Bitcoin Surges Over $6,700 as World Economy Continues to Weaken

Bitcoin continued its post-weekend recovery into Wednesday, rallying from the daily lows at $6,150 to a high of $6,750 in decisive fashion, gaining nearly 10% in a single 24-hour period. Altcoins followed suit, positing similar gains to the market leader.

Bitcoin’s outperformance comes as the stock market has shown tepid price action over the past few days, with the S&P 500 and other indices from around the world slightly retracing since last Friday’s highs.

This weakness has seemingly been catalyzed by a worsening coronavirus outbreak, which is on the verge of reaching 1,000,000 confirmed cases (over 20% of which are in the U.S.), and Thursday’s jobless claims report in the U.S. stating that a record 6.6 million workers filed for unemployment in the span of a week.

Many economists and analysts believe that this is the start of a deeper economic slowdown than the Great Recession of 2008, citing the fact that the economy has effectively come to a standstill while liquidity in capital markets has entirely locked up, seemingly due to a rising U.S. dollar.

Even with this macro backdrop, analysts believe Bitcoin is still poised to head higher, citing simple fundamental factors like buying interest and the upcoming halving that is set to arrive in the middle of May.

Strong Technical Outlook

Technical analysts believe Bitcoin has the ability to rally further.

The GTI Vera Convergence Divergence Indicator printed a buy signal for the Bloomberg Galaxy Crypto Index. A buy signal was last seen early on in January, when Bitcoin was trading in the mid-$7,000s. And a sell signal was seen near the end of February, when BTC was trading in the mid-$9,000s prior to the infamous March 12th capitulation.

The call for continued upside was echoed by trader Filb Filb, who noted in messages published to his Telegram channel that the below scenario is possible. That scenario playing out would see Bitcoin rally to $10,000 by August.

There’s a Reason Why Bitcoin Is Heading Higher

Bitcoin’s recent strength, or at least relative strength against other markets, seems to be directly related to a vast amount of buying interest in the cryptocurrency market.

As explained in a previous Blockonomi report, Coinbase reported that amidst the Black Thursday crash seen on March 12th, the exchanger reported a dramatic surge in buying interest for cryptocurrency:

“But beyond just a rush, two things are clear: customers of our retail brokerage were buyers during the drop, and Bitcoin was the clear favorite. Our customers typically buy 60% more than they sell but during the crash this jumped to 67%, taking advantage of market troughs and representing strong demand for crypto assets even during extreme volatility.”

Furthermore, stablecoin issuers, such as Tether, Binance, Paxos, and Circle/Coinbase, have created hundreds of millions of new coins over the past few weeks, most likely responding to the growing demand for cryptocurrency.

These booming statistics have been corroborated by first-hand accounts such as the one below from the CIO of crypto fund BlockTower Capital, Ari Paul, who noted that he “hasn’t seen this much organic new interest in Bitcoin since early 2017 in my non-crypto circles.”

I haven’t seen this much organic new interest in bitcoin since early 2017 in my non-crypto circles. Got pinged by 3 separate old friends I haven’t spoken to in years about buying their first BTC yesterday.

— Ari Paul

(@AriDavidPaul) April 2, 2020

And also, as I mentioned previously, even my nearly-90-year-old grandfather called me up last weekend, asking if I could digitally walk him through how he could buy “a little bit of” Bitcoin and Ethereum and how he could store the cryptocurrency.

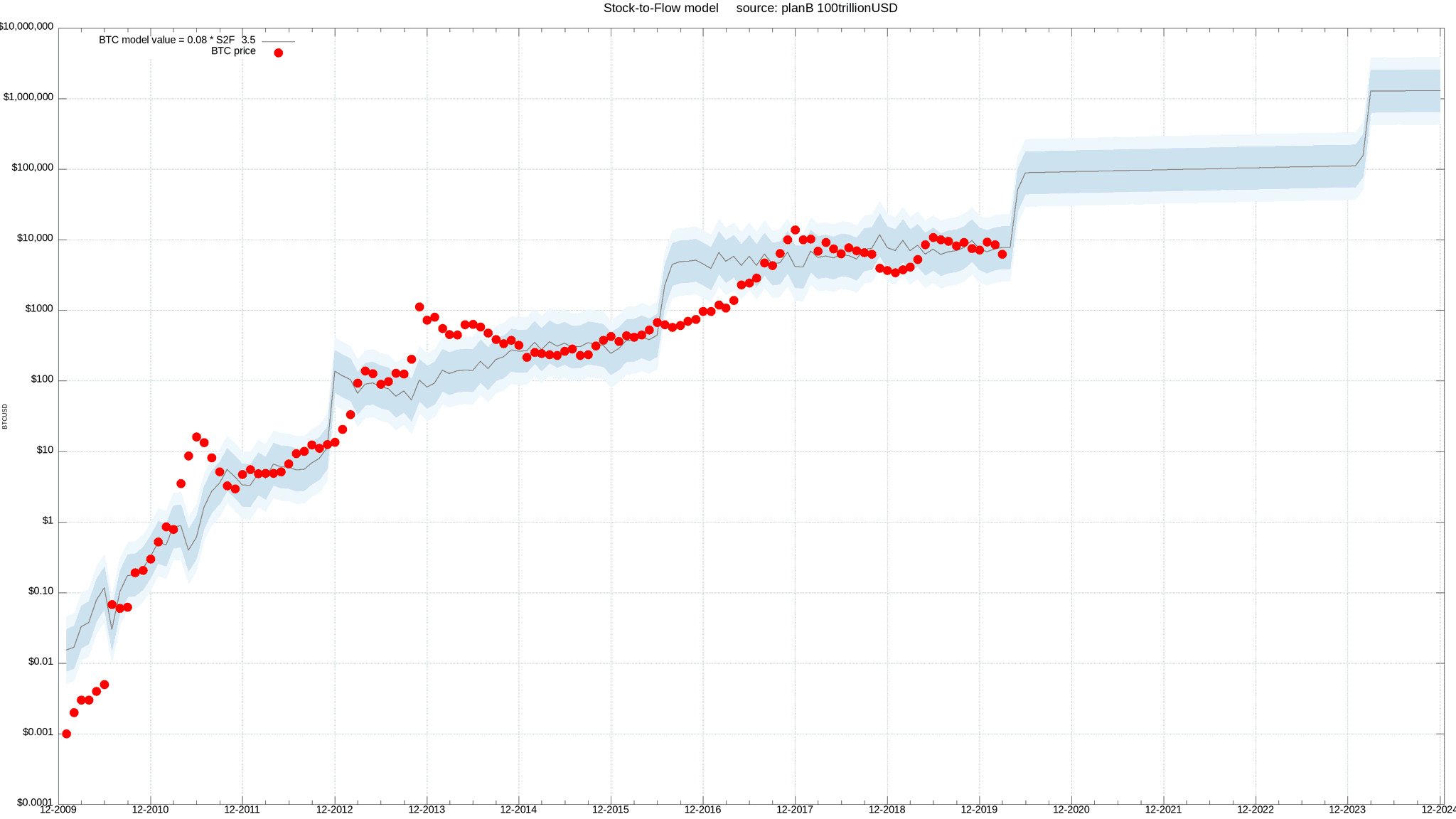

Couple this with the fact that in just over a month, the amount of Bitcoin that will be mined each day will be cut in half due to the halving, and you seemingly have a recipe for further growth in this market. As found by PlanB, the pseudonymous crypto-asset analyst, each halving reduces the inflation of the Bitcoin supply, which in turn increases the value of the network.

The post Bitcoin Surges Over $6,700 as World Economy Continues to Weaken appeared first on Blockonomi.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Nick Chong, @Khareem Sudlow