Bitcoin trading spike unlikely due to Hong Kong unrest

Protests against Beijing's control over Hong Kong began in June and continued last week as the Chinese state celebrated its 70th anniversary. The unrest has coincided with a sudden spike in volume on the Hong Kong branch of LocalBitcoins, which reported $1.42 million (172.8 BTC) in transaction volume in just seven days.

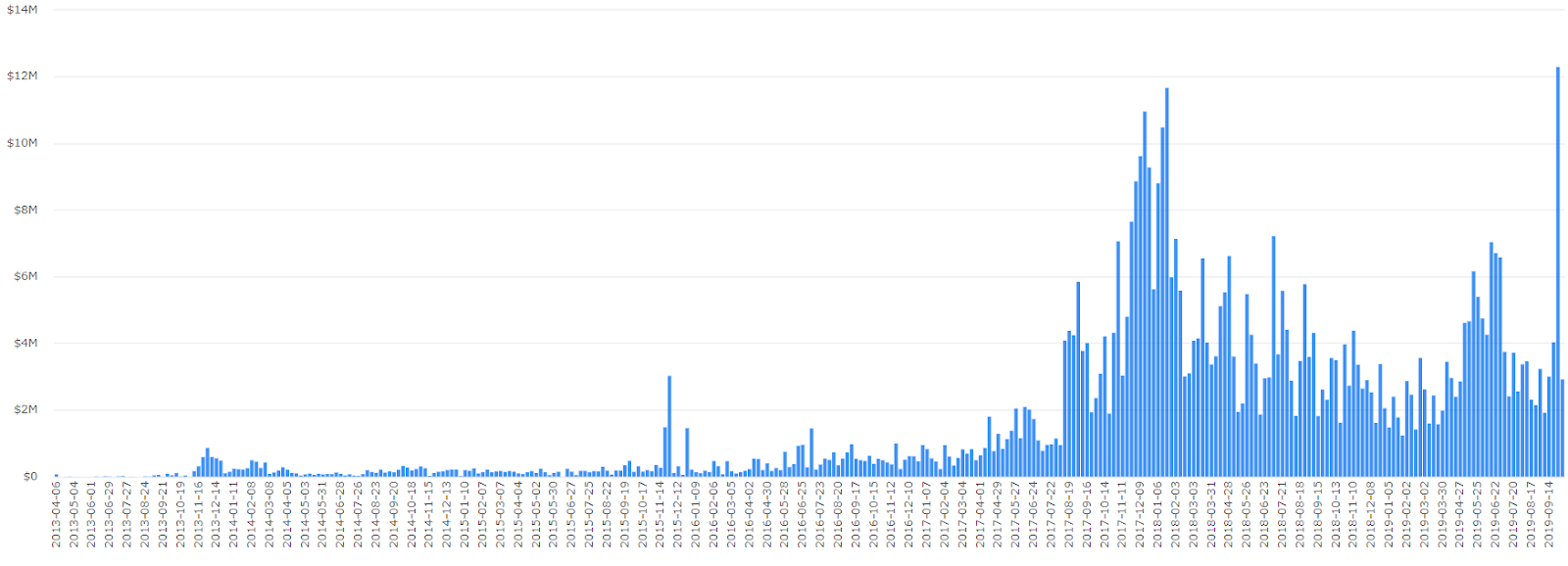

Weekly bitcoin volume on LocalBitcoins Source: coin.dance

'Opting out' of the local economy

The exact reasons for the spike in volume are unclear but some protestors appear to be turning to crypto to evade the financial system - abandoning Octopus cards, mobile payments and credit cards to avoid leaving a paper trail of transactions that could identify them.

This has led to greater demand for hard cash, leaving long lines for ATMs in the city as protestors withdraw money - conscious of the possibility of China passing an emergency law that could arbitrarily freeze their assets.

Google search trends in Hong Kong show that as the protests have worn on, interest has grown in encrypted messaging apps like Telegram— which allow citizens to avoid state-controlled apps like WeChat. At the same time, searches for Bitcoin have also pushed up slightly, suggesting that Hongkongers could be using cryptocurrency to avoid surveillance.

eToro analyst Mati Greenspan has directly linked increased interest in Bitcoin to the ongoing activism, claiming that protestors could be buying up the cryptocurrency as they lose faith in institutions. “I can’t help but feel that this could very well be a sign that some Hong Kong protesters are seeing Bitcoin as a way to opt-out of the local economy, which is run by governments and financial institutions,” said Greenspan in a market analysis.

A whale buying the dip

The link between Bitcoin and geopolitical turmoil has grown more established in recent months, with analysts noting a correlation between buying activity and political events in Venezuela, Turkey, and Iran. But while enthusiasts might be quick to suggest that Bitcoin is acting as a 'safe haven' or a protest tool in Hong Kong, in reality the evidence is scant.

Data scientist Matt Ahlborg suggests that "a single week of volume from a single source isn’t enough to conclude anything," and while LocalBitcoins might be an attractive platform for protestors to exchange cash for Bitcoin without leaving a breadcrumb trail, it represents "a tiny sliver of the OTC market."

Speaking to a "pro trader who claims they were the counterparty to most of this volume," Ahlborg says he discovered that the sudden spike in data was caused by a single trader with deep pockets 'buying the dip' in a bid to capitalize on low prices.

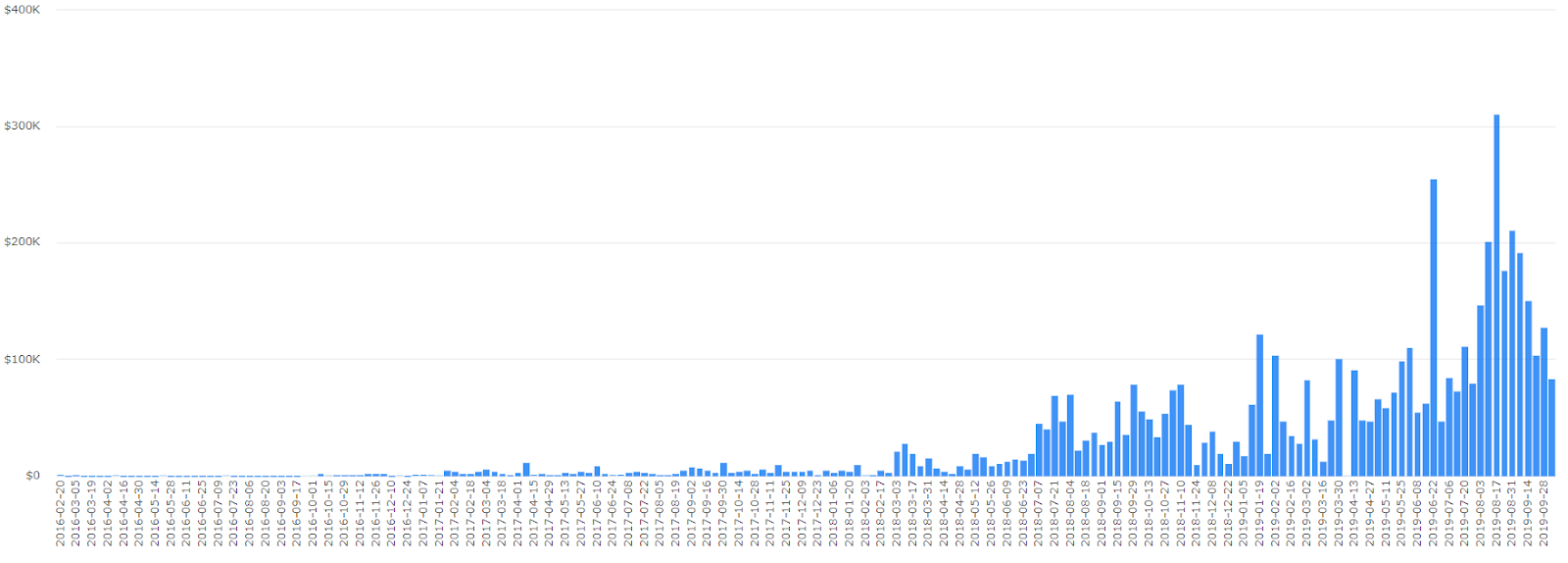

Data from LocalBitcoins competitor Paxful shows no spike in peer-to-peer trading activity in Hong Kong, supporting the idea that the transactions could be traced back to a 'whale' making a sudden splash.

Furthermore, the 'Hong Kong premium' that was once identified on local exchange TibeBit now seems to have dissolved, suggesting protestors are not flocking to the platform as once thought.

Weekly bitcoin volume on Paxful Source: coin.dance

Regulators warm to Bitcoin

Although the protests might not be spurring adoption, other recent developments could help to foster the growth of Hong Kong’s crypto sector.

New [guidelines](https://www.sfc.hk/web/EN/files/IS/publications/VA_Portfolio_Managers_Terms_and_Conditions_(EN)** **released by the Hong Kong Securities and Futures Commission (SFC) aim to make life easier for funds considering holding digital assets. These state that funds must maintain a minimum liquid capital of 3 million Hong Kong Dollars—which equates to almost $383,000—and set out detailed requirements for custody, along with advice on preventing money laundering and terrorism funding.

Only last month, Fitch downgraded Hong Kong's rating from AA+ to AA amid reports that local tycoons were moving their personal wealth offshore

But with clarity from regulators, digital assets could play a larger part in Hong Kong's future, helping the city to compete with Singapore as the major Asian financial centre.

OhNoCrypto

via https://www.ohnocrypto.com

Kieran Smith, Khareem Sudlow