Crypto Market Forecast: 18th November

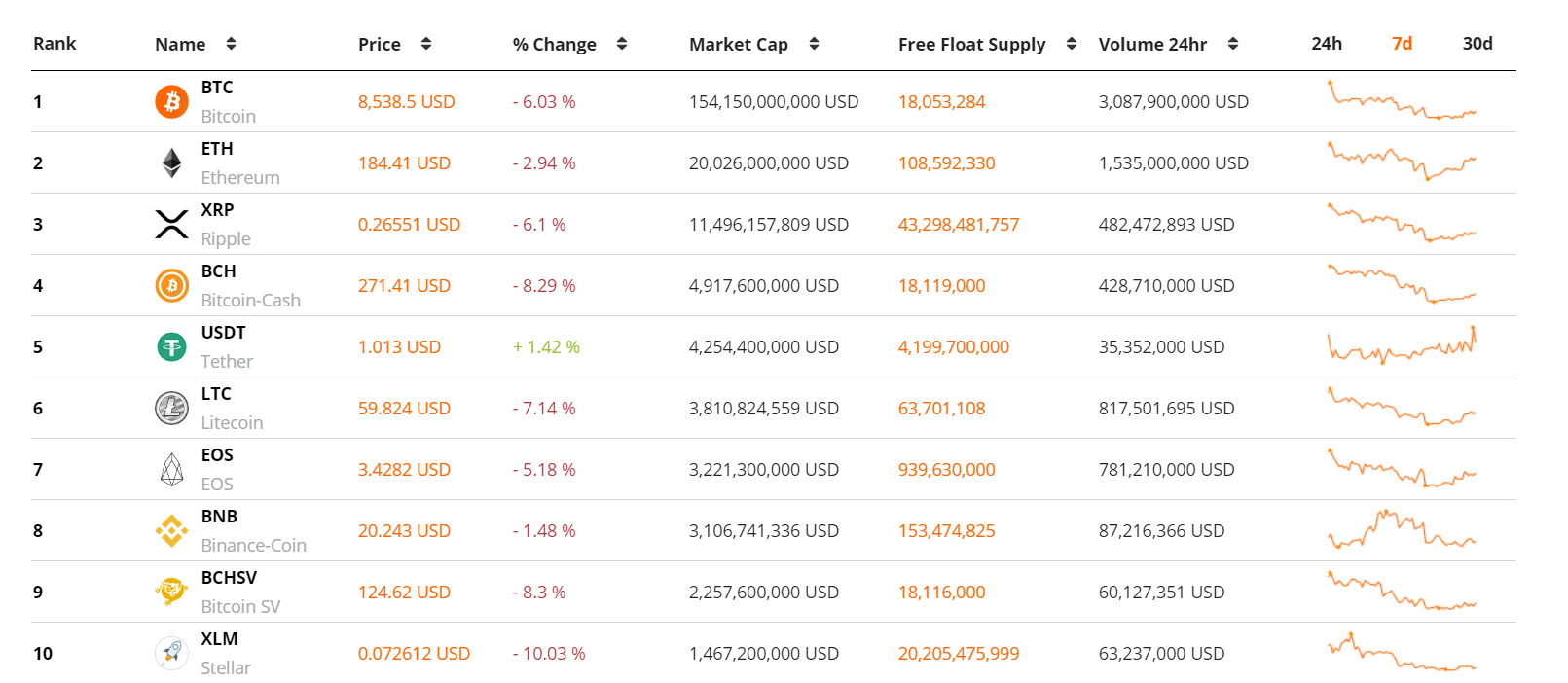

It was a difficult week for crypto traders with most large-cap asset prices dragged to lower levels over the course of the week. Market benchmark BTC ended the week down ~6%, while the second and third crypto assets on Brave New Coin’s market cap table, ETH and XRP, fell ~3% and ~6% respectively. The overall crypto market cap slid ~4%.

In contrast to the tepid week in crypto, the US stock market continued to hit record highs. On Friday, the Dow Jones stock index crossed 28,000 points for the first time, while the S&P stock index recorded its 6th consecutive week of positive gains.

The upward trend in the U.S. equity markets is impressive given the current macroeconomic and political risks. In recent months factors such as the US-China trade tensions, the near collapse of the Fed repo market, and the continuous lowering of US lending rates have led many analysts to suggest that the global economy is heading for a recession.

Euphoric traders and investors appear set to inject new money into equity markets despite recession concerns. CNN’s Fear & Greed Index continues to suggest that ‘extreme greed’ is dominating US stock markets. This is in stark contrast to the Crypto Fear & Greed Index, which suggests that the crypto markets are dominated by ‘fear’ at present.

Over the last week, low volume and stagnant prices in the crypto markets have been inversely correlated with the strong returns in the Dow Jones and S&P indices. This implies that gold, bonds, and stocks may still offer strong returns in the short term.

The Federal Reserve Board released a report last Friday suggesting that a stablecoin crisis in the form of a run could pose a threat to the global economy. It outlined steps for other financial authorities to mitigate against these risks. The controversial Facebook backed Libra stablecoin received a special mention. The report referenced the growing ambition of stablecoins and implied that they pose a potential systemic risk should they collapse.

Upcoming events in crypto markets

18th November- Launch of Multi-Collateral DAI (MCD) on the Ethereum network

The leading stablecoin project on the Ethereum blockchain launches the biggest update in its history this Monday. In a fundamental change to the network's operational structure, old DAI will now be called ‘SAI’ (Single Collateral DAI), newly upgraded DAIs will be called ‘DAI’, and what were previously referred to as Collateralized Debt Position (CDP) contracts will be called ‘Vaults’. Users will now have multiple options to collateralize debt and issue DAIs, meaning more flexibility and diversified risk.

November 25th- 0x V3 launches on Ethereum mainnet

Following approval after a successful community vote, another Ethereum project will have a major upgrade soon. 0x V3 proposes to add major improvements including deeper network liquidity and an improved developer experience. A major addition to the upgrade will let 0x become a community-owned liquidity API and the DEX liquidity aggregator for the greater DeFi ecosystem.

Every asset apart from US dollar Tether (USDT) traded red over the last 7 days, with the bearish activity in the Bitcoin market appearing to drag down alts. Outside of the top 10 some alts enjoyed gains compared to the rest of the market, with Cardano (ADA), Chainlink (LINK), and NEO all trading green last week.

Bitcoin bulls again failed to defend the US$9000 resistance level as prices gradually slid to the US$8,500 level as the week progressed. With the BTC/USD market ranging between 8600 to 9000 levels for most of the last month, many analysts are expecting an upcoming period of volatility. Historically, Bitcoin has tended to make a sudden volatile move following an extended period of sideways price movement.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow