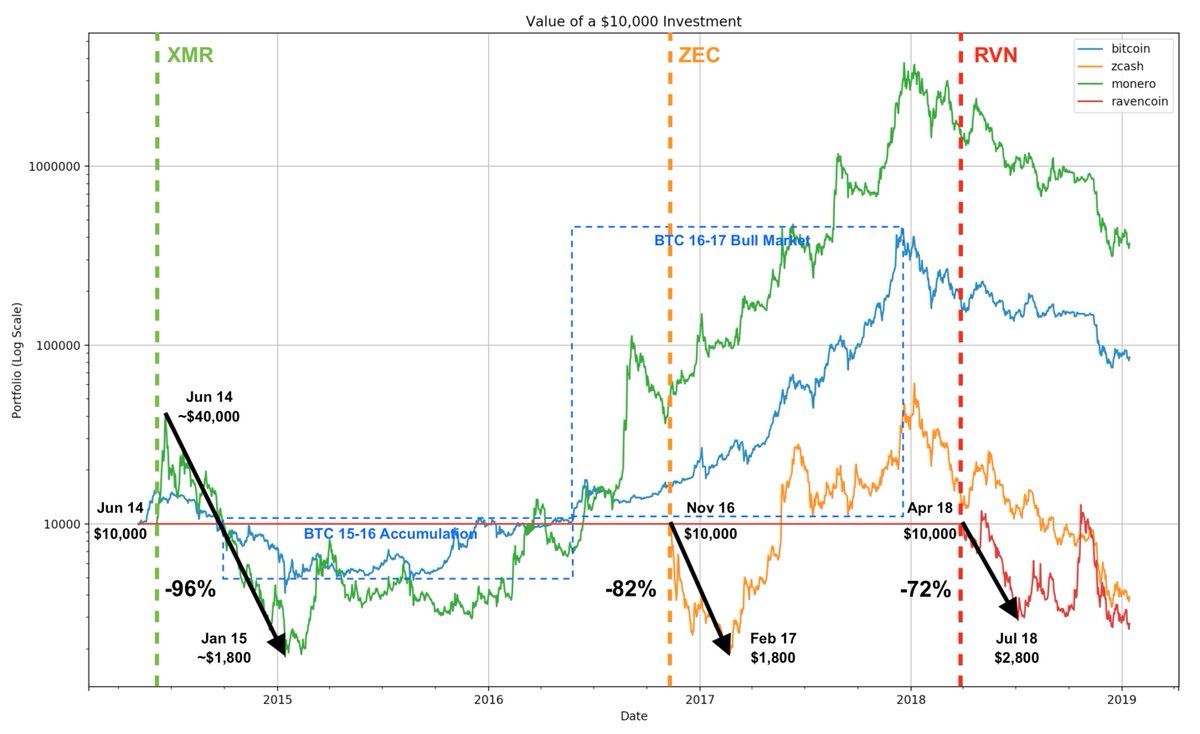

Source: @ByteSizeCaptial

Monero (XMR) for example, was launched during the 2014-2015 crypto bear market. It slid 96% in the six months following as it was dragged to extreme lows and underperformed versus Bitcoin during this period. Zcash (ZEC) however, launched a few months before the start of 2017’s alt-coin boom, recouping its initial price losses much more quickly than XMR and it outperformed BTC during the alt boom despite operating on a far more immature blockchain.

This pattern suggests that GRIN may be set for extreme gains if the crypto markets have an altcoin boom in 2019. GRIN’s characterization as an innovative, newly launched, fair PoW coin may give it alpha in the medium term.

Scaling and the nature of the GRIN ledger

(The following section involves discussion and analysis of the UTXO accounting model used by Bitcoin and other blockchains. Further information on the nature of the UTXO model can be found here)

GRIN aims to provide a solution to the global digital cash thesis, by being scalable, decentralized, private and fungible.

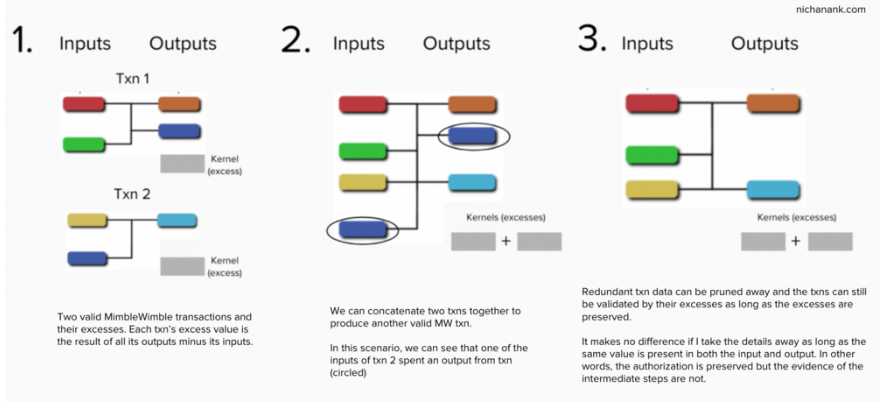

Grin transactions, due to the design of MimbleWimble, have no history attached to them, no addresses for the transacting parties and blockchain transaction data is minimized. Within the Grin blockchain, there are no addresses, no transaction amounts, and two transactions that “spend” one another are merged to form one, with intermediary information removed to enhance privacy and reduce data bloat.

Blocks on the Grin blockchain are designed to look like one single transaction, with interactions between individual inputs and outputs not stored on the blockchain. Unless a user has directly participated in a transaction, the inputs and outputs listed in a block look random.

Since most outputs end up being spent in later blocks, all spent transactions can be removed from the ledger. The whole Grin blockchain, if it grows to have a similar number of daily transactions as Bitcoin, will contain much less data and be easier to download than Bitcoin. The Grin blockchain scales with the number of unspent outputs (new ‘users’ interacting with Grin for the first time) and not the number of transactions.

How MimbleWimble reduces blockchain data storage requirements

Source:https://www.nichanank.com/blog/2019/1/29/privacy-in-crypto-intro-to-mimblewimble-amp-grin

Monetary Policy

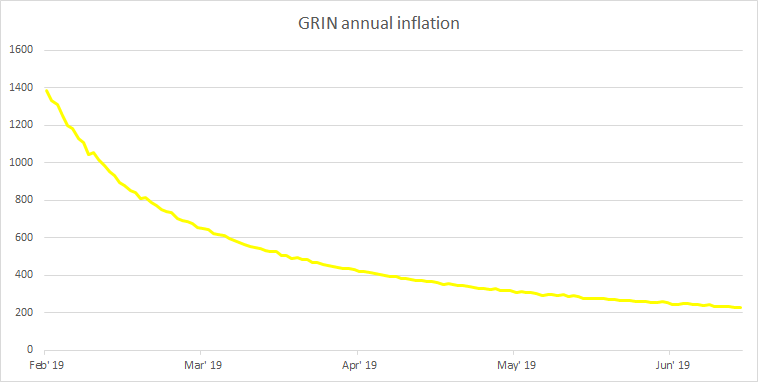

Currently, there is one new GRIN printed every second and this is likely to remain the case in the future. For the first 4 years of issuance, Grin’s creation was identical to Bitcoin and while the Bitcoin block reward halves every four years, the Grin block reward stays the same. Grin’s inflation rate slows down much more quickly than Bitcoin. After 10 years it will fall to 10% (new tokens make up a smaller portion of the total supply over time), after 20 years it will approach 5%, and in 25 years it will be 4%, the same as the Bitcoin block reward, four years after its genesis. Grin has an infinite maximum supply.

On-chain data source: Coinmetrics community data

Grin’s monetary policy is designed to disincentivize early hoarding of Grin tokens. A high rate of inflation may reduce the early emergence of whales who have the power to influence the price. It will ensure late adopters of GRIN have as much access to the digital currency as early adopters. GRIN is not designed to have store-of-value potential and can be considered an accessible, medium of exchange currency.

Grin, and the crypto asset industry in general, is still experimenting with alternative monetary policies and supply schedules. Monero, a privacy coin with similar characteristics to Grin (hidden user data, hidden transaction amounts, hidden coin histories), has a completely different supply schedule.

Ultimately, however, all ‘fair’ proof-of-work coins benefit from having a transparent, programmable and transparent monetary policy, which gives them some edge over government-backed fiat currencies that can be inflated at the discretion of central bankers.

Grin’s position in the market

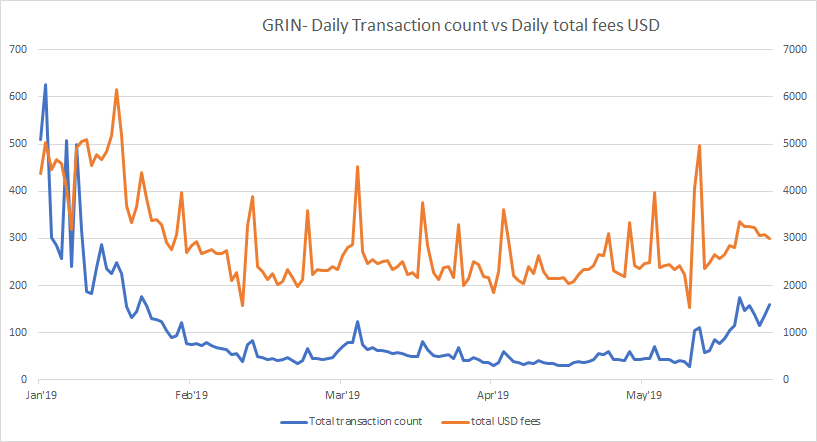

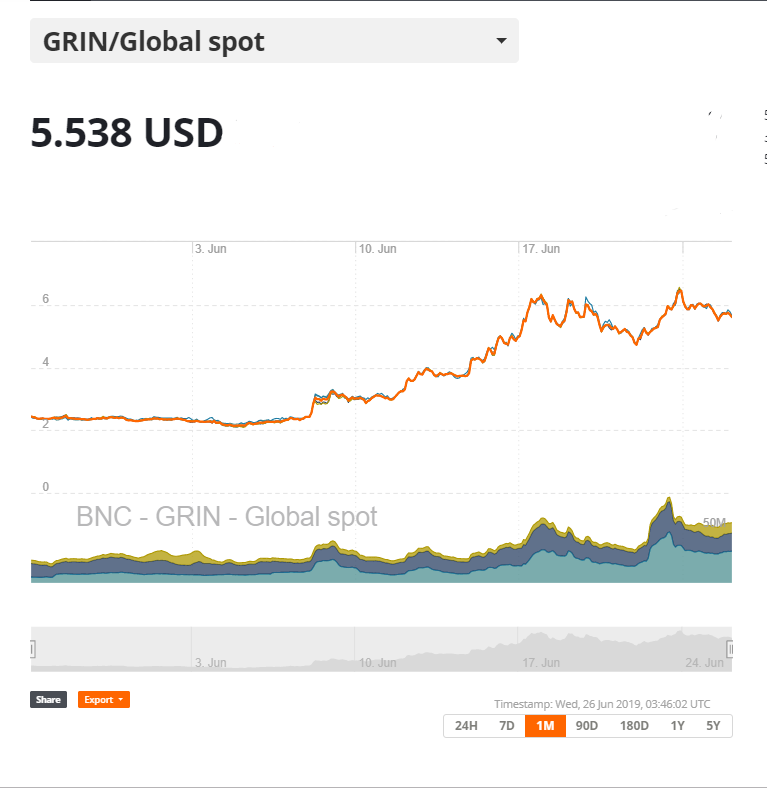

While the GRIN coin price stagnated in the months of April and May, the token has been one of June’s strongest gainers and has risen ~127% in the last month. Coinciding with these price gains there has been a pick up in on-chain activity with both total transaction count and total daily fees rising sharply in June. This is a bullish flag that suggests emerging demand and not purely retail trader hype.

Onchain data source: Coinmetrics community data

Source: Bravenewcoin.com

However, exchange trading volumes for GRIN have surged in recent months suggesting some of this new buying pressure is speculative. If new buyers are purchasing GRIN for short term profit opportunities, it is likely that they will not be as sticky as on-chain GRIN users. If market sentiment reverses, pullbacks are likely to be sharp.

Grin’s biggest barrier to growth and scale is the number of competitors in the digital privacy and payment space. Bitcoin, for example, offers a similar end solution to Grin if transactions are jumbled using a mixer. The wasabi wallet is currently gaining traction as a CoinJoin enabled wallet designed to easily obfusticate on-chain Bitcoin transactions. While Coinjoin solutions like Wasabi are not available by default and often involve some third party trust, because of the size (security) and easier liquidity of Bitcoin, it may still become the preferred medium to make blockchain based private transactions.

Beyond Bitcoin, other solutions within the privacy coin sector include Beam, Monero and Zcash. Each has unique fundamental characteristics and a unique set of advantages and disadvantages.

GRIN is an open-source community-driven coin and maintains a strong cypherpunk ethos. There are no advantages given to the creators, no founder’s reward, no ICO, minimal outside investment and the development for the project appears to be driven by donations.

The key backers include a major mining pool, an exchange, and another cryptocurrency project (QTUM).

Grin developers have provided a full income log of the project. There are currently 143 donations on the list.

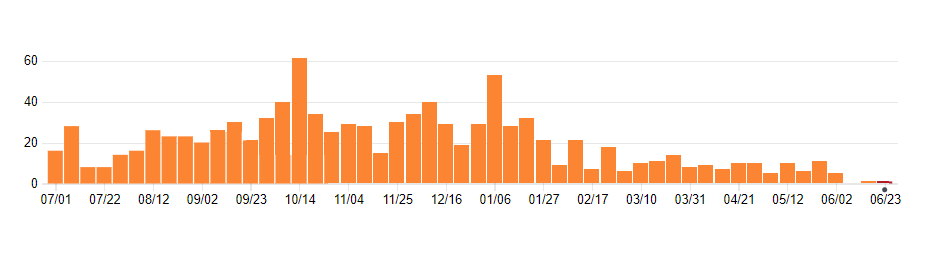

Turning to developer activity, the main Grin GitHub repo has had 2,061 commits, 16 releases, and 127 contributors. Most coins use Github as their open development platform, where files are saved in folders called ‘repositories,’ or ‘repos,’ and changes to these files are recorded with ‘commits,’ which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

There was a sharp ramp-up in commit activity on the ‘Grin’ repo towards the end of 2018 and the beginning of 2019. This was likely because of the Grin mainnet release in January 2019. Since this busy period commit activity on the main repo has slowed.

The most recent release on the Repo, v2.0.0-beta.1, occurred 8 days ago. Changes include a new API call and support for a new bulletproof rewind scheme.

These changes will be a part of Grin’s first hard fork, which is set to occur in mid-July 2019 (at block height 262,080). The main change will be a new secondary proof-of-work. Grin will be tweaked every 6 months to discourage ASIC manufacturers from building specialized hardware for it. As part of the hard fork, Cuckaroo29 will be deprecated for Cuckarood29. Miners will have to update their software to mine the forked chain.

Exchanges and trading pairs

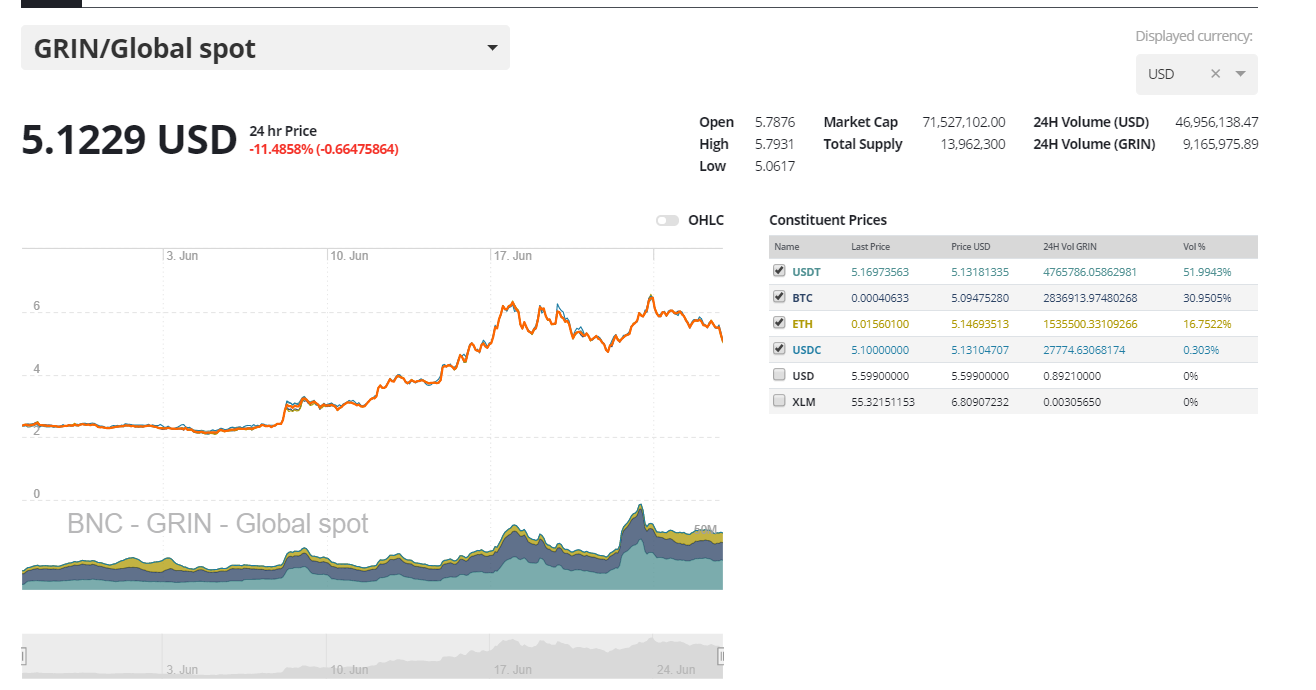

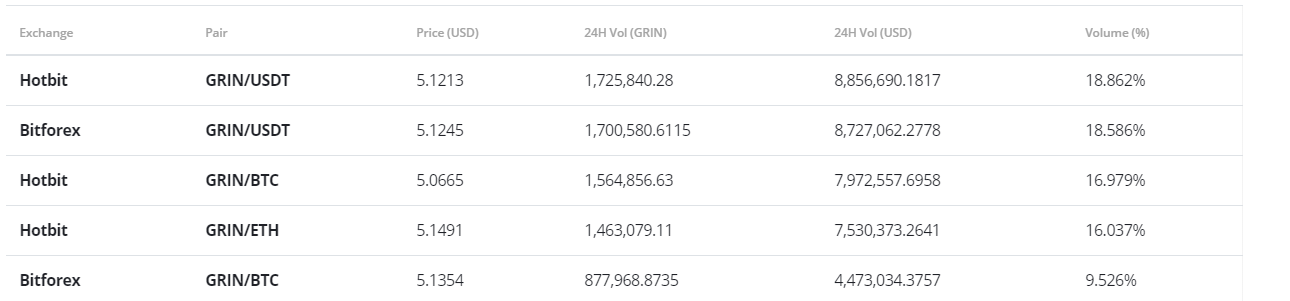

The most popular trading option for GRIN is USDT with the pair currently handling over 50% of daily trading volumes. The second most popular market is the GRIN/BTC pair. Together the top two pairs make up over ~83% of the daily trading volume. Fiat trading for GRIN is not active at all, reducing the token’s liquidity.

The USD value of the daily volume of the entire GRIN trading market is ~USD 46 million.

The Hotbit exchange appears to be at the center of the GRIN trading market, operating 3 of the top 4 GRIN trading pairs. The GRIN/USDT market on Hotbit is the most active market in the ecosystem. GRIN is also tradeable on high profile exchanges such as Poloniex and Bittrex.

Technical Analysis

GRIN began trading in mid-February 2019. GRIN has limited trading history, so lower time frames used below to find key levels in price action. A potential roadmap for upcoming price movements can be found using exponential moving averages (EMAs), volume (VPVR), Pitchforks (PFs), chart patterns, and Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the six-hour chart, the price found significant bullish momentum in early June leading to a bullish 50EMA and 200EMA cross. Until recently, the price has remained above the 50EMA. Mean reversion back to the 200EMA, currently at US$3.77, is likely. There are no active RSI or volume divergences currently.

Additionally, a bearish reversal pattern, an “M” double top, has formed. Hallmarks of this pattern include two inverted V-shaped highs in quick succession. Critical support for the pattern stands between US$4.63 and US$4.96 with a 1.618 fib extension of US$3.55.

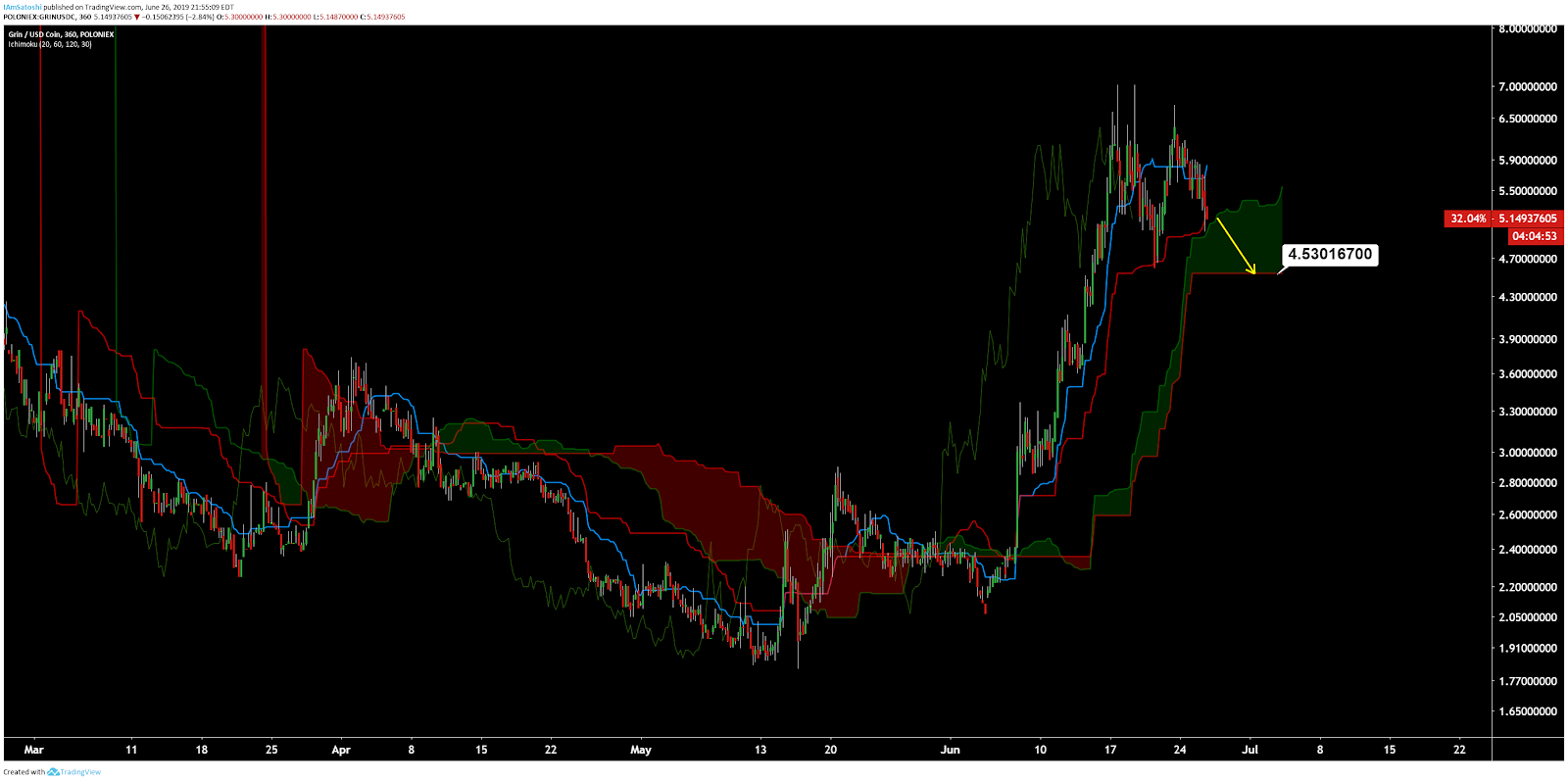

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, are currently bullish; price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and in price. However, the Cloud structure currently suggests a potential end of the bull trend with an edge-to-edge setup towards US$4.53. A Kumo breakout below the Cloud suggests both the beginning of a bear trend and a completion of the M double-top.

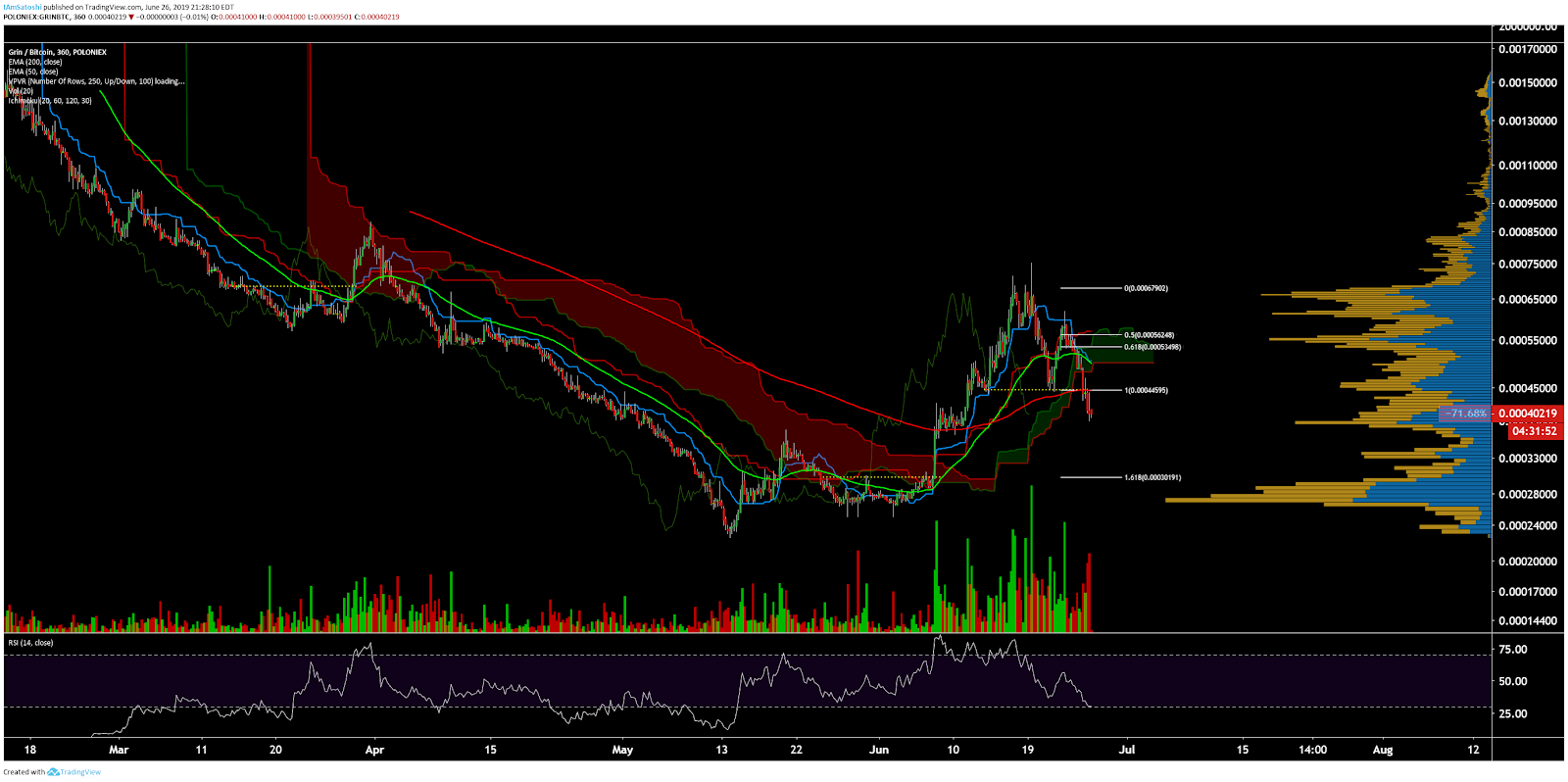

Lastly, on the six-hour GRIN/BTC chart, trend indicators also suggest a bearish trend with price recently breaching the Cloud. The 50EMA and 200EMA will also likely cross bearish over the next month. There are currently no RSI or volume divergences, suggesting waning bearish momentum. Based on VPVR (horizontal bars), the nearest significant support is at 38,700 sats. An “M” double top reversal yields a 1.618 fib extension of 30,200 sats, a level that holds significant volume support.

Conclusion

Following the public launch of its blockchain in January 2019, GRIN has gained some market traction as a privacy coin alternative. It’s blockchain, by default, has hidden user addresses, no publicly visible user amounts, and is more scalable because it is less storage intensive. The Grin blockchain project was successfully launched with no real VC or ICO backing and has created a monetary policy designed to make the coin accessible at multiple income levels.

However, the Grin project remains immature and it will face numerous challenges in the short-to-medium term that will challenge its relevance within the competitive privacy coin space. It will likely take years, or even decades for Grin’s true value to emerge. In the short term, price volatility will likely be explosive because of a lack of price discovery and the coin’s high dilution rate.

Technicals for the GRIN/USD pair suggest an end to the short-lived bullish trend. With an M double-top reversal and Cloud metrics shifting bearish, there is potential for a new bear trend. Support, based on the 200EMA and high volume node, currently sits at US$3.77. Technicals for the GRIN/BTC pair have already shifted bearish, with price below the Cloud and a pending bearish 50/200EMA cross. Once price breaks the current support at 38,700 sats, the bear trend should bring the price back to the previous accumulation zone, between 25,000 to 30,000 sats.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow