Bitcoin's market dominance overshadowed by low probability index for $14k

The first few weeks of 2020 were a good time for the cryptocurrency market, with a host of tokens embarking on a bullish rally. In fact, crypto-assets with a market cap of under $1 billion were performing significantly well as for the most part of the rally, small-cap and mid-cap assets’ growth even surpassed Bitcoin on the charts.

The road to recovery for these assets after the market crash over the 12th of March has been relatively long and difficult, as was suggested by Arcane Research in its latest report. According to the same, Bitcoin has gained the most in terms of total market share since the aforementioned market dump.

Previously, small-cap assets were the top-performing tokens for a greater part of 2020, closely followed by mid-cap assets. Last week itself, small-cap assets were down by only 22 percent in March, whereas Bitcoin was down by 28 percent.

However, the tables have now turned, with Bitcoin overtaking small-cap tokens after being down by only 22 percent in March. On the contrary, mid-cap assets continued to be the worst performers in the market, after incurring a loss of 34 percent in March.

Additionally, Bitcoin’s dominance in the market also increased over the week. On 21 March, Bitcoin’s dominance was around 63.45 percent, whereas, at press time, Bitcoin’s share in the market was up to around 65.4 percent.

Bitcoin’s probability index goes down

In spite of it registering a quick recovery with respect to the rest of the asset market, the probability index of Bitcoin crossing $14000 by June 2020 fell significantly over the past month.

In fact, towards the end of February, the Bitcoin probability index for crossing the above valuation by June was around 16 percent, but at press time, the index recorded a measly 3 percent, a substantial drop from the initially calculated probability.

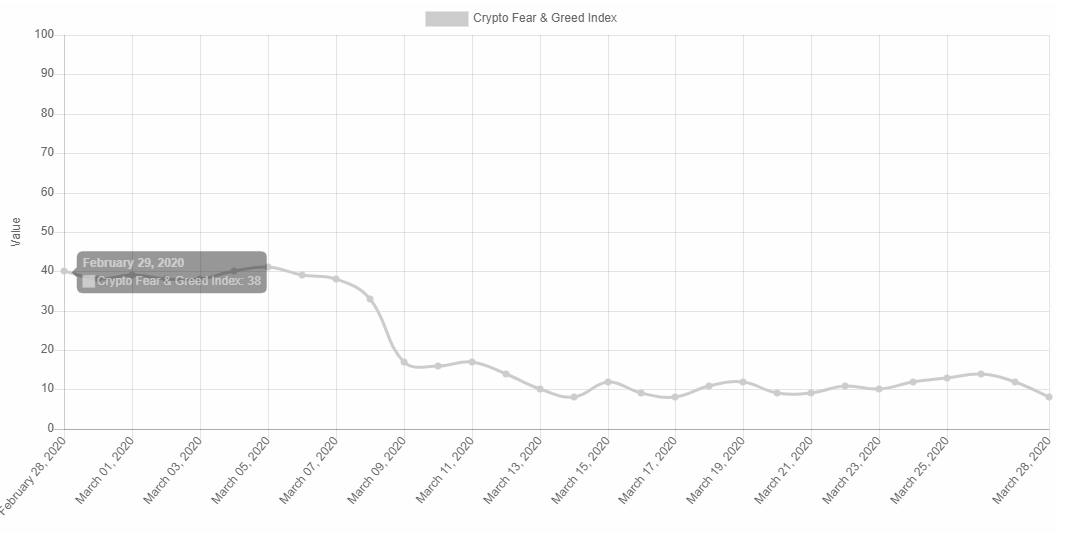

Source: Alternative.me

This sentiment was somewhat reciprocated by investors as well, with the Fear and Greed index continuing to mediate under the levels of 20. At the time of writing, the Fear and Greed Index continued to remain under 10, highlighting a scenario of ‘Extreme Fear’ in the market.

All things considered, it can be inferred that investors continue to remain cautious in the market, with the king coin’s market recoveries doing little to improve the long-term trend.

OhNoCrypto

via https://www.ohnocrypto.com

Biraajmaan Tamuly, Khareem Sudlow