Bitcoin's record plummet reveals BitMEX's vested interest

When we say Bitcoin is decentralized, what do we mean? Do we mean its supply is not based on the whims of a central banker? Do we mean it cannot be censored by the iron fist of one regulator? Or do we mean it cannot be manipulated by one exchange? These are important questions, questions that have plagued the Bitcoin community for almost a decade now, but there is a key difference between them. One has a single example within and not against the cryptocurrency community.

Bitcoin has evolved from being ‘magic Internet money’ to a competitor to the world’s top macro-assets and now amid the economic meltdown, yet another difference between the cryptocurrency and the rest has been revealed – the question of ‘too much control.’ While traditional assets resist and now revel in the centralization of power, Bitcoin was slated to be ‘decentralized.’ However, amid this meltdown, this ideal has been called into contention.

The need for liquidity hit assets hard, and Bitcoin, more than most, succumbed, dropping in a day from $7,800 to $5,500. If, however, you look closer, a drop to $3,800 was seen with a sharp pullback, pushing the crypto up by 40 percent. Volatility like this, and especially in both directions, was unprecedented, even for Bitcoin.

The cryptocurrency market is known for its erratic price movement, but a sell-off of this proportion was unheard of, and one segment of the market, a segment perpetually hungry for volatility, was the derivatives market. The market, in these short volatile hours alone, saw its volume double its 24-hour trading volume, and leading the pack was BitMEX.

The exchange on 12 March saw $11 billion in BTC Futures volume and a day later, saw a further $9.1 billion traded. However, the day after Bitcoin’s single biggest daily drop in the past seven years, the hot topic wasn’t just the price plummet, but what prevented it from ‘taking Bitcoin to 0,’ as some put it.

Must not be named

The collapse, or lack thereof, of Bitcoin on BitMEX, the most voluminous derivatives exchange [at the time], sparked the issue of the alleged use of a circuit breaker and what effect it had on the price if any?

Far-fetched as it was, it did spark an interesting “theory,” as FTX CEO Sam Bankman-Fried put it, denying the culprit exchange’s initial claim stating, ” there was no BitMEX hardware issue.” Bankman-Fried’s first evidence point was the liquidations, which he referred to as “a critical ratio,” He said,

“There were endless liquidations, and the BitMEX orderbook was basically nonexistent.”

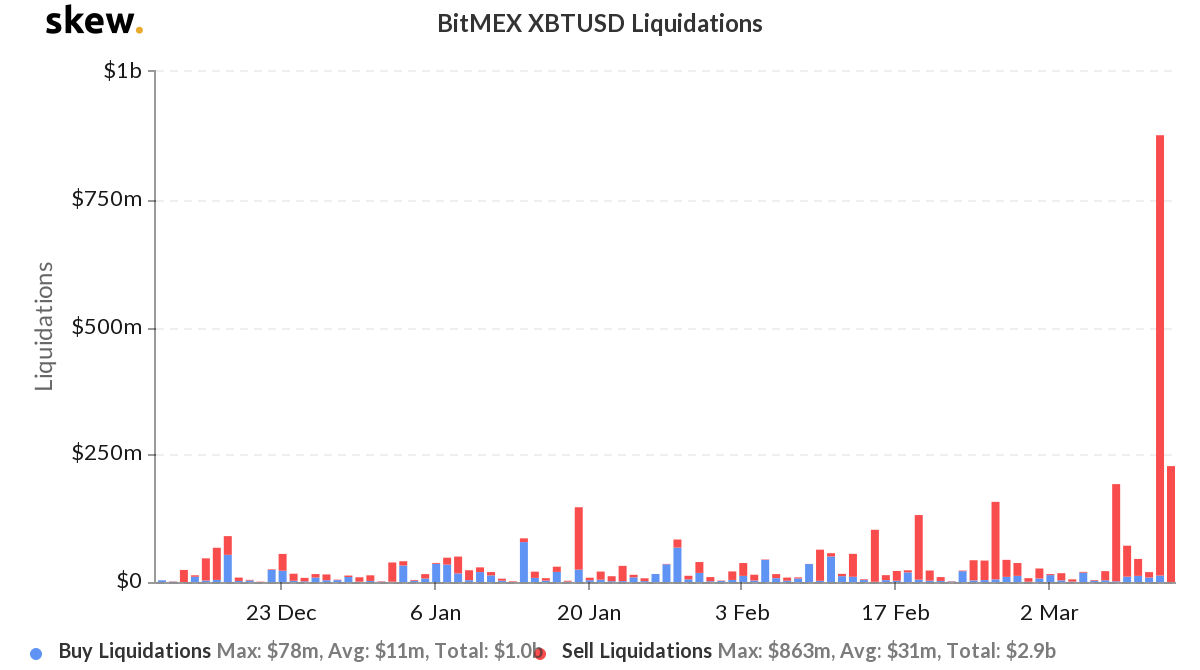

To put a number on the same, data from Skew markets suggests that on 12 March, during the peak hours of the price collapse, BitMEX saw $863 million in long position liquidations. In the early hours [UTC] of 13 March, when the price further dropped below $4,000, briefly albeit, another $400 million were ‘REKT.’

During this time, BitMEX’s insurance fund tanked. To put that in perspective, you have to look at the average holdings of BitMEX’s insurance which from the period of 3 January to 11 April stood at 34,552 Bitcoin. The average for the months of January, February, and March were 33,771 BTC, 34,442 BTC, and 35,130 BTC, respectively. The increments to the insurance fund, on both a month-on-month and a day-to-day basis, saw a linear increase, as can be seen in the chart above.

On 12 March, the insurance fund dropped to 33,881 BTC, a drop of 1,627 BTC in one day. The following day saw a replenish of 2,612 BTC [marginal difference between 12 March and 13 March] and a 1,941 top-up over the average [difference between fund balance on 13 March and an average of 34,552 BTC].

The massive deviation of liquidations and its effect on BitMEX’s insurance fund was by no means a small effect on the overarching question of Bitcoin’s price.

Bankman-Fried, in his 18-tweet long thread, started off his “theory” that BitMEX’s claims of “maintenance” could be incorrect, but concluded that he himself could be “wrong.” Despite BitMEX clarifying their stance and the FTX CEO accepting their explanation and rephrasing his thread as “BitMEX sees a danger in the space and averts it to help save crypto,” it does open up a can of worms about the alleged use of circuit breakers by an exchange who are stakeholders in the volatile movement of the cryptocurrency.

Later, Samuel Reed, BitMEX’s CTO, would state that the exchange, during the plummet, suffered a distributed denial-of-service [DDoS] attack. The attackers, having already hit BitMEX in February, were waiting for an opportune time to attack again, he said.

So here's what we know so far: on Mar 13 at both 02:15 UTC and 12:56 UTC, we came under attack from a botnet that appears to have been probing the system for some time. This botnet was also responsible for an attack on Feb 15.

— Samuel Reed (@STRML_) March 16, 2020

Not priced-in

For months, market participants debated the ‘priced-in’ nature of the Bitcoin block halving, unaware that this plummet would force them to question BitMEX’s role in whether the 12 March pullback was priced-in or not. Given the volume BitMEX handles, coupled with the trade size of its customers, many industry experts were skeptical that the pullback from $3,800 to $5,500 was organic, and instead due to centralized efforts.

In the case of a ‘circuit breaker’ allegedly being employed, either in and of itself or being labeled a ‘maintenance issue’, the price impact that it could have had were it not employed were disastrous. The accumulation of liquidations coupled with the rapidly degenerating price and the depleting insurance fund [as mentioned above] may have been reason enough to employ such a trading device.

CoinGecko’s Bobby Ong informed AMBCrypto of the “vicious cycle” that BitMEX had found itself in. He began with the price drop which caught the exchange, much like the rest of the market, “off-guard,” wrecking havoc to the long positions which pushed BitMEX to a “huge liquidation backlog.” He added,

“Ever time the order were liquidated, this pushed [the] Bitcoin price even lower causing more positions to be added to the liquidation backlog.”

Now that the “vicious cycle” was in play, traders on long positions were getting destroyed with the insurance fund dropping. When BitMEX announced it had “hardware issues,” the cycle “subsided,” said Ong. This “maintenance issue,” either hardware or software, was later termed by many in the industry as the “circuit breaker.”

BitMEX XBTUSD Liquidations December 2019 to March 2020 | Source: skew

Once the BitMEX volume and by extension its liquidations were removed from the equation, Bitcoin’s price recovered by $1,200 between 0200 UTC to 0400 UTC on 13 March. Ong was unsure about how much BitMEX had to do with the price recovery, but stated that if the derivatives exchange was still part of the equation, lower prices were likely. He added,

“Prices started recovering after that from around $3800 to $5000. It is hard to say what will [would] happen if Bitmex did not go down that day – most likely we will [would] test even lower prices.”

Vested indeed

There’s a difference between volatility and plummet. That difference is where most derivatives exchanges operate. Each exchange, much like each trader, has a vested interest in trading during volatile times – volumes increase, leverage increases, and so do liquidations [depending on which side of the positions your trades lie]. How an exchange manages the spread between volume from an organic move and straight move to 0 [or close to] is how performance and interests should be measured.

For derivatives exchanges to have a vested interest in price plummets remains a neither here nor there situation, or “Yes and no,” according to Kevin Kelly, CEO of Delphi Digital. Exchanges, especially those that provide contractual Bitcoin in a liquid market where volume is not scant, to say the least, are “long volatility” owing to their revenue model, one dependent on trading fees, Kelly told AMBCrypto, “when trading volume increases, profits increase.”

To put that in perspective, on 12-13 March, BitMEX had volumes of $11 billion and $9.1 billion. For the entire month of February, when Bitcoin broke $10,000, the average volume was $3.12 billion, a difference of 68 percent. In just two days, BitMEX’s trade volume was 22 percent the total volume it amassed in February.

BitMEX did make a killing during the plummet as volume spiked, and they could have very easily pulled the plug, but Kelly contends that this would cause a massive dent to its reputation,

“Any intervention may jeopardize an exchange’s reputation or trust with its clients (as we’re seeing play out right now), especially if they shut down during periods of extreme volatility and thus inhibit trading activity.”

Playing devil’s advocate, Kelly added that if an exchange does indeed pull out, it could be to prevent a complete meltdown of the traders and not the asset.

Keep in mind, the instance when BitMEX allegedly claimed hardware issues was after its volume spike and hence, revenue rise, and traders on the wrong side were rekt; hence, playing guardian to the deceased isn’t a moral high ground it appears to be.

Kelly added,

“On the flip side, a trading halt can save many traders from even greater losses, especially during periods of mass liquidations and forced selling, which could end up being beneficial for an exchange if it retains those clients.”

Necessary evil

What are the lessons learnt from this episode? Exchanges are too big? Decentralized currency can be manipulated? Vested interests keep Bitcoin alive? Viscous cycles cause participants to step in? As mentioned at the offset, these are important questions the cryptocurrency must answer as it strives for maturity in the eyes of investors and manipulation-resistance in the eyes of regulators. The medium for both these aims are exchanges who have a vested interest in maintaining price discovery, revenue, and volatility.

“Exchanges do not want to kill off the market,” said Ong, but what they seek is volatility. However, Ong added, “if the market completely evaporates, then that will be bad for everyone.” Preventing evaporation requires someone to play the bad guy.

OhNoCrypto

via https://www.ohnocrypto.com

Aakash Athawasya, Khareem Sudlow