Brave New Coin Weekly Bitcoin halving countdown update: 12th March

What is the Halving?

Bitcoin is a decentralized digital currency that enables instant payments to anyone, with no central authority. The Bitcoin network is secured by miners which are specialized computers that use a consensus mechanism called “proof of work” to verify each block of bitcoin transactions.

The miner that verifies each block is rewarded for their work with newly-created bitcoins. This ‘block reward’ is how new bitcoins are released into the system. A new block of transactions is added to the Bitcoin blockchain approximately every 10 minutes. The current reward is 12.5 bitcoins per block.

An average of 144 blocks are mined every day which means approximately 1,800 new bitcoins are generated every 24 hours.

The number of new bitcoins that are created via the block reward is reduced by half every four years. This is known as the Bitcoin Halving. The next halving will be the third halving, and the current block reward of 12.5 bitcoins will reduce to 6.25 bitcoins.

This week in the halving countdown

The Bitcoin network’s hashrate hit a new all time high of ~140 quintillion hashes per second

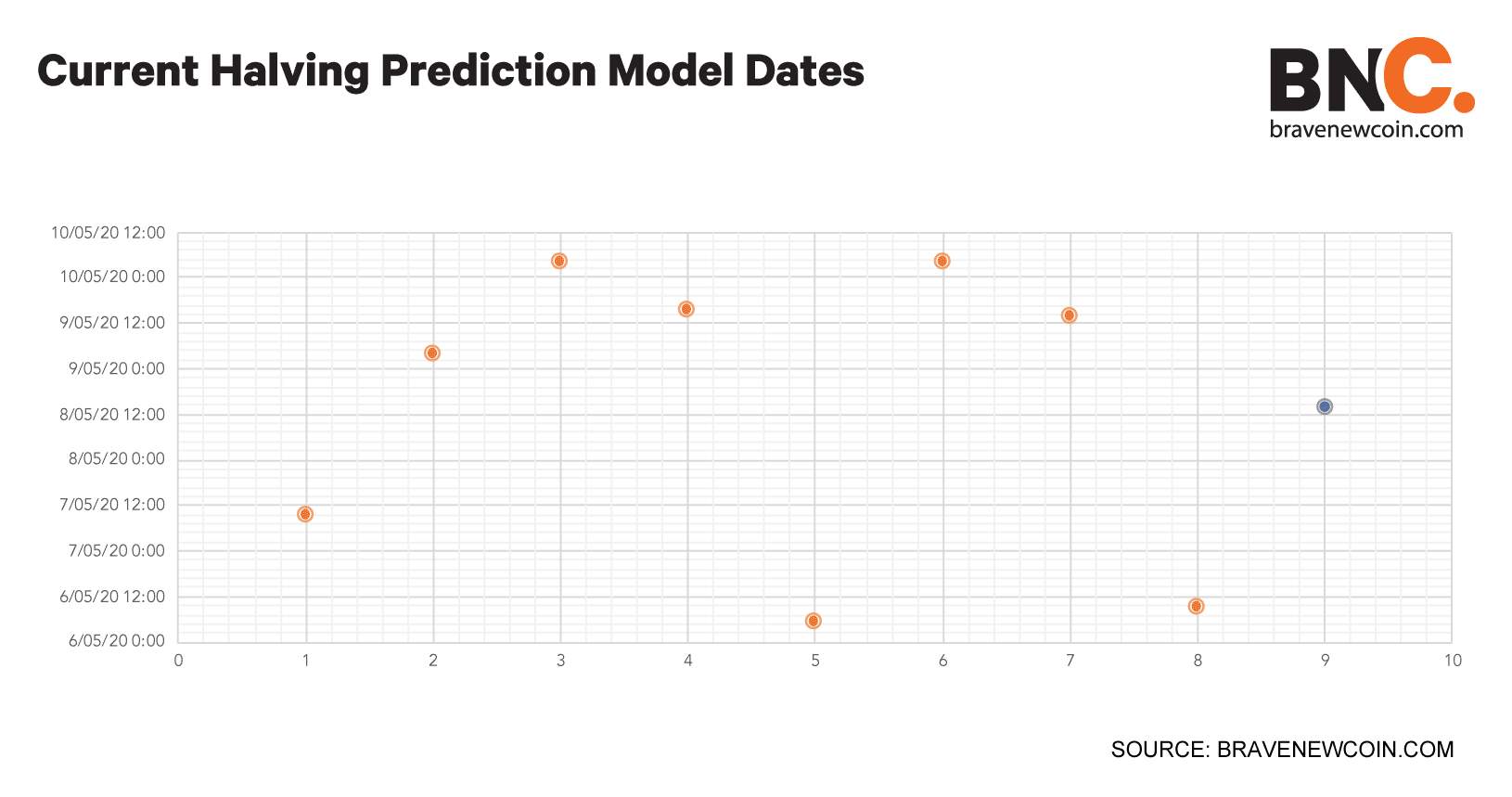

This week’s consolidated (across all Brave New Coin prediction models) Bitcoin block reward having prediction date is 08/05/2020 14:09

The consolidated prediction date from a week earlier was 09/05/2020 00:57 this week’s predicted date is 10 hours and 47 minutes earlier. Each model is recalculated every day. The consolidated block halving prediction date has been brought forward marginally.

The Bitcoin network’s hashrate continues to trend upwards in the lead up to Bitcoin’s block reward halving in approximately two months. Both of the models that use a 7 day moving average as part of their calculation have begun to predict dates in early May. The other models are now predicting dates in mid-May. This suggests that the uptick in hashrate has the strongest influence on short term driven predictive models.

A rising hashrate means that blocks are being processed at a slightly faster rate. This naturally pulls back the ‘average daily block time’ based models that BNC uses to predict the halving date. The Bitcoin hashrate rose ~6% over the last week maintaining a steady positive long term macro growth trend. Similarly, the Bitcoin network difficulty continues to rise. The Bitcoin network mining difficulty will increase sharply post halving and miners may be increasing their current usage before eventually slowing down as mining profitability is squeezed.

For now the COVID-19 coronavirus is not affecting the fundamentals of Bitcoin. Despite half of Bitcoin’s hashrate coming from mainland China, the epicentre of the COVID-19 outbreak, hashrate touched a new all time high on the 1st of March 2020. The disease’s outbreak within China, also appears to be under control with just 17 new confirmed cases being reported across the country on March 9th.

With China’s economy now returning to near-normal operations, Bitcoin mining looks to have been mostly unaffected by the peak of the COVID-19 panic in China. There are some concerns that the virus may have affected the preparations of some miners - who may have had their plans with how to deal with mining profitability drops post halvin - derailed due to virus related economic disruptions. Cash and liquidity remain in high demand across global financial markets and any capital investments from BTC miners in the short term is likely to be limited.

https://bravenewcoin.com/data-and-charts/bitcoin-halving

Halving prediction dates

Average predicted block halving date 01/03/2020 across the 8 different models= 08/05/2020 14:09

Average predicted block halving date the week before across the 8 different models= 09/05/2020 00:57

Difference= 10 hours & 47 minutes later

Date Convergence charts

Scenario 1: Average Daily Block Time

This is the average execution time of all Bitcoin blocks mined the day before. This model estimates the number of days left until the next halving, by multiplying the average daily block time by the number of blocks left to be mined before the next halving. Using this measure we calculate the timestamp for next halving.

Dates put out by this model remain below the historical average. This model is more affected by intra-day hashrate volatility and its predicted dates have been mixed this week as the metric has bounced around

Average predicted halving date (first observation 01/01/2019)= 12/05/2020 13:50

Predicted halving date on 08/03/2020= 07/05/2020 09:27

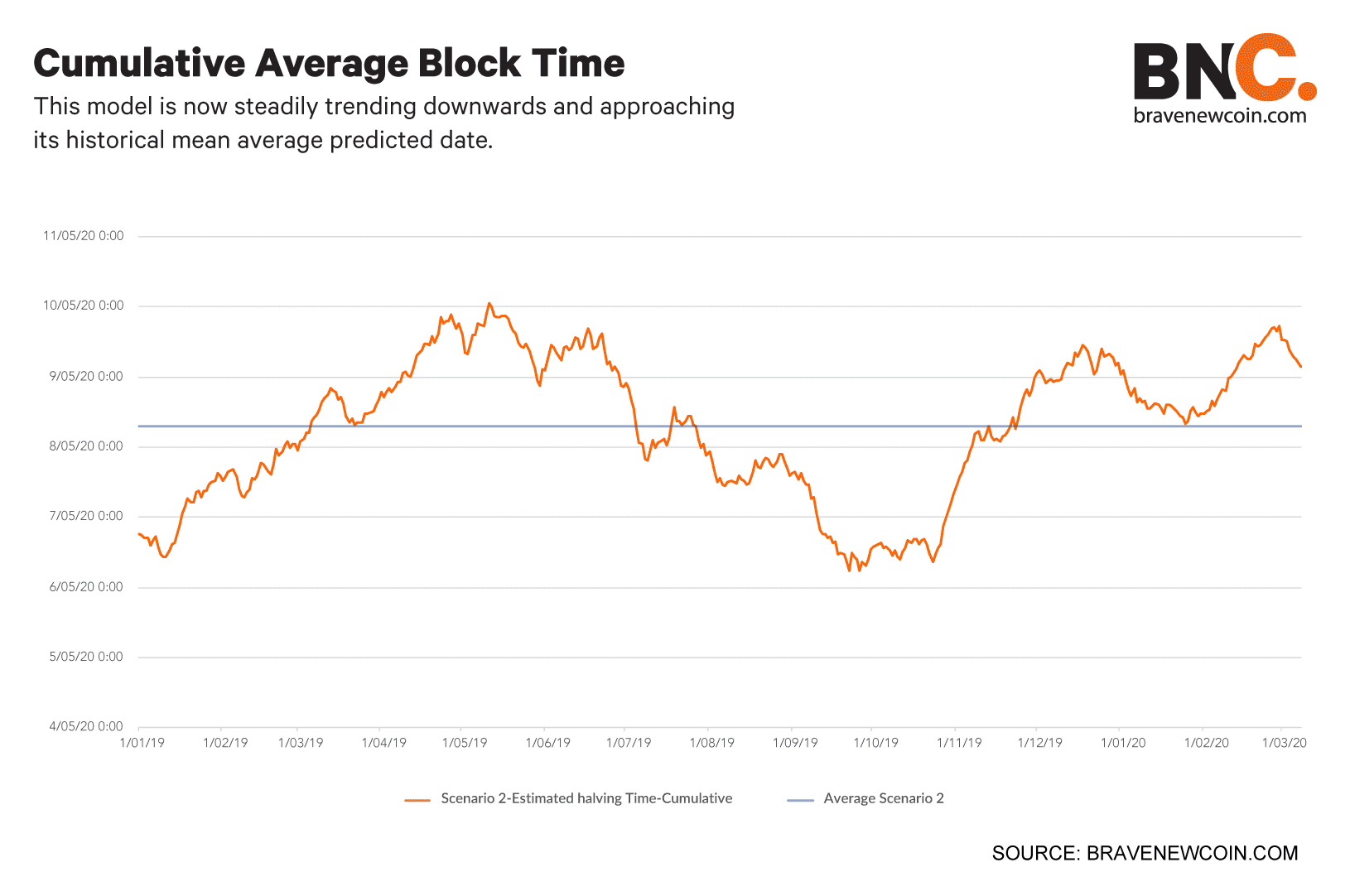

Scenario 2: Cumulative Average Block Time

This is the cumulative numerical average of execution time of all Bitcoin blocks mined till the present day. In order to remove the long gap between the initial block execution, the average block time between those blocks is taken as 600 seconds. We estimate the number of days left until the next halving, by multiplying the cumulative average block time with the number of blocks left to be mined before the next halving. By using this measure we calculate the timestamp for next halving.

This model is now steadily trending downwards and approaching its historical mean average predicted date.

Average predicted halving date (first observation 01/01/2019)= 08/05/2020 06:43

Predicted halving date on 08/03/2020= 09/05/2020 03:36

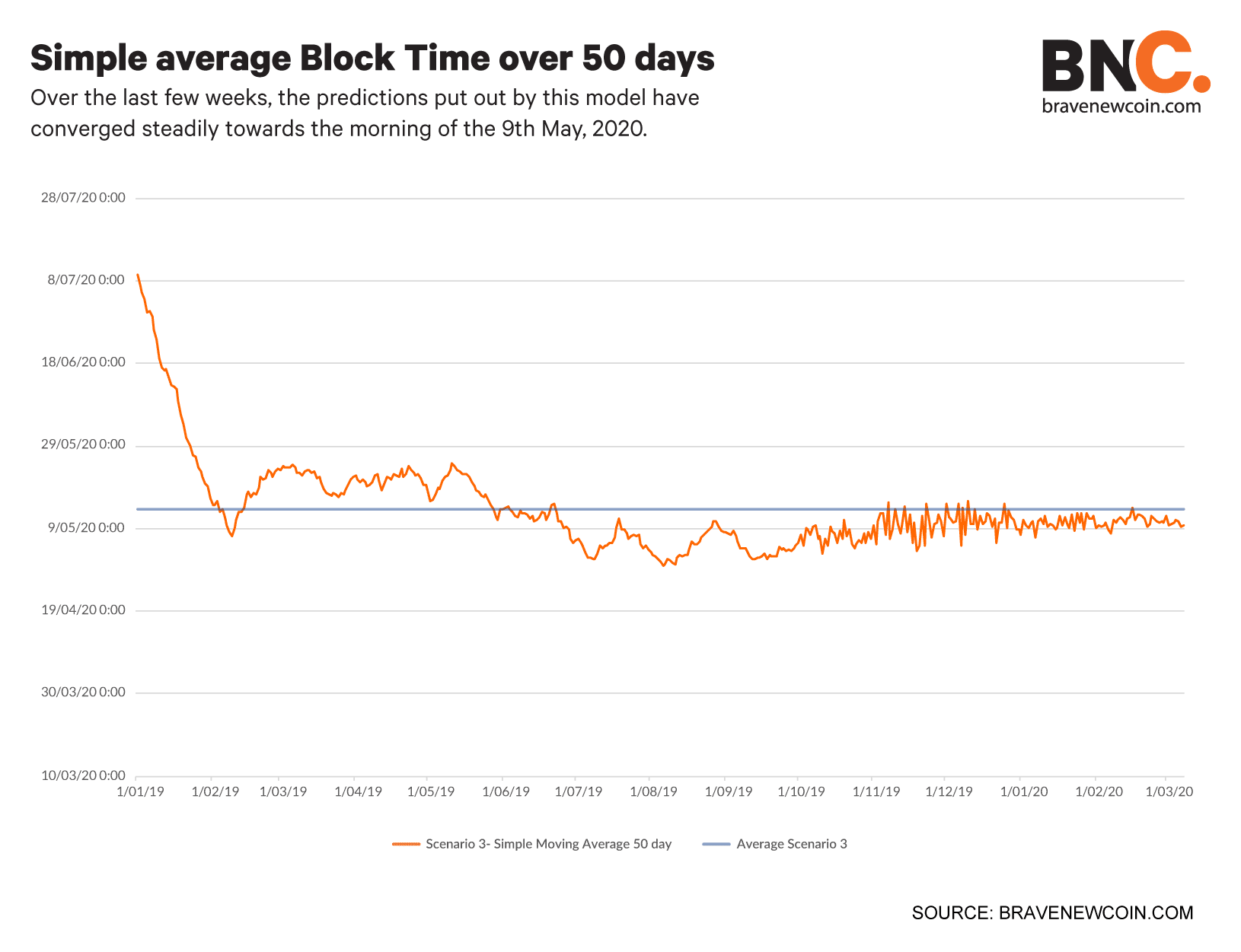

Scenario 3: Simple Moving Average Block Time 50 day

This is an arithmetic moving average of all block times calculated by adding the average block time of blocks executed each day for the last 50 days of the period. This is a lagging technical indicator which applies an equal weight to all observations over the period for determining if the block time will continue to have the same trend or reverse it. If the simple moving average points up, this will explain the increase in the number of blocks execution which means the halving date will arrive faster than expected. If it is pointing down it means that the blocks executed will decrease on a daily basis and the halving date can move further away.

Over the last few weeks, the predictions put out by this model have converged steadily towards the morning of the 9th May, 2020

Average predicted halving date (first observation 01/01/2019)= 13/05/2020 19:35

Predicted halving date on 01/03/2020= 09/05/2020 15:17

Scenario 4:Exponential Moving Average 200 day

This is a type of moving average where a greater significance is given to the most recent average block times. This provides good signals on crossovers and divergences from the historical average block time. This is a lagging technical indicator. When the average block time crosses the moving average block time, the large changes are expected in the average block time, where the trend changes direction. As EMA provides higher weight to the recent daily average block time than on older data, it is more reactive to the latest block time changes.

The 200 day EMA model is most affected by the long term trends in Average Daily Block Times. The model continues to predict dates late in March. It is less affected by the sudden increases in hashrate.

Average predicted halving date (first observation 01/01/2019)= 15/05/2020 10:44

Predicted halving date on 01/03/2020= 11/05/2020 04:03

https://bravenewcoin.com/data-and-charts/bitcoin-halving

Network fundamentals

Bitcoin’s Hashrate continues to trend upwards

Average Daily Hashrate from 23/02/2020-16/02/2020= 121,040,984,537 Th/s Average Daily Hashrate the week before= 113,965,268,669 Th/s Percentage change= 6.21%

There are less than 115,000 BTC left to be mined before the halving

*Bitcoin left to be mined before the halving as of 16/02/2020= *114237.5 btc

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow