Basic Attention Token Price Analysis - Week on-chain metrics

The Basic Attention Token (BAT) spot price increased 400% from February to April, but has since declined 61%. The market cap currently stands at US$259 million with US$7.93 million in trading volume over the past 24 hours.

BAT is an Ethereum (ETH) based ERC-20 token, designed to be exchanged between publishers, advertisers, and users. Brendan Eich, founder and CEO of BAT, is also the creator of Javascript and co-founder of Mozilla and Firefox. The token is designed to put a value on user attention.

The project encompasses an open-source, decentralized ad exchange platform, designed to address fraud and opaqueness in digital advertising. The BAT ecosystem also includes Brave, an open-source, privacy-centered browser designed to block trackers and malware. The Brave browser decreases page load times by blocking ads, while enabling micropayments between publishers and content creators, and provides an alternative to ad-based revenue streams.

When a user opts into Brave Rewards they start seeing Brave Ads and accumulate BAT, which they can claim on a monthly basis via the integrated wallet. Users can customize how many ads they’d like to see, 1 to 5 per hour, or choose not to see any ads.

Brave Ads don’t replace current Web page ads, they are separate and uniquely different. Users see them as offers in the form of notifications. When users click to engage with these notifications, they’re presented with a full page ad in a new ad tab of the Brave browser. Because ad matching happens directly on the user’s device, the user’s data is never sent to anyone, including Brave.

Users can donate the BAT earned from viewing Brave Ads to their favorite websites, YouTube creators, or Twitch streamers. Soon they will also be able to redeem BAT for real-world rewards, such as hotel vouchers and gift certificates via TAP Network’s 250,000 brand partners.

Creators and publishers do not need to use Brave to collect BAT payments, but can complete the verification process on Uphold, a payment processor, where audience contributions are kept in escrow. BAT can also be automatically converted to fiat currencies and transferred to the creator’s bank account. Earlier this year, Brave announced that users will soon be able to directly withdraw BAT from the browser, after verifying with Uphold.

Brave recently reported 20 million downloads and 5.5 million active users, with 20% of users on desktop and 80% on mobile. In comparison, as of November 2016, Google’s Chrome browser reported two billion installs. However, in repeated head-to-head testing, Brave had the quickest load times amongst competitors Chrome and Firefox.

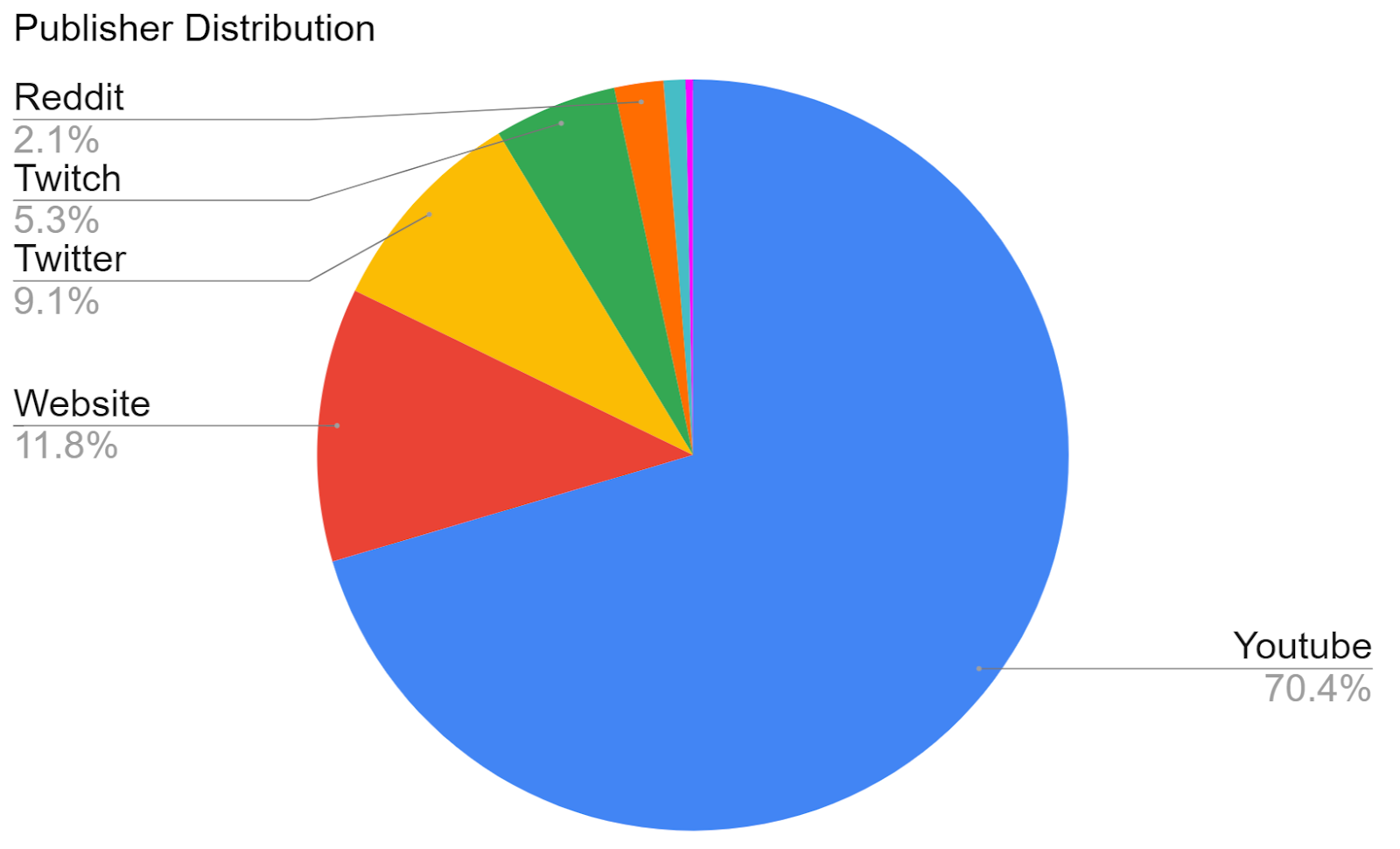

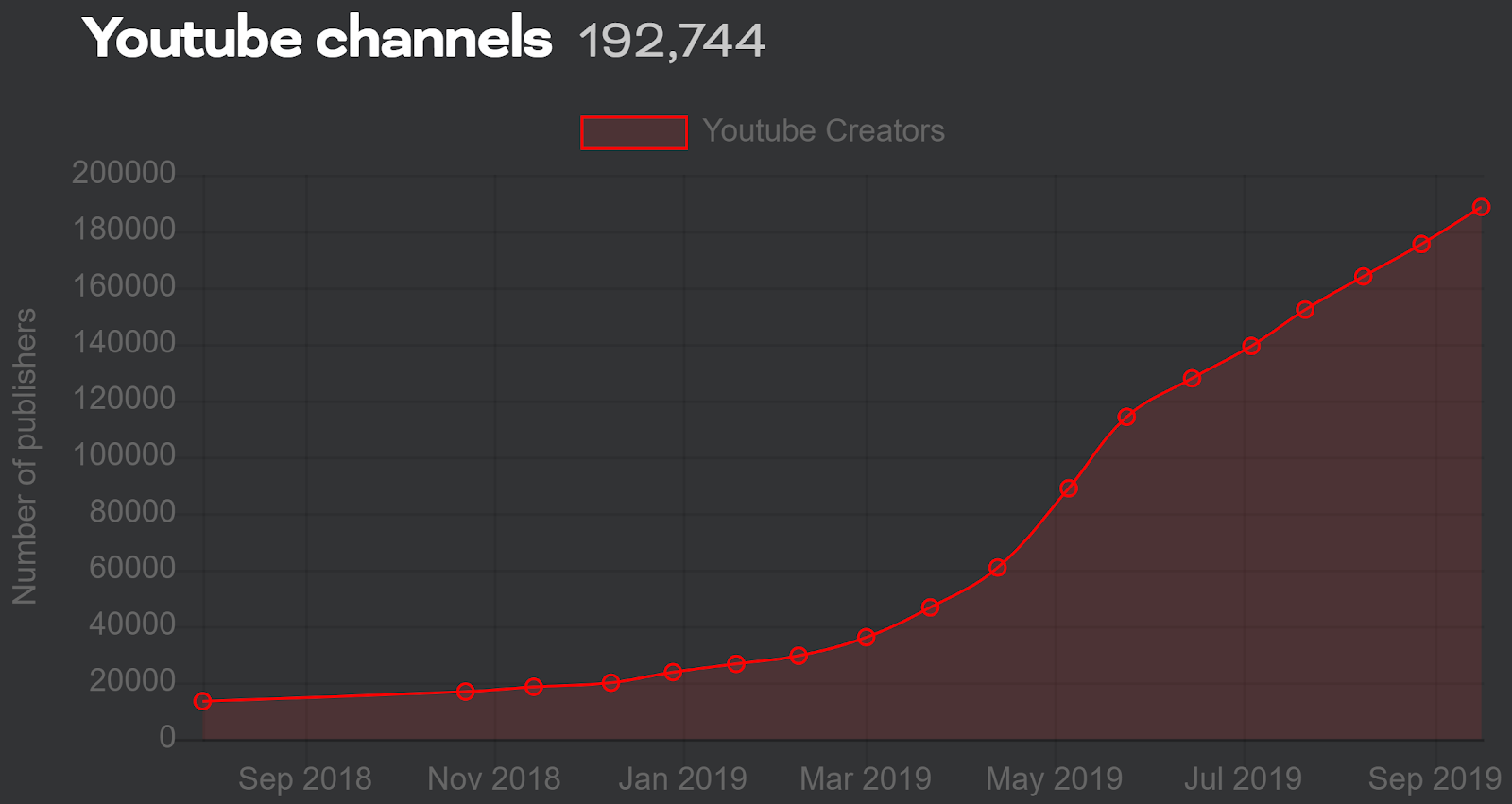

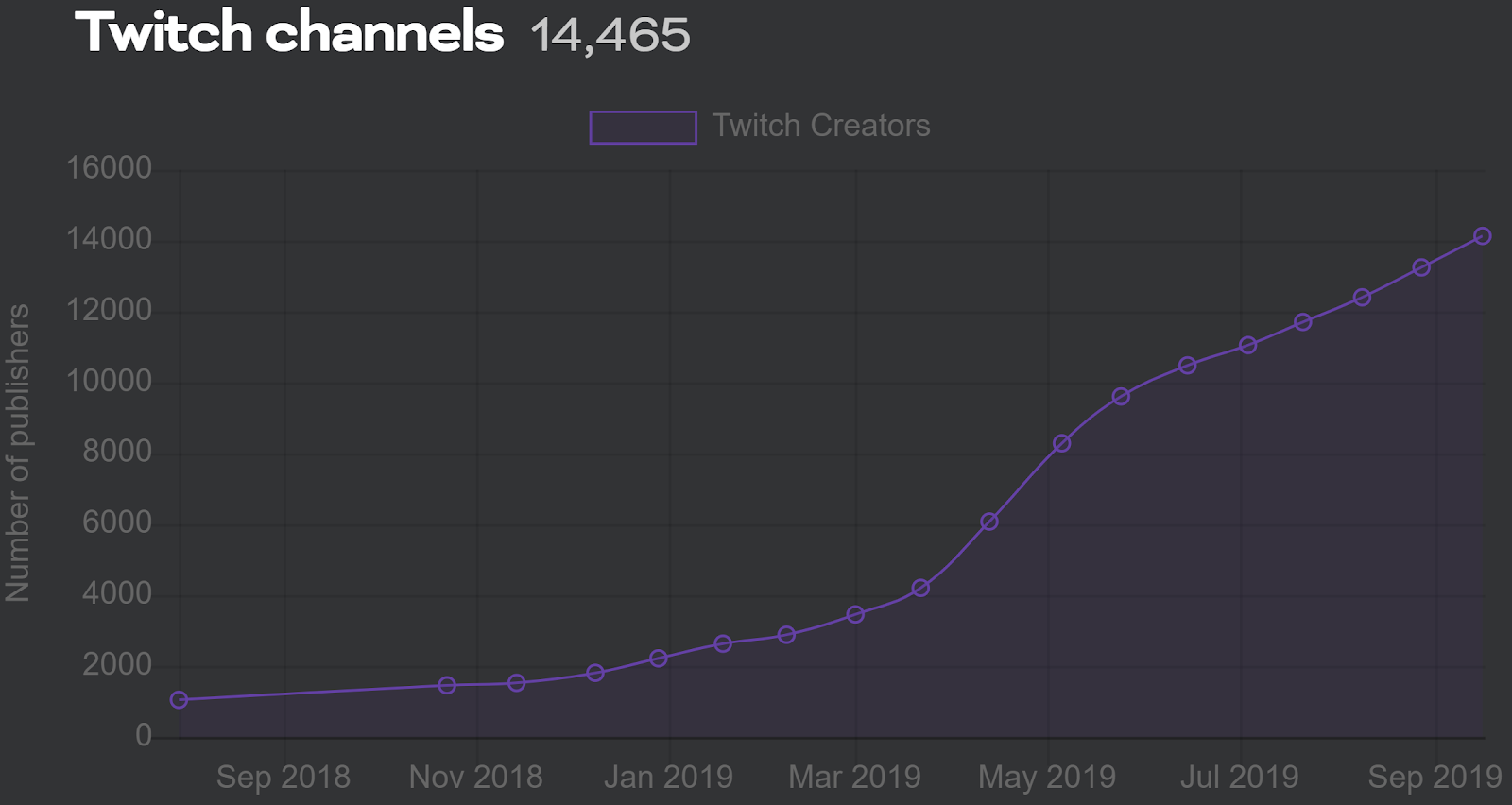

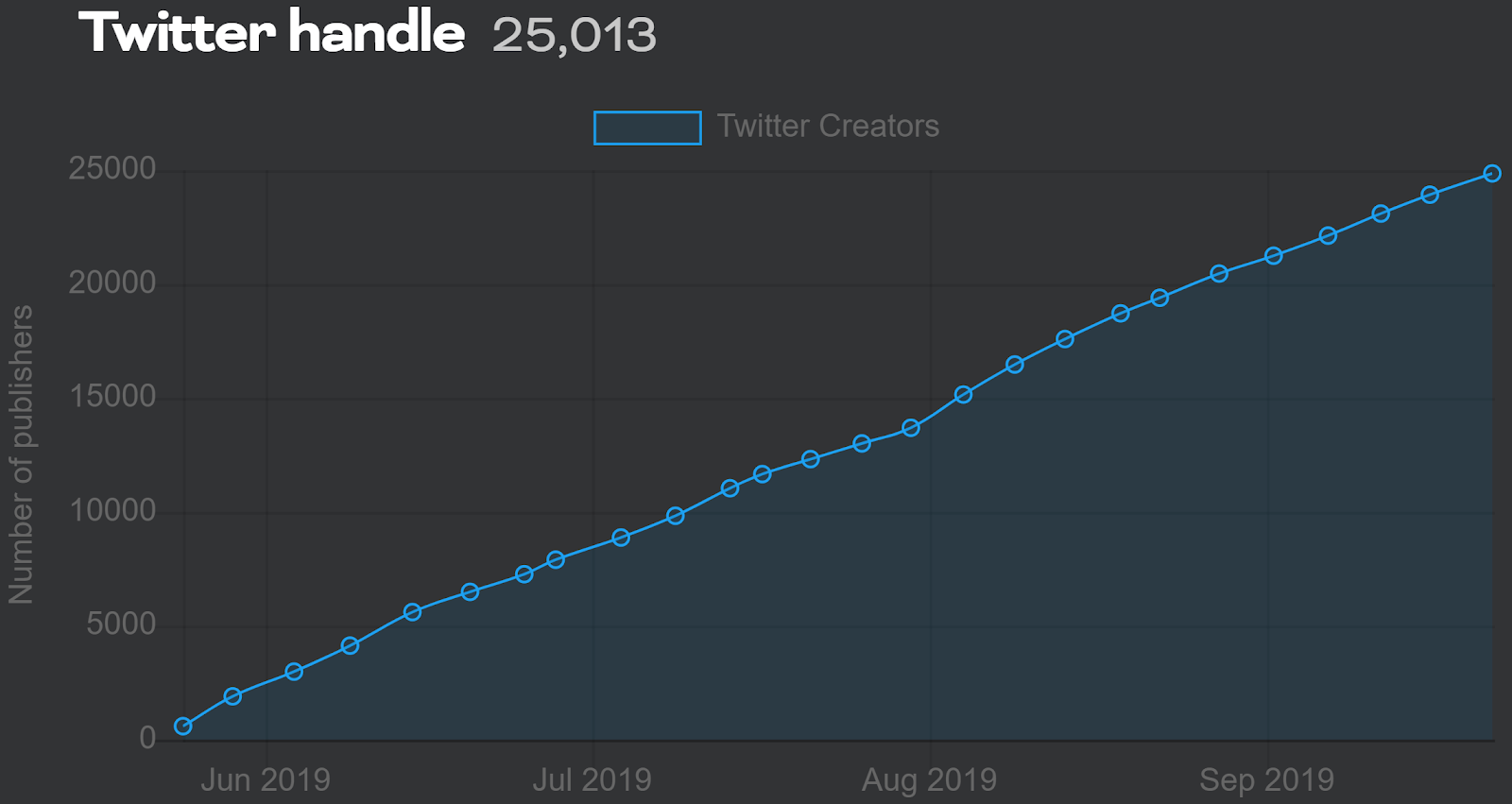

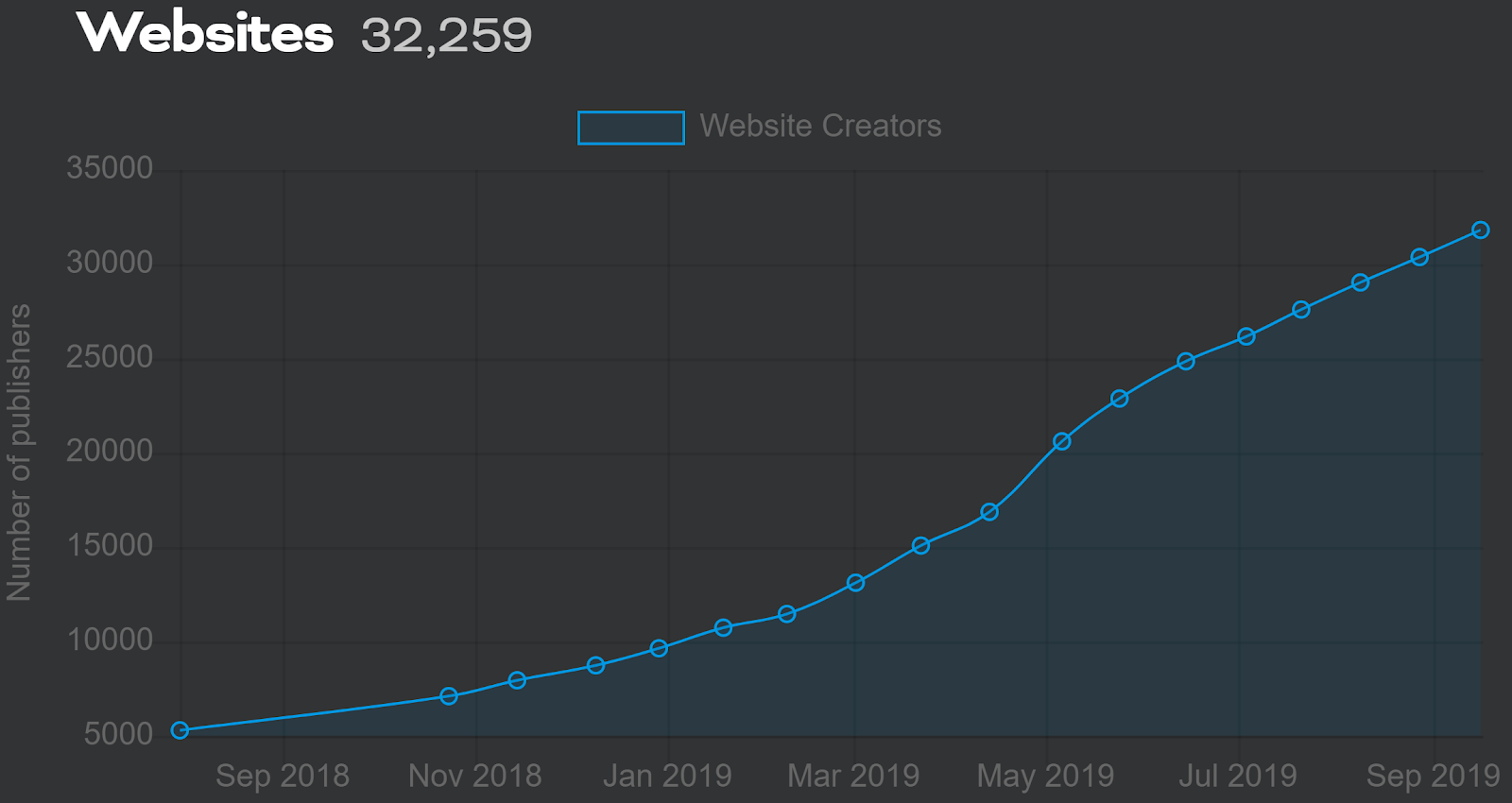

The Brave platform also has over 273,000 registered publishers listed to collect BAT funds from Brave users on YouTube, Twitch, Twitter, Reddit, Vimeo, Github, and other websites. Over 70% of all registered publishers originate from Youtube and all categories have seen continued growth over the past year.

Early on, Brave began collecting BAT donations for unverified publishers without their knowledge. YouTuber Tom Scott was angry to learn the platform was collecting donations on his behalf and called for all BAT to be refunded, which is impossible as the donations are anonymous. Scott also sent Brave a formal right-to-be-forgotten request under GDPR guidelines.

Eich responded by pointing to the BAT terms of service which acknowledges that funds donated to an unverified publisher are held for no less than 90 days before being sent to BAT’s user growth pool. Eich further states that no BAT has ever been clawed back thus far for this reason.

Additionally, there remains no opt-in option for publishers as, according to Eich, the feature would kill user-driven growth. Brave has changed the rewards system to make it clear which creators haven't yet joined through the verification process, and has no images of unverified creators in the platforms tipping panel.

There was further controversy a few months ago, regarding Brave’s ability to remotely inject headers in HTTP requests. Eich responded on Reddit by acknowledging that the custom HTTP headers are sent to Brave partners, with fixed header values. He added that this does not represent a privacy backdoor and that there is no tracking hazard.

In May, Dr. Johnny Ryan, Chief Policy & Industry Relations Officer at Brave, testified at the US Senate Judiciary Committee hearing on “Understanding the Digital Advertising Ecosystem and the Impact of Data Privacy and Competition Policy.” Ryan echoed Brave’s commitment to user privacy.

Brave offers private Tor browsing on desktop, and DuckDuckGo for private mobile tabs, as well as an integrated ETH browser wallet, MetaMask. Brave is also the default web browser for the recently released HTC Exodus1 blockchain phone.

The Brave platform went through three rounds of seed funding; a November 2015 raise of US$2.5 million, an August 2016 raise US$4.5 million, and a January 2017 raise of an undisclosed amount. Notable investors include Digital Currency Group and Pantera Capital. According to a May 2019 CoinDesk article, Brave is looking to raise another US$30–US$50 million at a valuation of US$133 million.

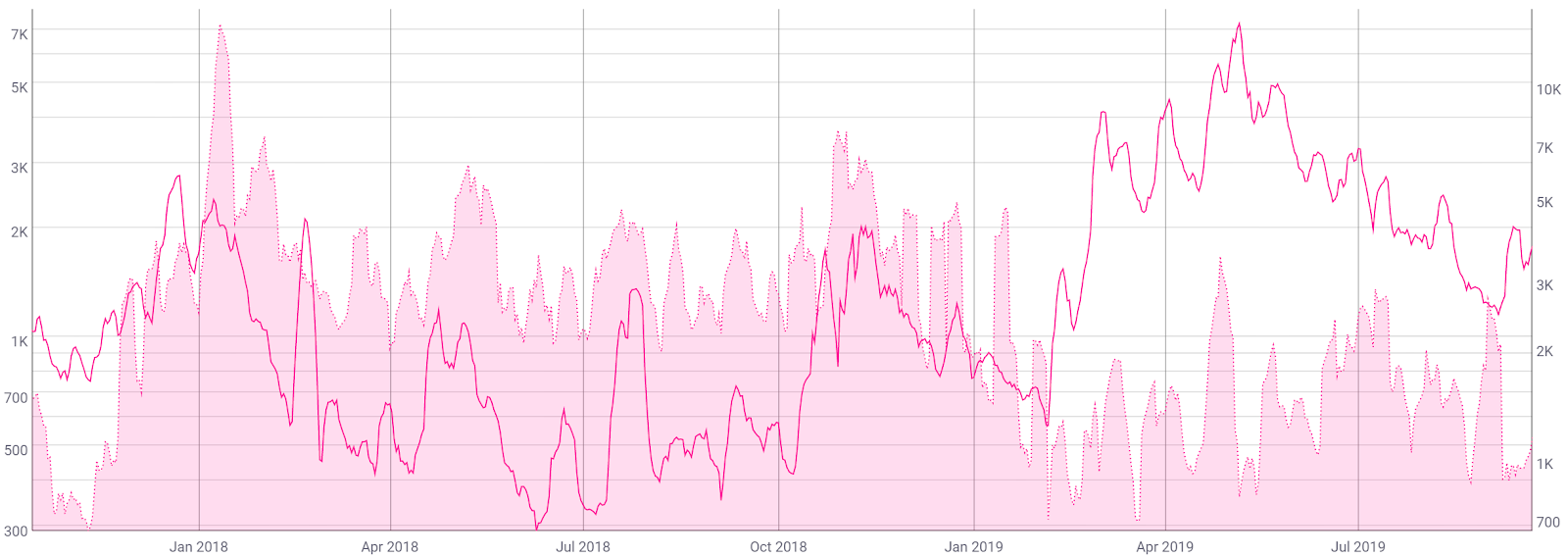

The BAT token ICO occurred in May 2017 raising over 156,000 ETH, or US$35 million at that time, in 30 seconds from 130 participants. Each of the one billion ERC20 tokens available for the crowdsale was sold at a price of US$0.036. According to wallet data, BAT spent 6,000 and 7,000 ETH in May and June of this year (shown below), with a remaining 30,000 ETH in their ICO wallet. The BAT team holds 500 million tokens and, according to the team, the total supply of BAT will never exceed 1.5 billion tokens.

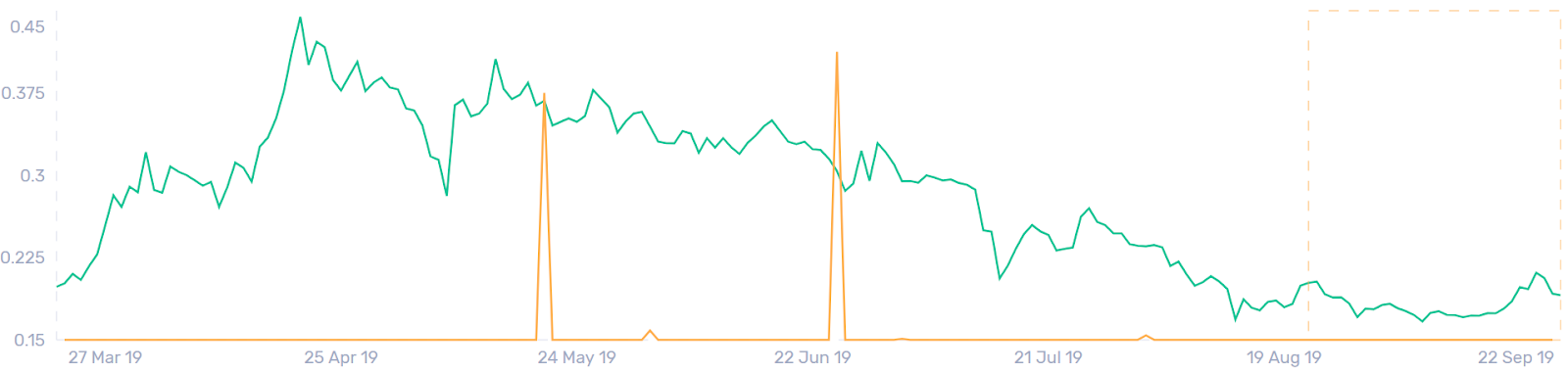

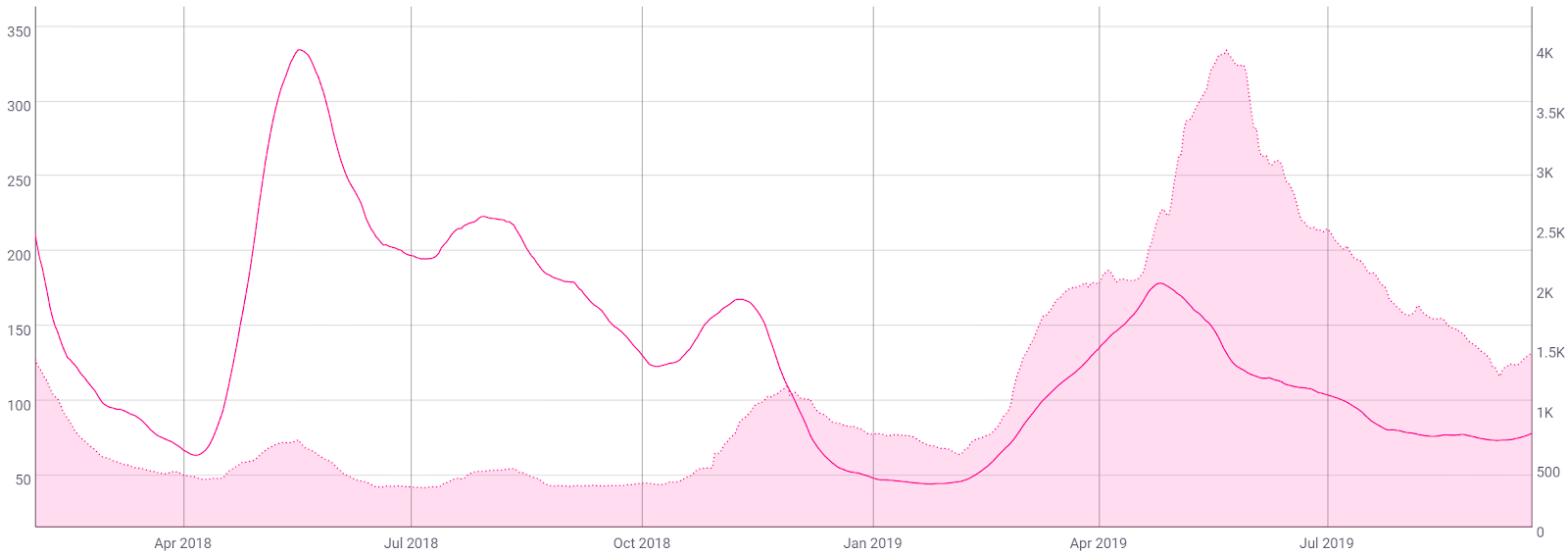

The number of BAT transactions per day (line, chart below) now stands below 2,000. This metric has fallen significantly from the record high of over 6,100 in early May. The previous spike in on-chain transactions in October and early November was likely due to speculative demand and/or transactions from a Coinbase listing at that time.

Since January, average transaction values (fill, chart below) have largely remained below US$1,000. Average transaction values tend to spike with any price spike of the token, and can be inversely related to transactions per day, as micropayment utility for the token increases.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has ranged from 67 to 108 since January. This metric has remained well below historic levels, suggesting increased token utility. A clear downtrend in NVT is bullish and suggests the coin is undervalued based on its economic activity and utility, whereas an uptrend should be considered bearish. Inflection points in NVT can be leading indicators of price reversal.

Monthly active addresses (MAA) increased to a record high of nearly 4,000 in mid-March, but have declined to less than 1,500 over the past few months (fill, chart below). A sustained increase in MAA, similar to rising transaction per day metrics, shows increasing utility for the chain, as opposed to a spike in MAA which largely suggests short-term speculative demand. Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe's law.

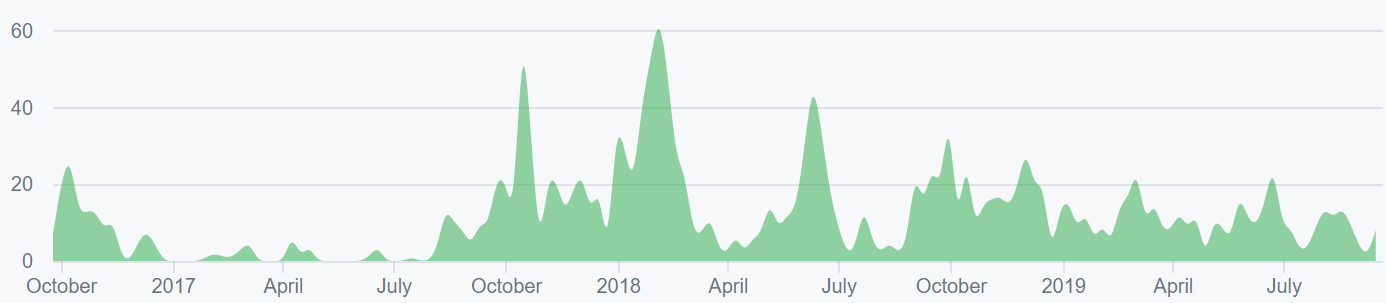

Turning to developer activity, the BAT project has 46 repos on Github with 191 commits on the main repo in the past year (shown below). In late August, Brave released the v0.68.131 desktop browser update, enabling BAT tipping on Vimeo and Reddit.

Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

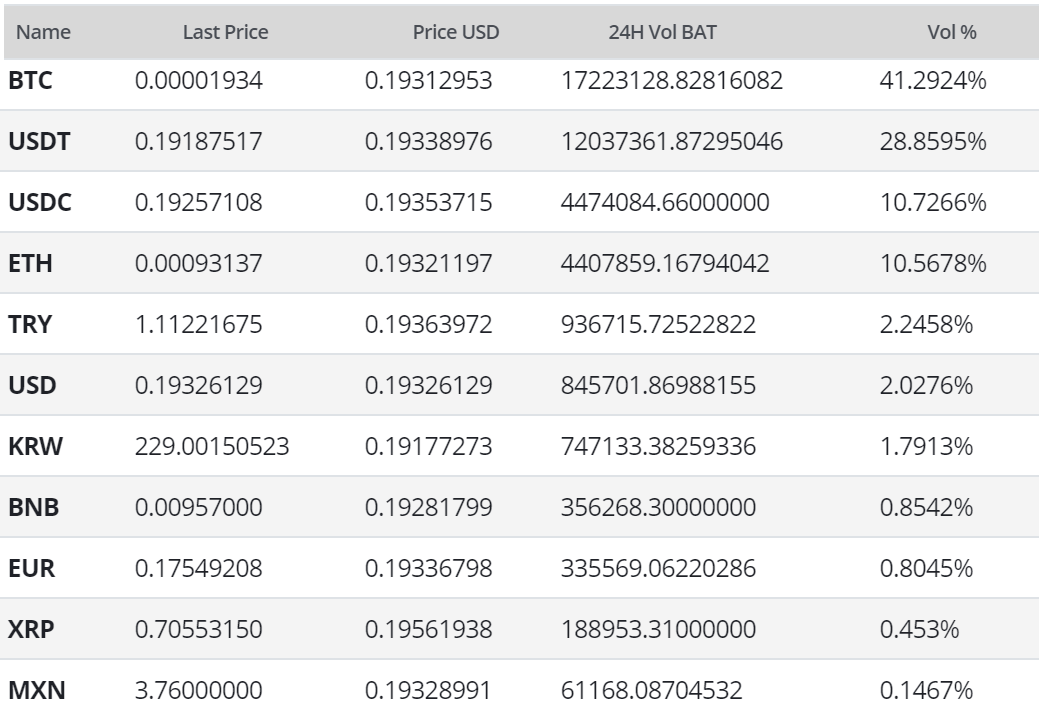

BAT exchange-traded volume in the past 24 hours has predominantly been led by the Bitcoin (BTC), Tether (USDT) and Ethereum (ETH) pairs. BAT was first listed on Bittrex in June 2017, followed by a Binance listing in November 2017, a Bitfinex listing in January 2018, a Poloniex listing in August 2018, and a Coinbase listing in November 2018. BAT/USDC and BAT/ETH are the only pairs listed on Coinbase Pro, but BAT can be purchased for USD through Coinbase’s retail platform. Earlier this year, eToro and Binance also added BAT trading pairs. BAT is also on the short list for a Binance.US listing.

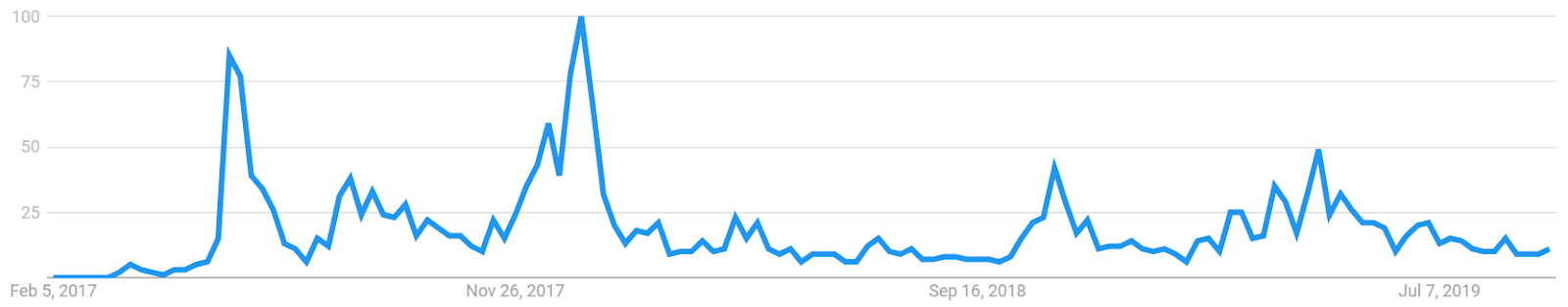

Worldwide Google Trends data for the term "Basic Attention Token" has decreased significantly from the local high in April. Spikes in Google searches often correlate with spikes in market prices. A 2015 study found a strong correlation between the Google Trends data and Bitcoin price, while a May 2017 study concluded that when the U.S. Google "Bitcoin" searches increased dramatically, Bitcoin price dropped.

A spike in early November 2018 corresponded with the Coinbase listing. Searches also spiked near the ICO date in May and June 2017, as well as in late 2017 when all crypto-related searches broadly increased.

Technical Analysis

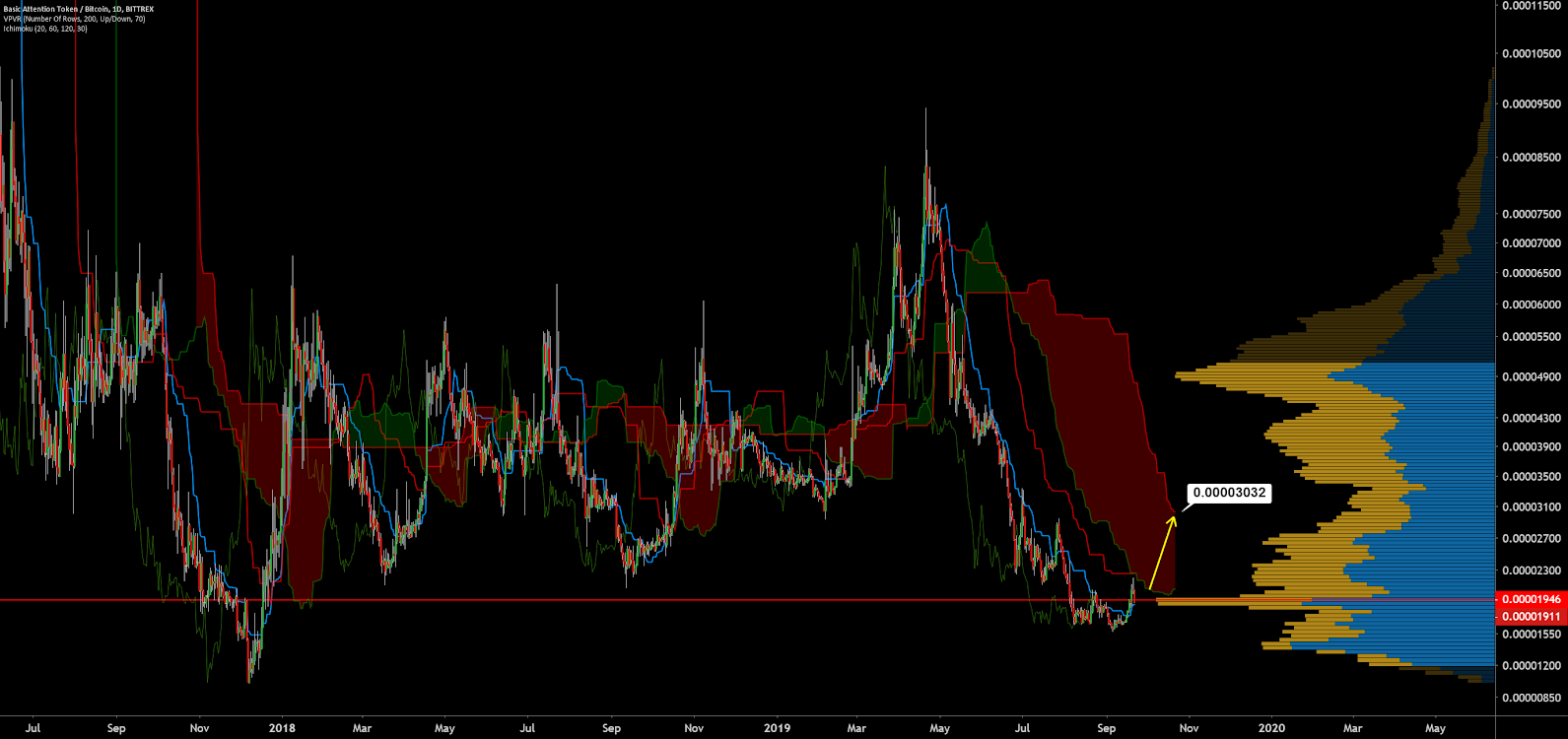

The fiat markets for BAT are fairly new and lack historic data,which makes charting the BAT/BTC pair the most prudent choice. As BAT continues to range, Exponential Moving Averages, Volume Profile of the Visible Range, and the Ichimoku Cloud can help determine optimal entry points. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the 50-day Exponential Moving Average (EMA) and 200-day EMA crossed bearishly on June 14th, representing fresh bear market conditions, with the spot price then declining over 60% since the cross. This Death Cross suggests the trend will remain bearish for the indefinite future, with the possibility of a mean reversion back to the 200-day EMA at 3,000 sats.

Volume Profile of the Visible Range (VPVR, horizontal bars) shows strong support just at the current price of 2,000 sats. The market will likely remain range bound between the 2,000 sat to 5,000 sat range until significant momentum and break of either extreme. There is also an active multi-month bullish RSI divergence suggestive of weakening bearish momentum.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame with doubled settings (20/60/120/30) are bearish; price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below Cloud and in price.

A traditional long entry will not trigger until the current spot price is above the Cloud with a bullish TK cross. However, a potential bullish edge to edge trade can trigger with a return to within the Cloud (yellow arrow). A breach of the Kijun at 3,300 sats should signify strong bullish continuation.

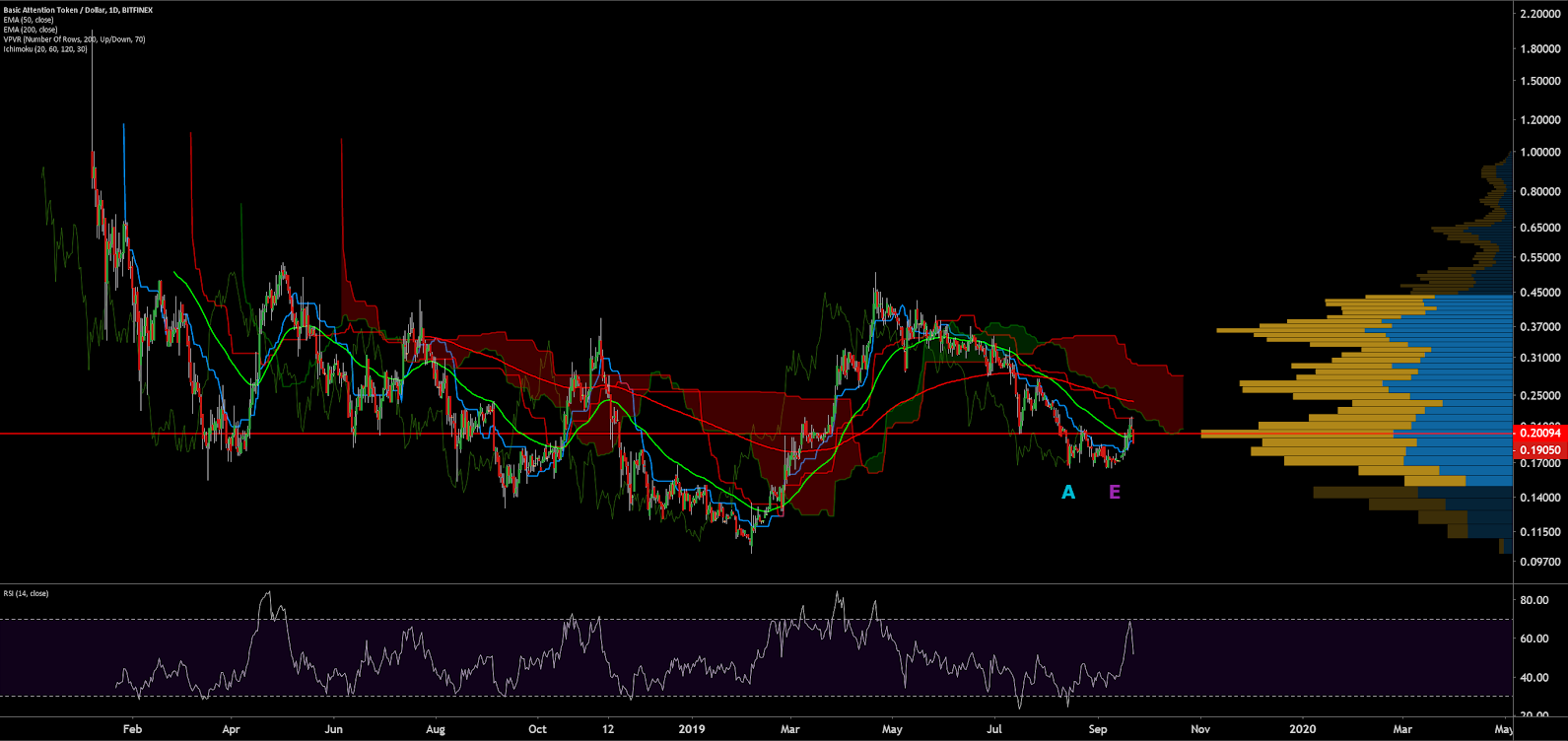

On the BAT/USD pair, which rose nearly 400% from February to mid April, trend metrics remain bearish. Price is currently below both the 50-day and 200-day EMAs with a Death Cross occurring in early August that has resulted in a 40% decline in price.

The current spot price is also below the Cloud with a recent Kijun touch, suggesting a mean reversion attempt has already occurred. VPVR shows a volume node at US$0.20, which should act as historic support. If this does not hold, the next VPVR zone sits near US$0.15.

Evidence for a near-term bottom includes a multi-month bullish RSI divergence, and an Adam & Eve (A&E) double bottom. The hallmarks of the A&E pattern include a descending volume profile but with V and U-shaped price action which increased in volume once resistance is broken.

Conclusion

Despite the strong growth in publisher numbers for Brave, on-chain data suggests that the BAT token has not benefited from an increase in these registrations. Despite on-chain metrics declining since May, these metrics remain above historic levels. NVT and average transaction values are near historic lows, suggesting increasing utility for the BAT token. However, the circulating supply of over one billion BAT tokens are likely to provide downward pressure until active Brave users, active addresses, and daily transaction amounts increase dramatically.

Technicals for the BAT/BTC pair suggest renewed ranging between the 2,000-5,000 sat levels, until the range high or low is broken. A bullish reversal trade could emerge if price is able to breach the 3,000 sat level. Based on the daily Cloud, a bull trend will not return until price is above this zone. Technicals for the BAT/USD pair also suggest an active bear trend showing signs of potential reversal. If the current low at US0.16 holds, a move towards the US$0.30 level is possible in the near-term.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow