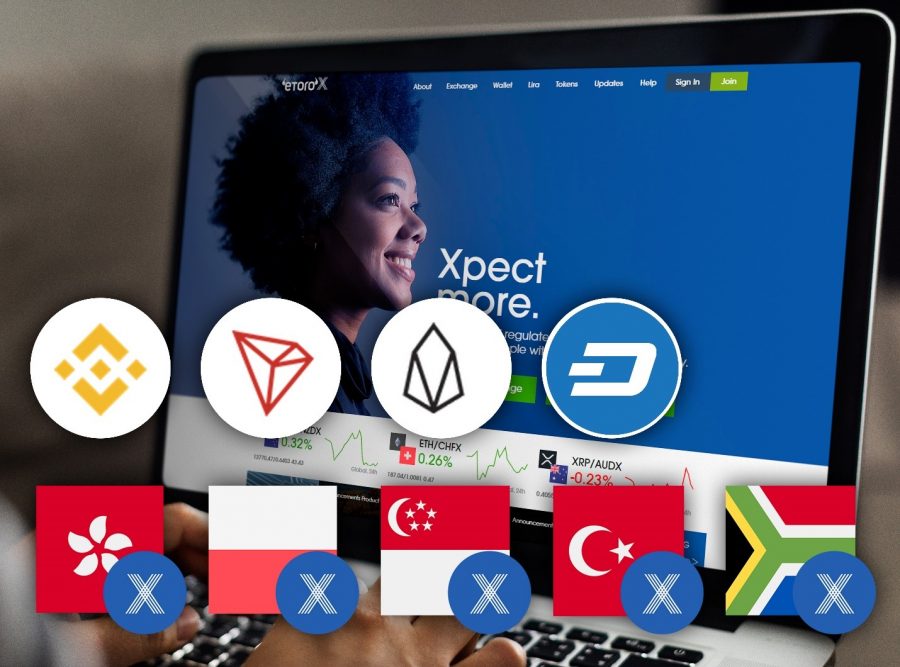

eToroX adds Dash, USDC, USDT and 5 new stablecoins

Institutional traders now have access to more instruments on the regulated crypto exchange

eToroX, the blockchain subsidiary of global investment platform eToro, has added five new fiat stablecoins, a new crypto asset, two further established stablecoins and a crypto-commodity pair, signalling its rapid growth, having only launched only six months ago. There are now 26 tradable assets available on the exchange.

The new assets announced today are:

- Turkish Lira [TRYX], Polish Zloty [PLNX], South African Rand [ZARX], Hong Kong Dollar [HKDX], and Singapore Dollar [SGDX]

- Peer-to-peer crypto asset, Dash

- Circle’s USDC and Tether’s USDT stablecoins

- GOLDX/BTC pairing

eToroX is committed to supporting the needs of algo traders seeking to diversify into crypto assets on a secure and regulated platform. These new additions also demonstrate eToroX’s focus on Asian markets.

Doron Rosenblum, Managing Director of eToroX commented,

“We see the addition of USDC and USDT as a way for eToroX to further meet the needs of professional and institutional algo traders, particularly in the Asian markets. Adding five new stablecoins, plus the addition of the Dash cryptoasset, demonstrates our ongoing commitment to bridge the gap between the world of blockchain and traditional financial markets.”

GoldX – the tokenized gold stablecoin – is now available as a base currency for a trading as a pair with Bitcoin [GOLDX/BTC]. Increasingly, Bitcoin is being compared with gold as a store of value. Gold is viewed as a safe haven asset, and Bitcoin is increasingly being referred to as “digital gold”.

Rosenblum continued,

“Our Gold/Bitcoin pair provides a means to trade between the old and the new stores of value, making Gold/BTC an extremely special and interesting combination.”

With today’s new additions, eToroX has added a total of 96 trading pairs since its inception in April this year, and currently offers seventeen eToroX stablecoins in addition to USDC and USDT.

The pairs include:

- USDEX/ZARX

- ZARX/JPYX

- EURX/PLNX

- USDEX/PLNX

- USDEX/HKDX

- USDEX/TRYX

- USDEX/SGDX

- ETH-USDT

- XRP-USDT

- LTC-USDT

- BCH-USDT

- XLM-USDT

- EOS-USDT

- TRX-USDT

- BTC-USDC

- ETH-USDC

- XRP-USDC

- LTC-USDC

- BCH-USDC

- XLM-USDC EOS-USDC

- TRX-USDC

As eToroX continues to open up the world of trading on the blockchain, more trading pairs will be announced. eToroX will also be adding additional cryptoassets and stablecoins to the exchange in the coming months.

About eToroX

eToroX is a subsidiary of the eToro Group. The business was formed in 2018 to provide the infrastructure to support eToro Group’s commitment to facilitating the evolution of tokenized assets. It provides eToro’s wallet and runs the exchange.

The distributed ledger technology [DLT] provider licence was granted by the Gibraltar Financial Services Commission to eToroX in December 2018 [licence number FSC1333B]. eToroX is incorporated in Gibraltar with company number 116348 and its registered office is at 57/63 Line Wall Road, Gibraltar.

About eToro

eToro was founded in 2007 with the vision of opening up the global markets so that everyone can trade and invest in a simple and transparent way. The eToro Group consists of the eToro platform, our multi-asset trading and investment venue, and eToroX, which manages our crypto wallet and exchange.

The eToro platform enables people to invest in the assets they want, from stocks and commodities to crypto assets. We are a global community of more than ten million registered users who share their investment strategies, and anyone can follow the approaches of those who have been the most successful. Due to the simplicity of the platform users can easily buy, hold and sell assets, monitor their portfolio in real-time, and transact whenever they want.

As technology has evolved, so has our business. In 2018, we created eToroX, our tokenized asset subsidiary. eToroX provides the infrastructure, in the form of a crypto wallet and the forthcoming exchange, that supports our commitment to facilitating the evolution of tokenized assets. We believe that leveraging blockchain technology will enable us to become the first truly global service provider allowing everyone to trade, invest and save.

eToro’s forte:

eToro is regulated in Europe by the Cyprus Securities and Exchange Commission, by the Financial Conduct Authority in the UK and by the Australian Securities and Investments Commission in Australia.

eToroX is incorporated in Gibraltar with company number 116348 and its registered office is at 57/63 Line Wall Road, Gibraltar. It’s distributed ledger technology [DLT] provider licence was granted by the Gibraltar Financial Services Commission in December 2018 [licence number FSC1333B].

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework.

Disclaimer: This a paid post, and should not be treated as news/advice.

OhNoCrypto

via https://www.ohnocrypto.com

Shirly McCoy, Khareem Sudlow