0x Price Analysis - A hint of pending bullishness

0x (ZRX) is an ERC-20 token designed to power various forms of decentralized exchange (DEX). The current USD spot price is down 91% from the all-time high set in January 2018. The token has a current total value of US$139 million, with US$26 million in trade volume over the past 24 hours.

The ZRX protocol was founded by an engineer and self-proclaimed U.C.S.D. Ph.D. dropout, Will Warren, and a former fixed-income trader, Amir Bandeali. Neither had significant technical work experience before starting the project. Bandeali previously worked for a leading Over The Counter cryptocurrency trading platform, DRW.

Notable project advisors include Joey Krug, co-CIO at Pantera Capital and founder of Augur, as well as three Coinbase alums; Fred Ehrsam, co-founder of Coinbase, Linda Xie, co-founder of Scalar Capital and Will Warren’s wife, and Olaf Carlson-Wee, founder of PolyChain Capital.

The rise of the DEX is, in part, a response to the more than US$1.5 billion lost by centralized exchanges in the form of hacks, malfeasance, or incompetence over the past 10 years. As opposed to a centralized exchange, which requires assets to be deposited in exchange wallets, a DEX user maintains custody of their assets. This key difference removes the centralized honeypot for hackers.

ZRX includes a messaging format for trade settlement, and a system of smart contracts for a decentralized governance module, which has yet to be implemented. Decentralized governance was included in an attempt to reduce the friction associated with upgrades and platform downtime. However, the platform’s core feature is providing DEX architecture solutions through a system of relayers.

Relayers can use the ZRX token to approve potential future upgrades, which decreases the tokens circulating supply, and is reminiscent of proof-of-stake. This model does not prevent relayers from forking the ZRX protocol, should they wish to implement their own changes, or if they disagree with changes implemented by the ZRX core team.

In December 2018, DDEX forked the ZRX protocol and created the Hydro protocol (HYDRO). CEO of DDEX, Tian Li, stated that the DDEX and ZRX teams had divergent opinions on what constituted an urgent protocol improvement, and whether fee-based tokens create unnecessary friction.

The original ZRX token ICO occurred in August 2017 and raised US$24 million through the sale of 500 million of the one billion tokens created. The remaining 50% of the tokens were split between the 0x company, a developer fund, the founding team, early backers, and advisors. Tokens allocated to founders, advisors, and staff members were locked in a four-year vesting schedule.

While there were no pre-sale or reservation agreements, PolyChain Capital lead an early seed round that covered legal fees. The ZRX team holds 11,480 Ethereum (ETH) in its treasury, currently valued at US$2 million. At least half of the treasury was spent during 2017, 11,000 ETH spent in late December 2018, and 7,120 ETH in 2019 (blue, chart below).

In September 2018, ZRX released v2.0 of the protocol which brought several new features including; the 0x Portal, Non-Fungible Token support (ERC-721), increased order matching efficiency, and the option for permissioned liquidity pools where token addresses must meet specific requirements that enable the enforcement and adherence to KYC/AML regulations. Wyre has also been working with a number of DEXs to help integrate a KYC token, as well as a fiat to Dai (DAI) on-ramp.

DEX legal compliance was thrust into the spotlight in November 2018 when the U.S. Securities and Exchange Commission fined the founder of EtherDelta, a non-ZRX DEX, US$388,000 for operating an unregistered national securities exchange.

0x Instant was released in December 2018, and enabled crypto purchases on any app or website with a few lines of code. Instant is open-source, configurable, and allows hosts to earn affiliate fees on every transaction. The process works by aggregating liquidity from 0x relayers and finding the best price for the purchaser. The transaction occurs using ETH through MetaMask, Ledger, Trezor, or any other Ethereum wallet. 0x has also attracted NFT marketplaces, like Emoon, to the family of relayers. Emoon has 0x instant enabled.

In January 2019, ZRX announced a market maker program to improve liquidity across relayers. Market makers increase liquidity by adding to order book depth when necessary. Accepted applicants can receive up to US$15,000 for completing the onboarding process.

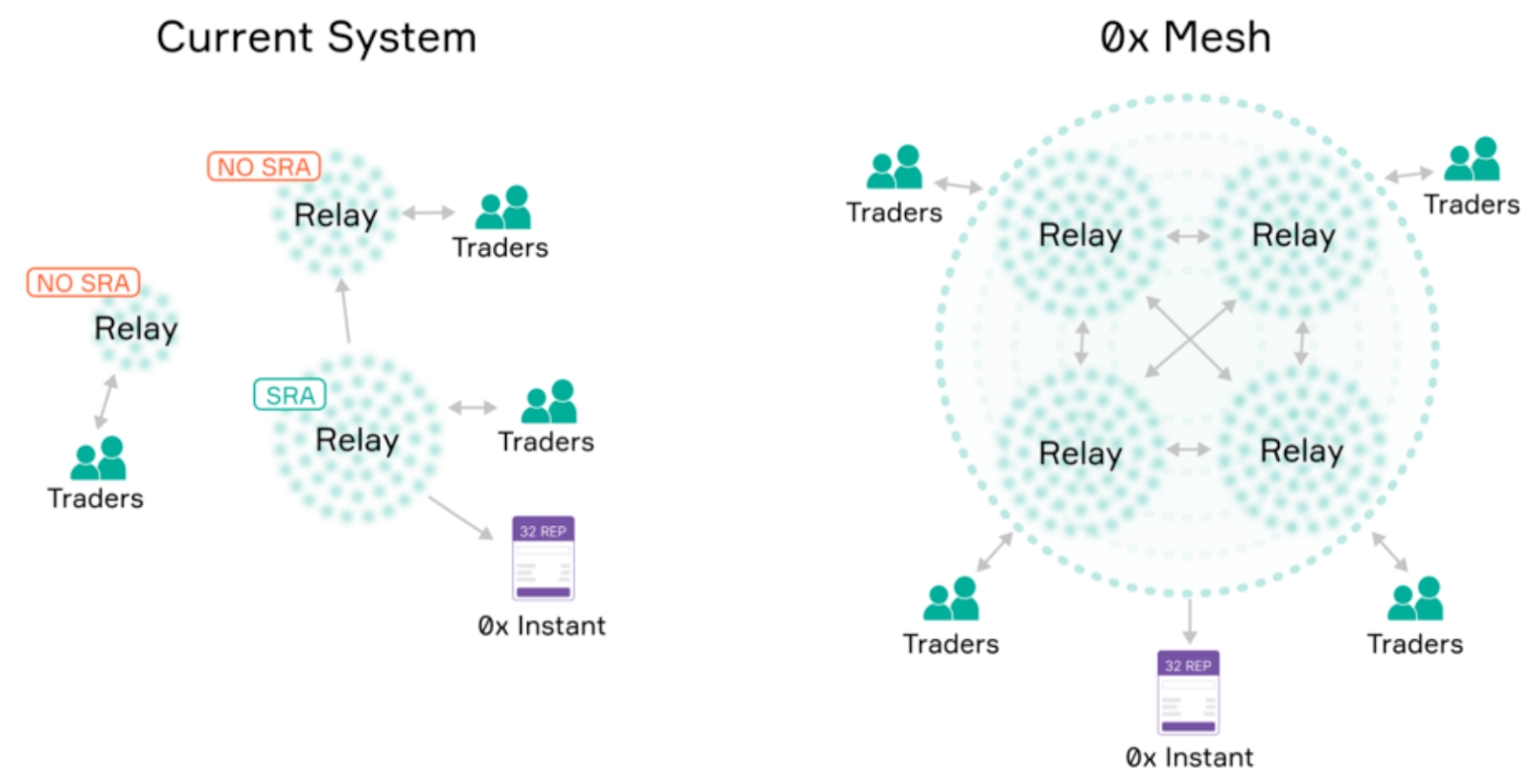

Throughout 2019, the ZRX team has updated the roadmap for future protocol changes, or 0x Improvement Proposals (ZEIPs). One key upcoming change is the inclusion of improved networked liquidity amongst relayers in the ecosystem through 0x Mesh. This change would increase market access for relayers, making it easier to connect to and share orders with other members of the 0x ecosystem. Each node in the network will also score its neighbors based on the quantity and quality of the orders it shares. The beta version of 0x Mesh went live in mid-July 2019.

In April 2019, Warren proposed a stake-based liquidity incentive (ZEIP-31), slated for release in v3.0 later this year. ZEIP-31 changes will mean that market takers pay a small protocol fee on each ZRX trade and market makers receive a liquidity reward proportional to the protocol fees generated from their orders and their stake of ZRX tokens. Market makers who do not own sufficient ZRX to collect liquidity rewards will also be able to form a ZRX staking pool for third-party delegators.

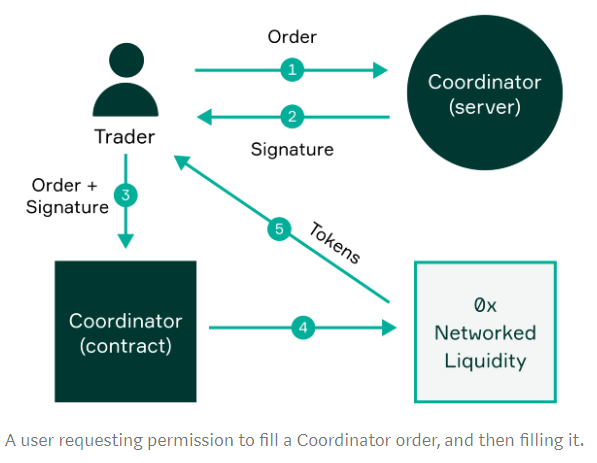

In July 2019, the ZRX team introduced coordinators, a service that combines order matching and open order book relayer models. These coordinators allow for pooled liquidity across all DEXs, quickly finding the best price for an asset. A demo implementation of a coordinator is currently live on Bamboo Relay.

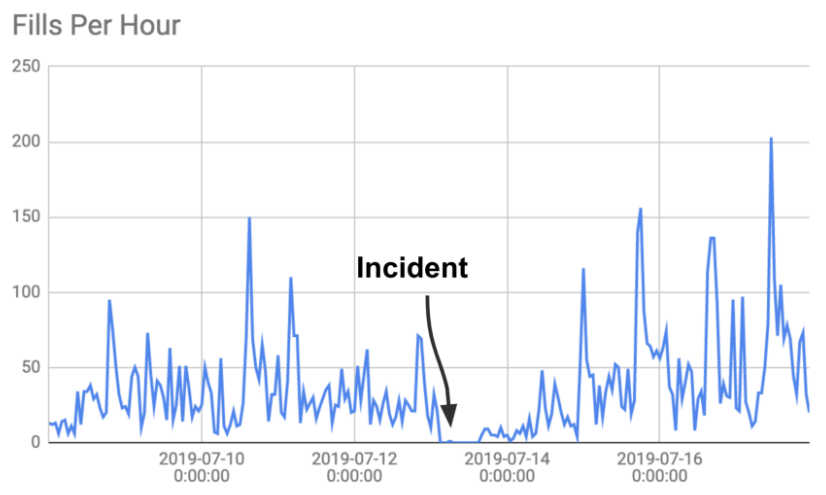

A contract vulnerability was found in July 2019, before it was exploited, and the network was briefly halted. The 0x v2.0 contract was shut down temporarily, patched, and brought back online. No user funds were lost and the bug reporter was awarded US$100,000.

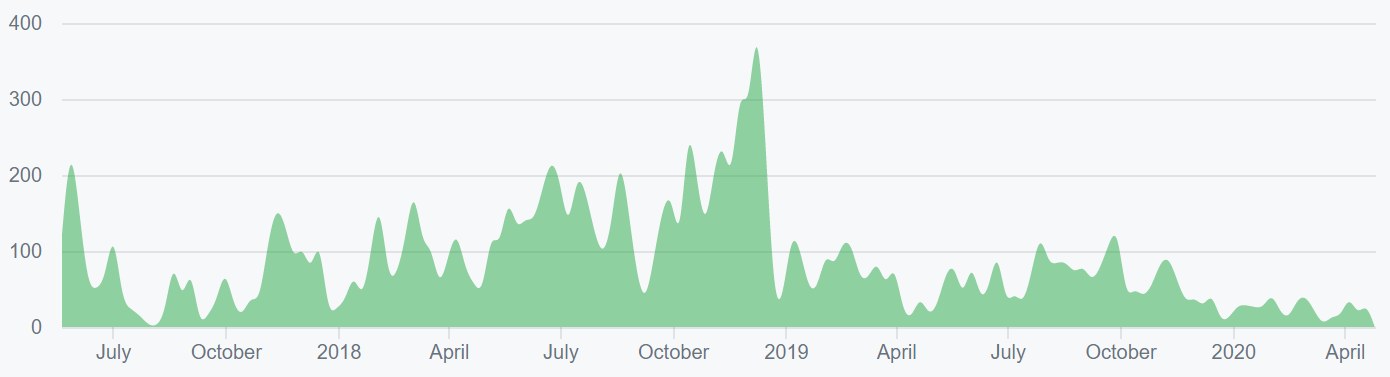

The ZRX project has 95 repos on Github with developers contributing nearly 3,000 commits to ZRX repos in the past year. Most of the ZRX related commits have occurred in the 0x-monorepo (shown below). Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

ZRX v3.0 was approved in November 2019 with a 99% ‘yes’ vote, bringing a type of staking mechanism to the network. Rewards are denominated in ETH and collected by market makers and other stakers. The v3.0 protocol upgrade also allowed for the possibility of a community-owned liquidity API, enabling DEX liquidity aggregation for a more robust DeFi ecosystem.

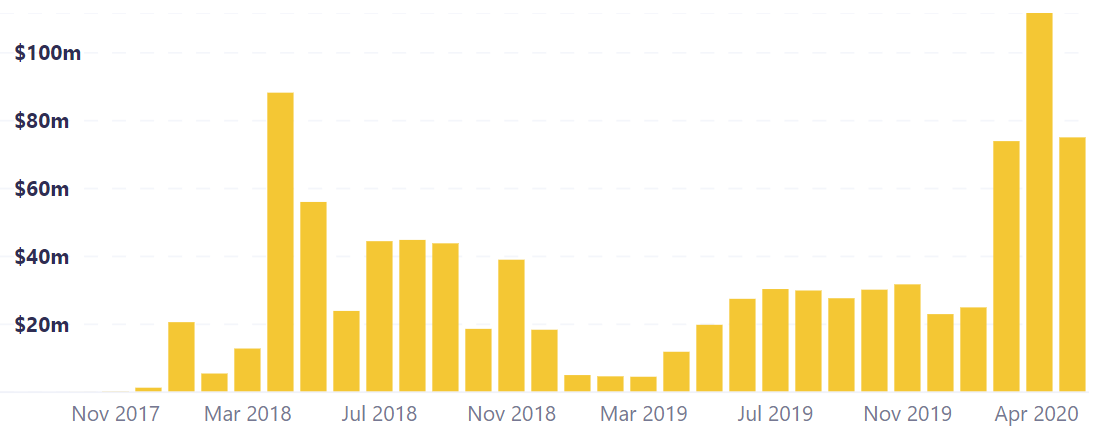

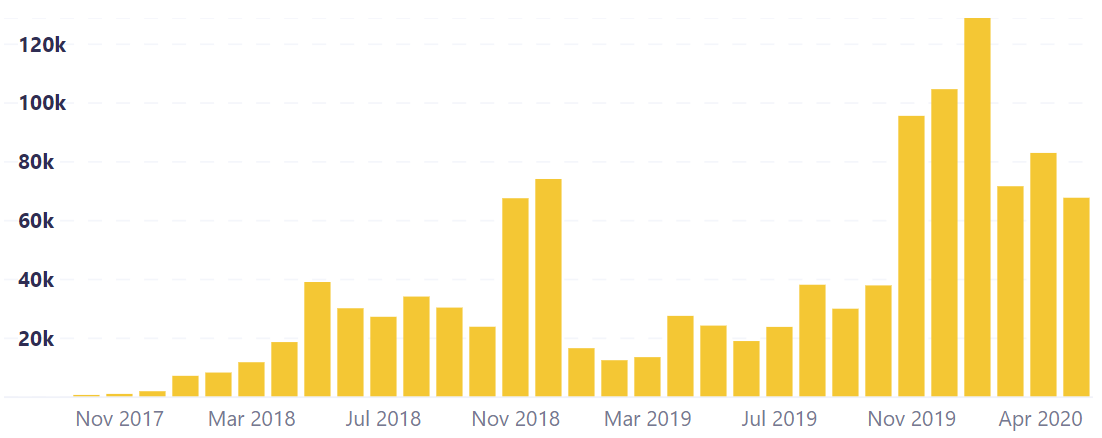

Since January 2020, the total USD network volume (top chart, below) across all relayers has increased substantially, while ZRX fees are non-existent (not shown). Exchange fills dropped off substantially in mid-December 2018 when DDEX left the ZRX protocol. Relayer fills have also increased substantially in recent months (bottom chart, below).

Of the 10 relayers tracked, Tokenlon leads by trade volume and number of trades. The most popular tokens traded between all relayers over the past month is Wrapped ETH, an ERC-20 compliant derivative of ETH, Tether (USDT), and Dai (DAI).

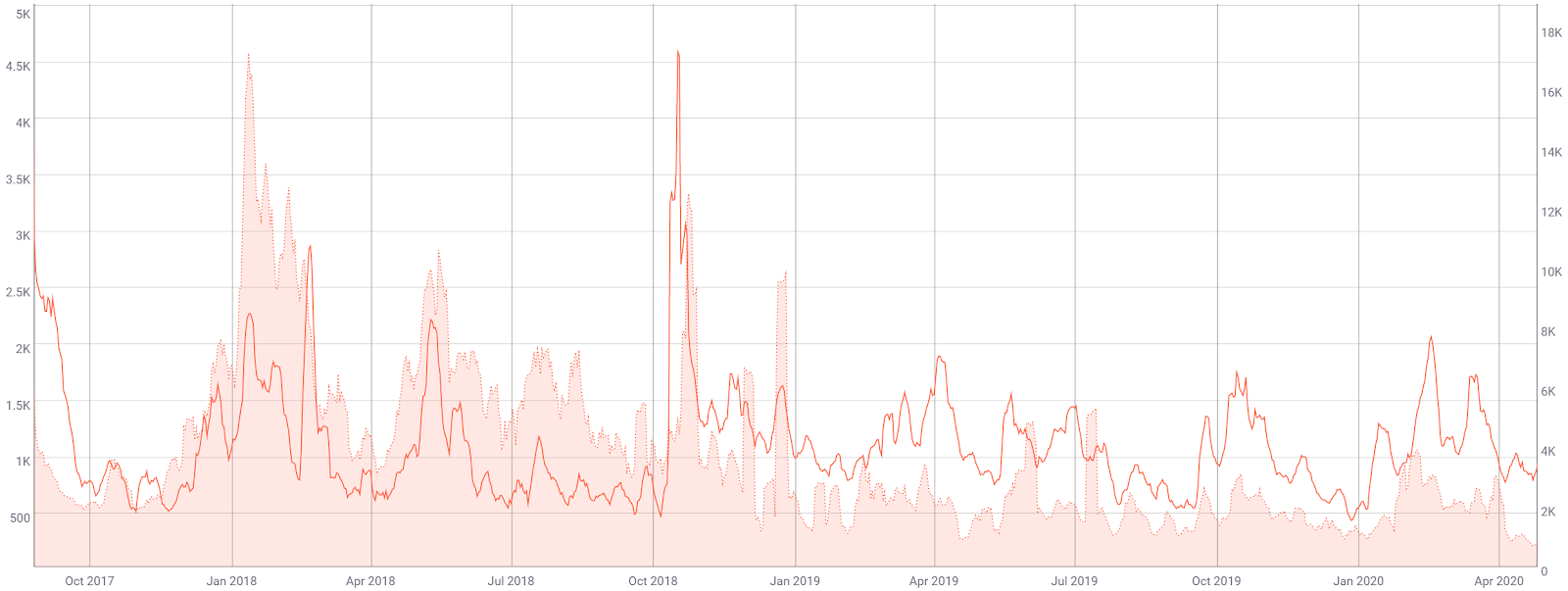

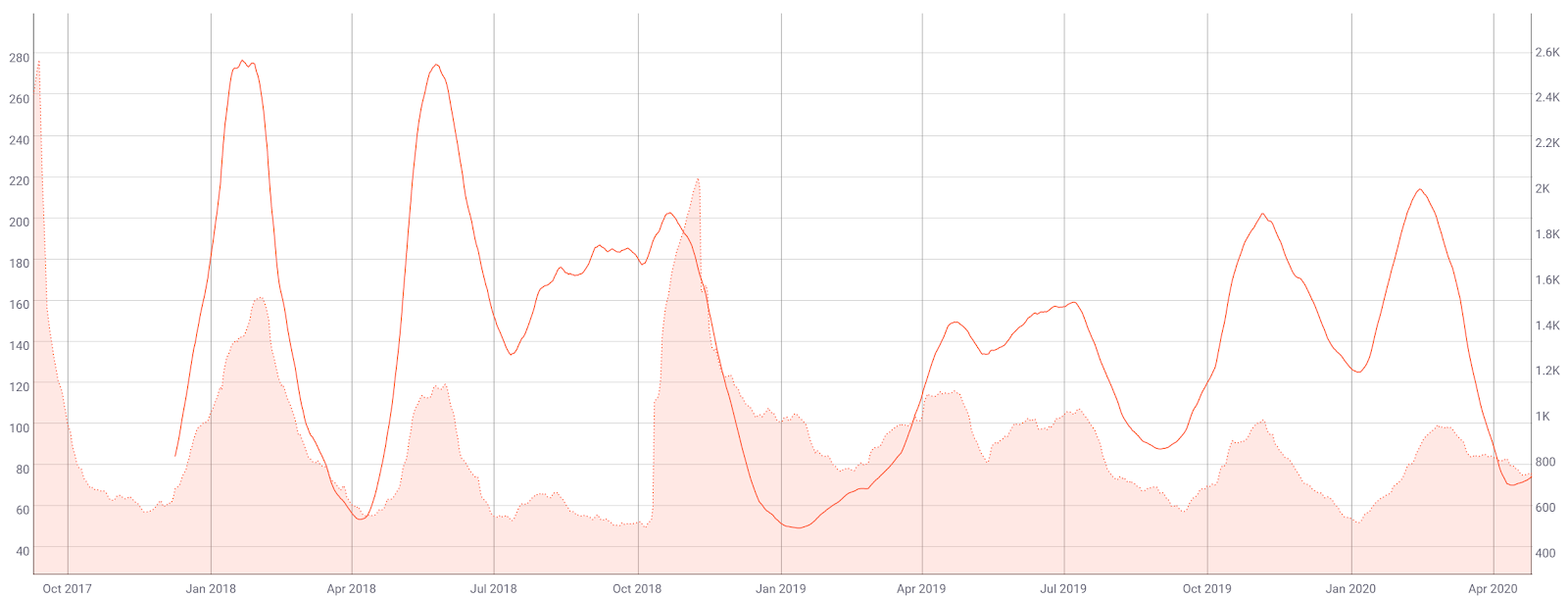

Transactions per day (line, chart below) spiked dramatically in late September, which is likely due to speculative demand. Transactions per day have essentially held a tight range over the past two years. The spike in transactions in October 2018 corresponded with a Coinbase listing at the time. The average transaction value (fill, chart below) has been in a downward trend since May 2018 and currently stands at US$1,000. Both metrics have not surpassed all-time highs set during token distribution in September 2017.

Declining ZRX token transactions, from October 2018 until recently, can be attributed to an inherent lack of importance regarding the ZRX token itself. The ZRX tokens are almost purely a speculative vehicle and are not required to trade on relayers. Staking and upcoming governance changes for v3.0 have likely contributed to the recent uptick in transactions.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) is currently 75, down from multi-month highs set in March. A clear downtrend in NVT suggests a coin is undervalued based on its economic activity and utility, which should be seen as a bullish price indicator. Inflection points in NVT can also be leading indicators of a reversal in asset value.

Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe's law. Monthly active addresses (fill, chart below) have increased slightly since the beginning of the year, but currently under 1,000. The rise in active addresses corresponds with the Coinbase listing in mid-October 2018.

In the markets, exchange-traded volume of the ZRX token has been led by the Bitcoin (BTC) and U.S. Dollar (USD) pairs on Binance and Coinbase Pro. Over the past two years, ZRX has been listed, or gained new pairs, on several exchanges including Binance, Binance.US, Bittrex, Coinbase, Coinbase UK, Ethfinex, OKCoin.com, and Poloniex. In June 2019, dYdX integrated 0x-based liquidity using Radar Relay. Bitstamp has also announced plans to potentially add ZRX in the near future.

Technical Analysis

From February to March, ZRX saw a 60% drawdown, which has subsequently mean reverted with the rest of the crypto market. To determine entries and exits throughout a trend, as well as the potential for a trend reversal, Exponential Moving Averages, Volume Profile of the Visible Range, pivot points, and, the Ichimoku Cloud can be used. Further background information on the technical analysis discussed below can be found here.

On the daily chart for the ZRX/USD market pair, the 50-day Exponential Moving Averages (EMA) and 200-day EMA have been bearishly crossed since March 11th. There were two other bullish attempts in the past one in November 2019 and February 2020. In the next few weeks, a third bullish attempt with a Golden Cross is likely.

Upside resistance, according to the volume profile (horizontal bars), stands at the US$0.25 - US$0.35 zone, with virtually no significant resistance above this level. Yearly pivot resistance also shows resistance at US$0.25 and US$0.33. Additionally, there are no bullish or bearish divergences on volume or RSI at this time.

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. Trades are typically opened when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish; price is below the Cloud, the Cloud is bearish, the TK cross is nearly bullish, and the Lagging Span is below Cloud and above Price. The trend will remain bearish so long as price holds below the Cloud. A long flat kumo at US$0.23 should act as a magnet for price.

Lastly, on the daily ZRX/BTC pair, trend metrics mirror the ZRX/USD pair. Price is sitting just below the 200-day EMA and daily Cloud. Upside resistance based on the volume profile sits at 4,000 sats and 6,350 sats with larger resistance approaching 10,000 sats. If the current lows do not hold, a move to the VPVR support of 2,000 sats is likely. Additionally, there are no bullish or bearish divergences on volume or RSI at this time.

Conclusion

With ZRX staking now online, the ZRX token has finally found a use case. Relayer trades and trade volume has also increased over the past few months. On-chain data still suggests very little day-to-day token use. Going forward, additional governance decisions may also help to retain token value (similar to the Maker DAO).

The ZRX core team continues to be very active, with an extensive upcoming roadmap. As regulatory concerns globally for crypto exchanges ratchet up significantly, DEXs may gain prominence in the absence of other options.

Technicals for the ZRX/USD and ZRX/BTC pairs both lean bearish with wisps of pending bullishness. Over the next few weeks, both are likely to cross above the 200-day EMA and daily Cloud. Key upside resistance for ZRX/USD sits at US$0.35, with very little volumetric resistance above that zone. ZRX/BTC shows upside resistance at 4,000 and 6,000 sats with strong support at 2,000 sats.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow