Bitcoin Price Holds Strong at $7,700: A Strengthening Case for Upside

Over the past 24 hours, Bitcoin has flatlined, barely budging from the $7,700 perch the cryptocurrency is on.

This comes in spite of the fact that analysts were expecting for BTC to reverse lower, citing the clear confluence of resistance at the $7,800 level, which Bitcoin has failed to break past on multiple occasions over the past five days.

The lack of price reaction in the current region, with no large influx of selling pressure arriving, could suggest, analysts say, that Bitcoin is ready to head even higher in the coming days as the block reward halving nears.

Forget the Correction

Despite Bitcoin’s stagnation over the past few days, Matt D’Souza — CEO of Blockware Solutions and a hedge fund manager — is convinced that from a medium-term point of view, more upside is in the cards.

Sharing his sentiment to a Twitter audience, D’Souza said that he thinks bears trying to push Bitcoin lower is like “trying to hold a basketball underwater” — in other words, a task that is nearly impossible. The investor added to not “fight physics,” referencing his sentiment that it’s almost inevitable BTC pops higher in the coming days and weeks.

It feels a lot like April 2019 to me. People didnt want to believe #Bitcoin could rally. The market has tried to push BTC below $7500 but its like trying to hold a basketball underwater – dont fight physics.

Gold's chart has exceptional symmetry.

Lets see if they work together pic.twitter.com/FxXZBMnClE

— Matt D'Souza, CPA (@mjdsouza2) April 26, 2020

It was a cheery sentiment backed by fundamentals.

Referencing Bitcoin’s market structure and the broad sentiment of crypto investors, D’Souza explained that Bitcoin currently “feels a lot like April 2019,” a time when analysts also expected BTC to reverse lower due to belief that it remained in a bear market.

April 2019, of course, was the three to four weeks of consolidation Bitcoin experienced before rallying explosively from the $5,000s to $14,000.

D’Souza added that the miner capitulation event that transpired last month — when Bitcoin’s hash rate dropped 40% and difficulty saw a nearly -20% correction in the wake of Bitcoin’s 50% crash to $3,700 — is actually bullish for Bitcoin:

Remember, miners capitulating = more BTC is allocated to miners best positioned to accumulate BTC, removing sell pressure from the network. March 26th was the 2nd Most Extreme Difficulty Adjustment in BTC’s history & the March 13th Crash wiped out the leverage traders.

The below chart from one of D’Souza’s contemporaries, digital asset manager Charles Edwards, corroborates this optimistic fundamental outlook predicated on mining factors.

Although it may be a bit difficult to determine what exactly is going on in the photo seen below, what Edwards is showing basically confirms what D’Souza said: Bitcoin mining indicators, like the moving rates of the hash rate, and the average cost of production overlayed on BTC’s chart, have confirmed that a bull market is about to ensue.

Looking at pure Bitcoin fundamentals only.

Basically everything screams "buy". pic.twitter.com/hpHGUjYq0m

— Charles Edwards (@caprioleio) April 28, 2020

Where Could the Next Bitcoin Bull Market Top?

With these fundamentals all but confirming a decisive start to the next Bitcoin bull run, a pressing question that investors likely want to be answered is where the rally will find a top.

It’s a complicated answer that has many different ways of being answered.

According to a new econometric model by PlanB — the popular yet pseudonymous Bitcoin quantitative analyst — the next rally will top somewhere around $288,000, which is more than 3,000% higher than the current price of the cryptocurrency.

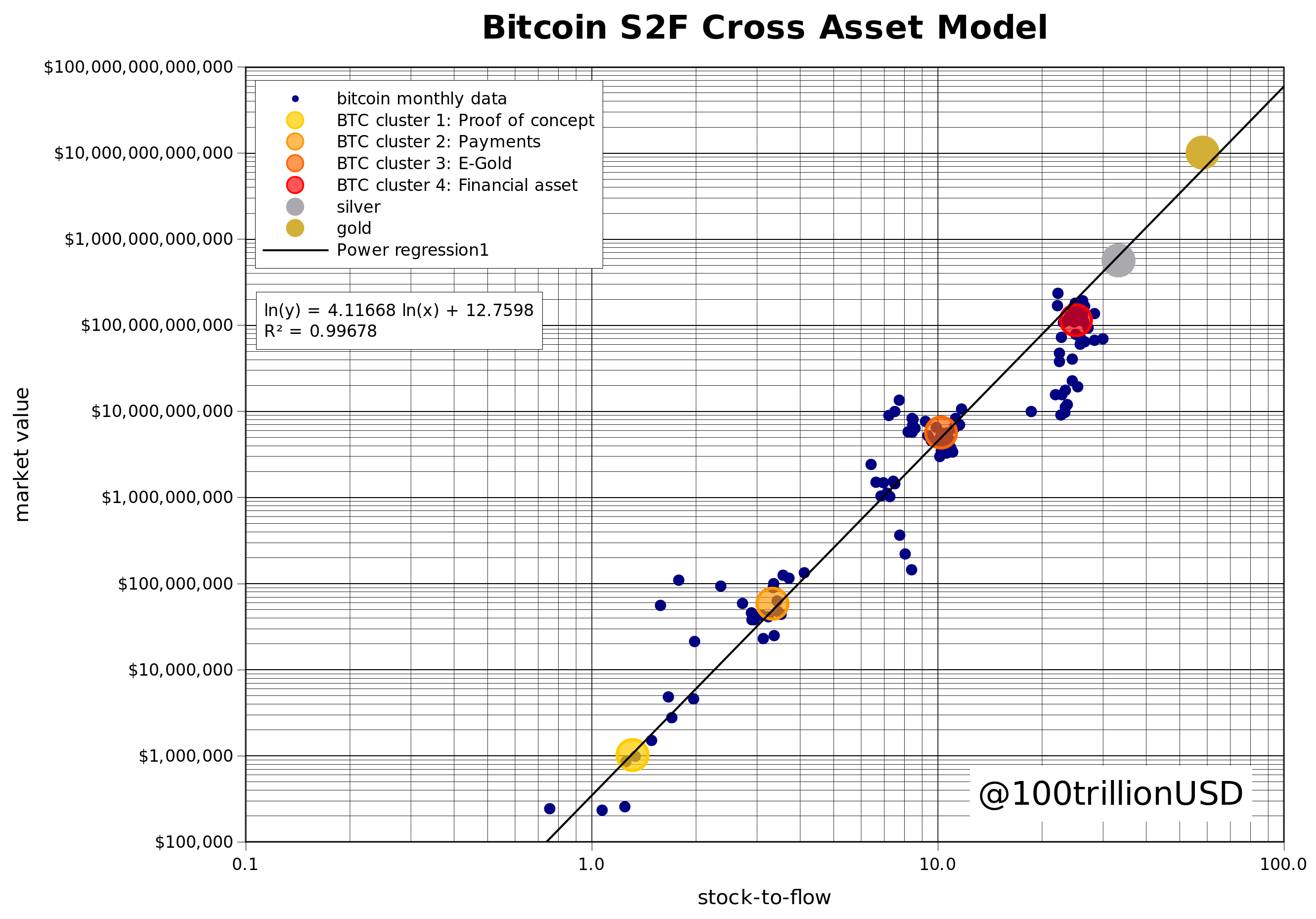

The new analysis was based on his original “stock-to-flow model” of the Bitcoin price, which suggests that one can predict BTC’s future market capitalization to a high degree of accuracy by using its stock-to-flow ratio — the ratio of an asset’s above-ground supply over its the yearly inflation.

While somewhat complicated, PlanB came to the following conclusion with this new model, which has a R squared value of 99.7% (meaning the model is a perfect fit):

[The new] model estimates a market value of the next BTC phase/cluster of $5.5T. This translates into a BTC price of $288K [between 2020-2024].

The post Bitcoin Price Holds Strong at $7,700: A Strengthening Case for Upside appeared first on Blockonomi.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Nick Chong, @Khareem Sudlow