A perfect storm for Bitcoin?

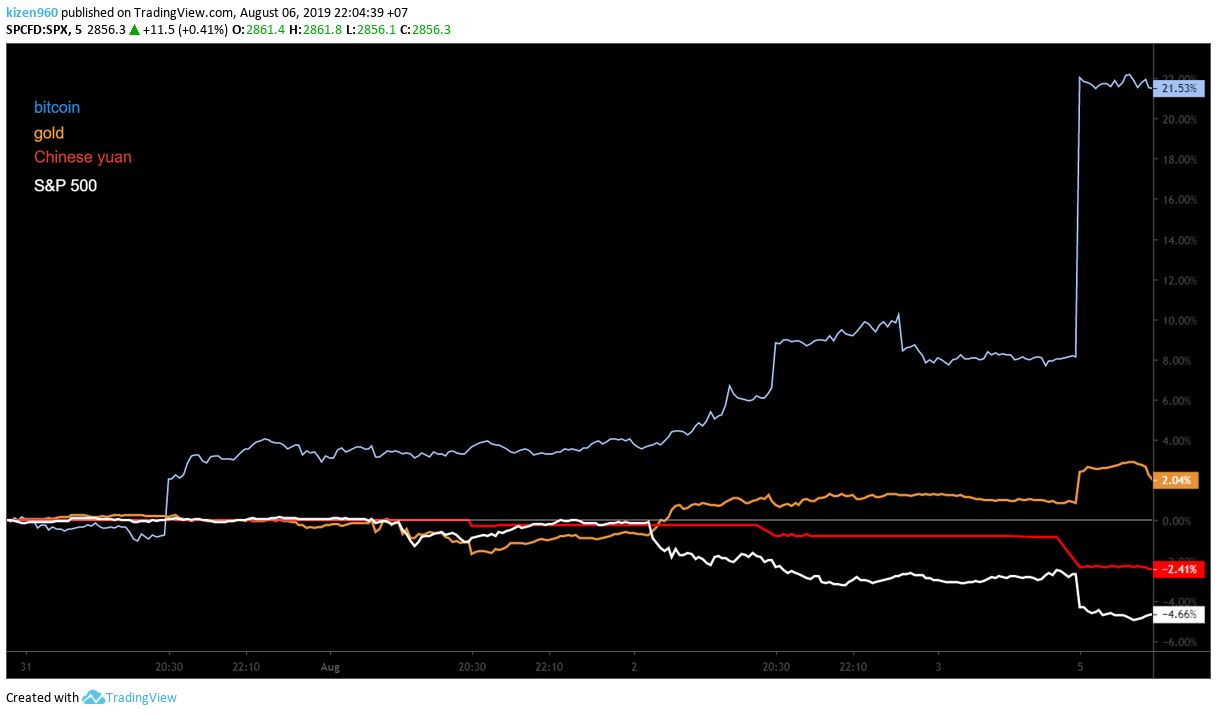

Against a chaotic week of macro tensions across the globe, a super-powered bitcoin surged 7.5 percent, prompting fresh speculation that the leading crypto asset has potential as a safe haven asset in tumultuous times.

The narrative that bitcoin may behave similarly to assets like gold has grown stronger in recent months as the global economy has slowed amidst ongoing geopolitical tensions. The protests in Hong Kong, rising tensions between the U.S. and Iran, the prospect of a no-deal Brexit, an overheated stock market, and an accelerating trade war between the U.S. and China continue to spook the markets.

A refuge from economic warfare

Few places have been more affected by the economic turmoil than China, where citizens bound by strict capital controls have been forced to watch the yuan give back 11 years of gains against the dollar.

After President Donald Trump said he would impose 10 percent tariffs on $300 billion worth of imports, the Chinese currency plummeted, prompting Trump and the US Treasury to accuse China of becoming a 'currency manipulator' by weaponizing the exchange rate to protect exports and offset the impact of higher tariffs on Chinese imports.

Whether it was manipulation or not, the falling yuan sent shockwaves through global markets — pushing US equities down as investor's risk appetite soured, and pushing safe-haven assets like gold and bitcoin up.

Bitcoin rallies alongside gold as a safe-haven

Though the price chart shows a sudden movement catalyzed by Trump's tariff, some analysts suggest the relationship between bitcoin and the yuan has been building for a while.

“On May 5th, the Chinese Yuan started weakening against the US dollar," observed Adamant Capital's Tuur Demeester in June. "Remarkably, that was also the week that bitcoin broke above the resistance of $6,500. In short, there’s a significant chance that it was Chinese investors who pushed bitcoin into bull market territory."

The strength of the Chinese influence on the price of bitcoin has been corroborated by other studies.

As Diar found earlier this year, a large portion of Tether's on-chain volume has come from China in recent months, which the research firm suggested is due to the use of the stablecoin as a method for bypassing capital outflow restrictions on the yuan.

The route out of an ailing national currency into crypto is now becoming a well-worn path — with the falling yuan sitting alongside Venezuela's bolivar and Turkey's Lira as devalued currencies that some investors have ditched in favor of bitcoin.

As the trade war mutates into a currency war, this economic disruption could extend to the US dollar, catalyzing bitcoin adoption by pushing down the global reserve currency.

The falling dollar

To compete with a weaker yuan, the Trump administration may retaliate against China by seeking a lower dollar. Or, equally likely according to some analysts, we could see an economic recession dragging the dollar down.

Andrew Gillick, an investment researcher at Brave New Coin says the president faces an impossible dichotomy. “He wants to devalue the dollar through lower interest rates and debt expansion, while at the same time maintaining its global reserve status, and stoking investor confidence in the US stock market. It’s no secret that Trump is at loggerheads with the Fed, and he has even tweeted about direct currency intervention.”

Fundamental indicators like the yield curve are flashing negative signs, creating speculation that the probability of a US recession is very high. If this comes to pass, we could see banks resort to quantitative easing or extremely low-interest rates to maintain economic stability.

This might not be a concern for central banks, who have been quietly buying gold at record rates over the last few months, but it could significantly devalue the dollar, and impact the savings of the American population.

A tailwind for bitcoin

The crash of 2008, which wiped 40 percent off the value of the dollar, is examined in Delphi Digital's latest report, which suggests that a currency collapse sparked by a recession could be a catalyst for wider bitcoin adoption.

This conclusion was reached through an analysis of gold, which is said to have benefitted hugely from the collapse in the dollar.

Though bitcoin is uncorrelated in the long term with gold, the two assets are found to have traded closely together in recent times, suggesting that bitcoin could be starting to fulfill the 'digital gold' narrative and flex its muscles as digital gold for a digital world.

"Heightened trade tensions between the U.S. and China have served as a boon for bitcoin as investors seek out non-sovereign assets to hedge against the fallout from the trade war. The rising risk of currency devaluation, especially among reserve currencies, is a longer-term catalyst that should propel BTC higher along with gold,” said Delphi Digital.

Finally, in his recent research report for Brave New Coin, Gillick states “Macro global tensions and negative interest rates could provide an upwind for new forms of digital commodity money such as bitcoin and litecoin as they move towards becoming a preferred store of value. Privacy-focused currencies like Zcash and Monero will become ‘digital cash’ for the next generation of investors as fiat cash and financial privacy is removed from economies.”

OhNoCrypto

via https://www.ohnocrypto.com

Kieran Smith, Khareem Sudlow