Less than 1% of Australians use crypto for payments says RBA

Researchers at the Reserve Bank of Australia (RBA) surveyed 1,100 Australians to gain insight into what Australia’s preferred payment methods are. In October and November 2019, survey participants were asked to record every financial transaction and which type of payment method they used to make it. The Reserve Bank has detailed the survey’s findings in the Consumer Payment Behaviour in Australia report, which was published on March 19.

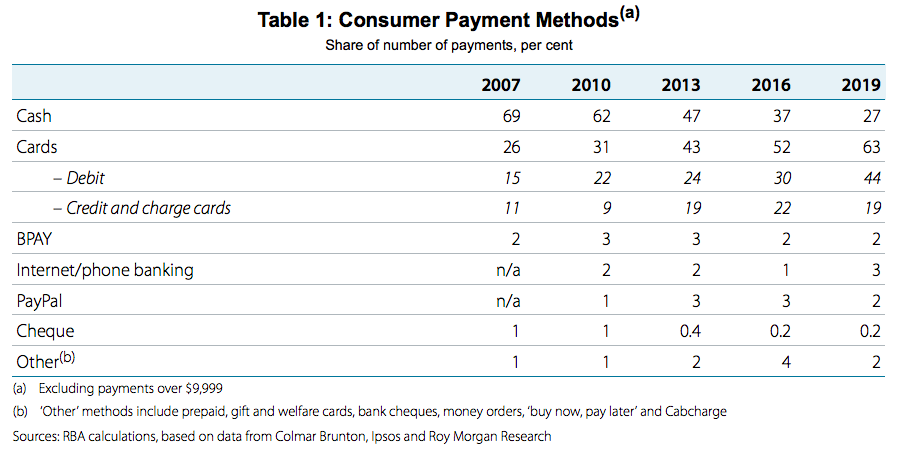

The Consumer Payments Survey has found that Australians are moving away from cash and towards digital payment options. Debit card and credit card payments are the most popular payment options, with contactless payments playing a significant role in that.

Interestingly, over a quarter of Australians still prefer to pay with cash over their digital counterparts. The survey found that the main reasons for using cash were the high merchant acceptance rate, the ability to make small transactions, to improve budgeting, and to save on the fees that come with electronic payments. However, the COVID-19 pandemic will likely increase the move away from cash as notes can carry the virus.

BPay, internet/phone banking, and PayPal are also being used and make up a combined 7% of payments. Conversely, the use of cheques has declined significantly over the years. Only 0.2% of payments made during the survey period involved the use of cheques.

Interestingly, cryptocurrency payments also made the cut as an alternative payment method. Despite the fact that cryptocurrencies are perceived and used more as an investment than as payment systems, there are individuals in Australia who are using them to buy goods and services. That number, however, is limited.

“Although many respondents had heard of ‘cryptocurrencies’, very few had used a cryptocurrency such as Bitcoin to actually make a consumer payment over the past year (indeed, less than one per cent had done so),” the RBA stated in the report. That means out of the roughly 1,100 survey participants, less than 11 used bitcoin (or other digital currencies) to make payments.

In light of how Australia taxes cryptographic assets, it is difficult to envision bitcoin taking a significant percentage of the consumer payments market. Currently, any sale of a cryptocurrency creates a taxable event because crypto is classified as property in Australia. Using cryptocurrencies to make payments, therefore, does not make practical sense.

However, given the current spread of the COVID-19, Australians may be pushed towards using more digital payment methods, which could boost bitcoin adoption as well, especially if the digital gold narrative begins to gain traction.

OhNoCrypto

via https://www.ohnocrypto.com

Alex Lielacher, Khareem Sudlow