Plustoken scammers contributed to Bitcoin downturn, finds Chainalysis

Chainalysis has tracked the movement of funds across various different blockchains in an attempt to ascertain if the liquidation of funds by PlusToken scammers is responsible for the recent bitcoin downtrend.

The findings point to a correlation between the selling of bitcoin by the scammers, and sudden moves in price. But whether the sales actually caused the price to fall is less clear, and rival blockchain detectives CipherTrace claim that PlusToken has nothing to with the bitcoin dump.

The PlusToken hypothesis

Bitcoin reached its June 2019 peak of almost $14,000 just a few days after Chinese authorities arrested multiple suspects on the island of Vanuatu on suspicion of operating a Ponzi known as PlusToken. The scheme, which promised returns as high as 600%, revolved around a token that was listed on several Chinese exchanges and hit a peak price of $350.

In total, the perpetrators are thought to have scammed 'investors' out of a total of more than $2 billion worth of cryptocurrency—or around one percent of the entire cryptocurrency market cap at the time.

Since the arrests were made, bitcoin has fallen into a downtrend which some speculators have suggested is caused by scammers periodically selling off the stolen bitcoin.

A study in August by crypto security firm PeckShield sparked the initial speculation—confirming the fraudulent funds had flowed mainly into Bittrex and Huobi, but providing no further insight.

The Chainalysis investigation reveals that a total of 25,000 bitcoin have already been cashed out by the scammers. These were traced by Chainalysis through various mechanisms designed to obfuscate them, including; peel chains, which are strings of transactions commonly used for money laundering; and tumblers, which mix up the inputs and outputs of addresses. Eventually, most of the funds ended up in the hands of independent OTC brokers operating on the Huobi platform.

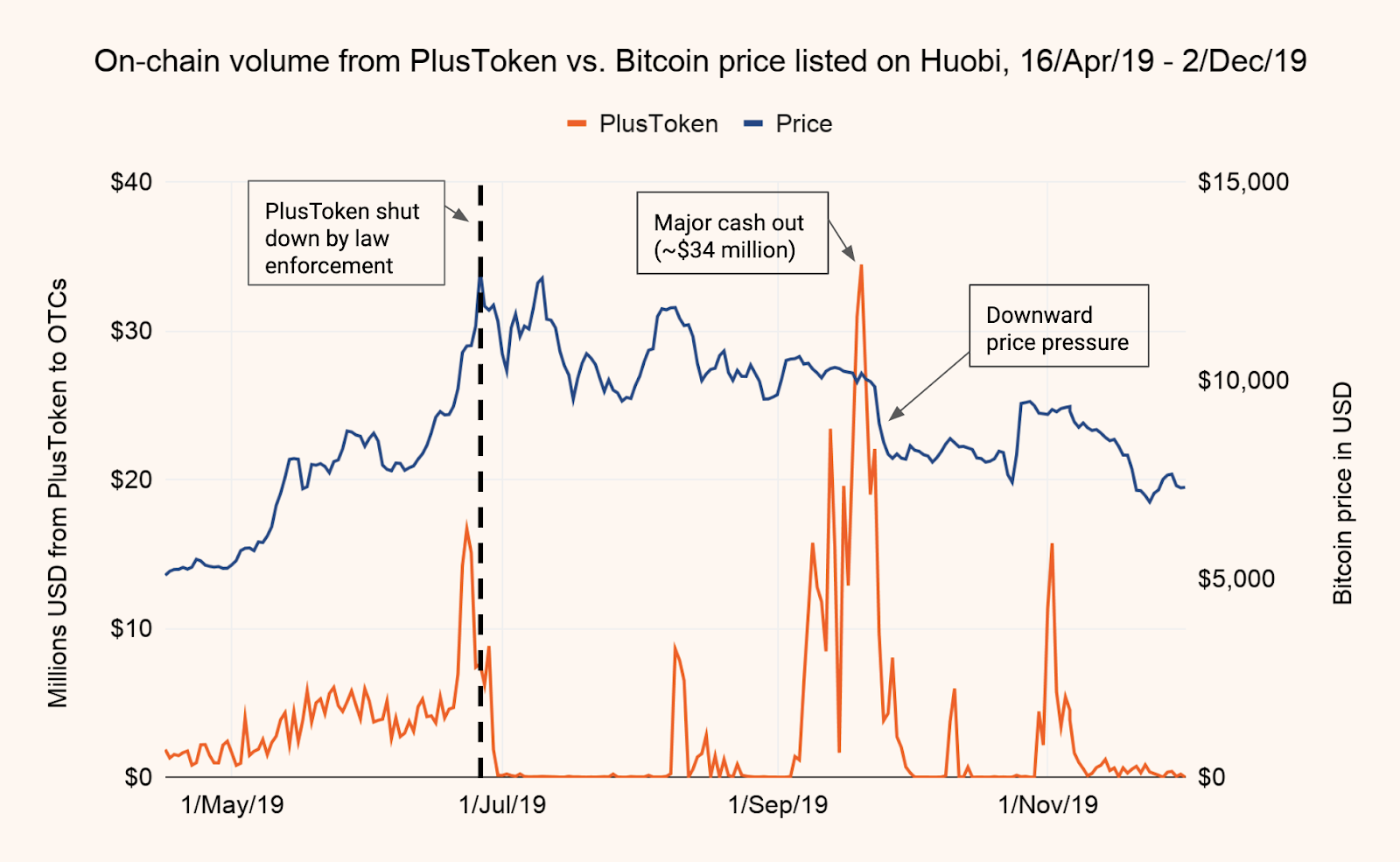

To link this flow of funds to price action, Chainalysis have analyzed the relationship between on-chain volume—the amount of Bitcoin moving from scammers' wallets to the dodgy wallets identified on Huobi, and trade volume—the amount of Bitcoin for Tether traded on Huobi.

Chainalysis found that upticks in on-chain volume were followed by an uptick in trade volume, as OTC traders receive Bitcoin from PlusToken wallets and subsequently exchange it for Tether, leading the price to fall as Bitcoin is unloaded onto the market by OTC traders.

Spikes in on-chain flow to certain OTC brokers on Huobi correlate with drops in Bitcoin’s price. The best example can be seen on September 20th when PlusToken scammers traded $34 million worth of Bitcoin with Huobi OTC traders. Shortly afterward, bitcoin began a steady descent—falling from just over $10,000 to about $8,000 between September 24th and 26th. [Source: Chainalysis]

Correlation ≠ causation

But as Chainalysis concede, the results show only correlation and not causation, "we can’t say for sure that Bitcoin price drops are caused by PlusToken cashouts. It’s possible that price drops follow the cashouts by coincidence."

By looking at on-chain volume against Trade Volume, and making an additional regression analysis, Chainalysis conclude that although the cashouts did strongly correlate with increased volatility, it is not possible to rule out the possibility of the drops being caused by something else.

Rival Bitcoin detective firm CipherTrace throws even more doubt into the mix by not acknowledging any relationship between PlusToken and the recent downtrend. CEO John Jefferies told Brave New Coin that “PlusToken did dump through Huobi but it has nothing to do with the current BTC price action.”

Across the web, netizens have floated other possible explanations on social media. Some suggest the move downwards is just a normal part of a normal market cycle, and others claim that big transactions over OTC markets don't actually affect the price of bitcoin anyway.

But if Chainalysis are correct, then the downturn might not be over yet. More than 20,000 BTC (worth over $134 million) from the scam is still scattered between 8,700 different crypto addresses and could be just waiting to be sold.

OhNoCrypto

via https://www.ohnocrypto.com

Kieran Smith, Khareem Sudlow