Grayscale is Seeing Mass Institutional Interest in Bitcoin

The numbers are in: Grayscale, a top cryptocurrency investment services provider, continues to see overwhelming interest from retail investors and institutions for Bitcoin.

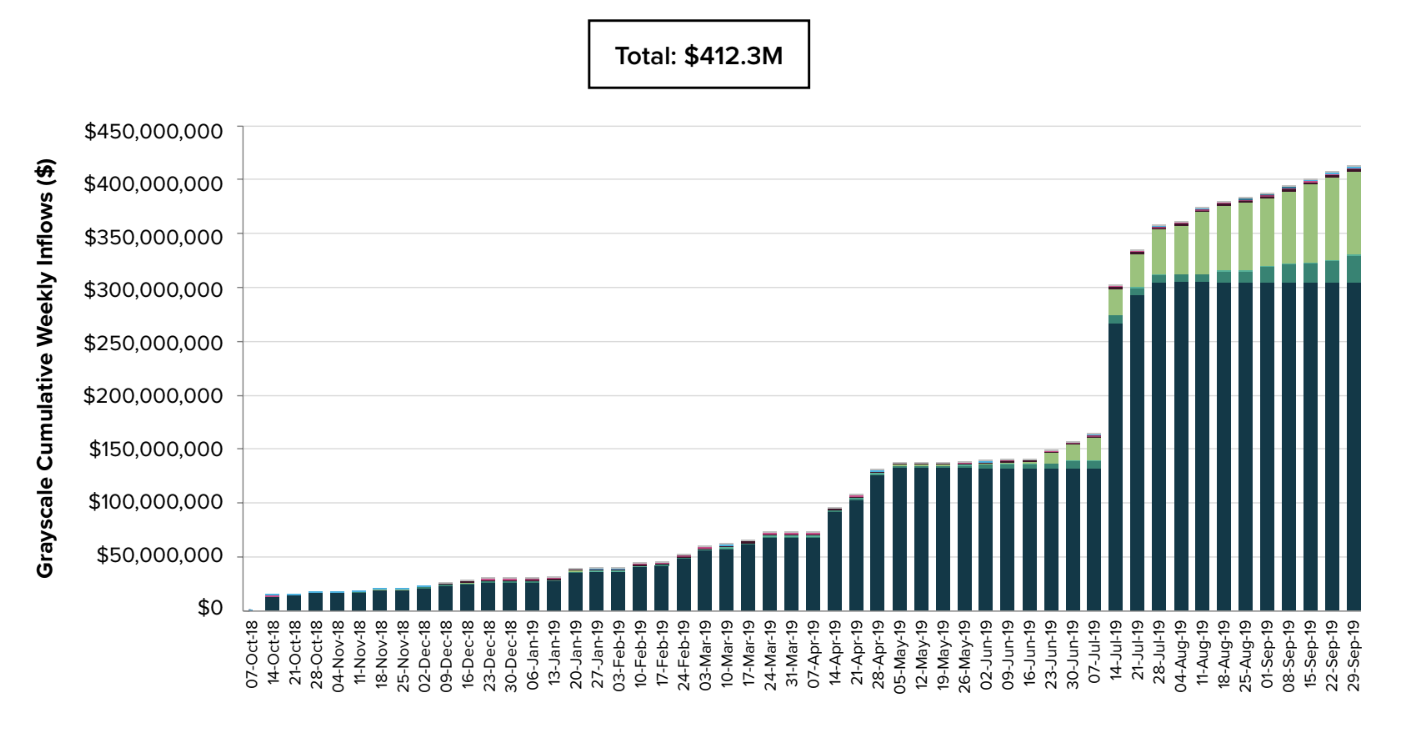

In fact, over the course of the third quarter, the New York-based firm, which provides investors with safe Bitcoin and altcoin vehicles, brought in some $254.9 million.

This comes in spite of the fact that the leading cryptocurrency’s price has collapsed by nearly 50% from the June 2018 peak.

Grayscale’s Bitcoin & Altcoin Products See Record Inflows

In a report published Tuesday, Grayscale revealed that its products saw a record quarter, drawing in $254.9 million in three month’s time. The company claimed that this is the firm’s strongest quarter since Grayscale’s incept:

“Inflows tripled quarter-over-quarter, from $84.8 to $254.9 million, despite recent declines in digital asset market prices,” it was added.

This fiscal quarter brings trailing 12-month inflows for the firm to over $400 million — a small yet respectable percentage of the cryptocurrency market’s total capitalization.

Grayscale’s Bitcoin Trust, which is the popular product that trades under GBTC, grew by an average of $13.2 million this quarter. The rest of Grayscale’s funds, which include trusts for Ethereum, ZCash, Litecoin, and an array of other leading altcoins, saw an average weekly investment metric of $6.4 million.

What’s interesting is that a majority of these inflows, to both the Bitcoin and altcoin funds of Grayscale, came from institutional players — something that likely pleases many cryptocurrency investors. The report, in fact, says that “a majority of investment (84%) came from institutional investors, dominated by hedge funds.”

According to a report from industry publication The Block, who recently interviewed Grayscale chief Michael Sonnenshein regarding the firm’s latest data, the growth can be attributed to two things.

First, Grayscale’s “Drop Gold” ad/marketing campaign that began to air earlier this year. The campaign, which is focused on convincing investors to “drop gold, buy Bitcoin,” was the talk of the town on Twitter and on some mainstream media outlets earlier this year.

Second, institutional investors coming to the realization that Bitcoin may be a proper way to hedge against economic and political risk. As Sonnenshein told The Block:

“Most of our institutional investors are actually not crypto hedge funds. It really runs the gamut — we have tons of global macros funds who maybe look at digital assets as a way to be short fiat money or thinking about all the economic and political turmoil going on globally.”

Institutions Aren’t the End All and Be All

While much of this industry’s focus has been on institutions, it is important to note that this subset of investors isn’t the end all and be all of cryptocurrency. Far from, really.

Speaking to CNBC’s “Power Lunch” panel last week, Lou Kerner, a partner at fund Crypto Oracle and a former Goldman Sachs analyst, argued that Bitcoin doesn’t need institutions to succeed and rocket higher, citing the fact that a majority of the asset’s adoption has been caused by people like you or me, not bankers. Kerner even went as far as to say that the institutions will be the followers in this market, not the trailblazers.

He isn’t kidding. An analysis from Twitter user “BitcoinEconomics” recently found that Bitcoin’s 2017 bull run from $1,000 to $20,000 “was caused by retail buyers”, as made evident by the growth in the holdings of addresses with small holdings.

Yet, Kerner in the CNBC interview did admit near the end of the segment that institutions will eventually make a true foray into this market, claiming they will be attracted to cryptocurrencies like apples are attracted to the ground due to gravity.

The post Grayscale is Seeing Mass Institutional Interest in Bitcoin appeared first on Blockonomi.

OhNoCryptocurrency via https://ift.tt/2PblI7a @Nick Chong, @Khareem Sudlow