Fire Blocks to increase security at Bitstamp

Fire blocks is an enterprise platform designed to help move easily digital assets between exchanges, wallets, custodians and counterparties at enterprise-level security standards. It uses both multi-party cryptography and chip Isolation technology to secure digital asset transfers. In an interview with Forbes, Fireblocks CEO Michael Shaulov suggested that ‘“the combination of the two methods removes the single point of failure from the key-management process and enables hardware-based authentication of counterparties transactions.”

The Fireblocks integration will be used to make it easier for Bitstamp’s customers to move assets between different platforms. The deal will also involve Bitstamp introducing an optimized process for clearing and settling digital asset transactions through Fireblocks.

The unique technology and Cybersecurity credentials of its founders has helped the Israeli startup secure an extended list of institutional clients including Galaxy digital, Genesis Capital and Celsius. Investors in the project include Fidelity’s investment Eight Roads, Cyberstarts and Tenanya capital.

Miha Grčar, Bitstamp’s Global Head of Business Development, discussing the deal says “As the infrastructure available to institutional cryptocurrency traders continues to mature, transaction speed is increasingly coming into focus as a potential bottleneck, by integrating with Fireblocks, we’ve made it much simpler for our customers to initiate transactions between different platforms. The lower confirmation requirement we’ve introduced is the next step towards more efficiency, allowing the transactions themselves to complete faster.”

Initially, the Fireblocks service will only be available to select institutional Bitstamp clients, and is in tune with the exchange’s specific targeting of this customer base. A report released in March 2020 titled “Institutional Adoption of Digital Asset Trading” written in association with Bitstamp and the CME group, outlines Bitstamp’s efficiency offering Institutional-driven trading services.

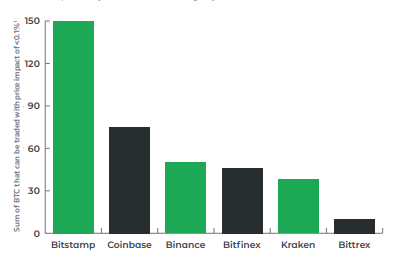

Data collected within the report suggests that Bitstamp was the 4th most popular spot exchange in the study. However, it was by far the most efficient exchange when trying to move large Bitcoin with minimal price slipping, and it was also the fastest exchange in terms of API response.

Bitstamp’s targeting of specific services within the cryptocurrency exchange space has made it popular with many algorithmic trading desks, and, asset managers who need to move larger than average volumes of crypto. Bitstamp is also unique because of its limited pool of trading options. Bitstamp only supports the trading of Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Litecoin (LTC) and Bitcoin Cash (BCH) paired with USD, EUR, and BTC.

Bitstamp compliments its specializations with a strong legal reputation, having been the first cryptocurrency exchange to receive a payment institution license in the EU. In May 2019, the Luxembourg based exchange was also granted a Bitlicense by New York’s Department of Financial Services (DFS).

However, the exchange has had some recent issues managing heavy liquidity loads. Bitstamp was used, potentially by market manipulators, to execute a sell order for 5,000 BTC that crashed the price on its platform in May 2020. The Bitstamp flash crash further wreaked havoc on a number of crypto derivative platforms that used Bitstamp’s BTC spot price for contract reference.

The event was not based on a hack or cybersecurity flaw and used the unique instant order feature available to traders on the exchange to deliberately flood Bitstamp’s BTC markets with selling pressure. Bitstamp acknowledged their role in the incident and has said that the incident led to an internal investigation.

Since the flash crash in May 2019, Bitstamp has made key partnerships to bolster its liquidity and security practices. The Fireblocks integration also complements an October 2019 partnership between the exchange and noted digital asset custody provider BitGo. The announcement for the deal states “With BitGo’s Custody, Bitstamp’s assets will be secured on 100% cold storage technology in bank-grade class III vaults and protected by BitGo’s $100 million (USD) insurance policy.”

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow