Monero Price Analysis - Random X removes ASICs but has led to mining pool centralization

Created in April 2014, the privacy coin Monero (XMR) enables untraceable, unlinkable, private, and analysis resistant transactions. The cryptocurrency is down 87% from the all-time high of nearly $500, established in December 2017. The market cap currently stands at US$1.1 billion, ranking XMR 13th on the Brave New Coin market cap table, with US$45.5 million in trading volume over the past 24 hours.

XMR’s default privacy features leverage Multilayered Linkable Spontaneous Anonymous Group signatures (MLSAG), ring confidential transactions (RCT), and stealth addresses. Other coins with the optional ability to send private transactions include Zcash (ZEC), DASH (DASH), GRIN (GRIN), and PIVX (PIVX), which use Zero-Knowledge proofs or CoinJoin.

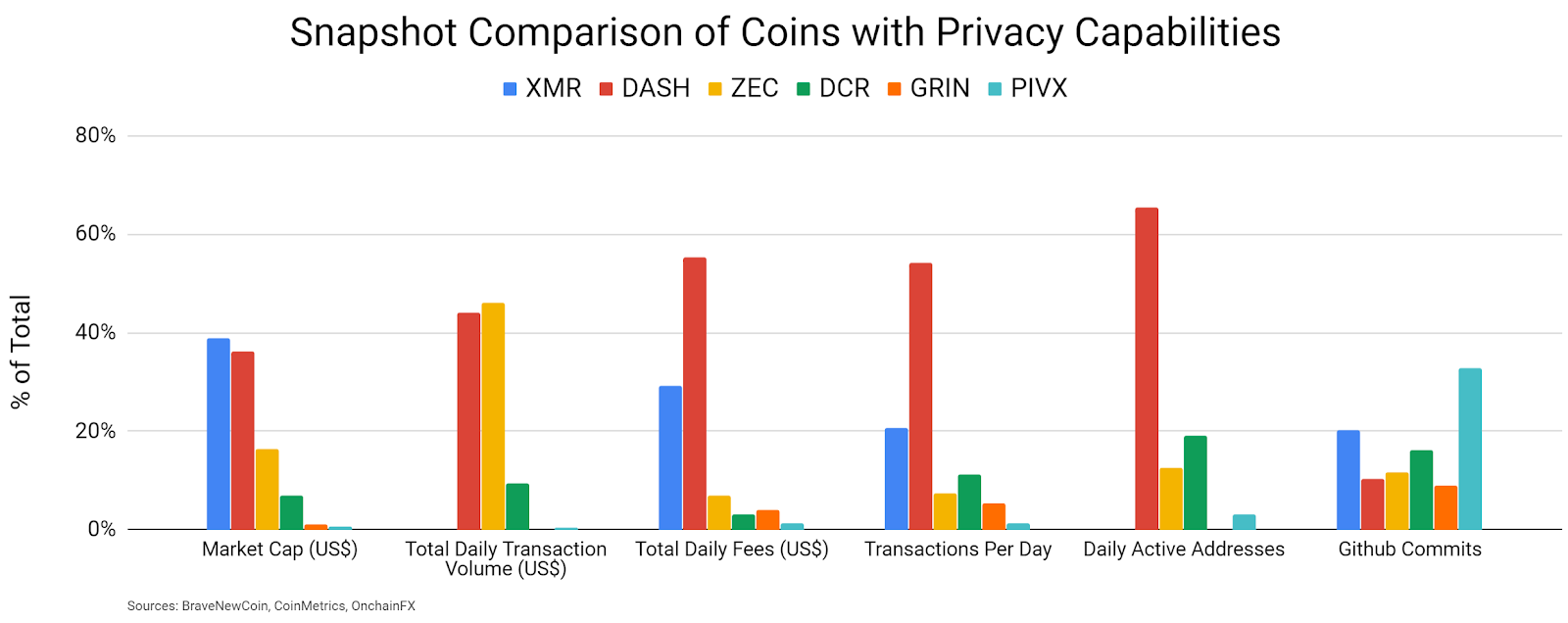

A quick comparison between coins with privacy capabilities shows that XMR leads in market cap and holds second place in all other categories with available data. Both XMR and GRIN obscure the blockchain transaction values and addresses used.

MLSAG signatures, as used by Shen Noether's RCT, are based on Gregory Maxwell's Confidential Transactions, and Nicolas van Saberhagen's Ring Signatures. These digital signatures allow any member of a group to produce a signature on behalf of the group, without revealing the individual signer's identity.

RCT was initially implemented on XMR in January 2017 and improves upon ring signatures by allowing hidden transaction amounts, origins, and destinations with reasonable efficiency and verifiably trustless coin generation. A stealth address feature gives additional transaction privacy by allowing for single-use addresses, which only reveal where a payment was sent to the sender and receiver. A multi-signature wallet function in the native XMR wallet was also implemented in April 2018.

A drawback of a hidden ledger is the inability to audit the chain to determine if extra coins have been minted. In July 2019, HackerOne revealed several vulnerabilities, including the ability to send counterfeit XMR to an exchange wallet. The report stated, “by mining a specially crafted block that still passes daemon verification, an attacker can create a miner transaction that appears to the wallet to include sum of XMR picked by the attacker...this can be exploited to steal money from exchanges.”

The bug did not affect on-chain XMR values and the vulnerability was patched months before the HackerOne report. ZEC had a similar but worse on-chain minting problem with an inflation bug that went without a fix for eight months.

XMR’s transactional privacy features have also attracted increased mining malware and ransomware operators over the past few years. A report released in January 2019 found that nearly 5% of all XMR in existence was created by crypto-mining malware.

There have been several malware variants affecting different operating systems. KingMiner, targeting Windows servers, likely accounted for an 86% increase in crypto-jacking throughout Q2 2018, as reported by McAfee labs. Linux.BtcMine.174, which targeted old Linux operating systems, was discovered in November 2018. Mining malware affecting cloud providers using Linux was found in January 2019 by Palo Alto Networks Unit 42. The Ukraine government was also affected by the crypto jacker Minergate.

Trend Micro has also reported a significant uptick in XMR-related mining malware since late 2018. This included two mining malware variants affecting Windows servers, RADMIN and MIMIKATZ, and Linux malware Coinminer.Linux.MALXMR.UWEIU which eliminated any competing malware on the infected machine. The security analysts also detected a URL that was spreading a botnet with an XMR miner bundled with a Perl-based backdoor component. The Perl-based backdoor component is capable of launching distributed denial-of-service (DDoS) attacks, allowing the cybercriminals to monetize their botnet through cryptocurrency mining and by offering DDoS-for-hire services. Most of the infection attempts thus far have occurred in China.

In response to the persistent and ongoing use of malicious software, the XMR community created a website to help users affected by these problems, including information for diagnosing and removing the malicious software. However, there are ongoing concerns around governmental attempts to declare a ban on XMR use. Japanese and U.S. governments have expressed interest in “legislative or regulatory actions” to prevent the use of privacy-focused cryptocurrencies, such as XMR and ZEC, for illicit purposes. UpBit delisted privacy coins in September 2019, and OKEx Korea remains in the process of discussing delisting these coins.

In late 2018, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) blacklisted two specific Bitcoin addresses for the first time, both of which had been used for ransomware. In early 2019, OFAC blacklisted 10 BTC addresses and one LTC address connected to narco-trafficking. These blacklisting procedures decrease coin fungibility and increases coin surveillance, both of which are not possible with XMR.

Riccardo Spagni, a member of Monero’s core developer team, has expressed his opinion that the U.S. is unlikely to declare privacy coins illegal. Spagni has stated that privacy coins will remain open to U.S. users as long as The Onion Router (TOR) remains open. He has also said that Zcash, which is managed by a U.S. company, is much more likely to be targeted by U.S. regulators.

There are two key XMR-related protocols, Tari and Kovri. Tari was announced in May 2018 and will introduce token creation, in a similar fashion to Colored Coins on Bitcoin, ERC20 tokens on Ethereum, and non-fungible tokens (NFTs) in general. Although there have been no recent announcements related to Tari, although the GitHub repository remains active.

Kovri, which is currently live, allows for wallet features that are similar to TOR by adding additional user privacy through anonymizing geographical locations and IP addresses with an overlay network. Eventually, all future XMR transactions will be routed through Kovri.

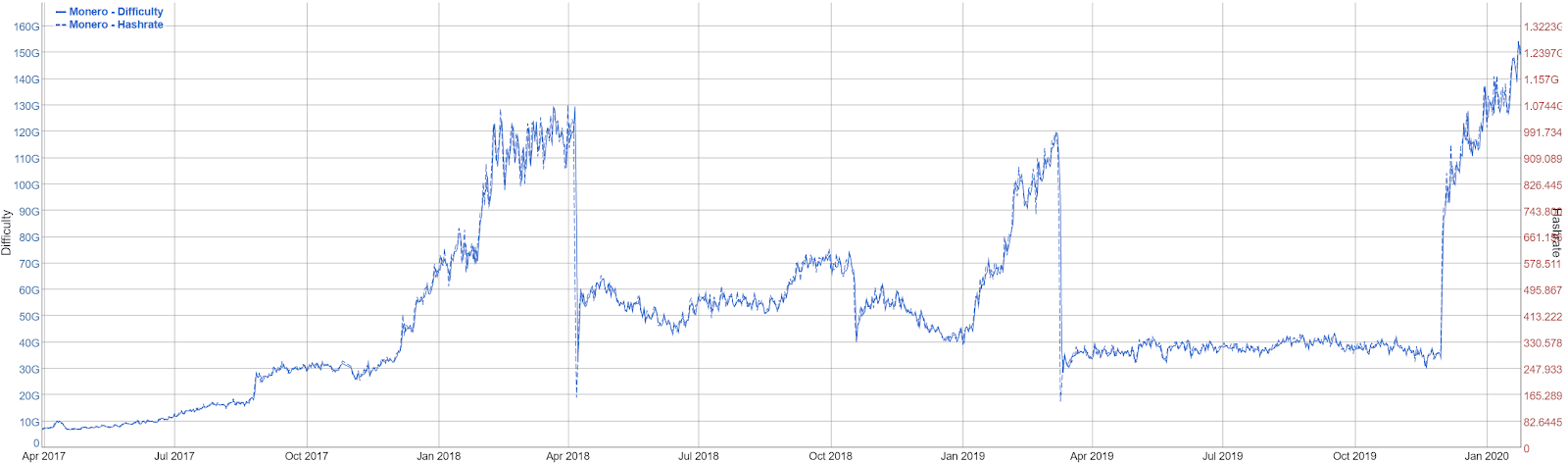

On the network side, the XMR community has taken an aggressive approach to regain Application Specific Integrated Circuit (ASIC) resistance. Beginning in late 2017, the XMR hash rate began to increase substantially, suggesting ASIC mining. This meant that CPUs and GPUs could no longer efficiently mine XMR due to ASIC competition. The increased use of ASICs on any chain can mean increased network centralization as less efficient hardware, like GPUs and CPUs, become unprofitable to use, allowing those with more resources to buy more ASICs.

The XMR Proof-of-Work (PoW) algorithm, CryptoNight, had been scheduled for slight changes through the use of periodic hard forks, every six months, which would have ideally decreased the use of ASICs on the chain. In an aggressive attempt to remove ASICs from the chain, the XMR community implemented a new PoW consensus algorithm, RandomX, via hard fork in late November. The new algorithm gives CPU mining a competitive advantage over both GPUs and ASICs.

Two further changes included; the removal of long payment IDs, where transactions require at least two outputs, and a ten-block lock time for incoming transactions. The goal of these changes is to improve privacy for the users and the network.

Since the hard fork and new consensus algorithm, hash rate has hit a new ATH. However, a CryptoNight hash is not equivalent to a Random X hash, so these cannot be compared directly. An increase in hash rate since the hard fork does suggest increased mining interest on the chain.

Source: BitInfoCharts

Since the November hard fork, the hash rate appears to have increased in centralization based on hash rate distribution between each pool. Over time, this distribution will likely even out as more and more pools and users switch to mining equipment advantageous for RandomX.

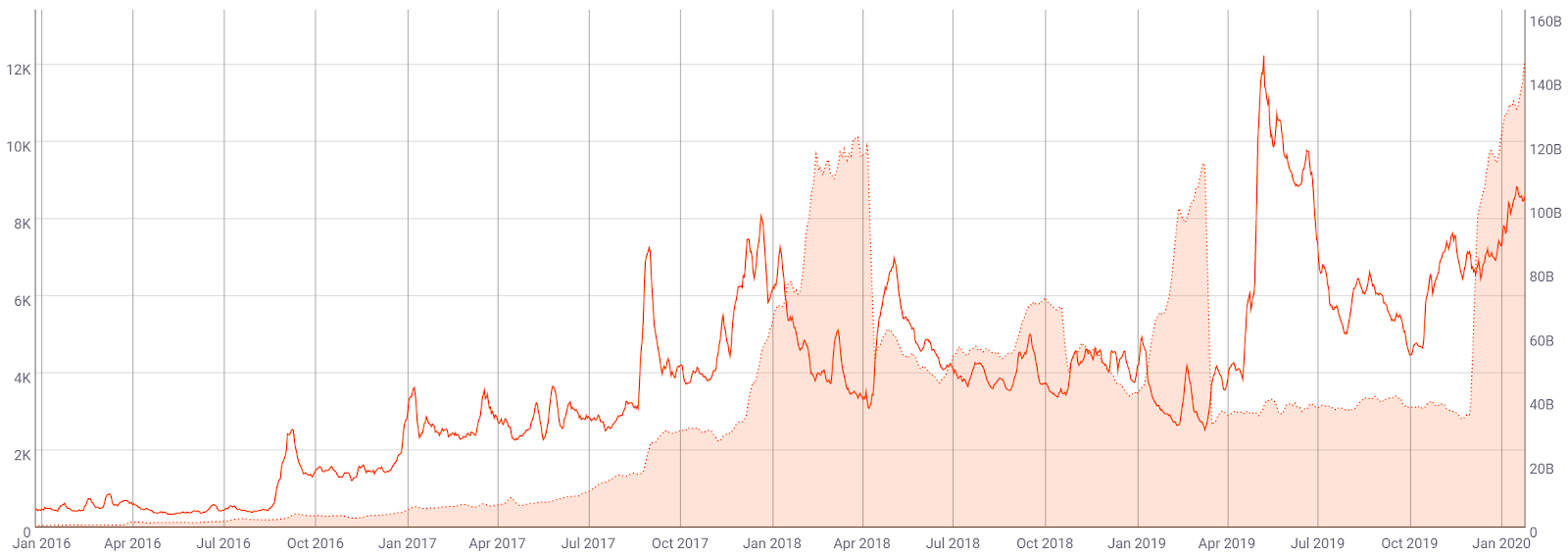

Just over 94.5% of the 18.4 million XMR to exist by May 2022 have now been mined. XMR has a two-minute targeted block time with ~3% annual inflation (line, chart below), which is among the lowest of all coins. When compared to the stepwise disinflationary curve which occurs after each Bitcoin block reward halving, XMR has a smoother emission curve until the block reward hits 0.3 XMR per minute, where it will remain indefinitely. This is known as tail emission and ensures a block reward in perpetuity, regardless of transaction fees.

Transactions per day (line, chart below) on the Monero network have continued to increase since the November hard fork. Peaks in mining difficulty (fill, chart below) since January 2018 have preceded spikes in transactions per day, suggesting that mining activity may be a cause for this transaction spike. As mining malware activity or new ASICs come on or offline, mining difficulty can vary wildly.

Source: CoinMetrics

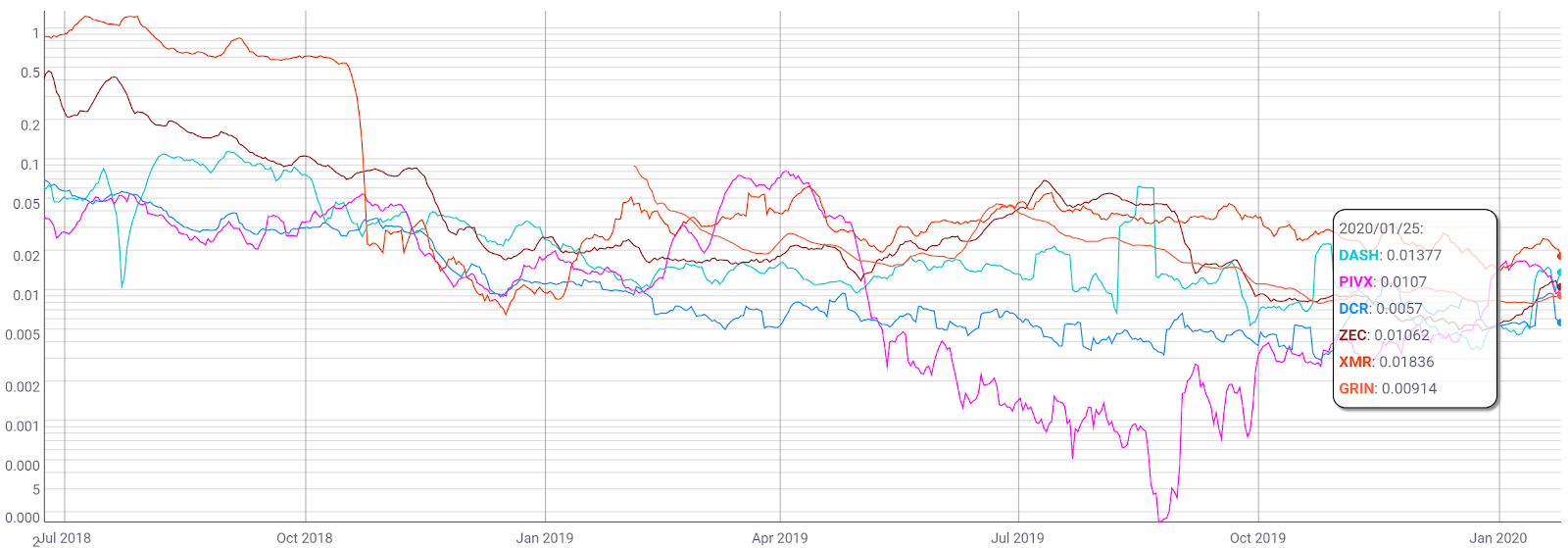

XMR historically led the pack in regards to transaction fees (red, chart below). XMR transaction fees are currently higher than DASH, ZEC, DCR, GRIN, and PIVX. XMR has also historically had more transactions per day than ZEC, GRIN, or PIVX, but fewer than DASH (not shown).

In October 2018, XMR completed a hard fork to implement Bulletproofs, which reduced transaction sizes by 80% and immediately brought average transaction fees down to US$0.027. XMR’s average daily block size is currently higher than DASH, ZEC, DCR, GRIN, and PIVX, and has also decreased significantly since the addition of Bulletproofs (not shown).

Source: CoinMetrics

Turning to developer activity, XMR currently has 17 repos on GitHub. In total, over 200 developers have contributed over 3,000 commits in the past year across all repos. Most of these commits have occurred on the main XMR repo (shown below).

Most coins use the developer community of GitHub. Files are saved in folders called "repositories," or "repos." Changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: GitHub

Exchange-traded volume has been led by the Bitcoin (BTC) and Tether (USDT) markets with most of the volume originating from Huobi and Binance. The sustained dominance of the BTC trading pair is largely due to the lack of direct fiat gateways for XMR.

Throughout 2019, several monero pairs were added to various exchanges; Binance added XMR/BNB and XMR/USDT trading pairs; XMR/BTC margin trading was added to Poloniex in late April; BTSE added XMR/BTC, LTC, ETH, USDT, USDC, TUSD, and a variety of other fiat pairs in October. In September, Poloniex delisted LTC/XMR, DASH/XMR, ZEC/XMR, MAID/XMR, NXT/XMR, and BCN/XMR pairs due to low volume.

As exchange services like Shapeshift and Changelly now require customers to register for KYC/AML compliance, XMR volume on decentralized exchanges (DEXs) will likely continue to increase. The XMR/BTC pair on Bisq, a peer to peer private DEX, currently accounts for 25% of the total exchange volume and the ZEC/BTC pair accounts for 42%. In 2018, the U.S. Securities and Exchange Commission announced that DEX owners need to register as exchanges, which may keep unregistered DEXs out of the U.S. entirely.

In the future, XMR may be delisted from centralized exchanges and relegated to DEXs entirely. Although, in August 2018, XMR was listed as a potential addition to Coinbase. ZEC was added to Coinbase with its optional privacy feature disabled. Hardware wallet solutions currently available for XMR include the Trezor Model T and the Ledger Nano S.

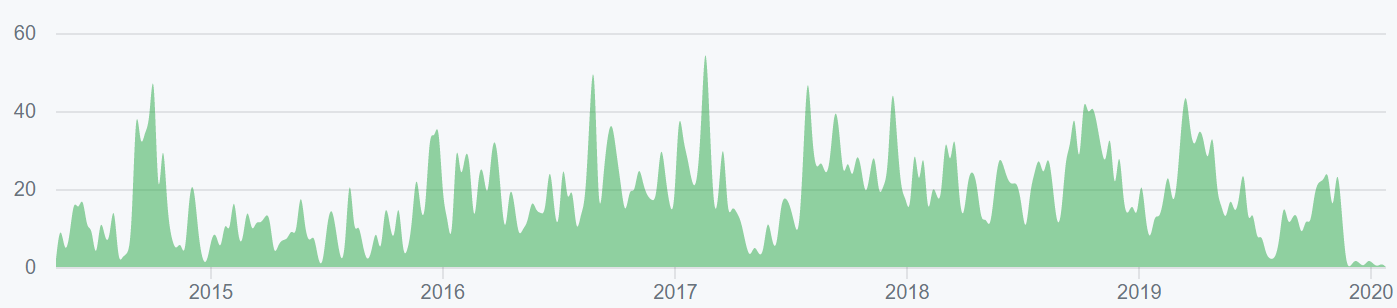

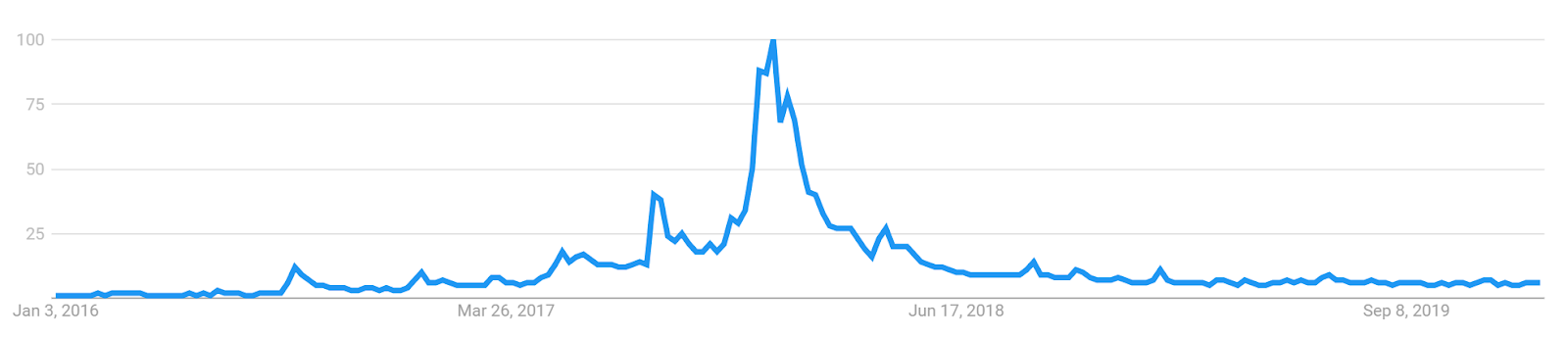

Worldwide Google Trends interest regarding the term "Monero" remained sharply down over the course of 2018 and 2019. A slow rise in searches for "Monero" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "Bitcoin" searches increase dramatically, Bitcoin price drops.

Technical Analysis

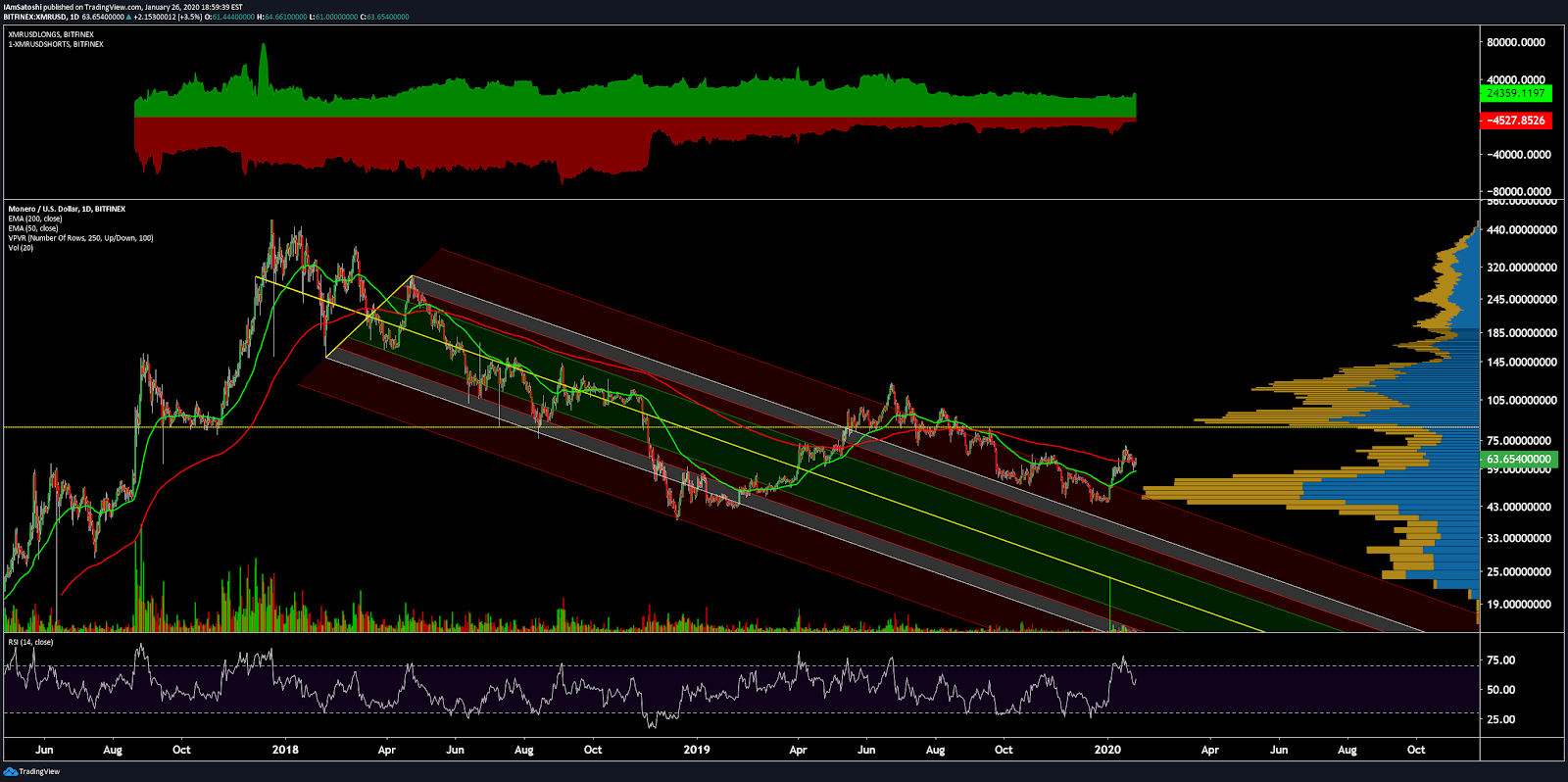

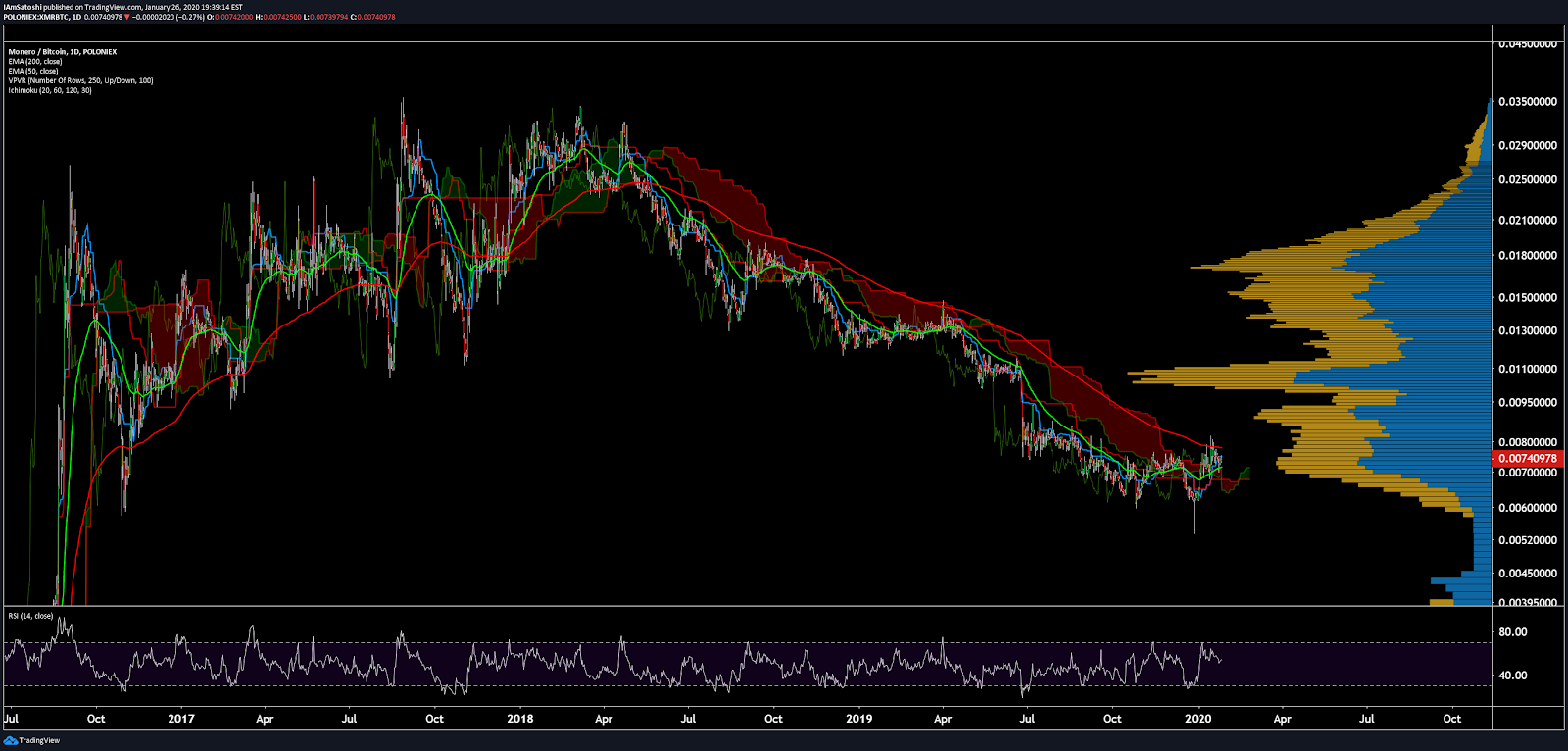

Since the April 2018 highs, XMR bleed off nearly 85% for both the XMR/USD and XMR/BTC pairs. However, since the Random X implementation, XMR pairs have gained 60% from local lows. A potential future roadmap for price action can be found using Exponential Moving Averages, Volume Profile Visible Range, Pitchforks, the Relative Strength Index, and the Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the 50-day exponential moving average (EMA) and 200-day EMA Death Cross occurred in early September 2019. Price is currently sitting below the 200-day EMA and above the 50-day EMA, with a bullish Golden Cross likely to occur within the next month.

Price has also breached a high volume Volume Profile Visible Range (VPVR) congestion zone from US$41 to US$53. The next zone of historical volume resistance sits at US$80 to US$95. Further, long/short open interest on Bitfinex (top panel, chart below) is currently 84% long, with long and short positions slowly increasing over the past few weeks. Additionally, there are no active divergences to suggest weakening bearish momentum.

The current spot price has also been bound by a bearish Pitchfork (PF) for the past year, with anchor points in December 2017, February 2018, and April 2018. Until recently, price has been unable to definitively breach the PF despite several attempts. With several days of consecutive closes above the PF, the bear trend is likely over.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best trade entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30) for more accurate signals are bullish for the first time since July; price is above the Cloud, the Cloud is newly bullish, the TK cross is bullish, and the Lagging Span is above price and inside of the Cloud. A traditional long entry will trigger on today’s close, which marks a bullish Kumo breakout.

Lastly, on the XMR/BTC daily chart, the trend is significantly bearish. The 50-day EMA and 200-day EMAs have been bearishly crossed for over 600 days and Cloud metrics are now 100% bullish (not shown). Over the next month, a bullish Golden Cross will likely form, hinting at further bullish momentum. VPVR suggests significant overhead resistance at the psychological resistance of 0.01 BTC. There are no bullish or bearish RSI divergences at this time.

Conclusion

Fundamentals show active and continued incremental upgrades over the past two years, including decreased transaction costs, improved transaction efficiency, blockchain pruning, improved privacy, and improved custody solutions.

In late November, the network changed from the CryptoNight consensus algorithm to Random X. The goal of the new algorithm is to help remove ASICs from the network permanently by giving CPUs a competitive mining advantage. Thanks to XMR’s ironclad privacy, darknet traffic continues at a fever pitch with new mining malware and various other attack vectors pointed at the Monero community, including on Monero’s official website.

Technicals for both the XMR/USD and XMR/BTC pairs suggest nascent bullish trends. Both pairs are ending an over 600 day bearish trend which led to an 85% drawdown. Since the November hard fork, price has rebounded nearly 60% on both pairs. In the coming weeks, a bullish 50-day and 200-day Golden cross, with price holding above the Cloud, should yield prices of US$100 and 0.01 BTC for each pair. Further consolidation at the respective psychological resistance will likely be necessary before additional bullish momentum.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow