Understanding index pricing methodology is critical for successful crypto derivatives trading

This article explores the risks associated with trading index products that are not backed by a robust methodology - and highlights the best practice approach to price methodology that is being applied by some market-leading indices.

Specialist crypto derivatives exchanges like BTSE and Bitmex have a unique market structure and position - one that differentiates them from traditional legacy derivative markets like the CME and CBOE.

Crypto derivative exchanges are designed to be accessible and global, with fewer barriers to trading than legacy derivative markets. For example, the crypto markets don’t have brokers acting as middlemen between the customers and the exchanges. Margin requirements are also generally much lower, with as little as 5% collateral required to access leverage trading. Trading is also open seven days a week, 24 hours a day.

The ‘unplanned’ liquidations problem

The cheap to access, open all-the-time crypto derivatives model does have some drawbacks, however. Traders need to carefully monitor positions without brokers, and because margin collateral requirements are small, a sharp price move in the wrong direction can quickly eat up a trader’s position - potentially resulting in full liquidations before capital can be moved from losing positions.

These factors, combined with the general volatility of digital asset prices - and the real potential for market manipulation, have contributed to large numbers of traders being caught out by sharp price moves in the past.

The Bitstamp flash crash

Consider the May 2019 Bitstamp flash crash that took place on its BTC/USD markets - and its repercussions across the wider market.

At the time the Bitmex exchange’s reference price for its perpetual swap contracts made up over 50% of the index price of the BTC/USD market on the Bitstamp spot exchange.

This led to major issues because markets on Bitmex are much more liquid than they are on Bitstamp. Thus, because the Bitstamp price was used to determine such a large percentage of the Bitmex reference price, an attack vector was created.

So on May 17, the rapid selling on Bitstamp of ~US$30 million worth of BTC pushed the bitcoin price down on Bitstamp, which in turn pushed down the reference price on Bitmex and led to ~US$230 million worth of user liquidations on the margin platform. A large number of longs were caught off guard and felt the pain of full liquidation.

Although crypto traders understand they’re operating in a high-risk arena, scenarios like this are nonetheless frustrating - more can be done to protect traders from the threat of full liquidation. For example, infrastructure solutions such as circuit breakers built within derivative platforms or incremental liquidations are two options.

Perhaps most important, however, is the need for more robust reference pricing methodology - something that would ensure traders were only fully liquidated based on genuine market price movements. If, for example, a more robust price index like Brave New Coin’s Bitcoin Liquidity IndexTM (BLX) had been used to generate liquidation prices, fewer traders would have been caught out.

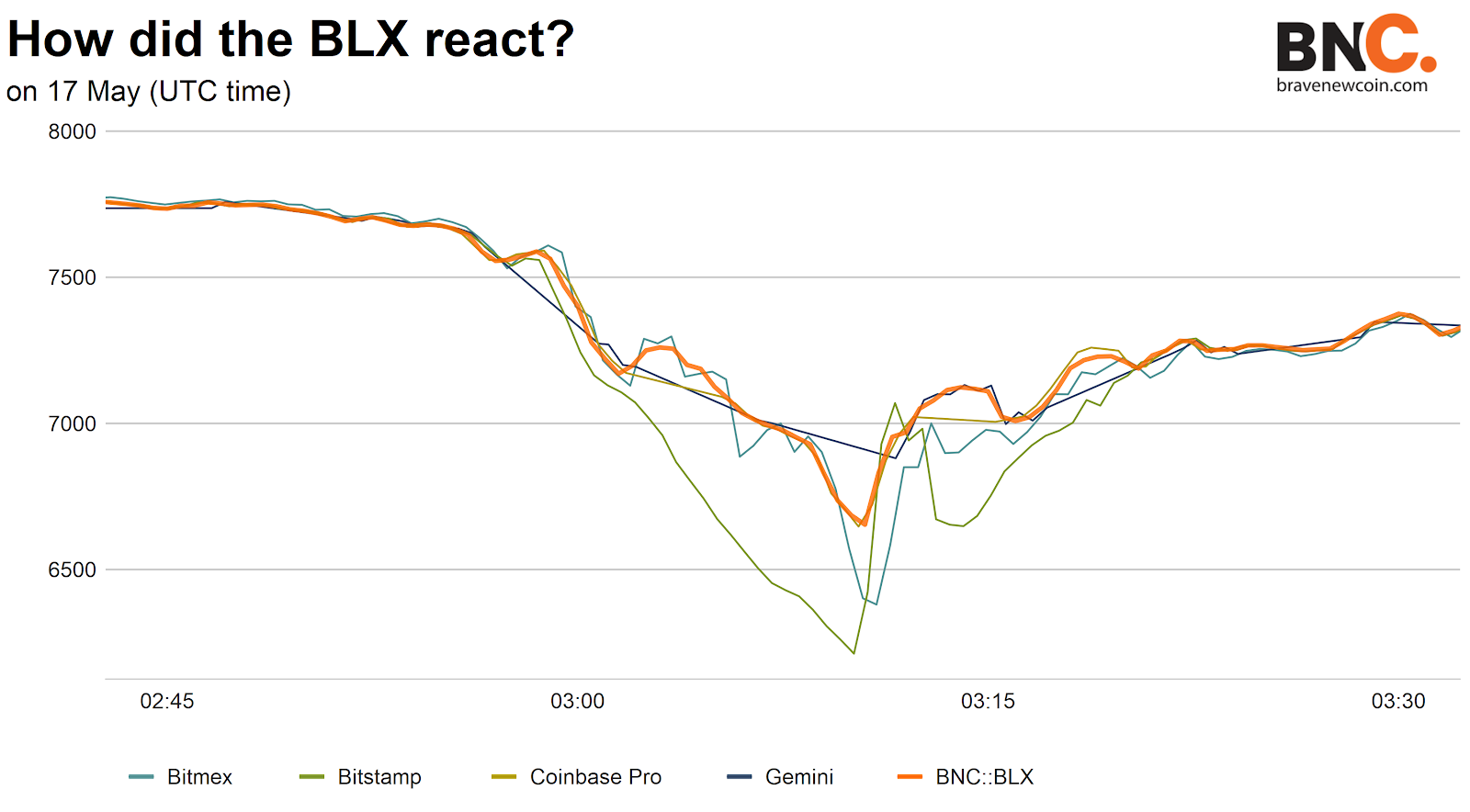

As the graph above shows, when the flash crash occurred the BLX (the orange line) maintained a higher reference price than the Bitstamp spot BTC/USD and the Bitmex perpetual contract price. With a minimum of six constituent exchanges for index compilation, the BLX was able to provide a better reflection of the true market price of bitcoin - one that was more inclusive of trading activity on non-Bitstamp spot exchanges and the wider BTC market.

A more dispersed index constituent base delivers smoother reference pricing. As a consequence, it significantly increases the cost of price manipulation. In the case of the Bitstamp/Bitmex incident, manipulation was easier as it only needed a price drop on a single exchange. The BLX adapts to just such a scenario with anti-manipulation mechanisms like an outlier removal system that automatically drops constituent price feeds that produce wildly different prices from other constituent exchanges.

Building the BBCX - diversification delivers robust pricing

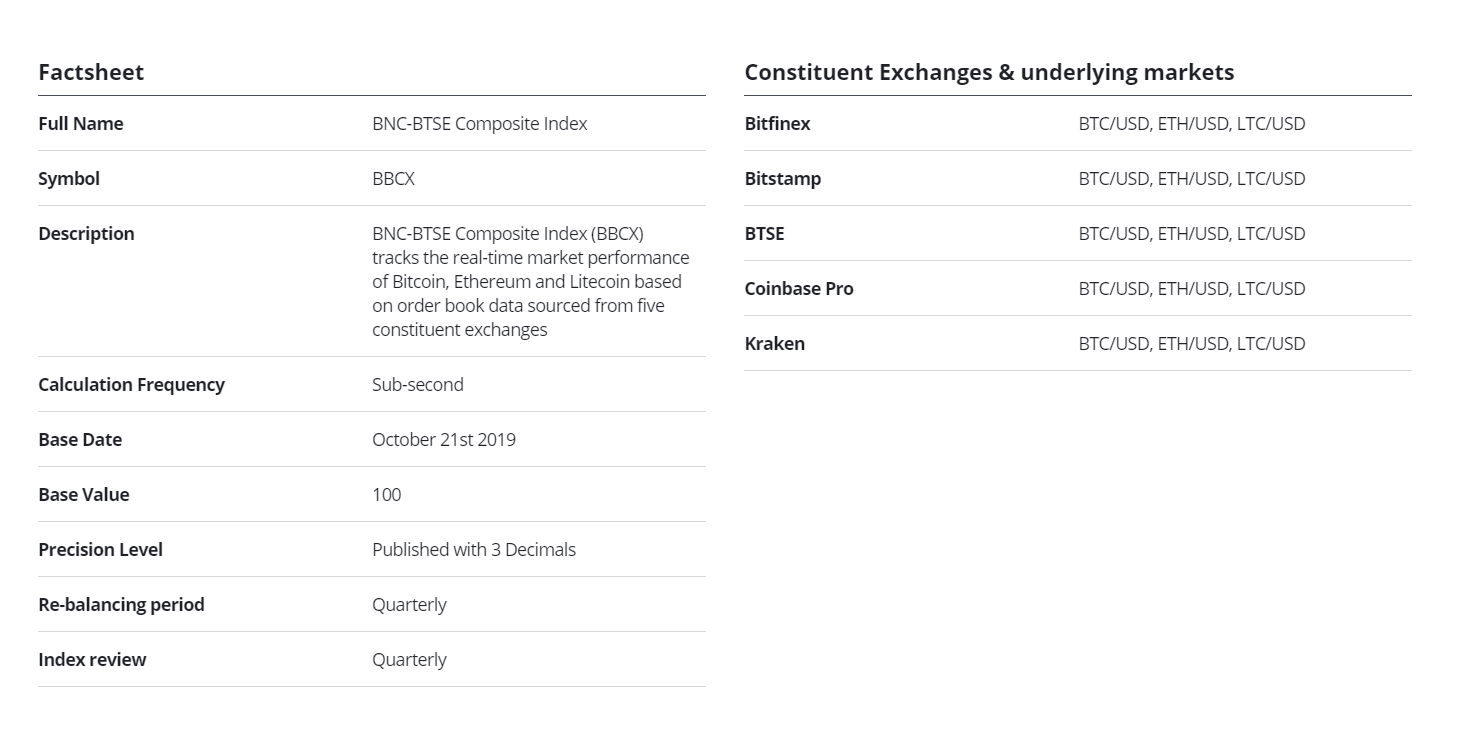

The BNC-BTSE Composite Index (BBCX) tracks the real-time market performance of a basket of large-cap cryptocurrencies by free-float market capitalization.

The BBCX product is unique in the marketplace - it is a composite crypto index that includes multiple digital assets and constituent exchanges - and was built by an independent third party (BNC).

This diversification means the individual price movement of a single asset within the basket is dampened by the price movements of other assets within the basket. Black swan events are mitigated against. The effect of individual markets on the index is also mitigated by the anti-market manipulation mechanisms already built by Brave New Coin.

The BBCX index uses exchange order books and/or the depth of their markets. Order books record the list of buyers and sellers willing to purchase or sell an asset and the prices they are willing to accept/pay before trading engines match up the orders. Using an order book mitigates potential price index disruptions like a trading engine failure occurring on a centralized exchange.

Order books are collected from each constituent exchange. A volume-weighted average price (V-WAP) is then calculated for both the bid and ask sides of the order books for every market. Following that, a midpoint price is calculated from the bid V-WAP, and the ask V-WAP for every market.

The index is recalculated at sub-second speeds ensuring outliers are removed quickly and the best possible price for the asset basket is always used as a reference price for the BBCX contract. The speed at which adjustments are made is near-instantaneous.

Summary

It is important for traders to understand the risks associated with the methodology used for determining the reference price of an index. Cryptocurrencies are highly volatile assets and value is assigned based on speculative assessment and the sentiment of market participants. These factors change quickly and therefore price movements are sharp and severe. These risk factors are accentuated when trading crypto derivative products that allow for heavily leveraged trading. In such an environment, robust indices like the BTSE BBCX are leading the way by introducing best practices and legitimacy into the burgeoning crypto derivatives marketplace.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow