New indices bring institutional-grade crypto futures contracts to retail investors

So what is an Index? In its simplest form, an index tracks the performance of a basket of assets to represent the strength of a market or market segment, via a single price. Assets within the basket can be given a different weighting as part of the price average. This is reflected in a single index price based on the performance of the assets in the overall market.

An index can provide a more accurate gauge of a market or sector’s health over any one single asset. It is a way of expressing the value of an asset, industry or commodity class using a balanced methodology that accounts for outliers. There are various kinds of indexes, methodologies and weighting factors.

Well-known indexes include the S&P 500, the Dow Jones, and Nasdaq in the US stock markets. The S&P and Nasdaq are composite indexes that collate the performance of 500 and 3000 securities respectively, weighted by their market capitalization (MCAP). A market-cap index can be skewed to one sector that is performing well compared to the rest of the index. For example, in the S&P index, the Information Technology sector has a 23% weighting compared to 13% for the next largest sector, healthcare. This reflects the popularity of technology and growth stocks such as Amazon, Google, and Facebook.

The DOW Jones Industrial Average, on the other hand, uses a weighted average methodology of the top 30 US stocks by stock price as picked by Dow Jones. It uses a simple average methodology of the stock prices to determine the weighting factor of each stock in the index. Companies with a higher share price have a big effect on the movement of the Dow index.

Criteria for inclusion is an important aspect in the creation of an index. To be included in the S&P, for example, stocks must have a market cap of $8.2 billion or more, have a public float of at least 50 percent, have positive earnings for the most recent four quarters, and have adequate liquidity as measured by price and volume. It’s market value-weighted methodology attempts to ensure that a $10 stock moves the index to the same degree that a $50 stock does.

The S&P is the most reflective of the overall market trend as it uses a greater sample of stocks and is used as a performance benchmark by many fund managers for portfolio returns. Composite indices are used as a barometer of health for every country’s stock market.

Index futures

While indices are for viewing and benchmarking the performance of assets in the spot market, tradeable derivative products can be built from them such as options, futures, forwards and funds.

A futures contract is a legally binding agreement between two parties to settle a transaction in the future for a certain price. Unless the contract is rolled-over (extended) before the expiry date, the contract must be settled by delivering or taking possession of the underlying asset - unless it is a cash-settled contract.

Traditionally, commodities futures are physically-delivered contracts, for example in the oil, grains, and metals markets, as manufacturers hedge production costs and take possession of the raw materials from the exchange’s warehouse or custodian at the end of the contract. Often commodities futures markets are more liquid than the spot markets, such as oil futures, and lead the spot price.

Index futures, on the other hand, are typically cash-settled contracts and there is no exchange of the underlying ‘assets’ (in this case shares) that the index tracks, it is purely a directional trade.

The CME trades S&P, Dow and NASDAQ futures contracts on its 24hr electronic Globex marketplace. These are called ‘e-mini contracts’ which expire at the end of every quarter. Typically the futures price leads the (present) price in the spot indices, so if the futures contract ends the day higher than the spot price, the spot market can be expected to open higher the following day.

Contract size, or the notional value of the amount of the underlying asset, is important. The contract size of CME e-mini contracts is $5 (the contract multiplier) which means for every point the index moves the trade will gain or lose $5, so a 100-point move will equate to $500. Similarly, the CME has futures contracts for Bitcoin with a contract size of 5 BTC and a tick value of $5 per BTC. When trading one CME contract, the minimum price movement is in $25 increments (5 BTC x $5).

BTC futures contracts on CME require around 40% initial margin, and trading is open only from Monday to Friday, thus a margin account is required with a traditional futures broker that is allowed to trade on CME and is comfortable clearing the product on CME. Due to this and the minimum contract size of 5 BTC, trading the CME Bitcoin futures is not suitable for retail traders.

Trading the BTSE crypto futures

Index futures are rare in the crypto-asset markets. The recently launched BBCX Composite Index of Bitcoin, Litecoin, and Ethereum is one of the few built by a third party for a host exchange - in this case by Brave New Coin’s market data team for the BTSE exchange. An ‘institutional-grade’ index product, the BBCX enables crypto futures trading with the same methodology and reliability of traditional futures contracts - and is one of the first in the world to track multiple crypto assets across multiple pricing sources at sub-second frequency. \

The arm's length relationship between index builders and the exchange aids price objectivity. Brave New Coin is in charge of running and developing the numbers and calculations for the indices (the BTSE-BNC Basket index family), while BTSE oversees the actual order book and product trading based on those indices on its exchange.

The BBCX contracts trade in monthly and quarterly expiry dates, similar to the traditional CME futures contracts, as opposed to the ‘perpetual futures’ traded on BitMEX which are rolled-over every 8 hours so that there is no fixed expiry date.

Brave New Coin has also created an altcoin index for the BTSE exchange. The BBAX composite index will consist of ETH, LTC, EOS and Ripple’s XRP and will launch before the end of 2019.

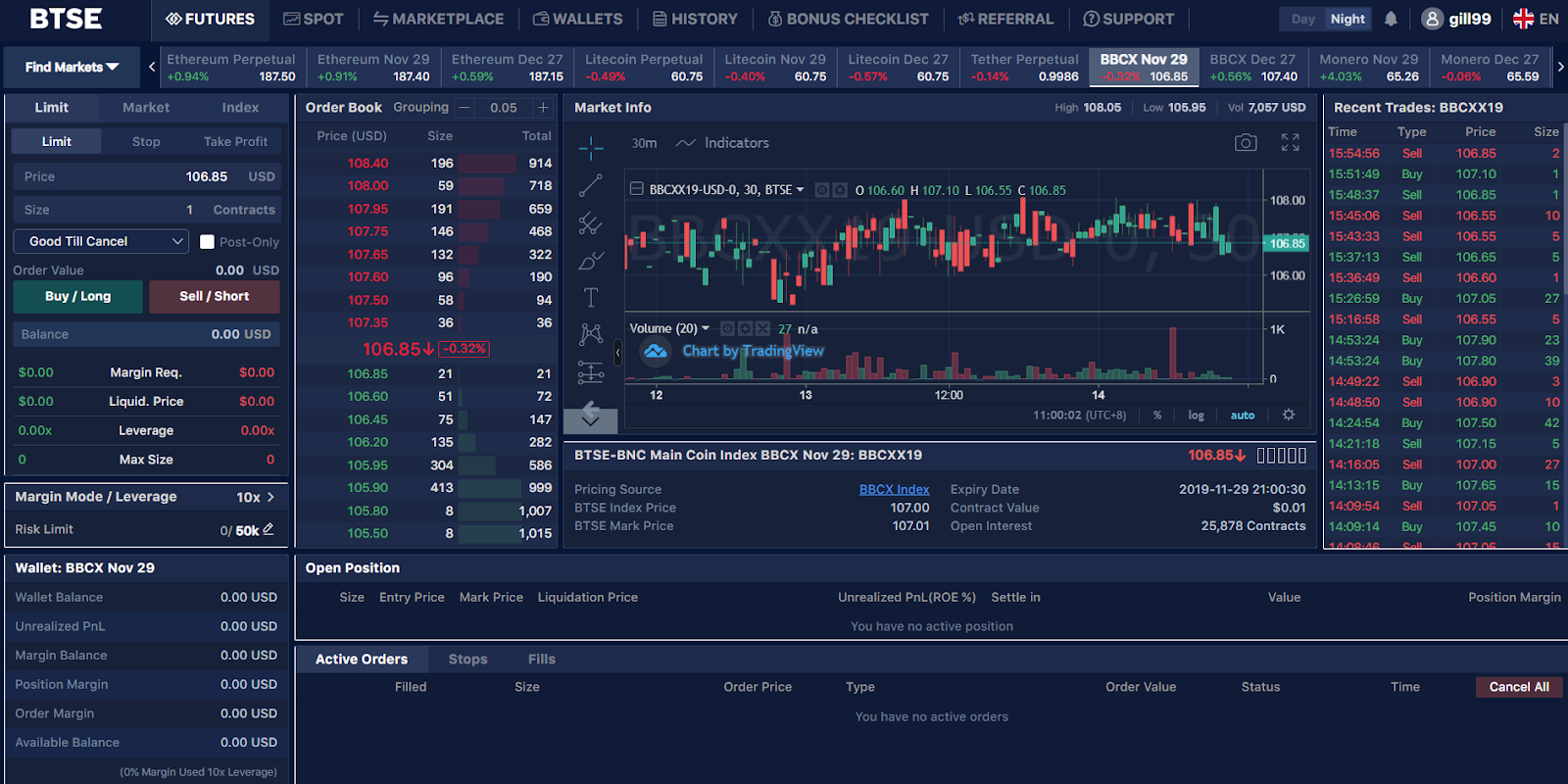

The full terminal view of the BBCX on BTSE

BTSE’s BBCX and BBAX are both cash-settled contracts so there is no custody or delivery of the underlying cryptocurrency. Each future has $ notional value to determine the user's exposure. For example, if BBCX futures is trading at $115, and the users go long 50 contracts, their notional dollar exposure is calculated as $115 * 50 * 0.01 = $57.5. The trader’s dollar profit & loss is calculated based on this notional exposure and is more suited to retail traders as it allows for smaller position sizes - the notional value of each contract is approximately $1.

In this sense, the BBCX futures contract combines the traditional contract expiry of the CME market but with smaller notional contract sizes and more customizable risk management.

Overall, the new BTSE-BNC indices are transparent indices that represent overall crypto market movements for the top crypto assets by market-cap and are an industry-first to track the underlying assets at sub-second frequency.

This high throughput of tick data is optimized for high-frequency and algorithmic trading strategies and BNC’s methodology ensures that constituent exchanges don’t skew the data and traders can rely on getting fair order executions.

The BTSE-BNC BBCX can be traded on the BTSE exchange.

The next article in this series will look at how to trade the BBCX index at the BTSE exchange.

OhNoCrypto

via https://www.ohnocrypto.com

Andrew Gillick, Khareem Sudlow