XRP Price Analysis - Price remains muted despite elevated on-chain stats

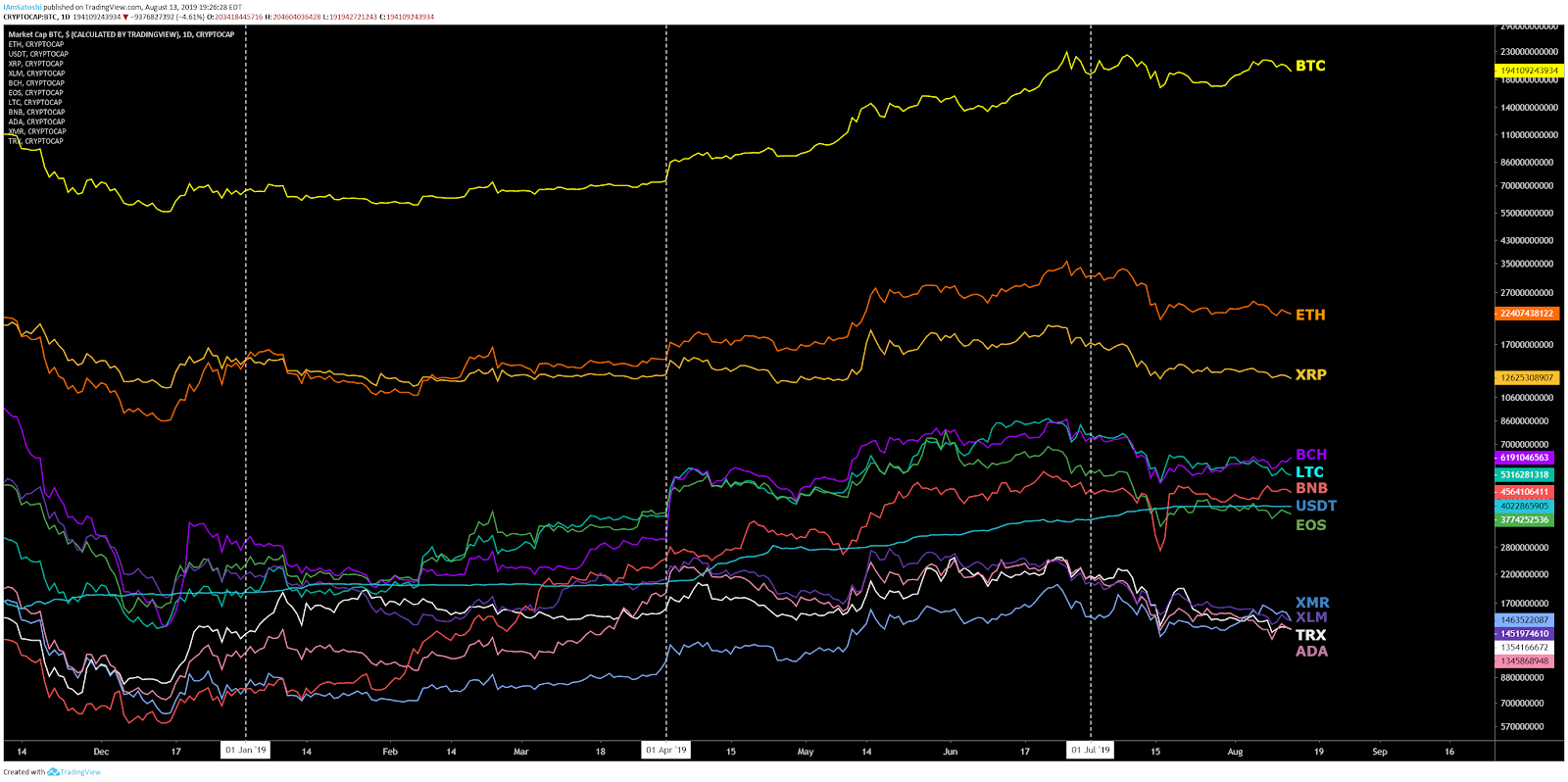

Ripple (XRP) is a payment protocol and network token which aims to compete with the banking protocol SWIFT. The crypto asset is currently down 92% from the all-time high established in January 2018. The XRP market cap stands at US$12.7 billion with US$482 million in trade volume over the past 24 hours. Over the past three months, XRP has markedly underperformed when compared to Bitcoin (BTC).

XRP was created in November 2012 by three founders; Arthur Britto, Chris Larsen, and Jed McCaleb, in collaboration with Ryan Fugger who began working on a payments protocol in 2004 called RipplePay. The project, which was closed source at that time, was incorporated under a new name, NewCoin, in September 2012. NewCoin rebranded to OpenCoin in October 2012 and then rebranded again to Ripple Labs in September 2013.

McCaleb resigned in May 2013, officially leaving the project in July 2013, and went on to create Stellar (XLM) in July 2014. McCaleb received a reported 5.3 billion XRP at the time of leaving Ripple, which he can sell restricted amounts of, based on a 2016 settlement that set yearly limits. McCaleb founded the MT GOX exchange in 2010, which was sold to Mark Karpeles in March 2011.

Since 2015, Brad Garlinghouse has served as the Ripple Labs CEO, with David Schwartz serving as CTO since July 2018. Schwartz joined Ripple Labs in 2011 as chief cryptographer. In January, Stuart Alderoty, who had previously worked at CIT Bank, HSBC, and American Express, joined Ripple as general counsel. In February, Cory Johnson, previously Chief Market Strategist, was removed from the Ripple website, with Ripple stating that "due to changes in market conditions, we've chosen to eliminate the role." In May, Breanne Madigan, former Goldman Sachs executive and former head of institutional sales and strategy at Blockchain.com become the head of global institutional markets at Ripple.

Initially, 100 billion XRP were minted by the founders, with 80% of that supply held by the currently branded Ripple Labs, which is also known as “Ripple.” In May 2015, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) determined that Ripple Labs was the “administrator” of the XRP tokens and levied the company with a fine of US$700,000 for failing to register as a money service business.

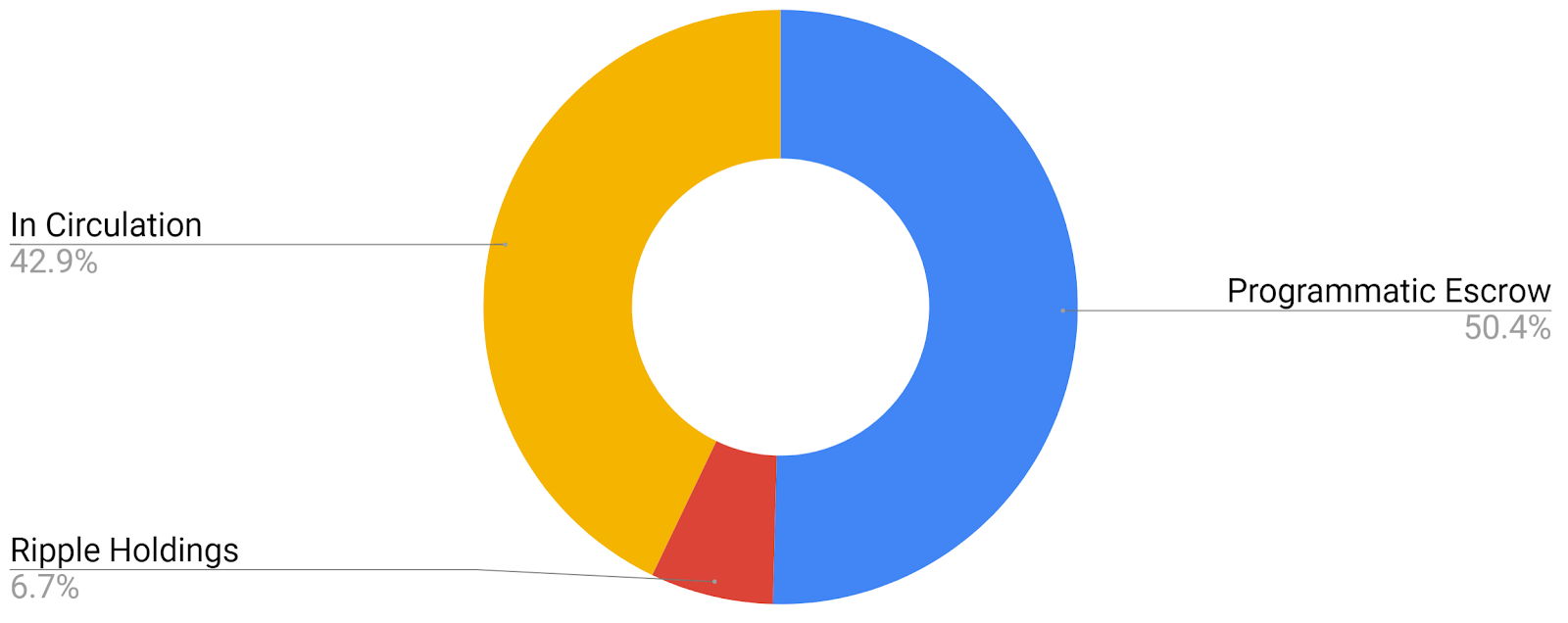

In December 2017, Ripple announced a programmatic escrow system for the remaining 55 billion XRP held by the company at that time. Each month, one billion XRP are unlocked from escrow and offered for sale. Any unsold XRP is then placed back in escrow at the end of the month. Ripple’s Q1 2019 report revealed 0.7 billion of the three billion XRP released from escrow over the quarter had been purchased on the open market, up from 0.3 billion sold in the previous quarter. Ripple’s Q2 2019 report is not currently available.

Since 2012, according to ripple.com, “Ripple has methodically sold XRP and used it to incentivize market maker activity to increase XRP liquidity and strengthen the overall health of XRP markets.” Currently, the top 100 largest XRP accounts, excluding 50.4 billion XRP currently in held escrow, hold 77.13% of the total circulating supply. Ripple holds a further 6.7 billion XRP, leaving 42.9 billion XRP in circulation.

The gorilla in the room continues to be whether or not XRP represents an unregistered security. Ripple initially created, escrows, owns a majority of, and continues to control the majority flow of XRP tokens. Ripple argues that the network is sufficiently decentralized because the XRP token does not represent shares of Ripple, the company, and the XRP network would continue to exist if Ripple Labs did not. Several pending court cases, as well as any comments from the U.S. Securities and Exchange Commission (SEC), will clear any regulatory uncertainty surrounding the asset.

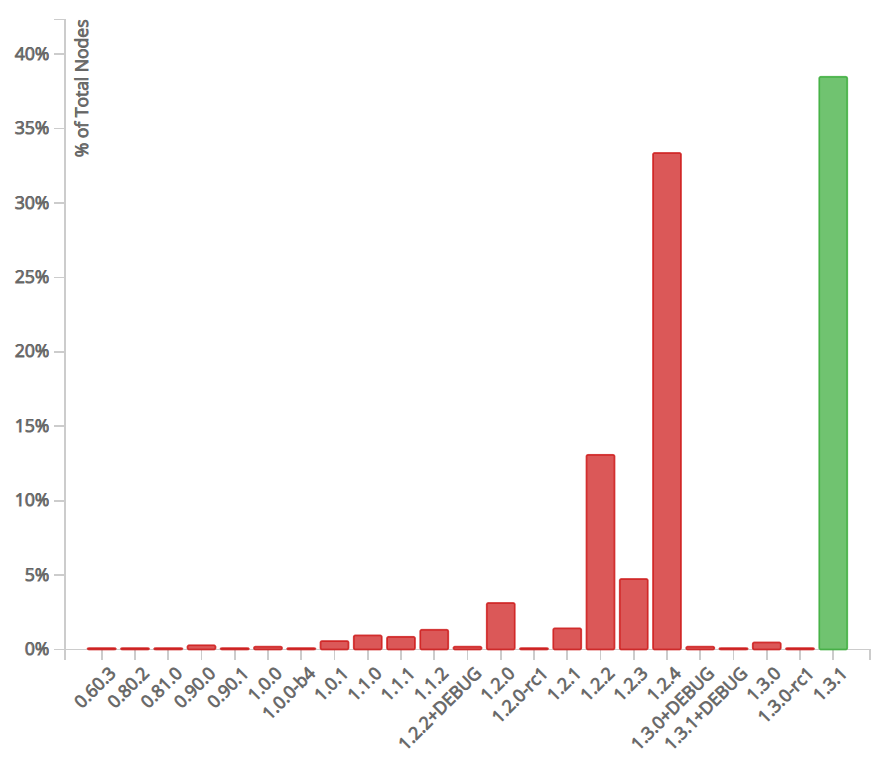

For consensus, the XRP network uses The Ripple Protocol Consensus Algorithm, which aggregates collectively-trusted subnetworks of nodes and validators. There are currently 1055 public nodes with only 40% running the most recent software, version 1.3.1. The network also has 150 active validators, 81% of which have an anonymous domain, with non-Ripple validators accounting for 79% of the total.

As of November 2018, a Ripple server required ~12GB of data storage per day and 8.4TB to store the full XRP ledger.** **However, a full node is not required to participate in the network and nodes can prune the ledger to free disk space.

Source: xrpcharts.ripple.com

Ripple offers a suite of tools for enterprise and banking solutions, collectively known as RippleNet, including; xCurrent, xRapid, and xVia. xCurrent processes global bank to bank payments for customers and is analogous to SWIFT. xRapid, which went live in October 2018, sources on-demand liquidity through buying and selling XRP. xVia can be used to send unidirectional payments. Of the three tools, only xRapid requires the use of the XRP token.

Several announcements regarding RippleNet and banking services have occurred over the past year. Mastercard and Barclays invested in SendFriend, a company using xRapid for remittances, primarily between the Philippines and the United States. Spain’s Santander bank expanded the One Pay FX app, which uses xCurrent, and created Pago FX for non-Santander customers. A subsidiary of Japanese SBI Holdings, launched a “demonstration test” of in-store payments using the Money Tap app before a planned full launch of the new service. However, Japanese bank Resona has discontinued remittance services through Money Tap. And most recently, CurrencyBird, a Chile-based remittance and payment service, joined RippleNet.

In June, Ripple partnered with MoneyGram through a capital commitment of US$50 million in exchange for equity over a two-year period, as well as the introduction of xRapid onto the platform. Other partnerships include two Thai banks, Siam Commercial and Kasikornbank, Brazil’s The Front Exchange, and remittances through the Saudi British Bank. Also, in July, Bank of America filed a patent showing a system using the XRP ledger for inter-currency transactions.

Ripple also has two other monetary arms to foster the growth of the ecosystem, a venture capital arm and a university blockchain research initiative (UBRI). The venture capital arm, Xpring, invests in, incubates, acquires, and provides grants to companies and projects run by proven entrepreneurs. In May, Xpring invested in Agoric, a smart contract platform. Other public investments of Xpring include Dharma, Kava, XRPL Labs, Forte, and Bolt Labs.

The UBRI research initiative has US$50 million in funding reserved for grassroots research and development related to XRP. This year, 33 universities joined the UBRI, including; Carnegie Mellon University, Cornell University, Duke University, Georgetown University, University of Kansas, University of Michigan, Morgan State University, National University of Singapore, Northeastern University, University of São Paulo, Institute for Fintech Research, Tsinghua University, Kyoto University and the University of Tokyo.

Additionally, Rippleworks, a non-profit focused on funding social ventures, was created in 2015 by Chris Larsen and Doug Galen. Rippleworks has paired startups and technology experts with 80 different social ventures. Earlier this year, Larsen and his wife donated US$25 million in XRP tokens to San Francisco State University.

The external XRP protocol ecosystem includes Interledger, Coil, and Codius, all of which are related in terms of functions and development teams. The Interledger Protocol (ILP) is capable of sending payments across different distributed and decentralized ledgers, and moves funds via intermediaries. Coil enables subscription-based donations for content monetization on the internet, without advertising or selling user data, and pays sites in real-time through a Web Monetization API. A similar micropayment system for content monetization is used by the Brave browser. Codius is a smart contract and smart program platform allowing for interoperability between blockchains. In November 2018, the Bill & Melinda Gates Foundation announced plans to use ILP and Coil, in conjunction with Mojaloop, to bring payments to the under and unbanked.

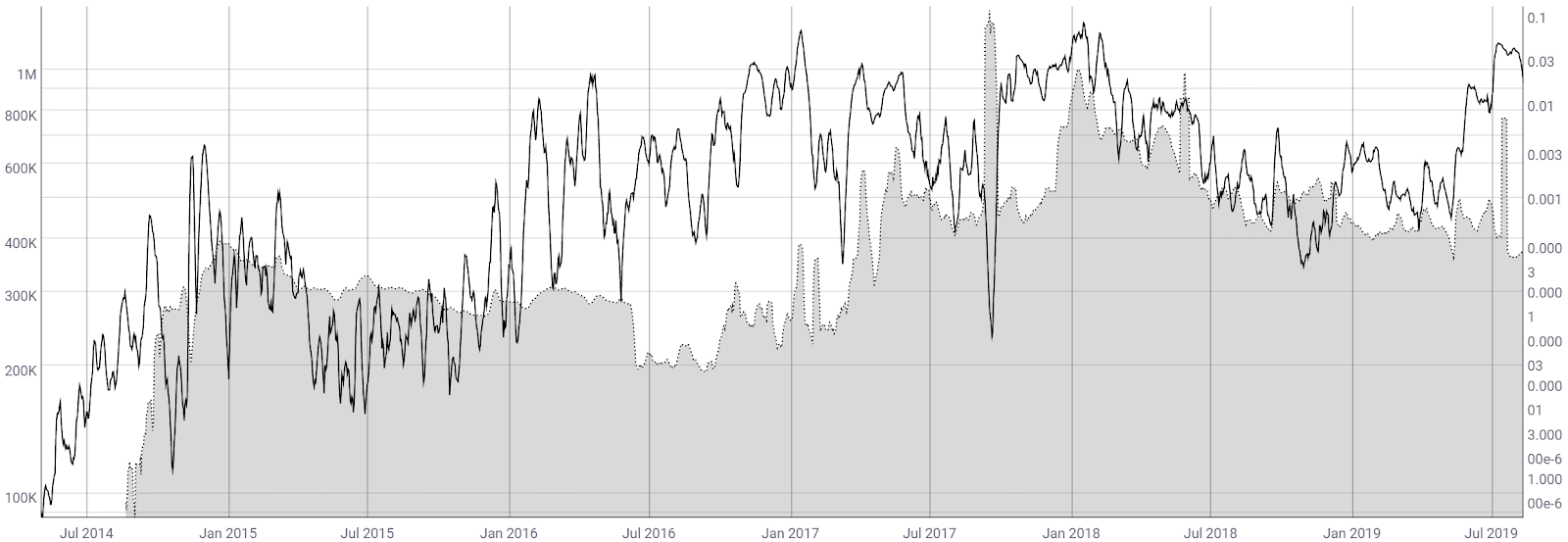

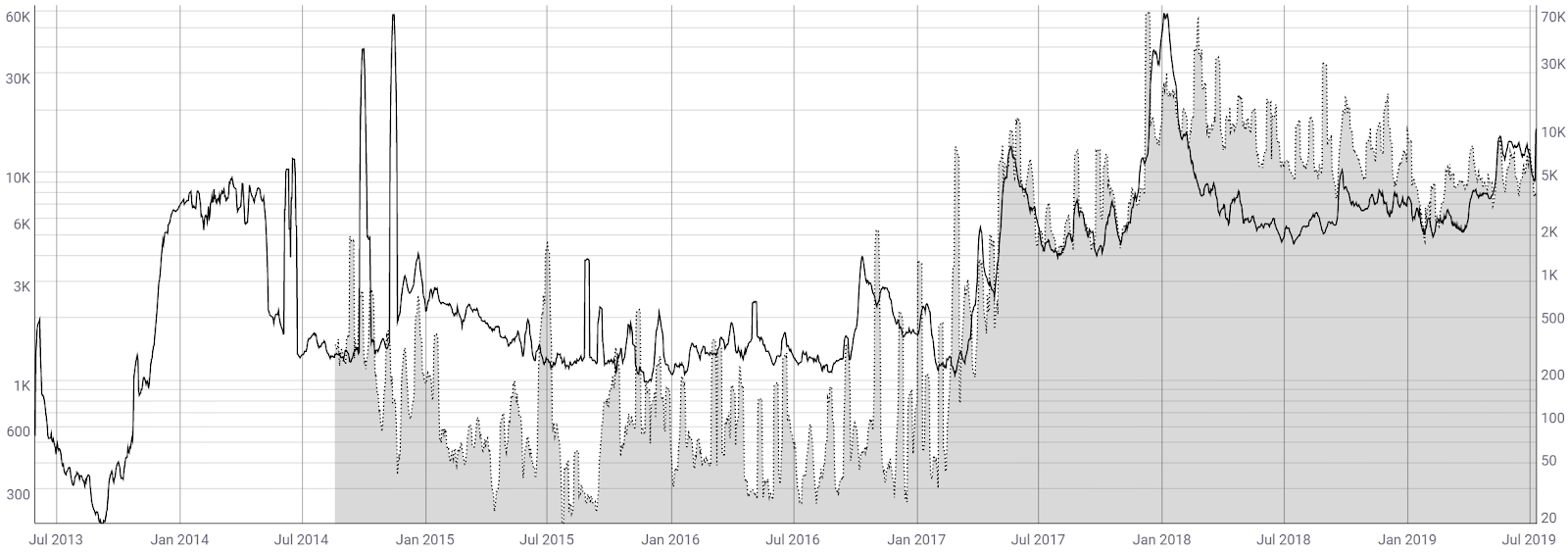

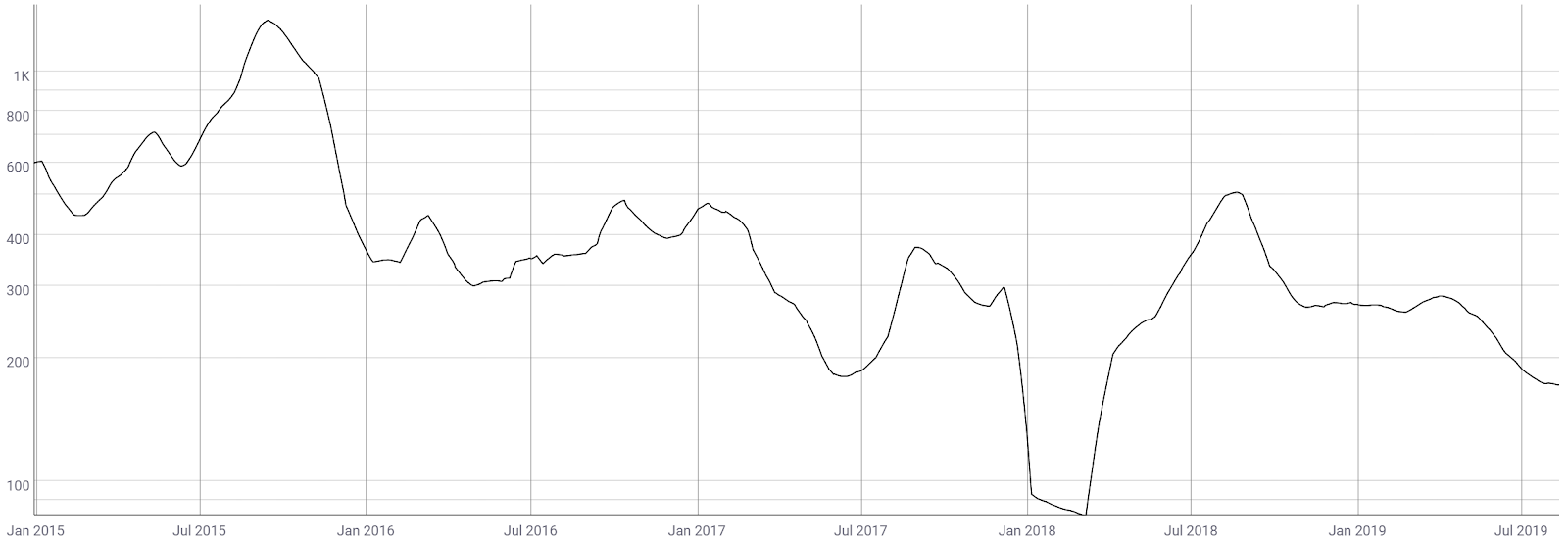

On the network side, transactions per day declined throughout most of 2018, have risen 3x since November 2018, and are currently nearing a record high. Most of these transactions are generated by the OfferCreate function, a currency exchange facility. The average transaction fee (fill, chart below) is the lowest among any cryptocurrency at US$0.00023.

Source: CoinMetrics

Weekly active addresses (WAA) have decreased substantially since January 2018 (line, chart below) but reached an 18-month high in mid-July. WAA are currently higher than the majority of 2017. A large uptick in active addresses should be seen as a bullish indicator for price, as it suggests increasing demand for the asset. The largest increases in WAA were in mid and late 2017, corresponding to large increases in price.

The average transaction value (fill, chart below) on the network has essentially held between US$120 and US$6500 since March 2018. Average transaction values have doubled since January this year and remain well above most of historic levels. Due to monthly escrow transactions, these values are likely slightly higher than actual organic use.

Source: CoinMetrics

The 30-day Kalichkin network value to estimated on-chain daily transaction ratio (NVT) is currently just above 170, which is within the historic range since 2016 (line, chart below). Although NVT is difficult to compare between coins, which use different transaction types, the metric can be useful when comparing a networks relative utility over time. For example, XLM, which uses a similar network structure to XRP, has an NVT of 930 currently.

However, a rising NVT should be considered bearish for price as this suggests declining network utility. Escrow transactions or coin arbitrage will falsely skew NVT significantly lower. A sharp decline in NVT below 100 would suggest bullish price action, which last happened in December and January 2018.

Source: CoinMetrics

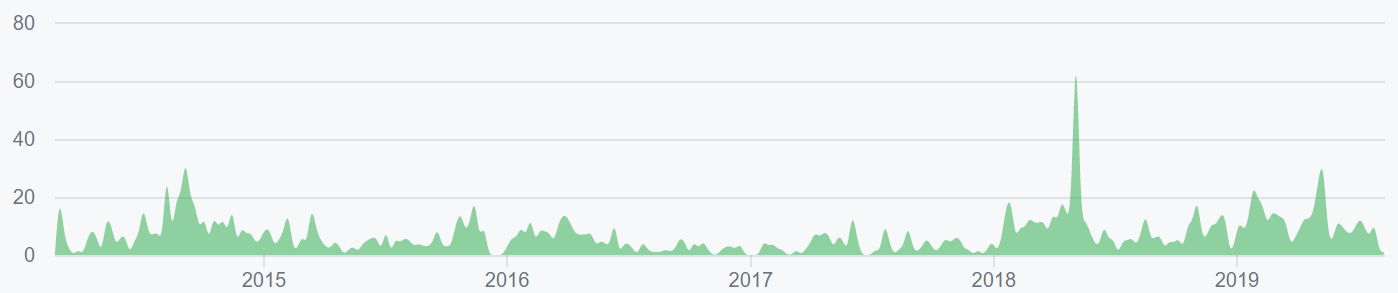

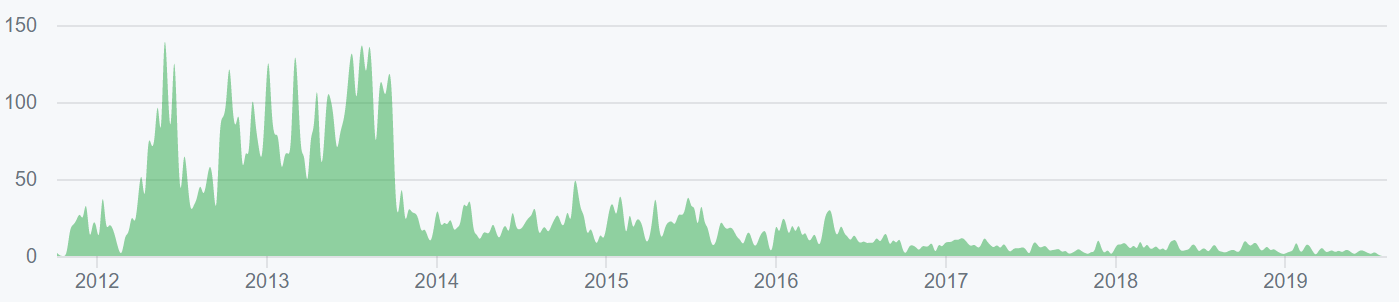

Turning to developer activity, the Ripple project has 75 GitHub repos with over a cumulative 165 commits over the past year from nearly 70 contributors. Rippled version 1.3.1 was released 20 days ago, and xCurrent v4.0 was released in early May. Most of the XRP related commits occurred in the Ripple dev portal (top) while the rippled repo has seen very few commits over the past few months (bottom).

Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: GitHub

Source: GitHub

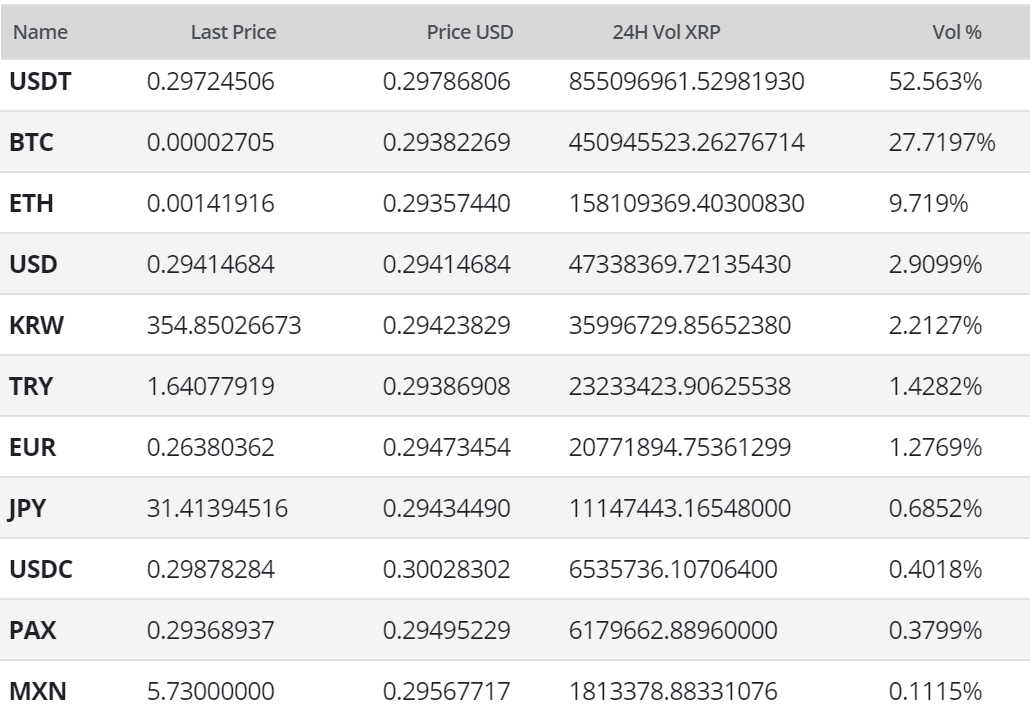

XRP exchange-traded volume over the past 24 hours has been led by the Tether (USDT) and Bitcoin (BTC) pairs. Both the KRW and JPY markets have generated a significantly higher percentage of volume than most. Exchange volume for XRP pairs is led by Binance, Upbit, and Bitstamp.

XRP had a slurry of custody and exchange-related announcements since late 2018. In November, OKEx opened the XRP/BTC pair for margin trading and the Trezor Model T hardware wallet announced support for XRP storage. In December, XRP pairs were listed on Coinbene and KuCoin, while Binance listed several XRP base pairs.

In January, OKEx added an XRP perpetual swap with 40x leverage and the exchange Bitrue also added several XRP base pairs. Bitcoinus, the Gibraltar Blockchain Exchange, BigOne, Biger, LykkeX, ProBit, and BankCEX also added XRP pairs in December and January. In late February, Coinbase listed XRP trading pairs and added XRP to the Coinbase wallet.

In May, the German exchange Börse Stuttgart listed exchange-traded notes (ETNs) based on Litecoin (LTC) and XRP. Coinbase Pro also added XRP for New York residents and the retail trading platform Abra began allowing for withdrawals of XRP. Fidelity Digital Assets may also list XRP trading pairs later this year.

In June, two exchanges, Gatehub, and Singapore’s Bittrue were hacked for US$10 million and US$4.5 million in XRP, respectively. Both exchanges estimated that hackers managed to compromise around 100 user accounts. The Gatehub hack involved compromising XRP ledger wallets through the Gatehub API, whereas the Bittrue hack involved compromising Bittrue accounts through a review process vulnerability. Gatehub has essentially blamed the vulnerability on the XRP ledger and will not refund losses. Conversely, Bittrue plans to reimburse the stolen funds completely.

Additionally, in mid-July, the Japanese exchange Bitpoint reported a hot and cold wallet hack of US$32 million involving BTC, LTC, ETH, and XRP. Remixpoint, the parent company of Bittrue, said it would compensate customers for the losses.

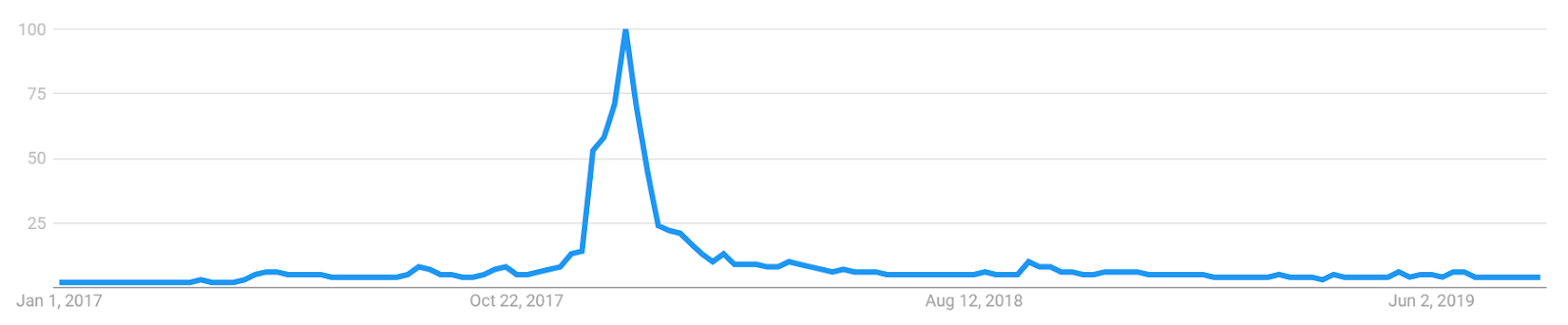

Aside from a brief period between December 2017 and February 2018, Google Trends data for the term "Ripple" has mostly been pinned to the floor. The increase in 2018 likely signaled a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "bitcoin" searches increase dramatically, bitcoin price drops.

Technical Analysis

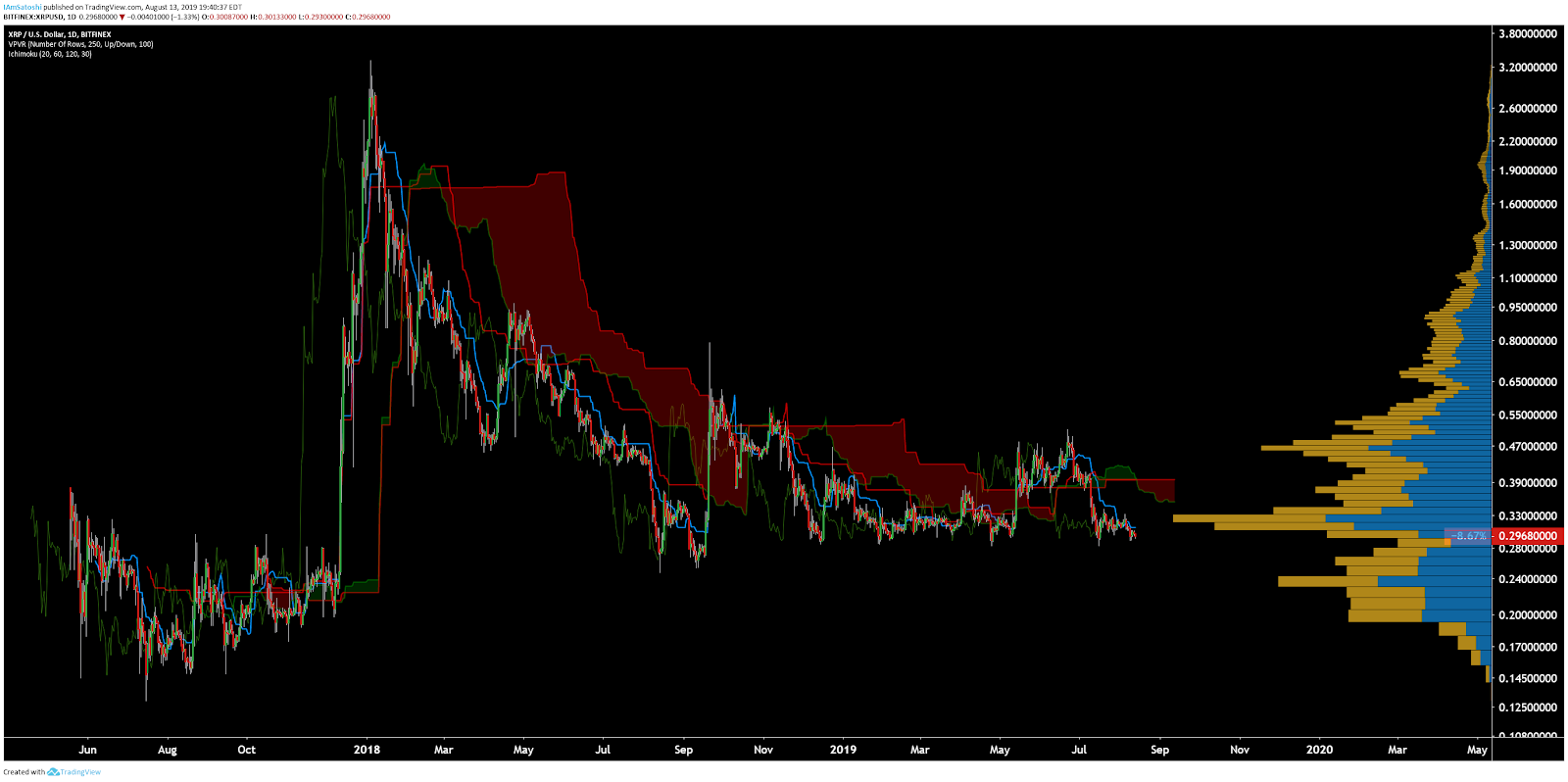

XRP has remained bound by a tight trading range over the past few months, which may be indicative of consolidation before a larger move. To determine entries and exits throughout a trend Exponential Moving Averages, Volume Profile, Pitchforks, and the Ichimoku Cloud can be used. Further background information on the technical analysis discussed below can be found here.

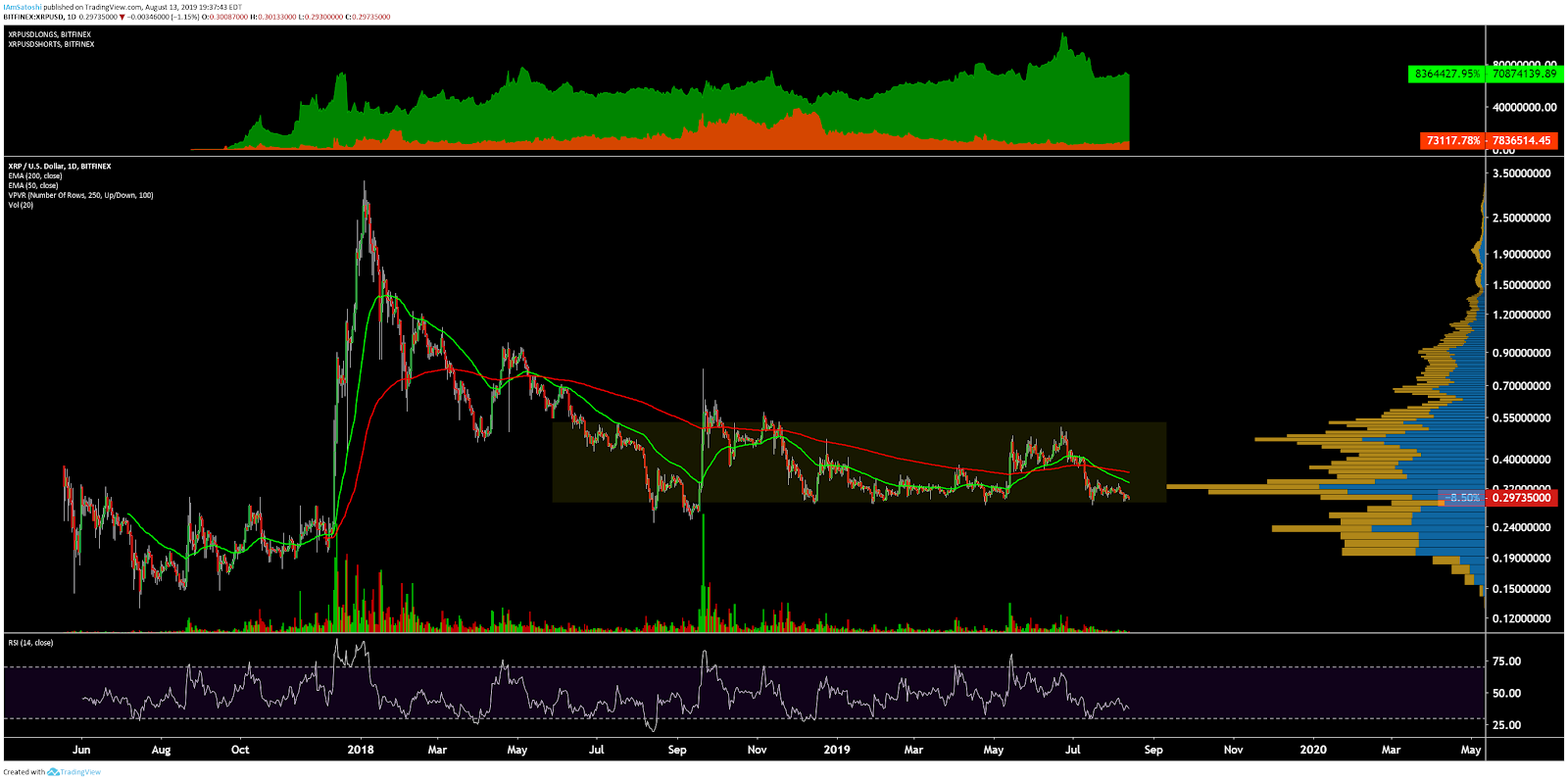

On the daily chart, the 50-day and 200-day Exponential Moving Average (EMA) created a bullish cross on May 31st, preceding muted bullish momentum. A Death Cross occurred in mid-July without significant bearish momentum. There are no active volume or RSI divergences at this time but a bullish divergence may form if price does make a lower low.

Volume Profile (VPVR, horizontal bars on the chart below) shows that most of the trading volume has occurred near the US$0.30 zone. VPVR also shows relatively little volume above US$0.54. Since September last year, the asset has been trading in a defined range between US$0.27 and US$0.53 (yellow rectangle). Falling below this range should bring price to the US$0.23 level quickly, representing a multi-year low.

Long/short open interest (top panel, chart below) on Bitfinex is currently 90% long, with longs dropping significantly since late June. A significant price movement downwards will result in an exaggerated move as the long positions will begin to unwind. This is known as a "long squeeze."

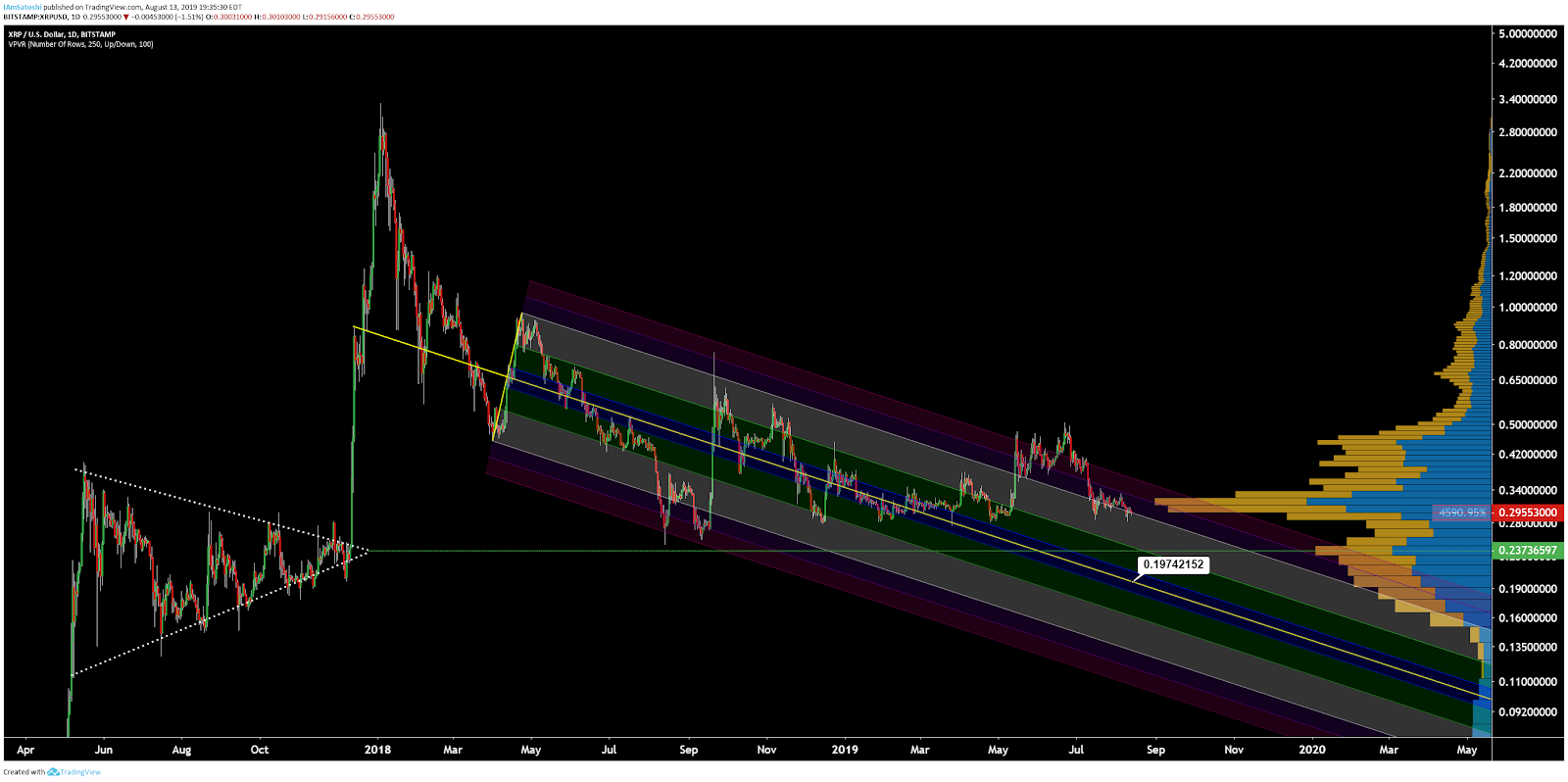

A potential bearish Pitch Fork (PF), with anchor points in December and April, encapsulates the range of the current downtrend. Price will continually attempt to return to the median line (yellow) throughout the duration of the trend, currently at US$0.20.

The lower bounds of support represent a buy zone whereas the upper bounds of the resistance represent a sell zone. The trend will remain bearish until the asset definitively breaches either zone. The median zone of the PF also matches the 2017 triangular consolidation zone.

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. Trades are typically opened when most of the signals flip from bearish to bullish, or vice versa.

On the daily chart, Cloud metrics are bearish; price is below the Cloud, the Cloud is bearish, the TK lines are bearish, and the Lagging Span is below Cloud and in price. A traditional long entry will trigger when price is once again above the Cloud, which has only happened once over the past few years, in mid-November 2018. Any bullish momentum will likely get halted at the Kijun, currently US$0.40, where sellers are likely to vigorously continue supplying bearish pressure.

Lastly, on the daily XRP/BTC chart, trend metrics show a strong bearish trend. A bearish Kumo breakout occurred on February 16th, followed by a bearish 50/200EMA Death Cross on March 26th. Since then, price has continued to drift downwards and is now building a bullish RSI divergence, suggesting waning bearish momentum. VPVR also shows a significant volume node at the current price level. Mean reversion to the 50-day EMA or 200-day EMA would bring price to 3,250 sats and 5,200 sats respectively. Should this support fail, a move to the 1,200 sat level is likely based on previous price action.

Conclusion

Fundamentals show increasing on-chain use over the past year in the setting of a growing number of Ripple partnerships across the globe. However, it remains difficult or impossible to determine if this on-chain growth represents institutional use or if these metrics are fueled purely by speculative demand. For many, regulatory clarity is still needed in regards to the possibility of the XRP token representing an unregistered securities offering by Ripple Labs. At the same time, several exchange hacks involving the XRP token over the past few months have likely dampened any bullish momentum.

Technicals on the XRP/USD pair are leaning increasingly bearish, while the XRP/BTC pair is in the throes of an ongoing bearish trend. The litmus tests for a trend reversal on any pair includes price position relative to both the 200-day EMA and the Cloud on the daily timeframe. For XRP/USD, a breach of US$0.40 on high volume would likely meet these requirements, otherwise, bearish continuation towards US$0.21 is likely. For the XRP/BTC pair, a bullish divergence has formed, which is suggestive of bullish reversal in the near term towards the 50-day EMA at 3,250 sats.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow