Bitcoin derivatives bloomed in 2019; is 2020 stunting their growth now?

In 2019, Bitcoin enjoyed a fruitful period of aggressive price hike between April and June, pushing its year-to-date price up to to $13,880. However, many tend to forget that the increased growth witnessed in the derivatives market was the major highlight following major institutions finally taking notice of Bitcoin as a substantial form of investment.

Flash forward to March 2020 – the narrative might be crumbling right in front of our eyes.

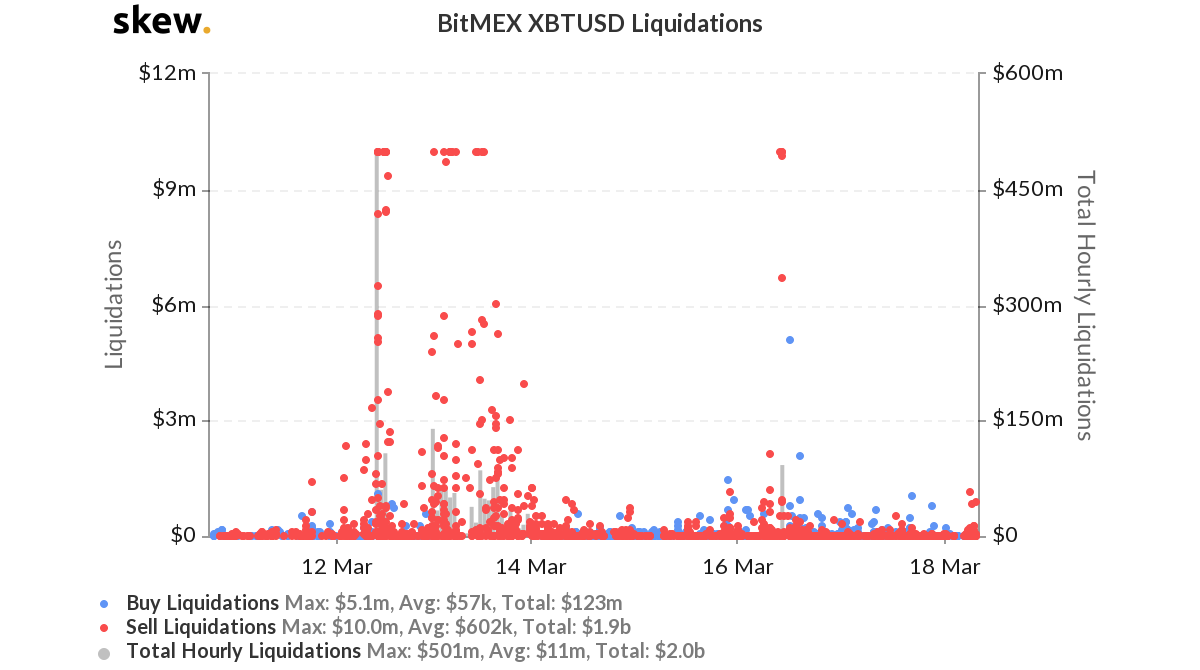

Following the price dump on 12 March, major exchanges projected huge figures for liquidations during the sell-off, and none other than BitMEX was at the center of it all.

Source: Skew

Over the past week, BitMEX, one of the world’s largest derivatives platforms, has registered total hourly liquidations of over $2 billion, which is the most in 2020. However, the liquidations indicated a bearish sentiment as over $1.9 billion on Bitcoin’s XBTUSD index were sell liquidations.

On average, contracts worth $600k were liquidated and most of them happened over 12-13th March. The number of buy liquidations over the week was a paltry $123 million, according to the attached chart.

Source: Skew

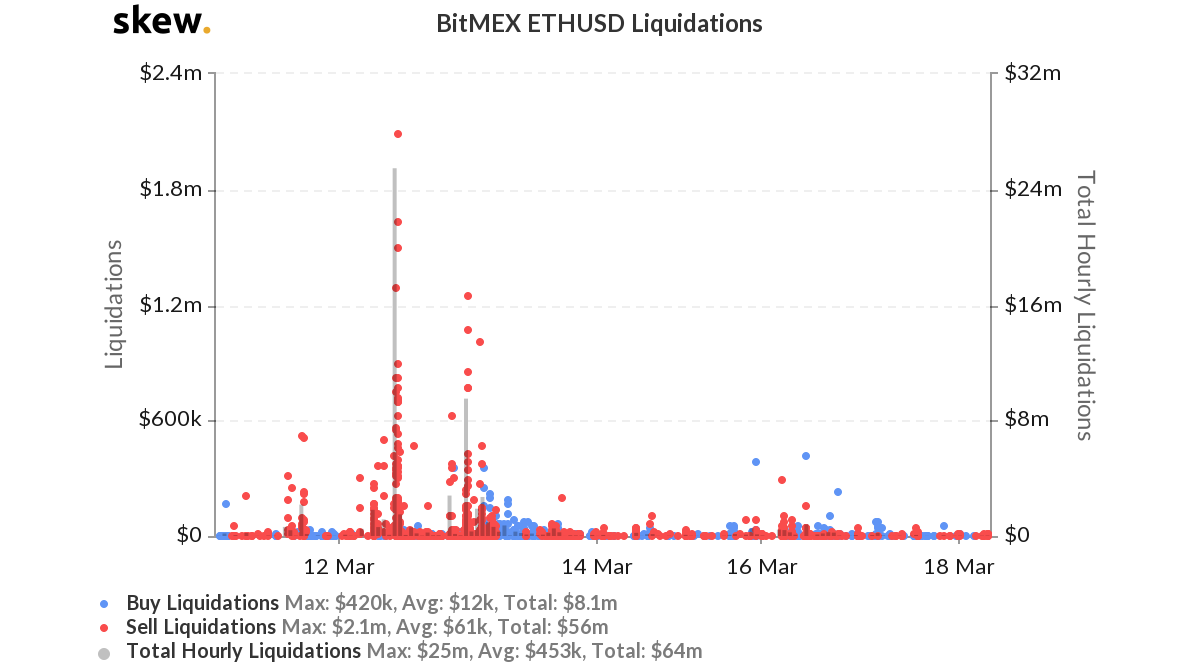

A similar case was recorded in the case of Ethereum Futures on BitMEX as ETHUSD liquidations were around $64 million over the past seven days.

Sell liquidations held the upper hand here as well, with about $56 million, averaging $61K per Futures contract. A meager $8.1 million in buy liquidations continued to offer little balance in the market.

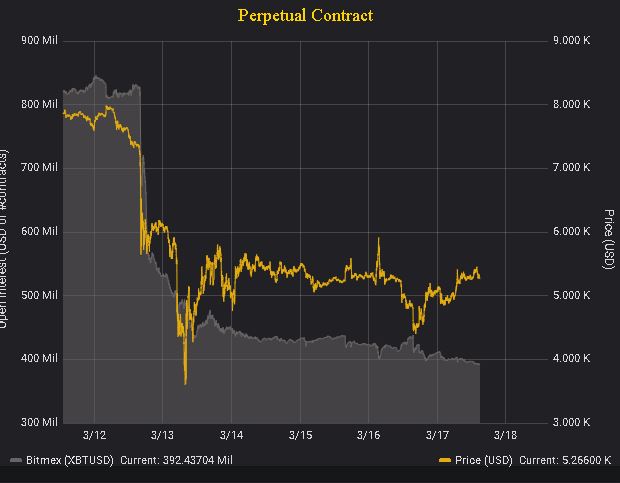

With major coins such as Bitcoin and Ethereum suffering sell-offs on BitMEX, we analyzed the Open Interest on the tokens’ perpetual contracts as well.

Source: delta exchange

With respect to perpetual contracts, Bitcoin’s OI suffered a 50 percent depreciation as the value fell from $830 million on 12 March to just under $400 million, at press time.

The Open Interest of Ethereum’s perpetual contracts faced a similar fate as the OI dropped from $58 million on 11 March to $37 million, at press time.

Source: delta. exchange

When other altcoins such as XRP and Litecoin were considered, there was no surprise as a similar story unfolded on the charts.

Although XRP did register a price point last seen back in May 2017, XRP/XBT Futures contract on BitMEX registered an OI that was less devastating than the assets listed above. Its Open Interest dropped from $79 million to $68 million, indicating a less aggressive sell-off.

Finally, LTCH20, an LTC/XBT Futures contract, registered a 40 percent decline in OI as the interest dropped from $176k on 11 March to $105k, at press time.

OhNoCrypto

via https://www.ohnocrypto.com

Biraajmaan Tamuly, Khareem Sudlow