Crypto market forecast: January 13th

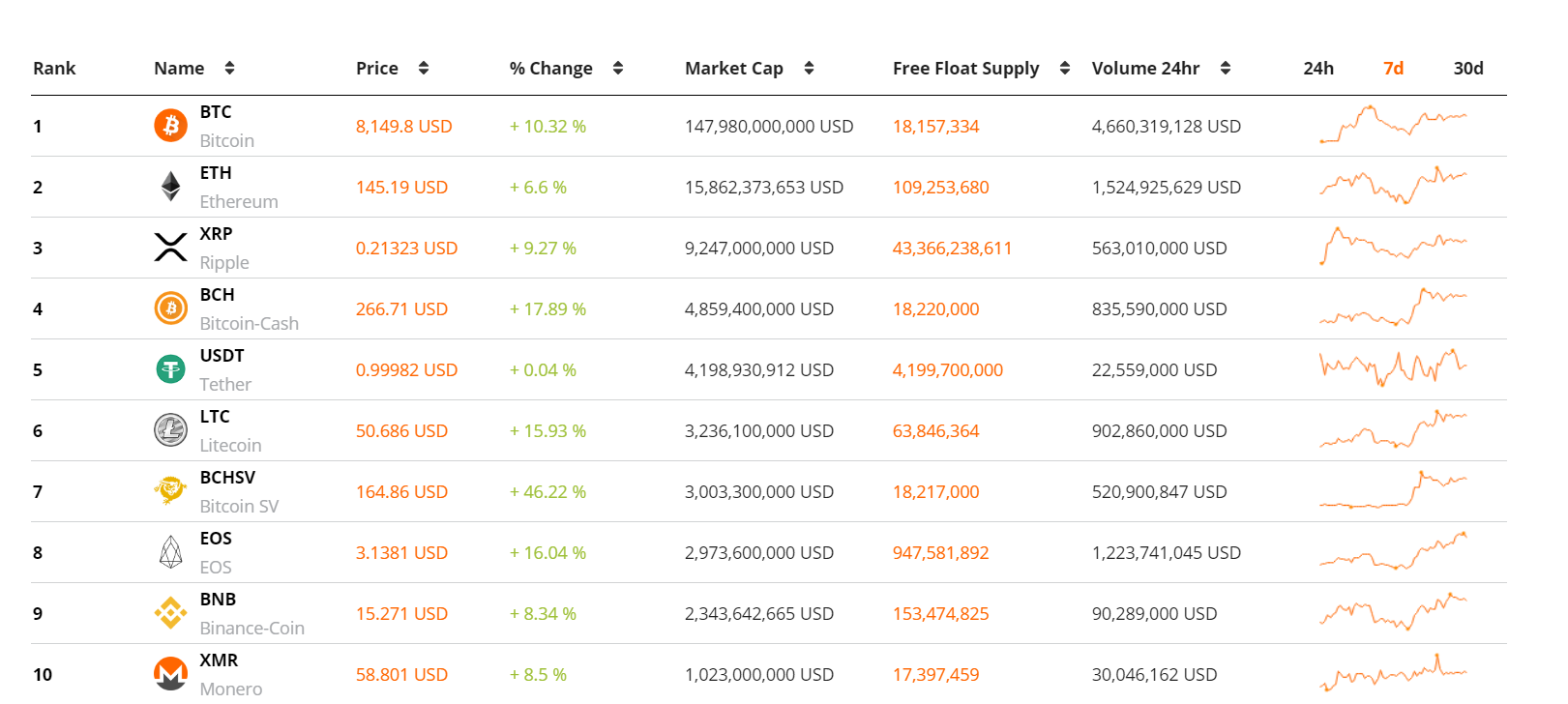

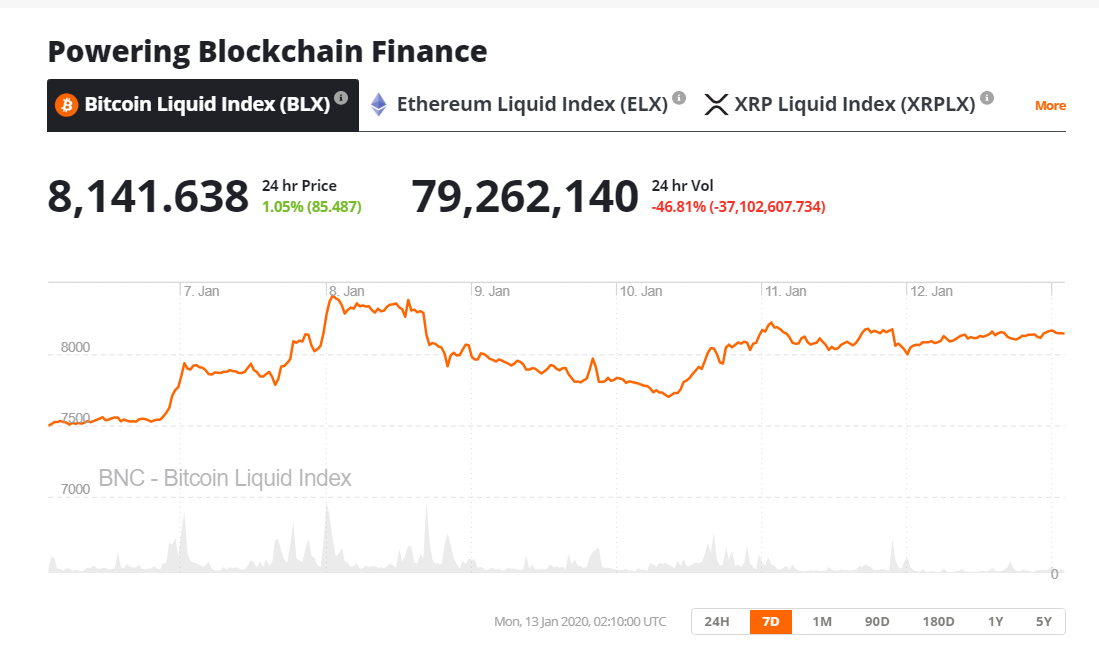

The crypto markets bounced back strongly this week with most large-cap assets enjoying a green trading week. Bitcoin (BTC), the crypto market’s top asset rose ~9%, while the number two and three crypto assets on Brave New Coin’s market cap table, ETH and XRP, rose ~5% and ~8% respectively. The total market cap rose ~8% across the week.

Pending regulatory approval, the CME will launch bitcoin options tied to their popular bitcoin futures products on January the 13th. However, launching new bitcoin contracts targeted at institutional traders has not always been a driver of positive market sentiment, nor does it signal a renewed interest in bitcoin trading.

The BAKKT bitcoin options currently tradable on ICE markets were launched to tepid demand and low initial open interest in 2019. The contract had several unique characteristics such as direct physical settlement and robust bitcoin custody solutions. BAKKT had been hyped for months leading up to its launch, so a number of bulls were caught out when the launch failed to live up to expectations.

The upcoming CME options will launch in different market conditions and indications suggest it will be more successful than the BAKKT futures contract launch. The new contract will launch to an existing customer base of CME bitcoin futures traders and is tied to its existing bitcoin futures product. The futures product has had an excellent year with open interest rising over 60% year to date.

The CME’s high profile is likely to boost initial demand for the new options product at launch. Options trading utilizes different strategies from futures trading and can be especially useful for hedging. Miners and large traders seeking to hedge their positions will be a key target customer segment for the CME.

Also last week Baidu, the Chinese internet giant, launched a public beta for a new cryptocurrency called Xuperchain. The cryptocurrency will be backed by an Ethereum style platform blockchain. According to the whitepaper, it will be able to handle 10,000 transactions per second and will support decentralized applications.

This week in crypto events

13th January- ATOM launches for trading on Coinbase Pro

On Monday the 13th of January, Coinbase Pro will begin accepting inbound transfers of the Cosmos (ATOM) cryptocurrency. While the Coinbase exchange has lost some of its luster in recent years, it remains a key retail onramp and may ignite some new buying pressure for ATOM, the native token of the Cosmos blockchain.

15th January- Augur application upgrade: v.16.6

Augur, the decentralized prediction market application, launches a new network update this week designed to address a number of UI/UX challenges. The upgrade will also fix a Metamask bug and allow Augur to communicate with Ethereum nodes more effectively.

It was an excellent week for Brave New Coin’s market cap top 10 with most assets achieving double-digit gains. Litecoin and EOS made gains against both the US dollar and Bitcoin, suggesting growing momentum for altcoins after an extended downtrend. In the 90 days before last week’s uptick, LTC prices fell ~22%.

It was an excellent week for bitcoin bulls with the price of BTC breaking through the key US$8,000 price level. Bitcoin also enjoyed a bullish weekly technical close and an apparent break in the market structure that may push its price to higher levels this week.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow