CME Bitcoin Futures contracts soar as institutional investors rush in

Bitcoin’s jump over $7,000 and higher is rekindling the institutional interest in the risk-on assets. As deep-pocketed investors scurry to hold onto anything that doesn’t sink either through the ongoing economic crash or the dollar-rush started by the Federal Reserve, it would seem, they have an eye for not equities or commodities, but crypto.

As major market indexes are still struggling with dwindling consumption, owing to government-enforced lockdowns, Bitcoin, is toeing the line between safe-haven and uncorrelated asset. US-based institutional investors are hoarding contractual Bitcoin contracts, in hope of salvaging some gains or expecting a big pump in the next few months.

Data from skew markets indicates the volume for CME Bitcoin Futures contracts have risen to its highest level since the anomaly of the March 12-13 pump when the price dropped by 40 percent. Leaving aside this massive volatility, even for the Bitcoin markets, Bitcoin’s movement over $7,500 on 24 April triggered the largest single-day volume rush since mid-February 2020.

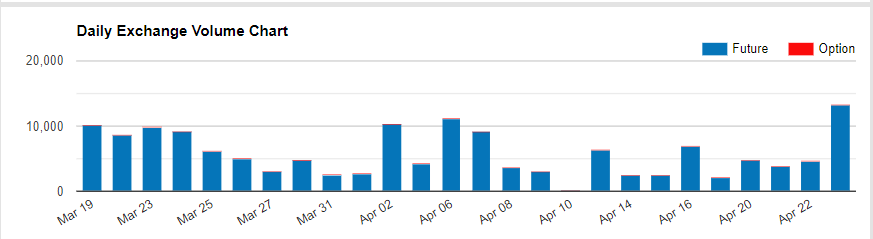

CME Bitcoin Futures volume by contracts | Source: CME

In terms of contracts, a whopping 13,285 contracts [each representing 5 BTC] were traded, with skew noting the total volume at $485 million. To put that sum in context, on March 12, with the largest single-day drop in 7 years for the cryptocurrency, CME recorded 24-hour BTC Futures volume at $595 million. The biggest high, overshadowing the recent move as well as the aforementioned plummet was on February 18, when over $1.1 billion was traded.

The move on CME is important for a few reasons. Firstly, the isolated move on CME and not on its geographical equivalent Bakkt, ICE’s digital assets platform, which offers partial physically-delivered BTC Futures, is indicative of the need to hold contractual Bitcoin, rather than physical cryptocurrency, with the former offering a hedge-only strategy.

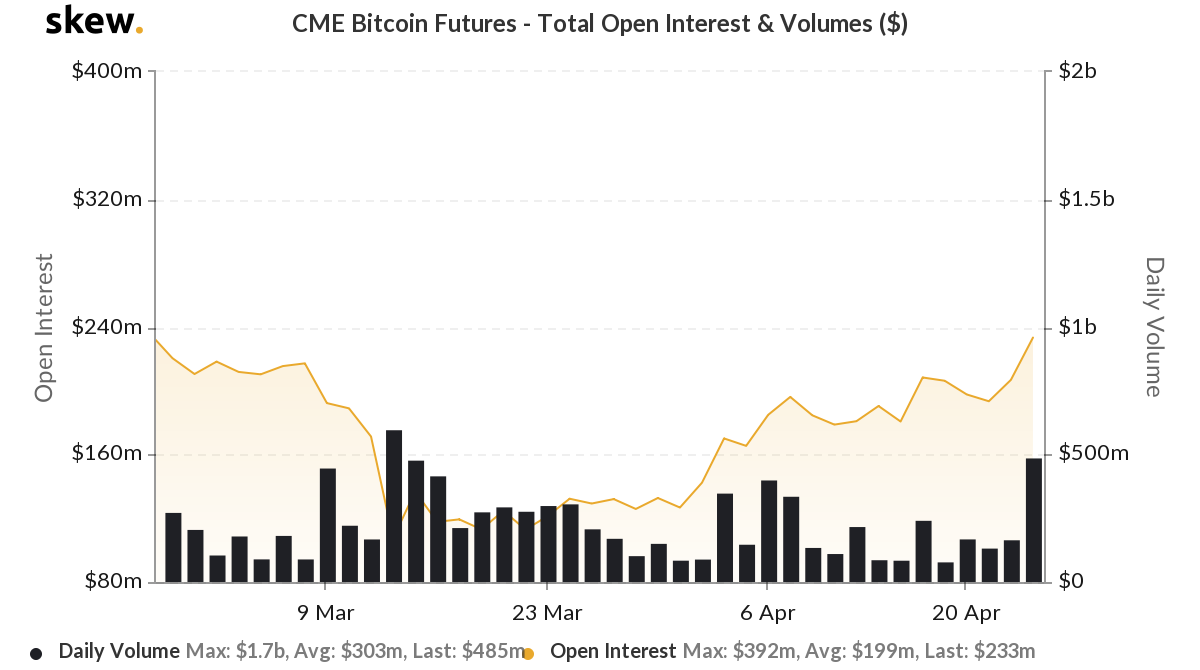

Secondly, the difference in open positions between CME and BitMEX and OKEx [the two leading derivatives platforms in the larger unregulated and non-US market] is indicative of more institutional investors based in the US, increasing their portfolio’s Bitcoin holding amid the increased liquidity and stimulus packages enforced by the Federal Reserve and US congress. CME’s open interest is $233 million, its highest point since February 25, while BitMEX and OKEx have not yet recovered the lost OI from the March 12 plummet.

CME Bitcoin Futures volume and open interest by USD | Source: skew

Thirdly, this comes at a time when Bitcoin is poised for a major change in its price, owing to the imminent halving. The shift in the cryptocurrency’s supply schedule in the next 20 days will decrease the mining rewards from 12.5 BTC per block to 6.25 BTC per block, with the price suspected to provide balance. Further, with the increased liquidity in the market, the post-pandemic market will cry out for a risk-on asset, which Wall Street claims Bitcoin to be.

CME’s Bitcoin Futures rekindling shows that institutional investors are back on the Bitcoin bandwagon.

OhNoCrypto

via https://www.ohnocrypto.com

Aakash Athawasya, Khareem Sudlow