Crypto Market Forecast: 30th March

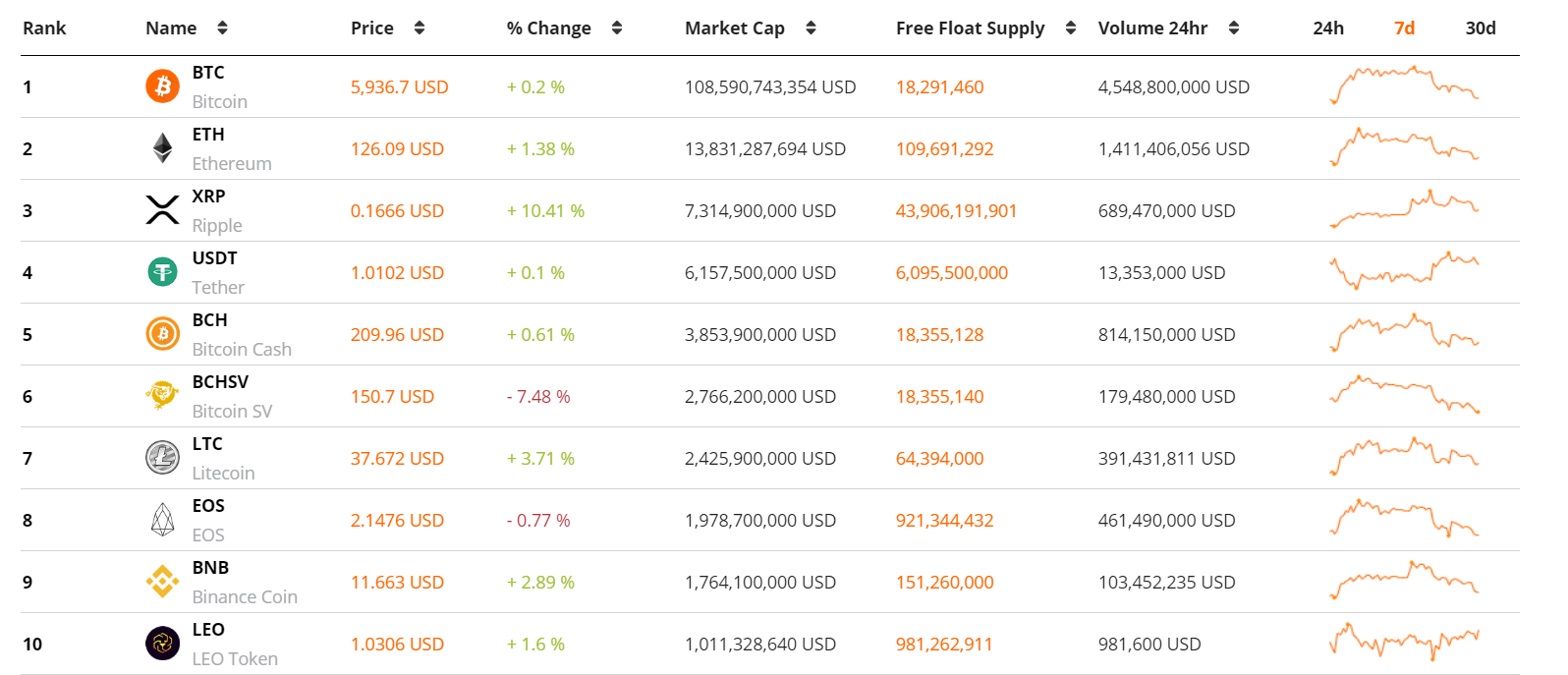

It was a middling but positive week in the crypto markets, with large-cap digital assets starting to recover following a period of strong bearishness caused by this month’s COVID-19 investor panic. The largest asset on Brave New Coin’s market cap table, BTC, rose ~2% in the last week. The number two and three assets on the table, ETH and XRP, rose ~2% and ~11% respectively.

The overall market cap for cryptographic assets rose ~2% as the temporary recovery continues following solid gains in the crypto markets the week before. The entire digital asset space may also benefit from positive macro headwinds in the near term as a number of senators in the United States Congress push for a digital dollar.

Late last week in Washington, it was confirmed that US senator Sherrod Brown (Democrat-Ohio) had fought strongly to include a bill for ‘US digital dollars’ in the 3rd economic stimulus package launched by the government in response to the COVID-19 economic crisis.

While there was no digital dollar provision included in the 3rd stimulus package that was confirmed on Friday, Brown and others continue to push for its inclusion in future stimuli as the American economy continues to falter against a backdrop of rising COVID-19 deaths and increasing job losses nationwide.

Brown’s digital dollar ‘Banking For All Act’ (S.3571) would...‘require member banks to maintain pass-through digital dollar wallets for certain persons and for other purposes.’ In the senator’s bill, the digital dollar would be implemented as part of a digital wallet called a ‘FedAccount’. This would be a free bank account that can be used to receive money, make payments and take out cash based on digital dollar balances. Notable advocates of the digital dollar program include former CFTC chair J. Christopher Giancarlo and current CFTC chief innovation officer Daniel Gorifne.

The digital dollar program is designed to use the speed and low transaction costs of digital currencies to efficiently deliver financial services/support to the unbanked and underbanked in the USA. These goals align with the general ethos of a number of cryptocurrency projects and is likely an endorsement of the cheap, accessible financial digital solutions offered by open source projects like Bitcoin and Ethereum.

This week in crypto

March 30th- CME futures trading round settlement

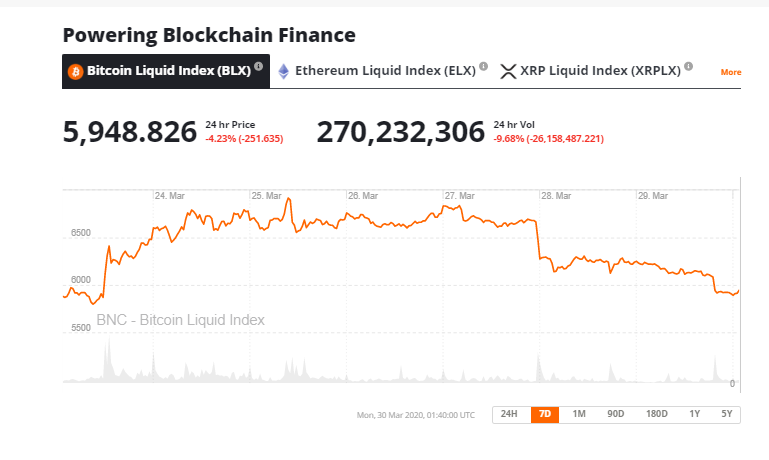

On Monday, the current round of CME XBT BTCH20 long term contracts (September 2019 to March 20) settle. The nature of futures contracts means they need to be settled on a predefined date, based on a contract. All contracts will have to be traded, or settled, before this date. There is generally a fall in the trading volume of futures around expiration, which coincides with a rise in volatility and a potential short/long squeeze. The price of BTC fell heavily on Sunday 29th March, in the 24 hours before CME contracts settled.

While they were a few losers most large-cap assets enjoyed relief following a period of heavy selling pressure earlier this month. XRP was an alpha gainer in price this week, having slid last week. It may be enjoying a slightly delayed relief pump to the rest of the large-cap market.

The price of BTC hovers back near the ~US$6,000 level it started the week at following a strong weekend sell-off. It was a relatively ugly weekly close for BTC and ETH which suggests a possible move down to the ~US$5800 level.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow