Crypto Market Forecast: 16th September 2019

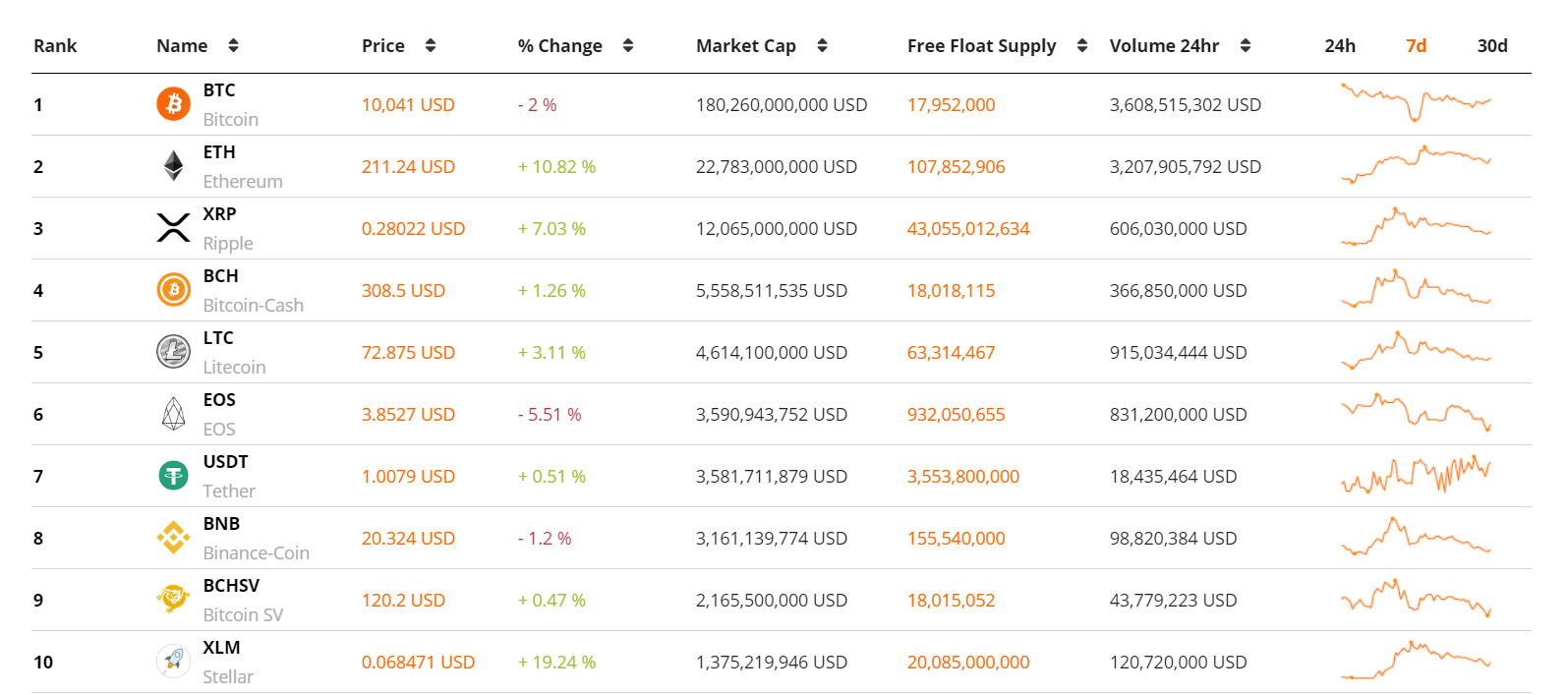

It was a mixed trading week in the crypto asset markets. With BTC trading sideways, a number of large-cap altcoins were able to post large USD gains. The number two and three crypto assets on Brave New Coin’s market cap table, ETH and XRP, rose 11% and 7%, respectively, while Bitcoin fell ~2%. The week’s price pattern hints at a possible reversal of one of 2019’s most persistent macro market trends - growing Bitcoin market dominance and a rise in the Bitcoin maximalist narrative.

In recent months, many cryptocurrency analysts and Bitcoin maximalists have expressed a view that the altcoin market is dead. In 2019, the BTC price has appreciated 300% while Bitcoin’s dominance of the total global crypto market cap has grown from ~50% on January 1st to ~70% in early September. The dominance metric has now pulled back slightly and it currently sits at ~68%.

Over this same nine-month period a number of 2017/2018 ICO projects have been forced to liquidate raised capital in order to continue operations. Despite having 2-4 years of development time, very few altcoin projects have managed to attract a large commercial user base, achieve token utility beyond trading, or find a reason for holders to keep holding tokens.

Bitcoin, on the other hand, has continued to find wide appeal as an accessible store-of-value asset analogous to digital gold. It has been functional and secure for a decade and benefits from a range of network effects, including liquidity, a growing number of wallet addresses, a highly competitive network of nodes that ensure immutability, and a wide range of fiat currency options to trade against.

Until the narrative changes, some market participants will continue to shift their altcoin holdings towards BTC due to a view that crypto’s original and leading asset will continue to absorb more of the altcoin market’s value due to its position as the only crypto asset to organically create lasting fundamental value.

In the meantime, altcoin projects such as Ethereum and XRP (Ripple) continue to attract speculators. Both projects have major development goals that appear to be on track for execution in the medium term. These milestones may create new buying pressure. This week's strong Ethereum performance follows the news that testing has begun to raise block sizes as a response to network congestion. If successful, this could result in a 25% increase in gas capacity. This means network users like the Tether stablecoin should be able to run gas operations on the network more cheaply and quickly in the near future.

Whether a ranging Bitcoin price can continue to bolster a growing altcoin market in the weeks ahead is uncertain. Despite some strong buying activity in recent weeks, sentiment surrounding the altcoin market remains muted. Recent gains in the XRP and ETH markets have happened with only marginal gains in trading volume. The current Crypto Fear & Greed Index is leaning towards ‘Fear’ as the sentiment driving the crypto markets. However, current low trading volumes imply a lack of conviction in the market as current participants remain uncertain of the primary trend.

September 30th or earlier- Matic Network mainnet release (beta)

With Q3 2019 coming to a close at the end of this week, several crypto projects appear to have lined up key releases in accordance with the start of the new quarter. Matic, the network behind one of 2019’s biggest IEOs is scheduled to release the beta for its mainnet by the end of September. The Matic network mainnet seeks to provide scalable and secure Ethereum transactions using layer-2 plasma infrastructure and proof-of-stake. Matic fell ~2% in the last week and was not a token that benefited from the bullish sentiment in altcoin markets.

Late September/Early October- 0x version v3.0 launch

0x, one of the ecosystem’s leading blockchain-as-a-service solutions, provides tools for network participants to build their own decentralized exchanges. It announced in January that it would be releasing version 3.0 of its product by the end of Q3 2019. However, as announced in a development update in July, a more likely date range for the launch is between September and mid-October. The new update arrives with more flexible order matching and will “unlock a richer experience for smart contract devs.” The price of 0x rose ~43% in the last week and it was a major mid-cap winner.

Top 10 crypto market cap

This week’s Brave New Coin top 10 market cap table is a mixed bag with some losers, some winners, and some assets trading sideways. XRP, a token that has stagnated and struggled to pick up any positive momentum over the last year, performed well in USD and BTC terms. Some of these gains may stem from a petition for a community-driven hard fork of the XRP ledger. The new ledger would seek to protect XRP investors from early investor, treasury and developer dumps that have put a lid on any bullish market activity over the last 9 months.

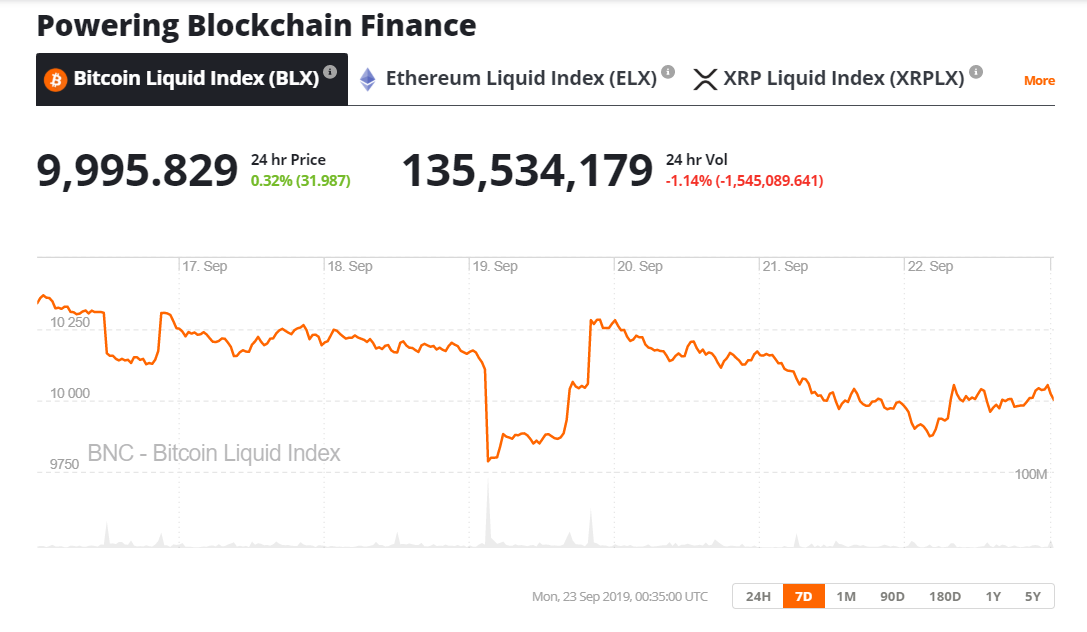

The price of Bitcoin ranged between USD10,250 and USD 9,750 for most of the last week, finding support or resistance anytime it threatened to go above or below these levels. September 23rd marks the launch of trading for BAKKT futures contracts on the Intercontinental exchange. The exchange’s first contracts have already begun trading. With early indications suggesting that initial volume on the exchange will be underwhelming, many are viewing the event as an opportunity to go short.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow