Basic Attention Token Price Analysis - Publishers increasing across all platforms

The Basic Attention Token (BAT) spot price increased 400% from February to April 2019 but has since declined 60%. The market cap currently stands at US$294 million with US$20.17 million in trading volume over the past 24 hours.

BAT is an Ethereum (ETH) based ERC-20 token, designed to be exchanged between publishers, advertisers, and users. Brendan Eich, founder, and CEO of BAT, is also the creator of Javascript and co-founder of Mozilla and Firefox. The token is designed to put a value on user attention.

The project encompasses an open-source, decentralized ad exchange platform, designed to address fraud and opaqueness in digital advertising. The BAT ecosystem also includes Brave, an open-source, privacy-centered browser designed to block trackers and malware. The Brave browser decreases page load times by blocking ads, while enabling micropayments between publishers and content creators, and provides an alternative to ad-based revenue streams.

When a user opts into Brave Rewards they start seeing Brave Ads and accumulate BAT, which they can claim on a monthly basis via the integrated wallet. Users can customize how many ads they’d like to see, 1 to 5 per hour, or choose not to see any ads.

Brave Ads don’t replace current web page ads, they are separate and uniquely different. Users see them as offers in the form of notifications. When users click to engage with these notifications, they’re presented with a full-page ad in a new ad tab of the Brave browser. Because ad matching happens directly on the user’s device, the user’s data is never sent to anyone, including Brave.

Users can donate the BAT earned from viewing Brave Ads to their favorite websites, YouTube creators, or Twitch streamers. Soon they will also be able to redeem BAT for real-world rewards, such as hotel vouchers and gift certificates via TAP Network’s 250,000 brand partners.

Creators and publishers do not need to use Brave to collect BAT payments but can complete the verification process on Uphold, a payment processor, where audience contributions are kept in escrow. BAT can also be automatically converted to fiat currencies and transferred to the creator’s bank account. Earlier this year, Brave announced that users will soon be able to directly withdraw BAT from the browser, after verifying with Uphold.

Brave released v1.0 in mid-November and reported 10 million active users in early December. In comparison, as of November 2016, Google’s Chrome browser reported two billion installs. However, in repeated head-to-head testing, Brave had the quickest load times amongst competitors Chrome and Firefox.

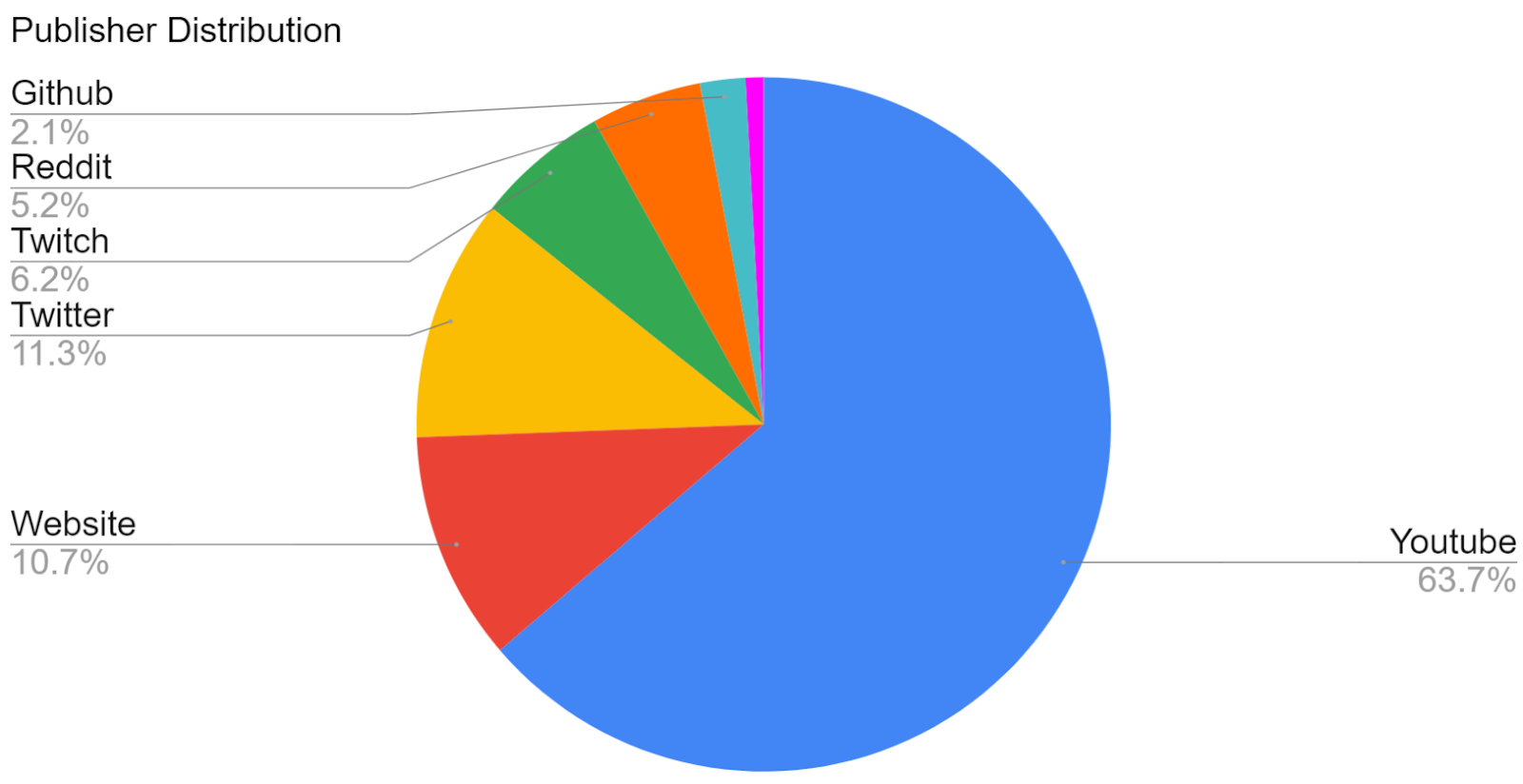

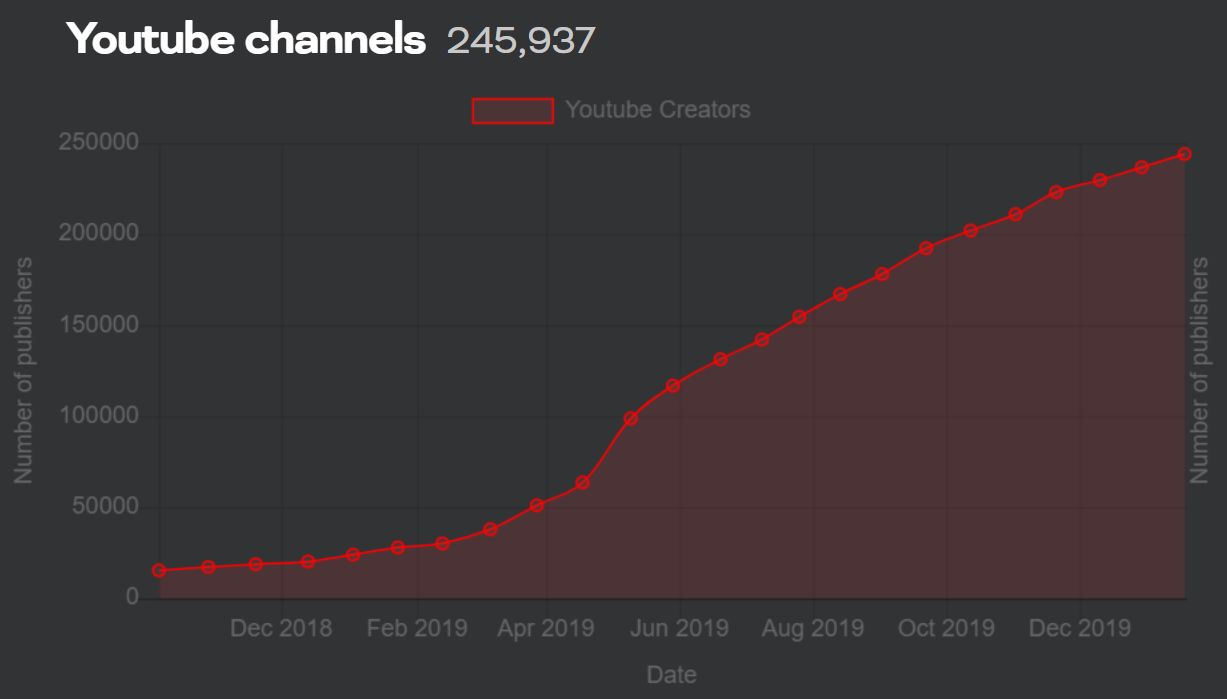

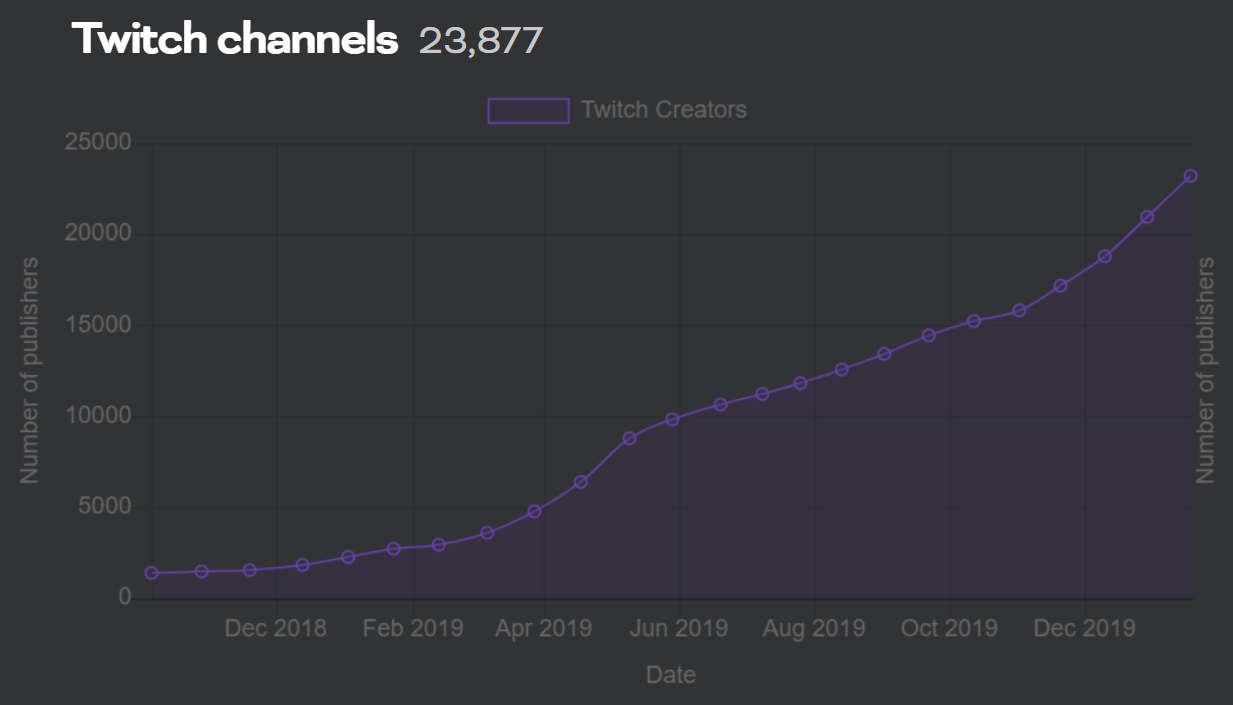

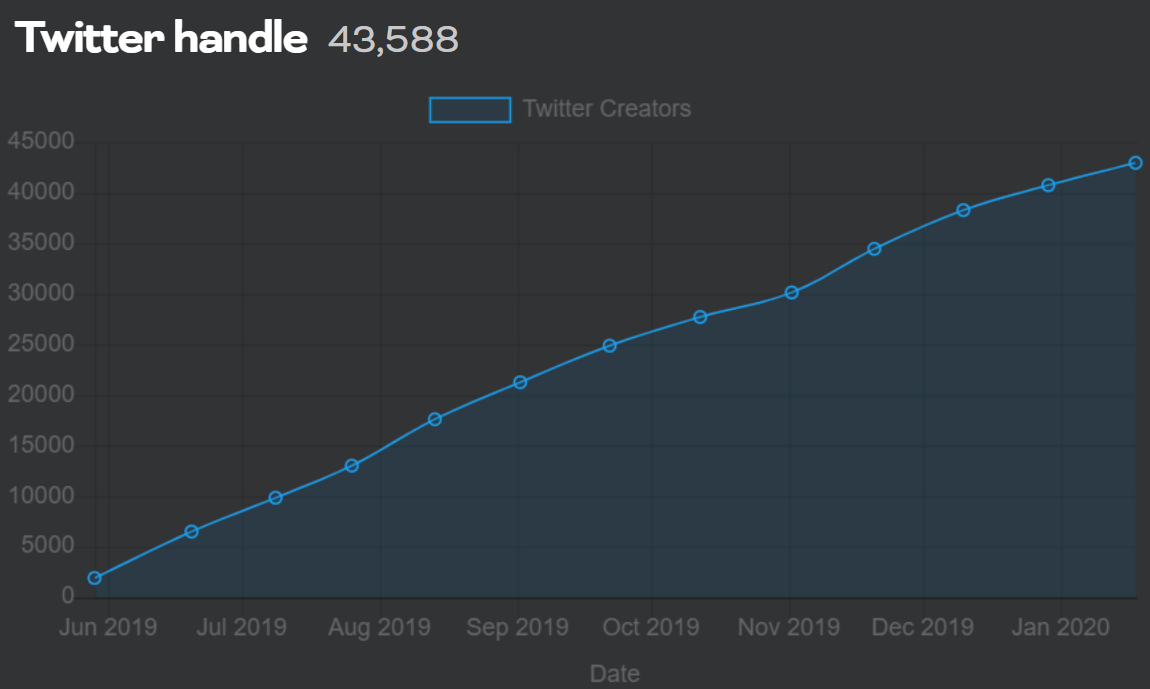

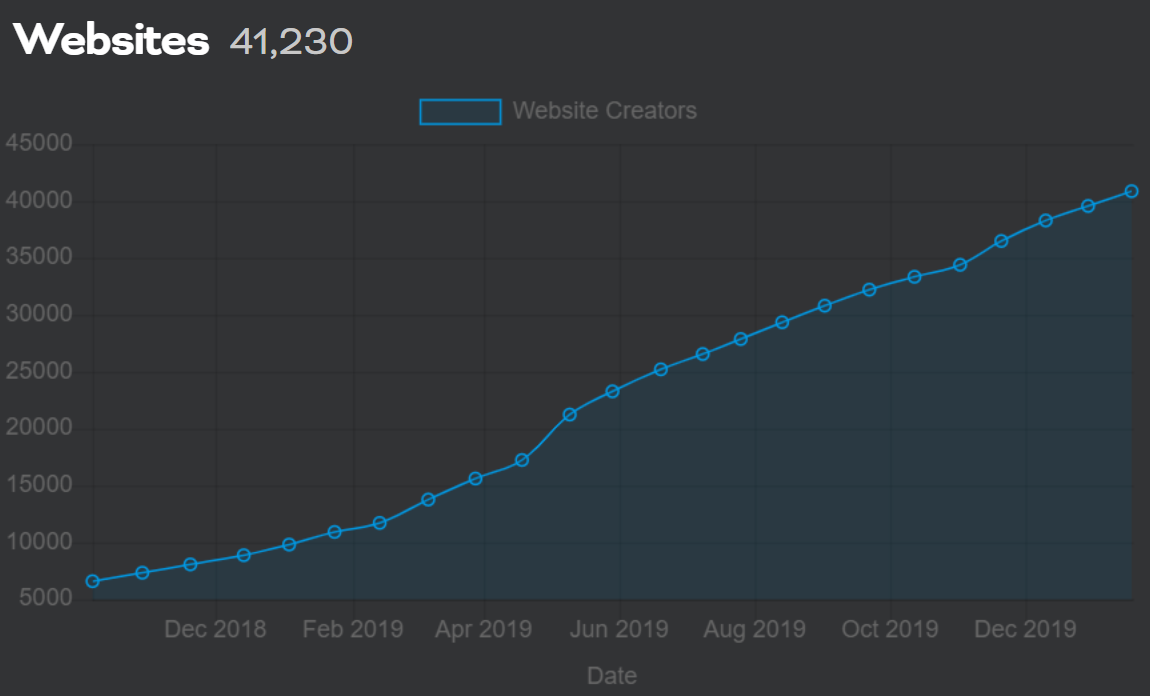

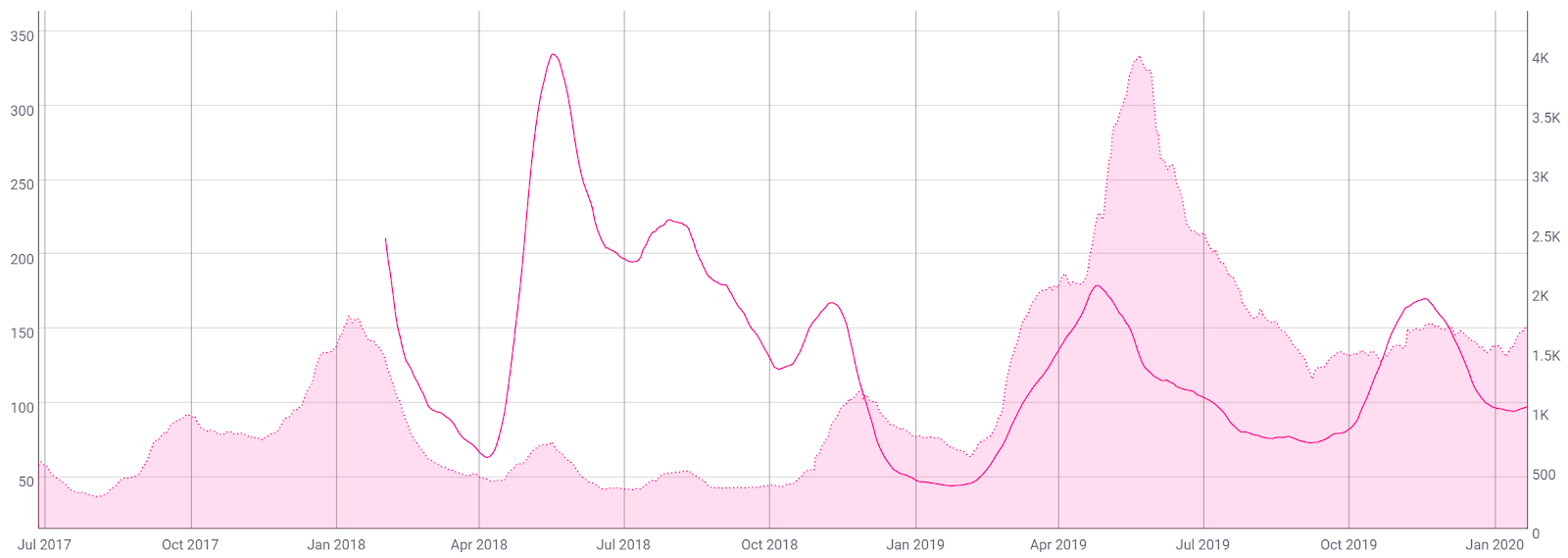

The Brave platform also has nearly 386,000 registered publishers listed to collect BAT funds from Brave users on YouTube, Twitch, Twitter, Reddit, Vimeo, Github, and other websites. Over 60% of all registered publishers originate from Youtube and all categories have seen continued growth over the past year.

Source: batgrowth

Source: batgrowth

Source: batgrowth

Source: batgrowth

Early on, Brave began collecting BAT donations for unverified publishers without their knowledge. YouTuber Tom Scott was angry to learn the platform was collecting donations on his behalf and called for all BAT to be refunded, which is impossible as the donations are anonymous. Scott also sent Brave a formal right-to-be-forgotten request under GDPR guidelines.

Eich responded by pointing to the BAT terms of service which acknowledges that funds donated to an unverified publisher are held for no less than 90 days before being sent to BAT’s user growth pool. Eich further states that no BAT has ever been clawed back thus far for this reason.

Additionally, there remains no opt-in option for publishers as, according to Eich, the feature would kill user-driven growth. Brave has changed the rewards system to make it clear which creators haven't yet joined through the verification process and has no images of unverified creators in the platforms tipping panel.

There was further controversy a few months ago, regarding Brave’s ability to remotely inject headers in HTTP requests. Eich responded on Reddit by acknowledging that the custom HTTP headers are sent to Brave partners, with fixed header values. He added that this does not represent a privacy backdoor and that there is no tracking hazard.

In May 2019, Dr. Johnny Ryan, Chief Policy & Industry Relations Officer at Brave, testified at the US Senate Judiciary Committee hearing on “Understanding the Digital Advertising Ecosystem and the Impact of Data Privacy and Competition Policy.” Ryan echoed Brave’s commitment to user privacy.

Brave offers private Tor browsing on desktop and DuckDuckGo for private mobile tabs, as well as an integrated ETH browser wallet, MetaMask. Brave is also the default web browser for the HTC Exodus1 blockchain phone.

The Brave platform has completed three rounds of seed funding; a November 2015 raise of US$2.5 million, an August 2016 raise US$4.5 million, and a January 2017 raise of an undisclosed amount. Notable investors include Digital Currency Group and Pantera Capital. According to a May 2019 CoinDesk article, Brave is looking to raise another US$30–US$50 million at a valuation of US$133 million.

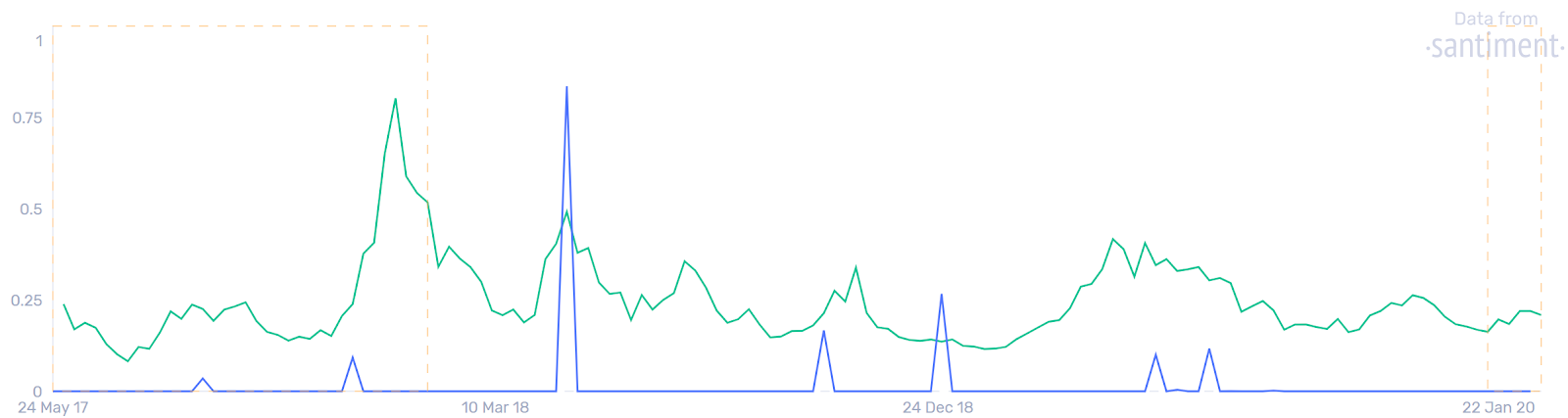

The BAT token ICO occurred in May 2017 raising over 156,000 ETH, or US$35 million at that time, in 30 seconds from 130 participants. Each of the one billion ERC20 tokens available for the crowdsale was sold at a price of US$0.036. According to wallet data, BAT spent 6,000 and 7,000 ETH in May and June 2019 (shown below), with a remaining 30,000 ETH in their ICO wallet. The BAT team holds 500 million tokens and, according to the team, the total supply of BAT will never exceed 1.5 billion tokens.

[

Source: sanbase

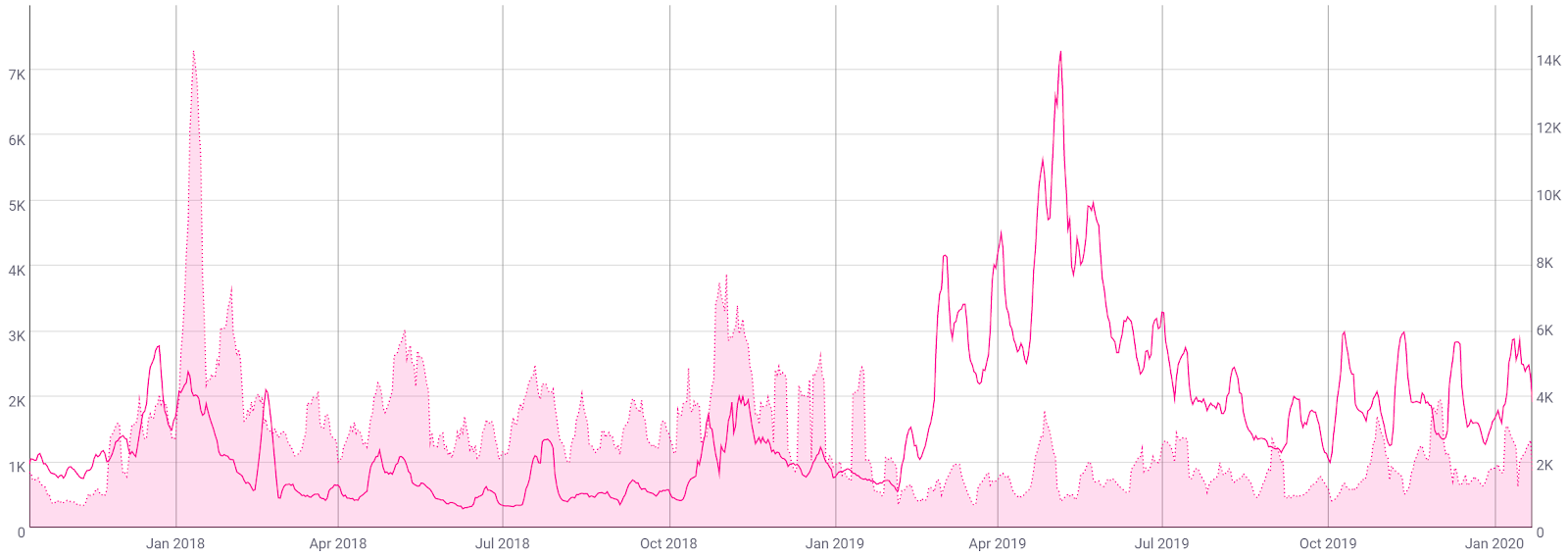

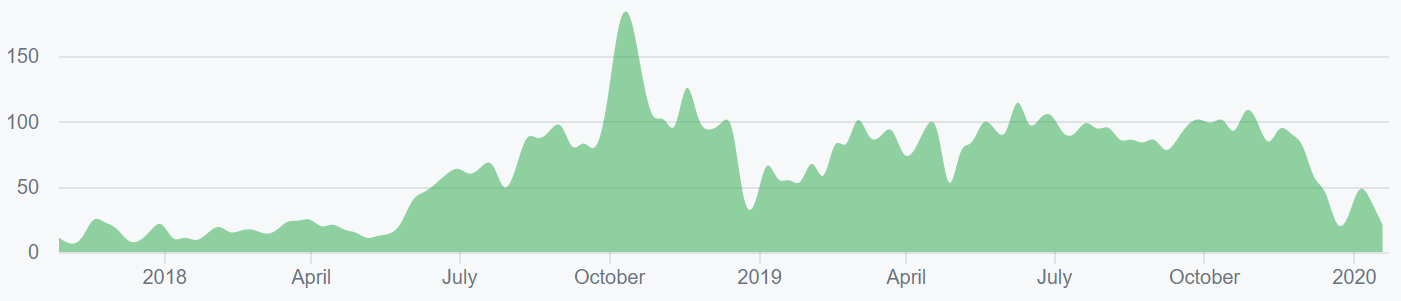

On the network, the number of BAT transactions per day (line, chart below) has ranged from 1,000 to 3,000 since October 2019. Transactions on the network spike once a month when BAT rewards are distributed to creators. Overall, this metric has fallen significantly from the record high of over 6,100 in early May. The previous spike in on-chain transactions in October and early November was likely due to speculative demand and/or transactions from a Coinbase listing at that time.

Since January, average transaction values (fill, chart below) have largely remained below US$4,000. Average transaction values tend to spike with any price spike of the token and can be inversely related to transactions per day, as micropayment utility for the token increases.

Source: CoinMetrics

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has ranged from 70 to 180 since February 2019. This metric has remained well below historic levels, suggesting increased token utility since mid-2018. A clear downtrend in NVT is bullish and suggests the coin is undervalued based on its economic activity and utility, whereas an uptrend should be considered bearish. Inflection points in NVT can be leading indicators of price reversal.

Monthly active addresses (MAA) increased to a record high of nearly 4,000 in mid-May, but have declined to less than 1,800 over the past few months (fill, chart below). A sustained increase in MAA, similar to rising transaction per day metrics, shows increasing utility for the chain, as opposed to a spike in MAA which largely suggests short-term speculative demand. Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe's law.

Source: CoinMetrics

Turning to developer activity, the BAT project has 150 repos on Github. The Brave core repo has had nearly 3,250 commits over the past year from 55 developers (shown below). The Brave browser repo also has 381 commits over the past year from 36 developers (not shown) with 162 commits on the main repo in the past year (shown below). Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: Github - brave-core

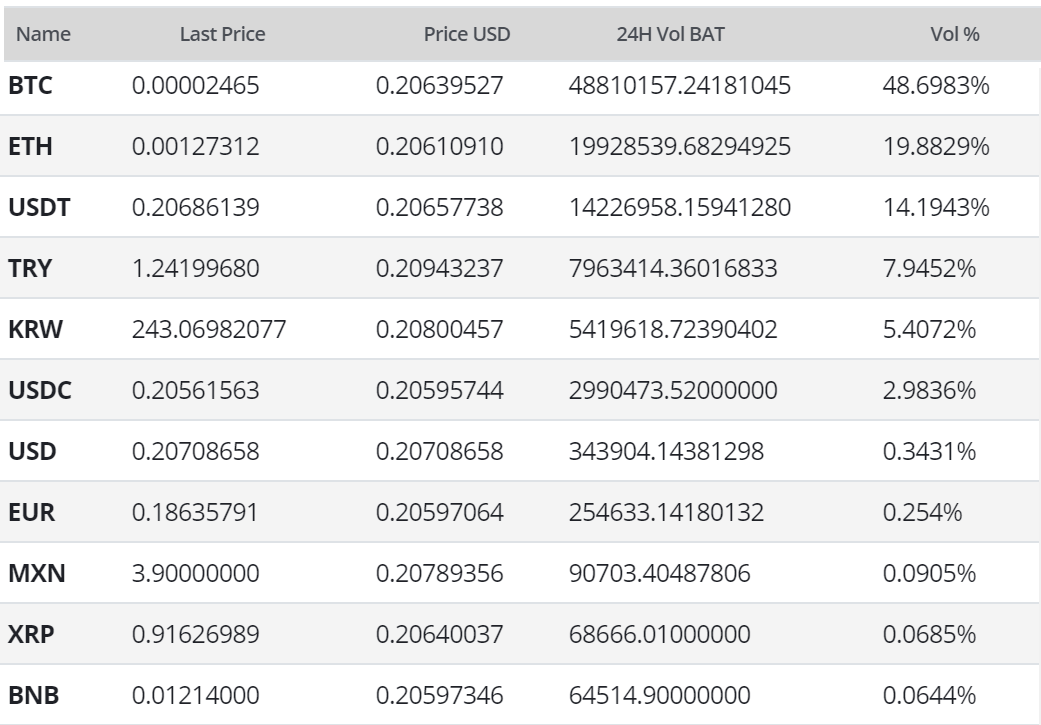

BAT exchange-traded volume in the past 24 hours has predominantly been led by the Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) pairs. BAT was first listed on Bittrex in June 2017, followed by a Binance listing in November 2017, a Bitfinex listing in January 2018, a Poloniex listing in August 2018, and a Coinbase listing in November 2018. BAT/USDC and BAT/ETH are the only pairs listed on Coinbase Pro, but BAT can be purchased for USD through Coinbase’s retail platform. In early 2019, eToro and Binance also added BAT trading pairs, with a BAT/USD and BAT/USDT pair listed on Binance.US as well.

Worldwide Google Trends data for the term "Basic Attention Token" has decreased significantly from the local high in April. Spikes in Google searches often correlate with spikes in market prices. A 2015 study found a strong correlation between the Google Trends data and Bitcoin price, while a May 2017 study concluded that when the U.S. Google "Bitcoin" searches increased dramatically, the Bitcoin price dropped.

A spike in early November 2018 corresponded with the Coinbase listing. Searches also spiked near the ICO date in May and June 2017, as well as in late 2017 when all crypto-related searches broadly increased.

Technical Analysis

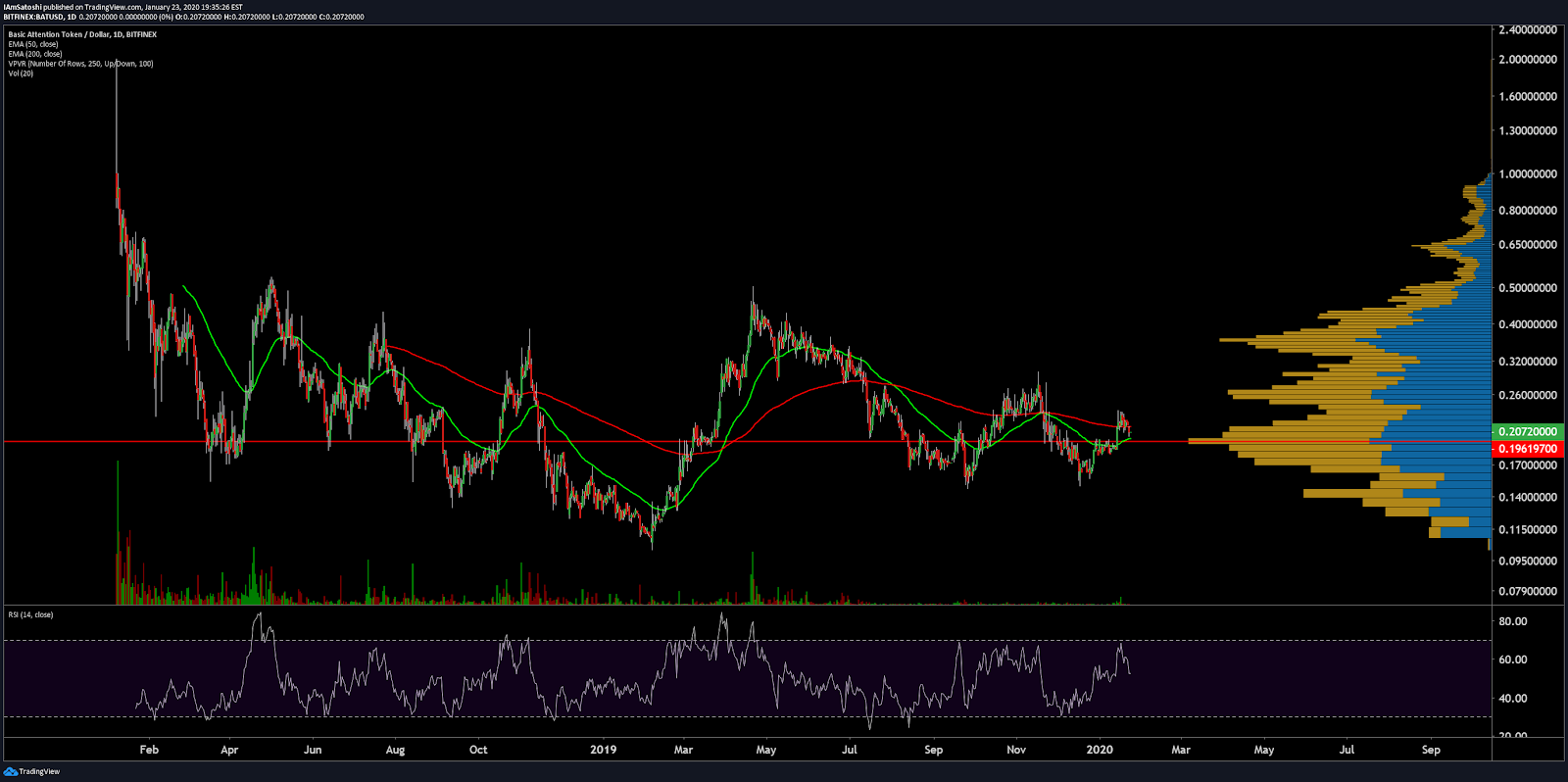

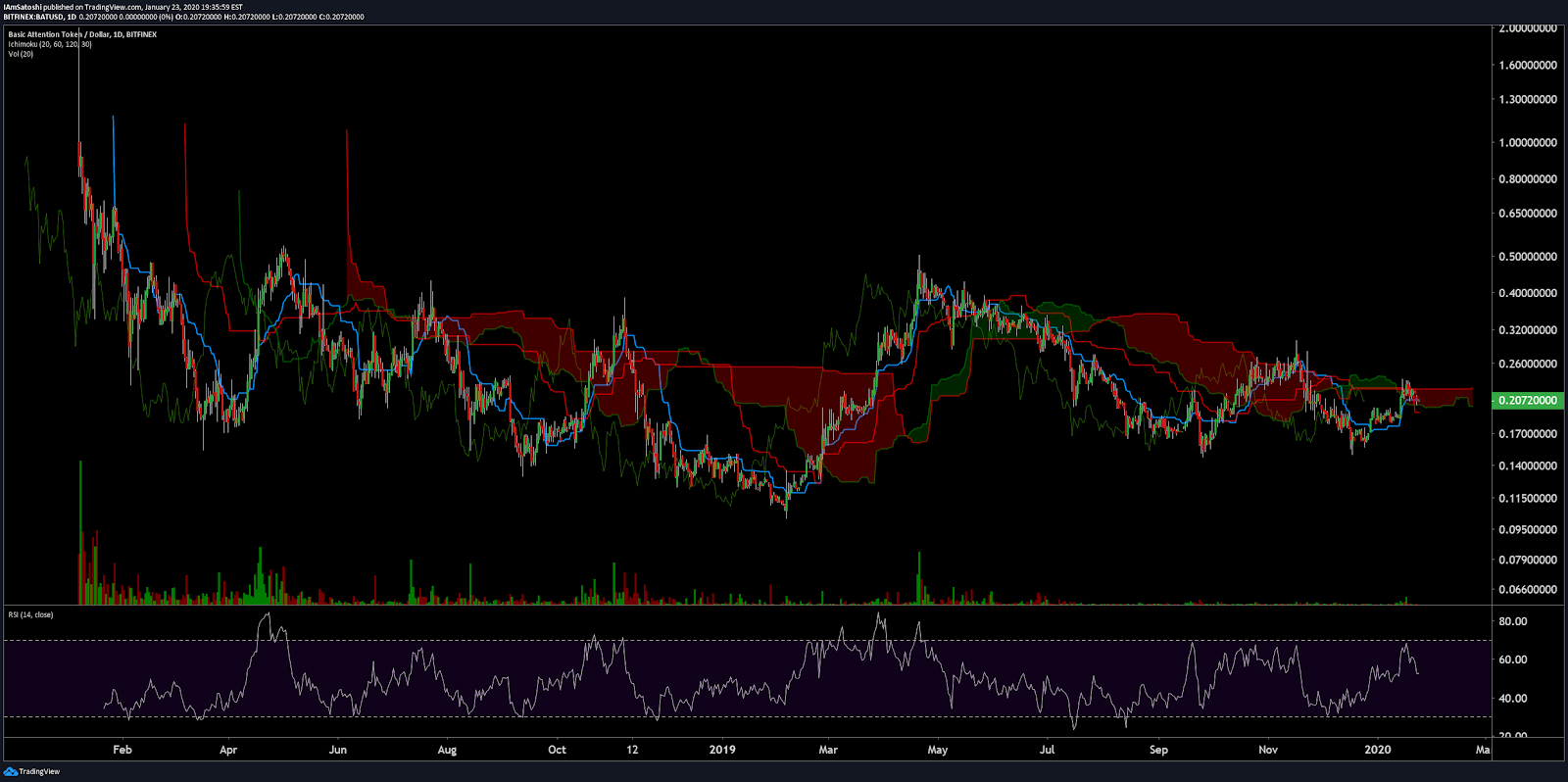

BAT has mainly been held to a wide but defined ranged since trading began in June 2017. As both the BAT/USD and BAT/BTC pairs sit near historic lows, the likelihood of a bullish reversal continues to increase. To determine the existence or strength of any trend, Exponential Moving Averages, Volume Profile of the Visible Range, Relative Strength Index, and the Ichimoku Cloud can help determine optimal entry points. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the 50-day Exponential Moving Average (EMA) and 200-day EMA crossed bearishly in August 2019 followed by a failed bullish cross in November. Price may be forming a “W” double-bottom with the 50-day and 200-day EMAs threatening a bearish cross over the next few weeks.

Volume Profile of the Visible Range (VPVR, horizontal bars) shows strong support at the US$0.20 zone. However, if this zone fails to hold price, a return to local lows at US$0.15 is very likely. There are no bullish or bearish divergences at this time.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame with doubled settings (20/60/120/30) are bearish to neutral; price is inside of the Cloud, the Cloud is bearish, the TK cross is bullish, and the Lagging Span is below Cloud and above price.

A traditional long entry will not trigger until the current spot price is above the Cloud with a bullish TK cross. Additionally, a bullish Kumo breakout will likely result in a completion of the “W” double-bottom, resulting in a further bullish rally.

On the BAT/BTC pair, trend metrics are also leaning bearish to neutral. Price is below the 200-day EMA and weaving in and out of the Cloud. Price is also attempting to form a “W” double-bottom on this pair as well. Strong VPVR support sits at the 2,000 sat zone, with overhead VPVR resistance strongest at the 5,000 sat zone. Should the 2,000 sat support zone fail, a revisit to the all-time low at 1,000 sats is likely. There are no bullish or bearish divergences at this time.

Conclusion

Brave has continued to post strong active user numbers and an increase in publishers over the past year. However, on-chain data suggests the BAT token itself has not benefited from this increase in browser downloads and publisher registrations. Over the past four months, daily transactions have failed to break Brave’s own monthly distribution of BAT. Although active addresses sit at local highs, this may be a direct result of the increase in subsidized publishers, and not necessarily an increase in BAT holders and users. Additionally, the circulating supply of over one billion BAT tokens are likely to provide continued downward pressure until active Brave users, active addresses, and daily transaction amounts increase dramatically.

Technicals for both the BAT/USD and BAT/BTC pairs lean bearish to neutral. Both pairs sit below their respective 200-day EMA and sit in an indeterminate trend position in the Cloud. Both pairs have also attempted to form a “W” double-bottom with targets of US$0.35 and 3,000 sats, respectively. If the current VPVR support levels and the local lows for both pairs fail to hold price, a revisit of all-time lows on both pairs is very likely.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow