Bitcoin SV Surges 20% as Kleiman Case Develops: Passes Litecoin

#OhNoCrypto

Over the past ten or so days, the cryptocurrency market has finally mounted a significant recovery.

Since the $6,800 low put in nearly two weeks ago, Bitcoin has gained 24%, surging as high as $8,480 just minutes ago as of the time of writing this article.

While this is impressive in and of itself, one altcoin has been dramatically outperforming the rest of the digital asset market: Bitcoin Satoshi Vision (BSV), the second-largest fork of the BTC chain pioneered by Calvin Ayre, Craig S. Wright, and CoinGeek.

The fork gained even more steam on Monday, gaining 20% as BTC gained a relatively measly 2.75%.

Although BSV’s surge higher was reminescent of a pump and dump, the rally seemingly had a fundamental factor backing it: Craig Wright, a prominent BSV proponent and the self-proclaimed creator of Bitcoin, was purportedly revealed to have a third “Tulip Trust” set up to hold billions of dollars worth of BTC that he claims he mined in the asset’s earliest days.

This is more fact than speculation because the self-proclaimed Bitcoin creator once said that by the end of 2019, there would be a fatal flaw in the largest Bitcoin that would kill the entire chain, showing that he prefers BSV over BTC.

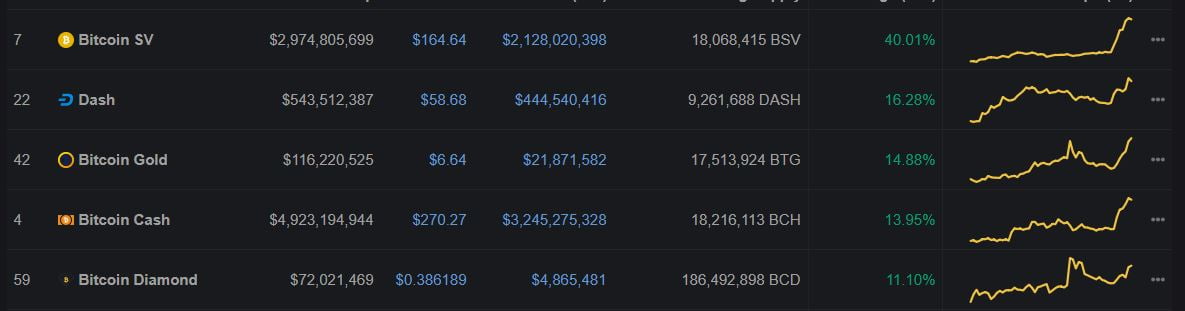

The cryptocurrency gained even more strength on Monday, rallying by another 20% to $200 on top of the 40% surge to $160 seen on Friday. This latest move has allowed it to surpass Litecoin, EOS, and Binance Coin in the cryptocurrency standings.

This surge seemingly had no catalyst, though there was news released today that may benefit BSV. Namely, a United States District Judge has ruled that a sanction ordering Craig Wright to give up half of his BTC to the estate of Dave Kleiman, purportedly once his business partner, has been reversed.

Should Wright have the funds he claims to have — something that is still up for debate — this would mean that more money can go towards the development of BSV.

Both BCH and BSV, while altcoins with their own blockchains independent of Bitcoin, have their own block reward reduction protocols, also known as halvings. Analysts expect Bitcoin’s next halving will push the price of BTC higher, though for the halvings of BCH and BSV to potentially “lead to their ultimate demise.”

Benjamin Celermajer of Coinmetrics and Magnet Capital recently broke down on why he thinks this is the case in an extensive thread on Twitter.

First, he noted that due to mining trends, BCH’s block height, meaning the number of blocks in the chain, is thousands more than that of BTC. While this may seem negligible, Celermajer noted that this discrepancy in the block heights of BTC and BCH will likely lead miners of the latter chain to abandon it for BTC due to profitability concerns. The analyst explained:

The post Bitcoin SV Surges 20% as Kleiman Case Develops: Passes Litecoin appeared first on Blockonomi.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Nick Chong, @Khareem Sudlow

Over the past ten or so days, the cryptocurrency market has finally mounted a significant recovery.

Since the $6,800 low put in nearly two weeks ago, Bitcoin has gained 24%, surging as high as $8,480 just minutes ago as of the time of writing this article.

While this is impressive in and of itself, one altcoin has been dramatically outperforming the rest of the digital asset market: Bitcoin Satoshi Vision (BSV), the second-largest fork of the BTC chain pioneered by Calvin Ayre, Craig S. Wright, and CoinGeek.

The fork gained even more steam on Monday, gaining 20% as BTC gained a relatively measly 2.75%.

Bitcoin Satoshi Vision Surges Higher, Again

On Friday, BSV surged 40% higher, rallying higher alongside a number of other leading Bitcoin forks, the Cash, Gold, and Diamond variants, which are all dramatically smaller than the original chain.Although BSV’s surge higher was reminescent of a pump and dump, the rally seemingly had a fundamental factor backing it: Craig Wright, a prominent BSV proponent and the self-proclaimed creator of Bitcoin, was purportedly revealed to have a third “Tulip Trust” set up to hold billions of dollars worth of BTC that he claims he mined in the asset’s earliest days.

The idea with BSV surging on this news: if Wright actually has the funds and gains control of them, he would dump the BTC on the market en-masse to suppress the Bitcoin chain he hates while supporting BSV adoption.New: Craig Wright just so happened to have a third "Tulip Trust" set up to hold that missing $10 billion fund.He sent the info about the "Tulip Trust III" in a document dump of 428 dossiers.

Can someone involves in this mess pls send me $1 million to keep going? pic.twitter.com/zAcI9Wohn9

— Brendan Jay Sullivan (@MrBrendanJay) January 9, 2020

This is more fact than speculation because the self-proclaimed Bitcoin creator once said that by the end of 2019, there would be a fatal flaw in the largest Bitcoin that would kill the entire chain, showing that he prefers BSV over BTC.

The cryptocurrency gained even more strength on Monday, rallying by another 20% to $200 on top of the 40% surge to $160 seen on Friday. This latest move has allowed it to surpass Litecoin, EOS, and Binance Coin in the cryptocurrency standings.

This surge seemingly had no catalyst, though there was news released today that may benefit BSV. Namely, a United States District Judge has ruled that a sanction ordering Craig Wright to give up half of his BTC to the estate of Dave Kleiman, purportedly once his business partner, has been reversed.

Should Wright have the funds he claims to have — something that is still up for debate — this would mean that more money can go towards the development of BSV.

Long-Term Survival Up For Debate?

Although BSV has undoubtedly seen a strong rise over the past few days, some are fearful that the asset’s long-term future remains up in the air.Both BCH and BSV, while altcoins with their own blockchains independent of Bitcoin, have their own block reward reduction protocols, also known as halvings. Analysts expect Bitcoin’s next halving will push the price of BTC higher, though for the halvings of BCH and BSV to potentially “lead to their ultimate demise.”

Benjamin Celermajer of Coinmetrics and Magnet Capital recently broke down on why he thinks this is the case in an extensive thread on Twitter.

First, he noted that due to mining trends, BCH’s block height, meaning the number of blocks in the chain, is thousands more than that of BTC. While this may seem negligible, Celermajer noted that this discrepancy in the block heights of BTC and BCH will likely lead miners of the latter chain to abandon it for BTC due to profitability concerns. The analyst explained:

“In April, when miners start receiving half the BCH and BSV rewards they currently receive, their profits will half (unless price doubles). This will lead to miners switching to mine Bitcoin which will not have a reduction in profitability until May.”This simple dynamic, he wrote, is likely to create “massive market fear and capitulation” among the investors of the two key forks, “potentially leading to their short term and longer term demise.”

The post Bitcoin SV Surges 20% as Kleiman Case Develops: Passes Litecoin appeared first on Blockonomi.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Nick Chong, @Khareem Sudlow