BNC Research: IEOs mitigating investor risk

Whereas Initial Coin Offerings (ICOs) are peer-to-peer fundraising typically held on a project’s own website or facilitated by a specialized platform, IEOs are token sales hosted by a third-party exchange.

For the retail investor this has several risk-mitigating advantages over ICOs: the exchange performs due diligence so to ensure the high standard of the project, there is an immediate secondary market upon issuance which the investor can cash out of any time, and the exchange also has skin in the game with reputational risk.

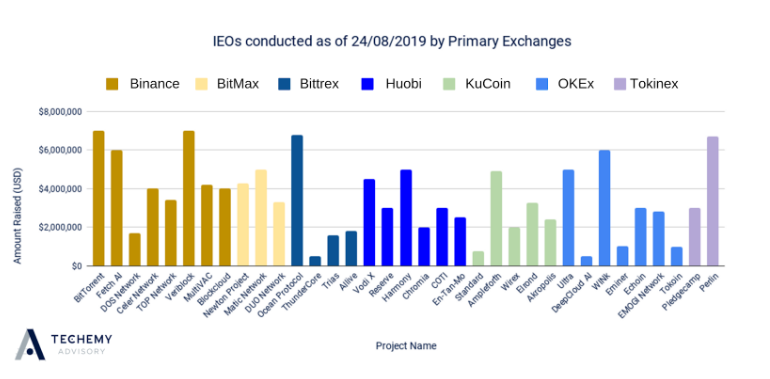

Since ICOs have petered out this year from their 2018 highs IEOs have proliferated throughout 2019. While IEOs started out as largely an Asian phenomenon, by large Chinese-exiled exchanges, the model is now being adopted by large reputable US exchanges. Bitfinex recently launched Tokinex and Coinbase is also reported to be interested in launching an IEO as well as security token offering (STO) feature.

Like ICOs, IEOs are a form of early-stage investing available to retail investors. Instead of buying company equity IEOs allow retail investors to invest in the potential utility of a company through its token and those projects with a product already built are at an advantage. The IEO boom can be seen in the context of the wider venture capital (VC) and private equity scene of which IEOs play a minor role - as an appendage to seed funding that quality blockchain startups are using to bolster their VC funding.

The low-interest rate environment has made credit cheap and expanded the hunt for yield into new more diverse markets such as blockchain and cryptocurrency. This environment, alongside a growing interest from the millennial demographic in early-stage investing rather than late-stage stock market investing should provide a strong upwind for the IEO market going into 2020.

OhNoCrypto

via https://www.ohnocrypto.com

News, Khareem Sudlow