Crypto Market Forecast: 6th January

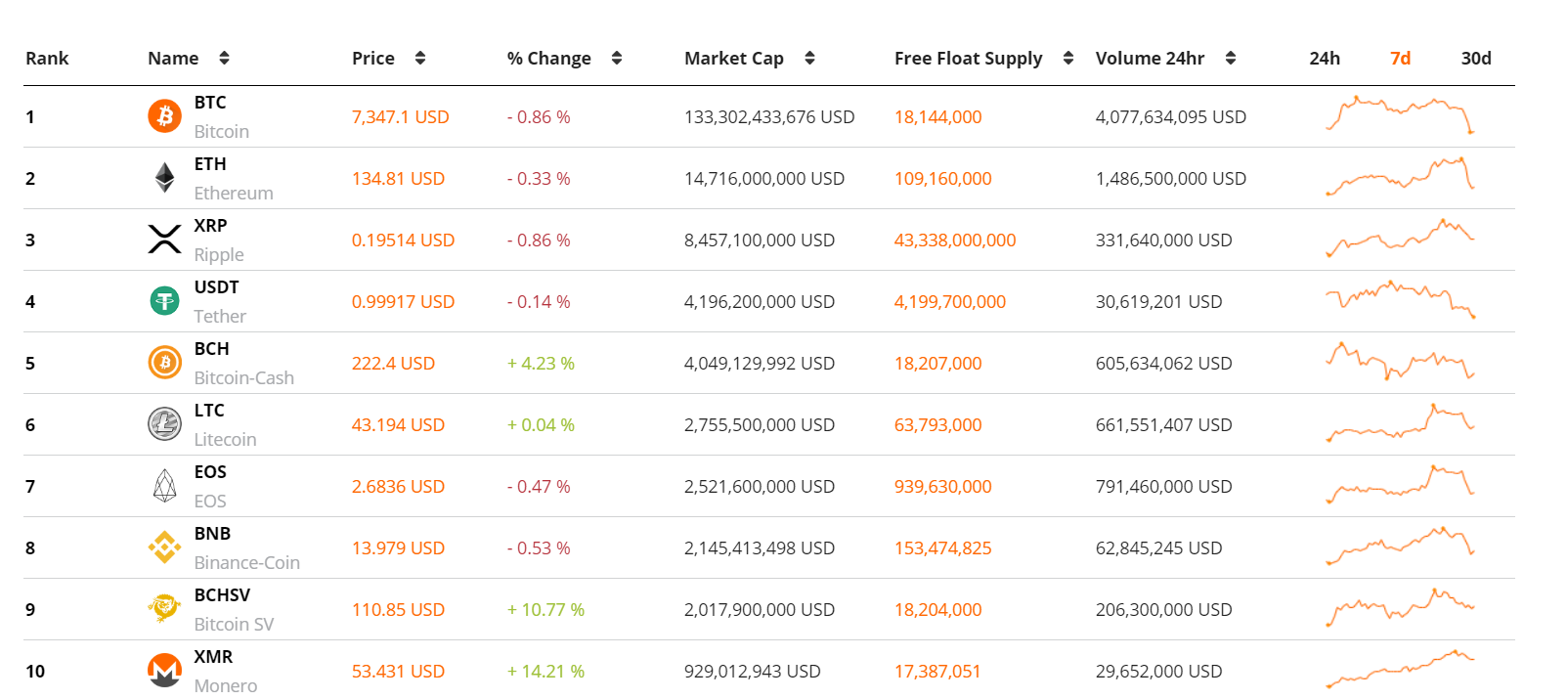

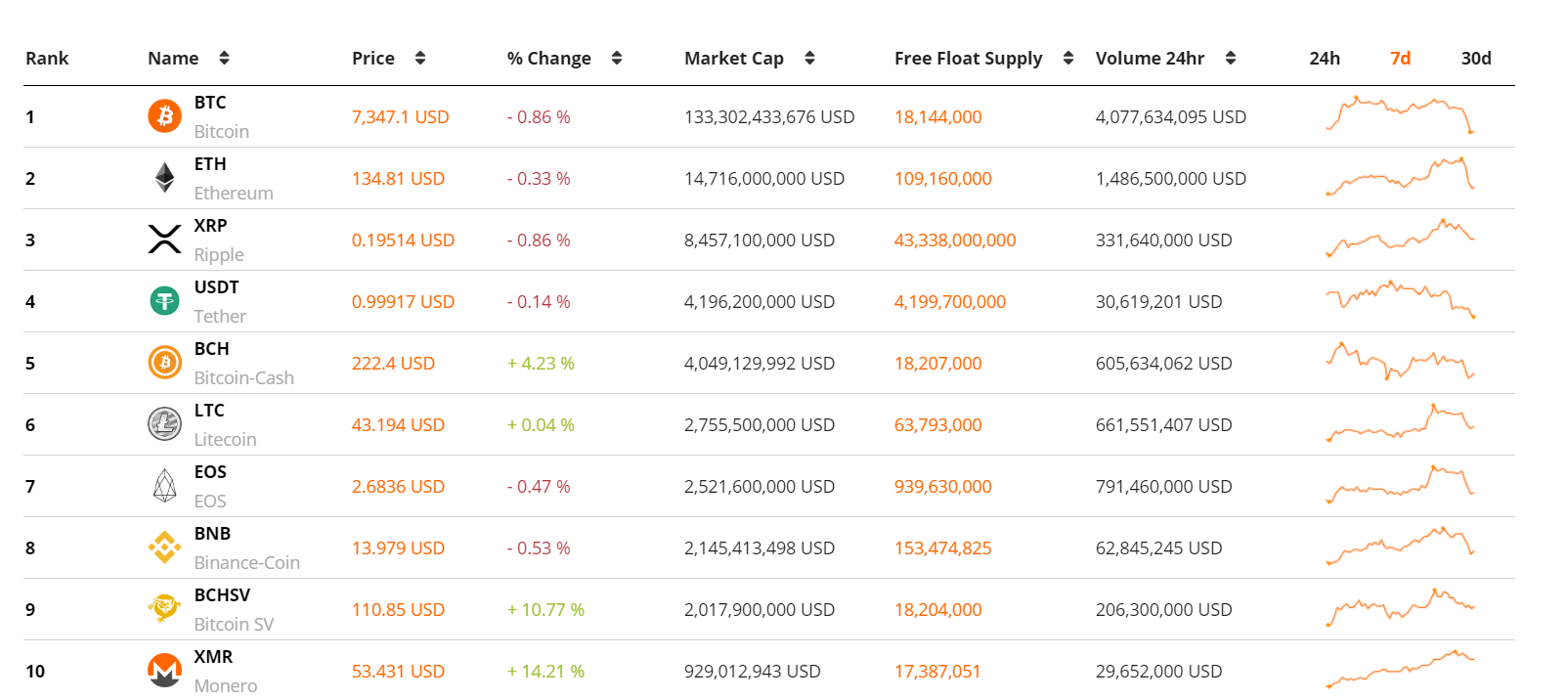

It was a volatile week in the crypto markets with Bitcoin prices touching as low as ~$6900 across major exchanges on Friday, before bouncing back over the weekend to end the week near $7400. Bitcoin’s price fell ~1% over the week while the price of the number two and three crypto assets on Brave New Coin’s market cap table, ETH and XRP, fell by ~1% each. The total crypto market cap fell by ~1%.

Some analysts are bullish about this week’s BTC price bounce from $6,900 because this is a higher low than the asset’s previous cycle low of ~US$6,500 which it hit in mid-December 2018. Bulls will hope this pattern is indicative of a trend reversal. When an asset’s price consistently makes higher lows or higher highs towards the end of a cycle, this can be a sign of an impending price break-out.

As a contrast to these potentially positive price signals, the Crypto Fear and Greed index is still in the ‘fear’ zone. The index provides a general snapshot of sentiment from crypto markets, and if the market is feeling ‘fear’ it may suggest that traders do not trust the bullish price activity emerging over the weekend.

It was also an important week in Bitcoin network dynamics with ‘Segregated Witness’ or Segwit transaction usage hitting a new all-time high. The Segwit protocol involves improving block malleability by removing (segregating) some transaction signature (witnesses) data from Bitcoin transactions. This process frees up space on the chain to make room for more transactions.

Segwit transactions are faster and cheaper because of their compact nature and remain safe because the segregated transactions are still verifiable. On the 01/01/2020 ~62.11% of all daily Bitcoin transactions were conducted using the Segwit protocol. Last month, mega-derivative exchange Bitmex enabled user BTC withdrawal to BECH32 (native Segwit) blockchain addresses. Bitmex transactions may be a key contributing factor to the uptick in Segwit usage. An increase in Segwit transactions is a bullish fundamental flag because it means Bitcoin’s scaling solutions are achieving greater adoption and network transactions continue to be fast and cheap.

This week in crypto events

7th January- Pre-activation of Aragon network Jurors

This Tuesday the Aragon DAO launches a new smart contract that will allow interested users to convert existing Aragon Network Tokens (ANT) to Aragon Network Juror tokens (ANJ). Once converted and staked, ANJ tokens can be earned through dispute fees or by being selected to participate in Aragon courts. Aragon is a leader in DAO infrastructure and it appears to be the first project to use token community jurors to automatically deal with on-chain disputes. The price of ANT tokens fell 10% in the last week.

7th January- ICON network stability update

Popular Korean blockchain network and a big winner during the 2017 bull run, ICON launches a major network-wide stability update this week. The update changes the way network data is reported and calculated. It is also a sign that the network’s developers are active and community support is still a priority for ICON’s operators. The price of ICON fell 4% in the last week.

It was primarily a quiet week for large-cap crypto assets, apart from a few exceptions including Monero (XMR) and Bitcoin-SV (BCHSV), with both enjoying strong green trading weeks. Monero holders received a boost in confidence following a webinar where Europol analyst Jarek Jakubcek stated that Monero transactions remain extremely difficult for authorities to trace. Jakubcek said the point when users convert BTC and ETH to XMR is often where forensic blockchain investigations end.

The price of BTC has been stuck in a range between ~US$7600 - ~US$6800 for the last 50 days. Any drop or jump may above or below these levels may drive BTC’s next big move given how tightly wound this range has become. A weekly close above $7600 may have been a strong bullish flag, however, BTC’s price closed the week (00:00 GMT, Monday) below this level.

OhNoCrypto

via https://www.ohnocrypto.com

, Khareem Sudlow