The stablecoin regulation landscape for 2020

This article looks at the global regulatory landscape and identifies the key regulatory bodies. Who are they and what is their current position regarding stablecoins?

Structural Changes

In her debut speech as the ECB President at the European Banking Conference in Frankfurt in November, Christine Lagarde spoke of the structural changes happening in the global economy, alluding to blockchain and emerging technologies:

“World trade is being reordered as new technologies disrupt conventional supply chains and workplace organization” - Christine Lagarde, ECB President

Lagarde added, “Ongoing trade tensions and geopolitical uncertainties are contributing to a slowdown in world trade growth, which has more than halved since last year. This has in turn depressed global growth to its lowest level since the great financial crisis.”

Later, in December, Ms. Lagarde acknowledged stablecoins as an area of focus for her tenure, addressing them in a message that also covered global issues such as climate change. “There is clearly demand out there that we have to respond to,” and the ECB, “should stay ahead of the curve,” she said. This has elevated the status of cryptocurrency to a global priority for the ECB in 2020.

The ECB has also created a proof-of-concept DLT platform, called EUROchain, for bank intermediaries that have access to central bank accounts and can draw on reserve balances held at the central bank to provide central bank digital currency their customers.

The G20 agenda

Crypto assets also made the agenda of the G20 summit held in Osaka, Japan in June 2019. In their declaration, leaders of the G20 group of nations acknowledged the benefits that blockchain technology could deliver to the global financial system and the broader economy. They reiterated that crypto assets do not pose a threat to global financial stability at this point. However, they recommend close monitoring of cryptocurrency developments and ongoing monitoring of the underlying risks.

Later in the year, in October, the Financial Stability Board, which is chaired by the G20, sent a more urgent letter to G20 leaders about the potential threat to stability from ‘global stablecoins.’ This letter came after the announcement of Facebook’s proposed Libra stablecoin and acknowledged that ‘GSCs’ could become systemically important and eventually even substitutes for domestic currency.

As many stablecoins use the same mechanics as real-world currencies such as a currency board, currency basket, dollar pegs, and even open market operations, they are subject to the same risks as legacy currencies and potentially the same regulations as well. With stablecoins, agents such as designated market-makers may have significant market power and the ability to determine the stablecoin price. This leaves open the potential for market manipulation.

Meanwhile, the ‘oracle problem’ in decentralized systems is yet to be resolved. This dilemma describes the reliance on a third-party for price feeds to maintain the price of the stablecoin to an external peg. Late last year, the Synthetix stablecoin SUSD suffered an attack from a trading bot which exploited the oracle price feeds, issuing more debt than there was collateral and brought the stablecoin close to insolvency.

The term ‘global stablecoins’ has emerged among regulators to describe digital currencies such as Libra, which are not decentralized but have the potential to gain widespread adoption. A G7/Bank of International Settlements report on stablecoins concluded, “GSCs could have significant adverse effects, both domestically and internationally, on the transmission of monetary policy, as well as financial stability, in addition to cross-jurisdictional efforts to combat money laundering and terrorist financing.”

Meanwhile, the Chinese government appeared to change its tune on blockchain with an official announcement that China would embrace the technology as a core strategic pillar of its future economy. In October, China’s President Xi Jinping gave a major speech stating that the country needed to make a greater effort with blockchain_ _“to get an edge on other major countries.”

2019 timeline of regulator statements and publications

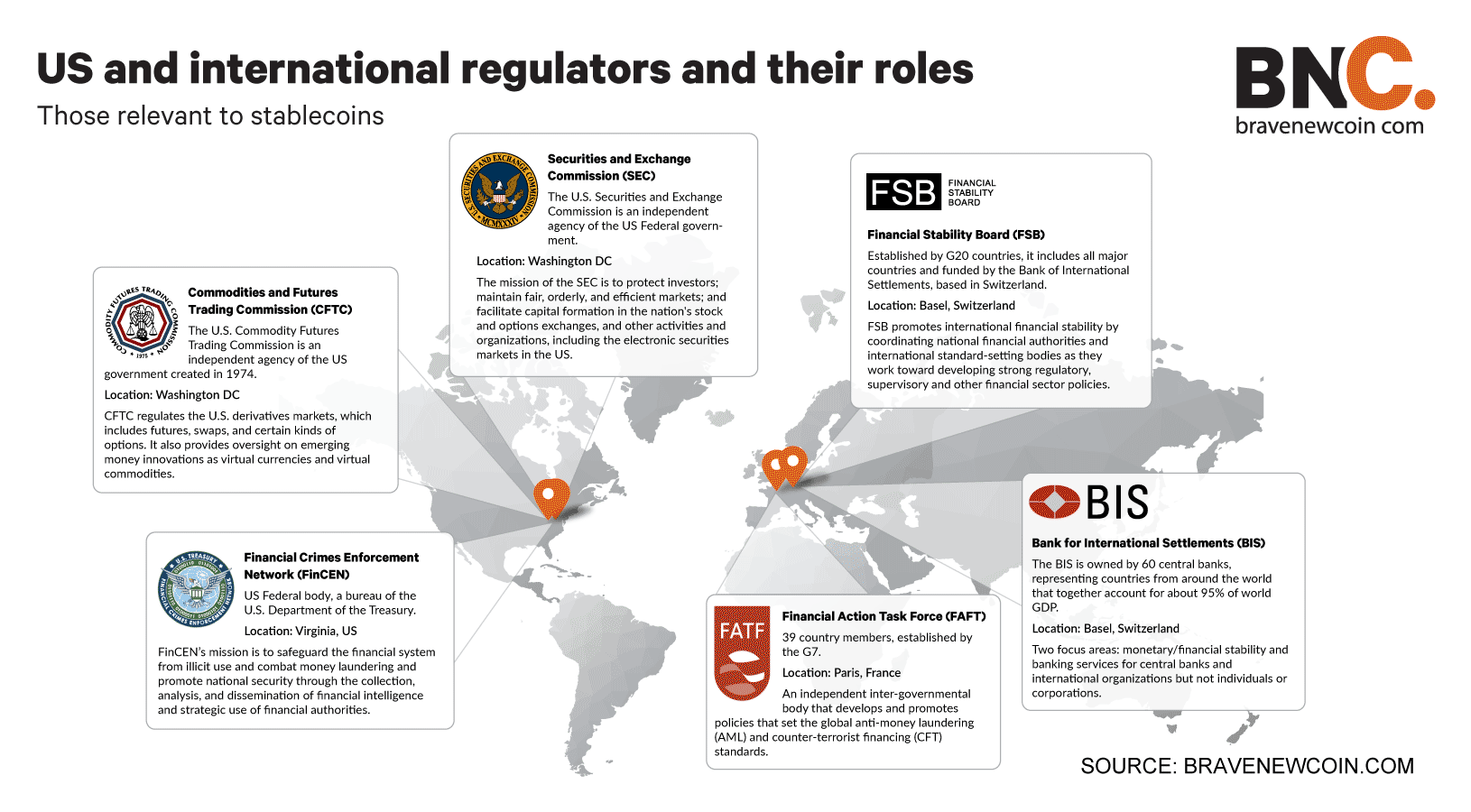

*June: Financial Action Task Force (FATF) *- The FATF Recommendations are recognized as the global anti-money laundering (AML) and counter-terrorist financing (CFT) standard. It updated its framework on “Virtual Asset Service Provider (VASPs) to be regulated for anti-money laundering and combating the financing of terrorism (AML/CFT) purposes, licensed or registered, and subject to effective systems for monitoring or supervision.”

*August: European Central Bank *- The ECB published a rare technical whitepaper on stablecoins, summating that “initiatives with a clear governance framework may nevertheless be hampered by the uncertainty relating to the lack of regulatory scrutiny and recognition.”

*October: FSB/G20 * - In a letter to G20 leaders, FSB Chairman Randal K. Quarles wrote “the introduction of ‘global stablecoins’ could pose a host of challenges to the regulatory community, not least because they have the potential to become systemically important, including through the substitution of domestic currencies.”

October: G7/BIS *- A co-authored working group paper on stablecoins declared *“Some risks are amplified and new risks might arise following global adoption. Stablecoin initiatives built on an existing – large and/or cross-border – customer base may have the potential to scale rapidly. These are referred to as “global stablecoins” (GSCs).

November:** FinCEN** - FinCEN Director Kenneth A. Blanco spoke at a Chainalysis Blockchain Symposium saying “accepting and transmitting activity denominated in stablecoins makes you a money transmitter under the BSA (Bank Secrecy Act). It does not matter if the stablecoin is backed by a currency, a commodity, or even an algorithm — the rules are the same. To that point, administrators of stablecoins have to register as MSBs with FinCEN.”

November: Fed Financial Stability Report *- *“Stablecoin initiatives that are built on existing large and cross-border customer networks, such as Facebook’s Libra, have the potential to rapidly achieve widespread adoption. These initiatives are referred to as “global stablecoins, but if poorly designed and unregulated, could negatively affect financial stability.”

OhNoCrypto

via https://www.ohnocrypto.com

Andrew Gillick, Khareem Sudlow