Crypto Market Forecast: 6th April

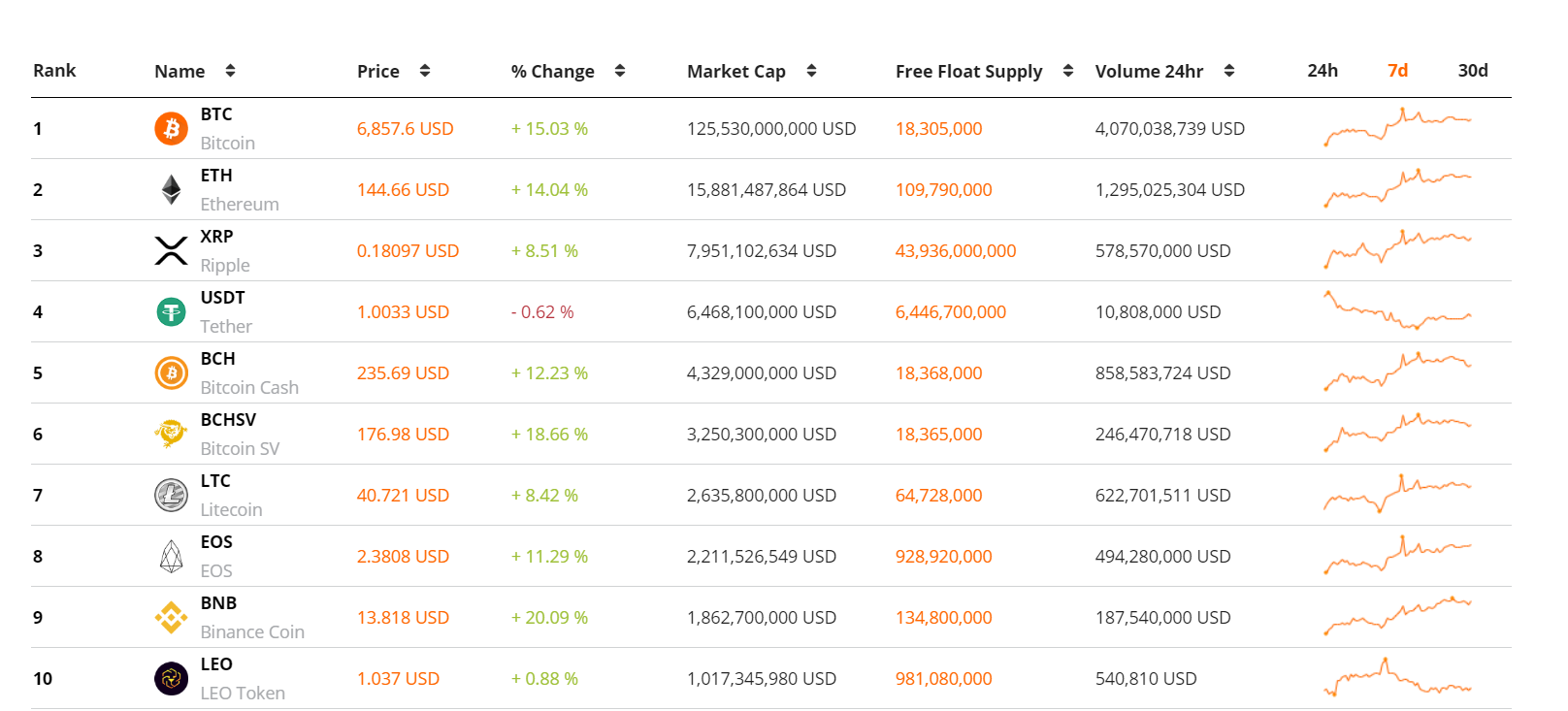

Last week continued the mini-recovery for digital assets with many large caps enjoying double-digit gains. Market benchmark and the largest asset on Brave New Coin’s market cap table, BTC, rose an impressive ~13%. The number two and three crypto assets on the table, ETH and XRP, rose 13% and 8% respectively. The overall market cap for digital assets rose ~14% in what was a surprisingly bullish week in the crypto markets.

Several factors appear to be behind the bullishness that helped crypto outperform the Dow Jones and S&P 500 indices in recent weeks. On Twitter, BlockTower Capital Chief Investment Officer Ari Paul said, “we haven’t seen this much organic new interest in Bitcoin since early 2017 in my non-crypto circles.”

A number of crypto exchanges also reported a surge in new sign-ups over the last month. Kraken recorded an 83% rise in sign-ups and a 300% rise in intermediate verifications, where users opt-in to a KYC process to be able to deposit fiat instantly on to accounts.

It has been suggested that the COVID-19 crisis has pushed new buyers towards cryptocurrency due to concerns around the stability of centralized financial systems. World governments have failed to contain the outbreak of the virus and most global economies now face extended periods of unemployment, plunging asset valuations and compromised supply chains. These factors have pushed some individuals towards Bitcoin as a hedge, or “protest” in the words of Kraken's Bitcoin strategist Pierre Rochard.

With Bitcoin and crypto prices rising in response to reports of increasing retail interest, the asset class may continue to outperform traditional equity and commodity markets in the short term. Beyond this, bulls also have Bitcoin’s block reward halving to look forward to.

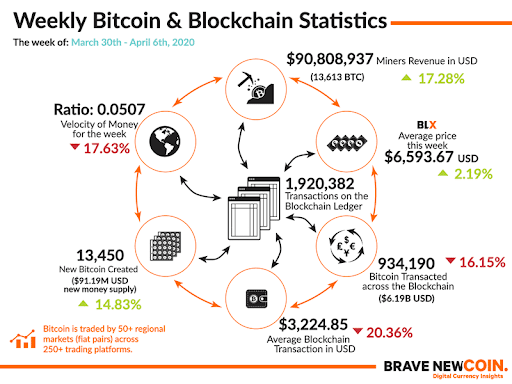

The halving is on track to occur in mid-May. Post halving, Bitcoin miners will earn 6.25 BTC per block, as opposed to the 12.5 BTC they currently earn. This pre-defined scarcity model and deflationary mechanism further separates Bitcoin and digital assets from traditional assets that are more dependent on the monetary policy decisions of global central banks and bail-outs.

This week in crypto

8th April- Bitcoin Cash (BCH) Block reward halving

Preceding the Bitcoin (BTC) network’s block reward halving in May, Bitcoin Cash (BCH), the largest fork of Bitcoin, will experience its block reward halving on Wednesday. Bitcoin-SV, the third-largest fork, is also expected to have its block reward halving in the next 50 days. For miners, all three major SHA-256 chains will see a reduction in block rewards, and miners will have to allocate resources between the three chains depending on mining profitability. With Bitcoin Cash, miners will be earning less BCH per block from this week, and this may turn miners away from the network in the near term. The price of BCH rose ~12% in anticipation of its halving.

A number of large-cap crypto assets enjoyed excellent gains last week, posting a strong start to April following a difficult March. Binance coin was one of the biggest gainers of the week, enjoying sustained growth in buying pressure over the week. Binance, the parent company of BNB, announced the acquisition of major crypto market data provider CoinMarketCap this week.

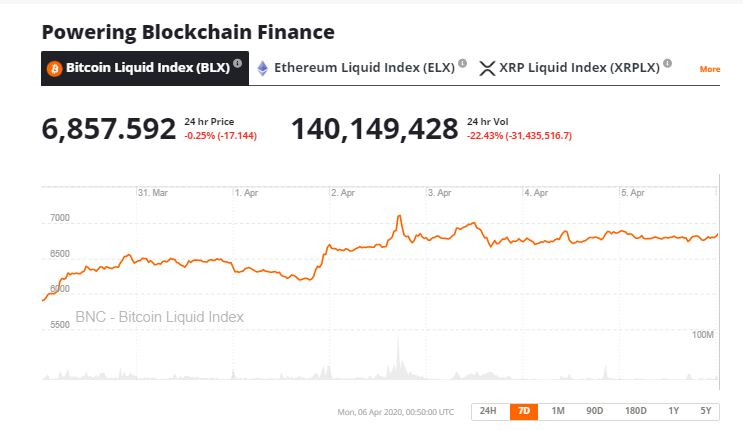

It was a week of upward movement in BTC markets, as the asset easily crossed past the ~US$6500 level and now hovers around the ~US$7000 level. Despite the recent bullishness, sentiment in crypto markets remains mixed. Bitcoin withdrawals out of exchanges continue to rise and the Crypto Fear & Greed Index continues to suggest traders are in a state of ‘extreme fear’.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow