Lisk Price Analysis - The top 10 wallets hold 37% of the circulating supply

Lisk (LSK) is a deployable blockchain ecosystem capable of running smart contracts. LSK currently 44th on the BraveNewCoin market cap table and down 97% from the record high established in January 2018. LSK holds a market cap of US$122 million, and a total of US$2.7 million in trade volume over the past 24 hours.

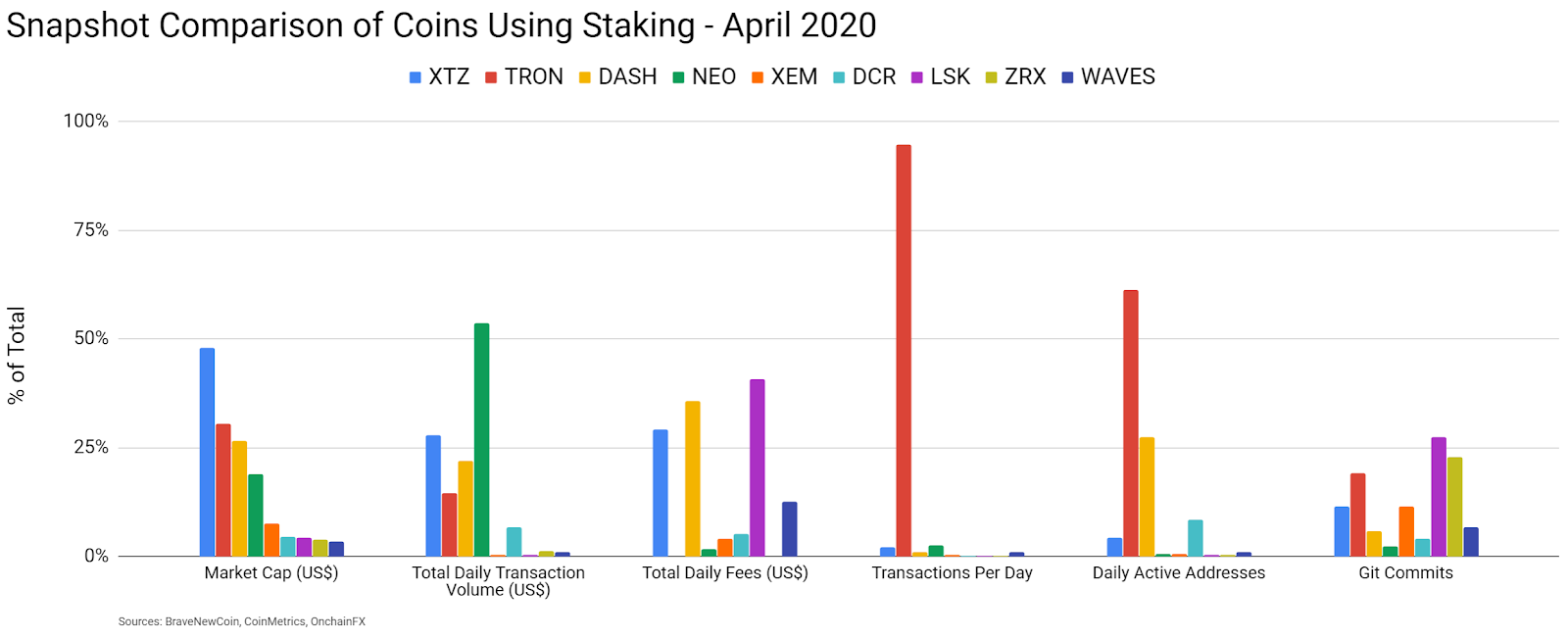

A quick comparison between coins using a staking mechanism shows LSK leading in total daily fees and GitHub commits. LSK is near the bottom of the group in all other categories. According to stakingrewards.com, the average LSK real staking yield, or staking yield minus inflation, is currently +0.11%. EOS (EOS) was excluded from the on-chain data comparison due to a lack of currently available reliable on-chain data.

Created by Max Kordek and Oliver Beddows, LSK was initially forked from the Crypti codebase, a project which raised 750 BTC in July 2014. The LSK ICO ran for one month from late February 21 to late March 2016 with just over 3,900 participants raising 14,052 BTC or US$6,472,497 at that time. The LSK token price during the ICO was US$0.076. Initially, 100,000,000 LSK were created with 85% sold in the crowdsale and the remaining 15% of tokens split between the Lisk core team, post-ICO campaigns and bounties, advisors, partners, third parties, and early supporters.

Lisk also has a non-profit foundation which, as of September 2019, held US$39.27 million in assets split between Euros, Swiss Francs, 7.86 million LSK tokens, all of which originate from the non-crowdsale tokens, 3,228 Bitcoin, and 62,243 GBYTE tokens.

LSK mainnet launched in August 2018 and uses the delegated Proof of Stake (PoS) consensus mechanism, a model created by Dan Larimer whose other projects include BitShares (BTS), Steemit, and EOS. The network has 101 delegates, or validators, 1,825 total nodes, and a 10 second blocktime. The LSK ecosystem runs in TypeScript, a superset of the JavaScript executable programming language.

The blockchain is open source with most of the development work coming from the Berlin-based software company Lightcurve. In late 2018, Lisk announced plans to open a LiskCentre in Utrecht, the Netherlands, which will act as a blockchain incubator for enabling the adoption of Lisk-based applications.

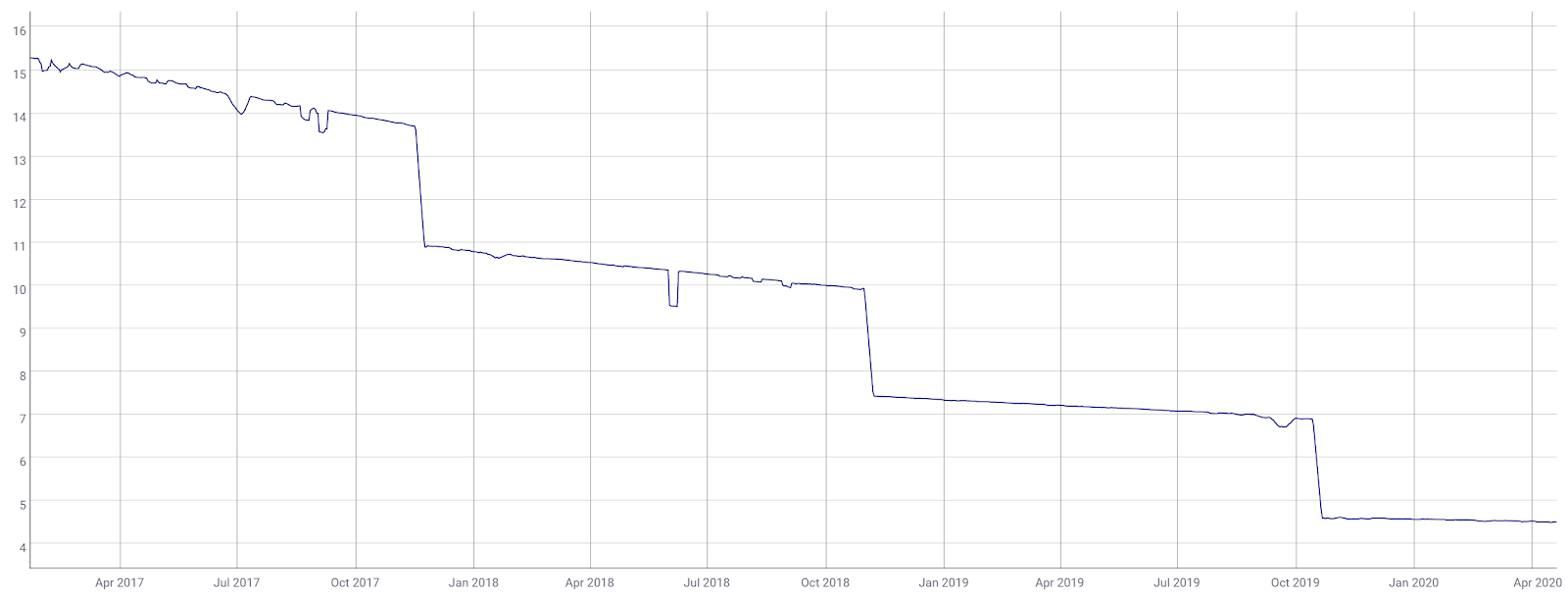

The block reward is currently two LSK with a block reward reduction set for October 2020. Every 3,000,000 blocks, or one year on average, this reward is reduced by 1 LSK, ending at 1 LSK per block in perpetuity. The block rewards are equally distributed among all 101 delegates, who also receive transaction fees. Annual inflation is currently 4.5%.

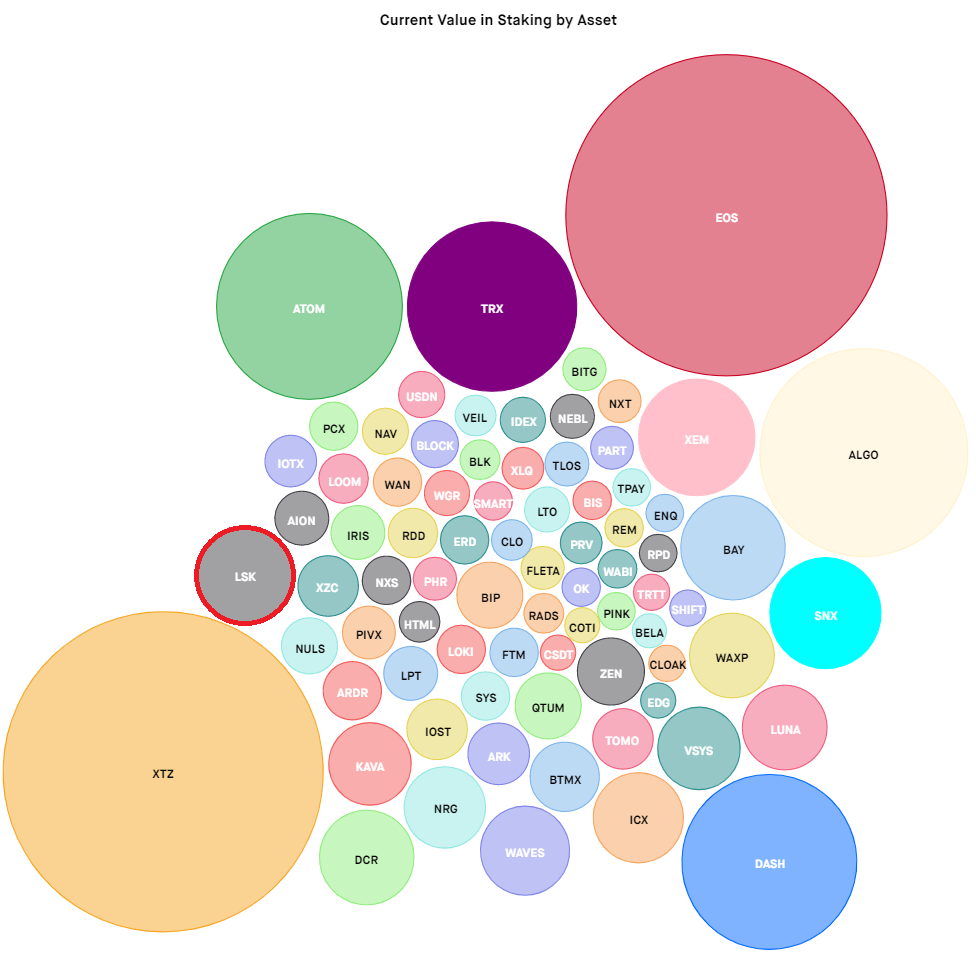

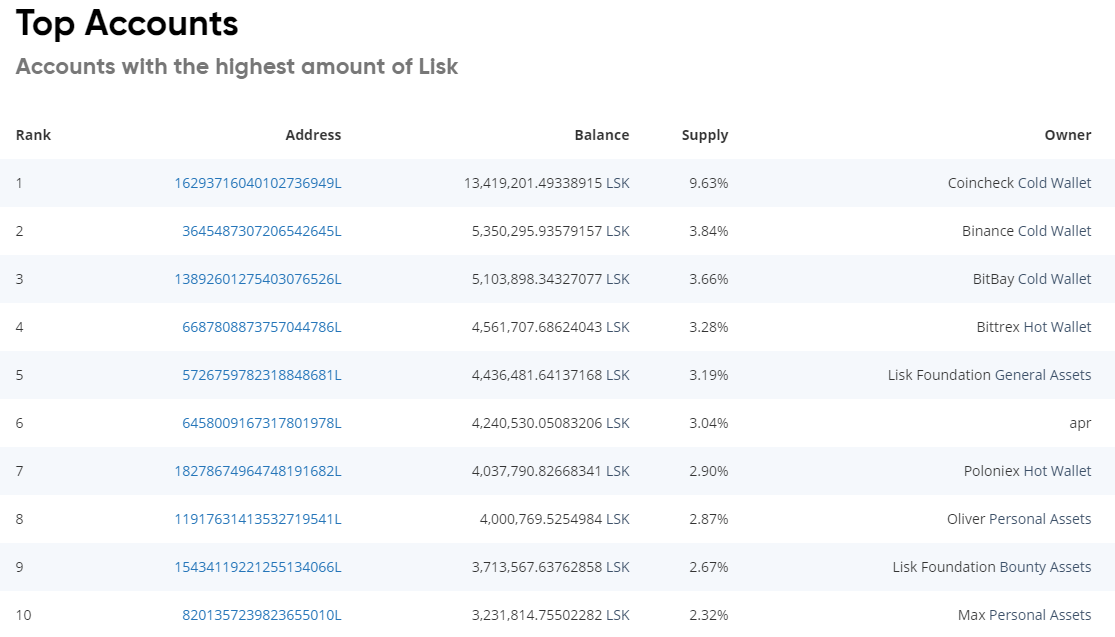

Non-delegate nodes stake LSK by voting for the 101 delegates and receive reward sharing set by the delegate. Other than the 101 main delegates, non-delegate nodes remain on standby to ensure 101 delegates validating the network at all times. Nearly 43% of the current circulating supply is participating in staking, with an aggregate value smaller than many other PoS currencies. The top 10 wallets on the network hold 37% of the circulating supply.

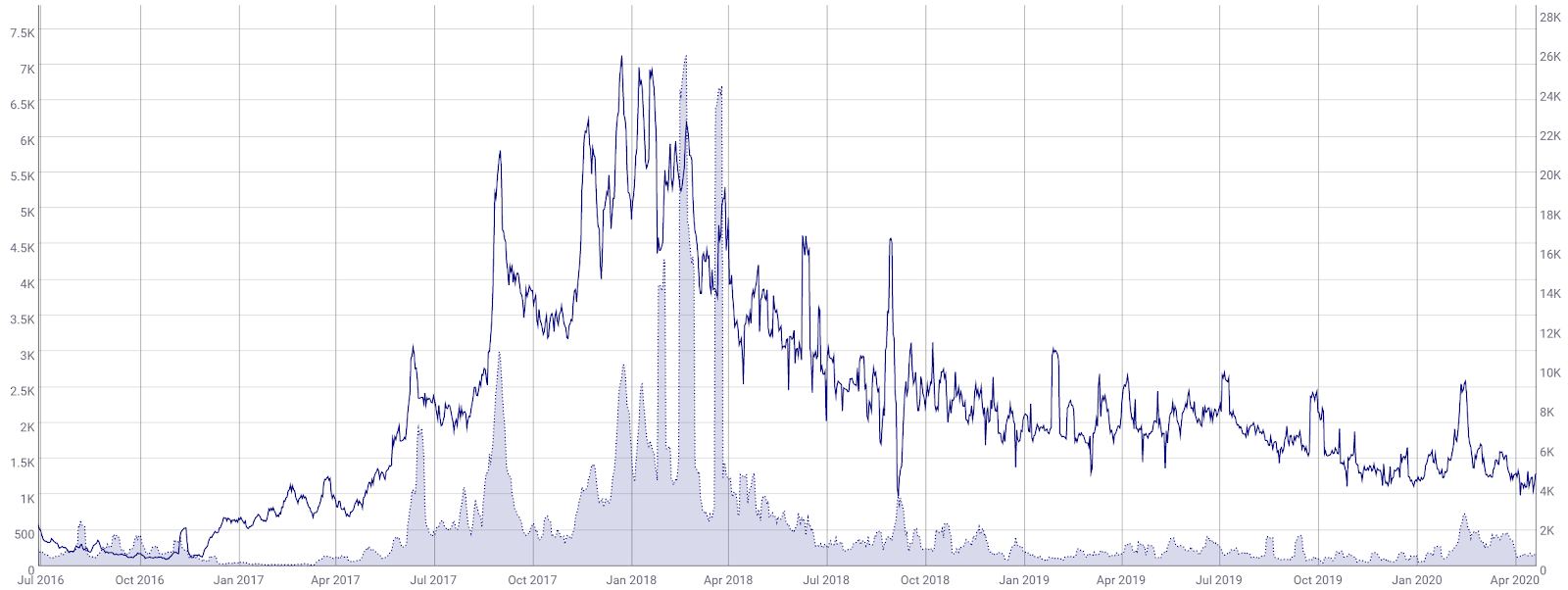

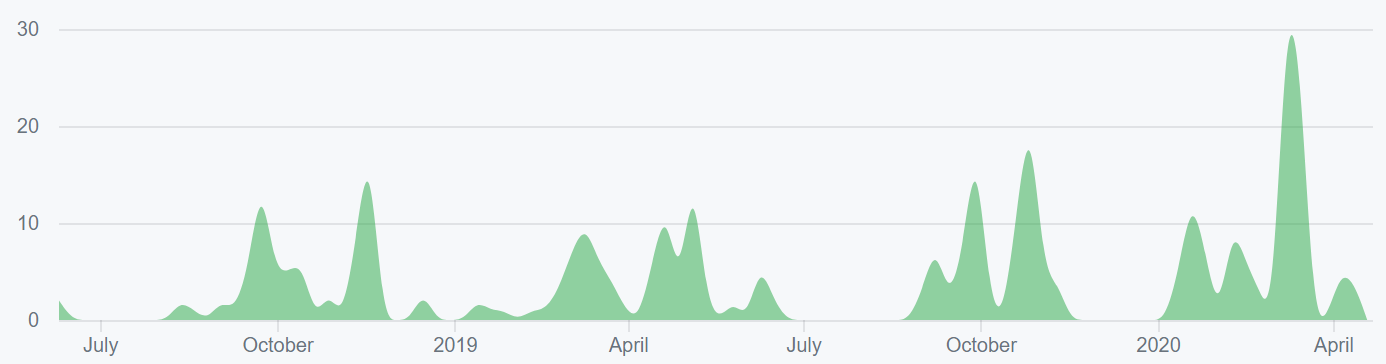

On the network, average transactions per day (line, chart below) have decreased consistently since early 2018. A consistent decline in transactions per day paints a bearish picture for any asset. Average transaction values per day (fill, chart below) have ranged from US$200 to US $3,500 since mid-2018.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) is currently 95, decreasing over the past two months, now sitting at a multi-month low. Inflection points in NVT can be leading indicators of a reversal in an asset's value. A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite. An NVT holding below 50 would likely signify bullish market conditions.

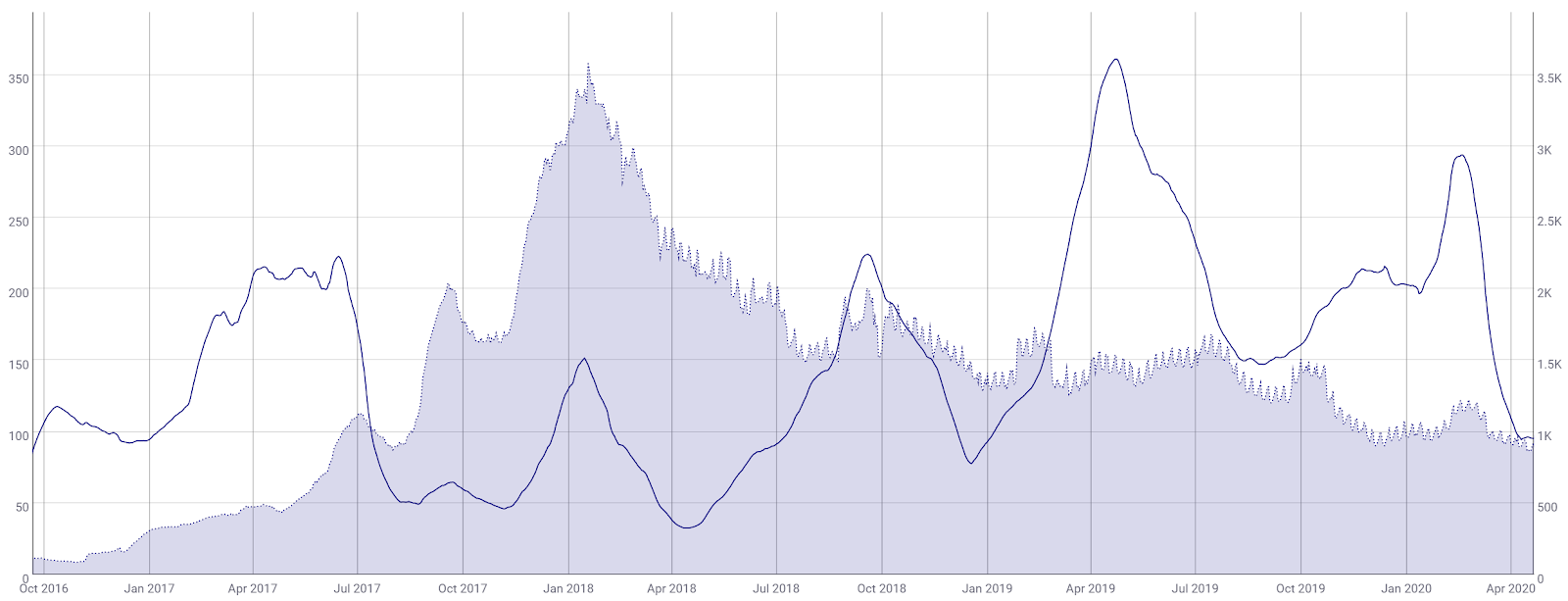

Active and unique addresses are important to consider when determining the fundamental value of the network when using Metcalfe's law. Monthly active addresses (MAAs) have continued to decline (fill, chart below) since early 2018 but still remain higher than most of 2017. A consistent decline in MAAs paints a bearish picture for any asset.

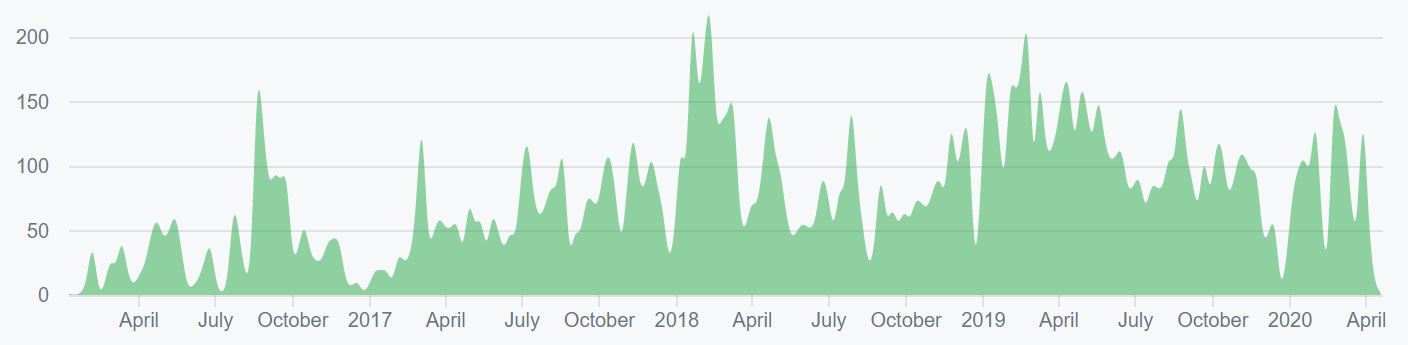

Turning to developer activity, the Lisk project has 31 GitHub repos with a cumulative 3,600 commits over the past year. Lisk Core 2.1.5 and Lisk 1.24.0 for desktop were both released in early January. The Lisk roadmap is descriptive and vast, with years of development in the pipeline.

Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

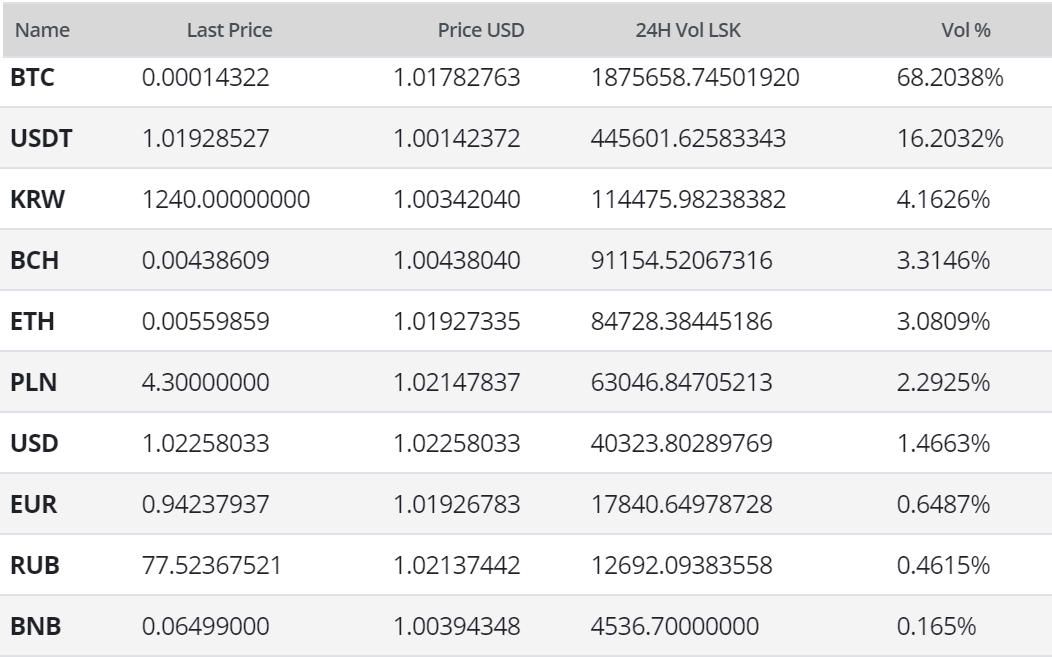

LSK exchange-traded volume during the past 24 hours has been predominantly led by the Bitcoin (BTC) and Tether (USDT) pairs on OKEx, Binance, and Kraken. LSK has traded on Bittrex and Poloniex since May 2016 and Binance since November 2017. Binance also recently added a LSK/USDT pair and LSK staking. Non-exchange custody solutions for LSK include the LSK desktop and mobile apps developed by the Lisk team.

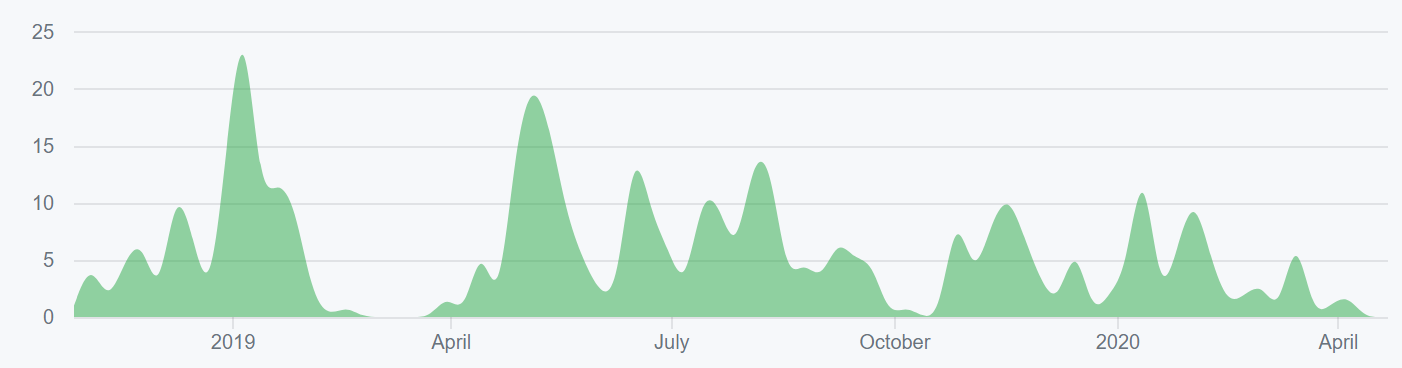

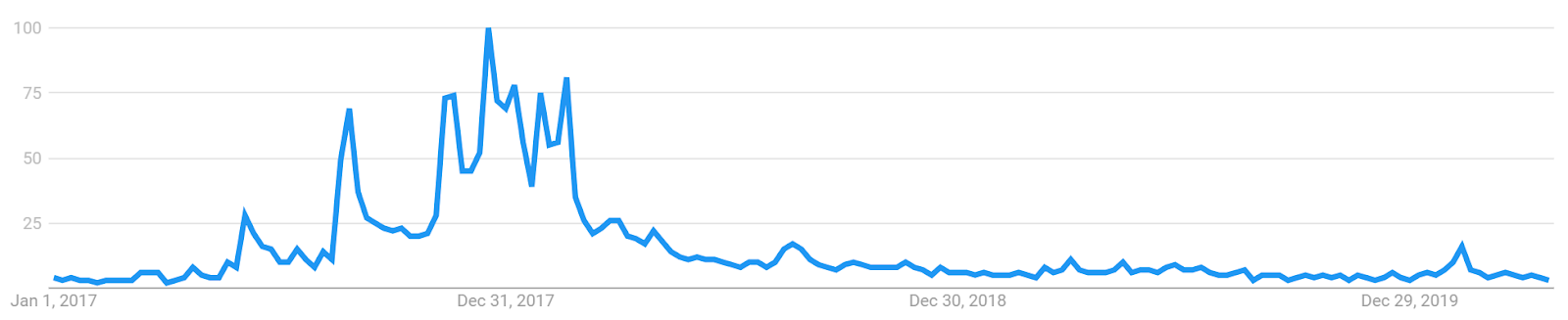

Google Trends for the term "Lisk" remain down sharply since early 2018. A slow rise and large spike in searches for "Lisk" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "bitcoin" searches increase dramatically, bitcoin price drops.

Technical Analysis

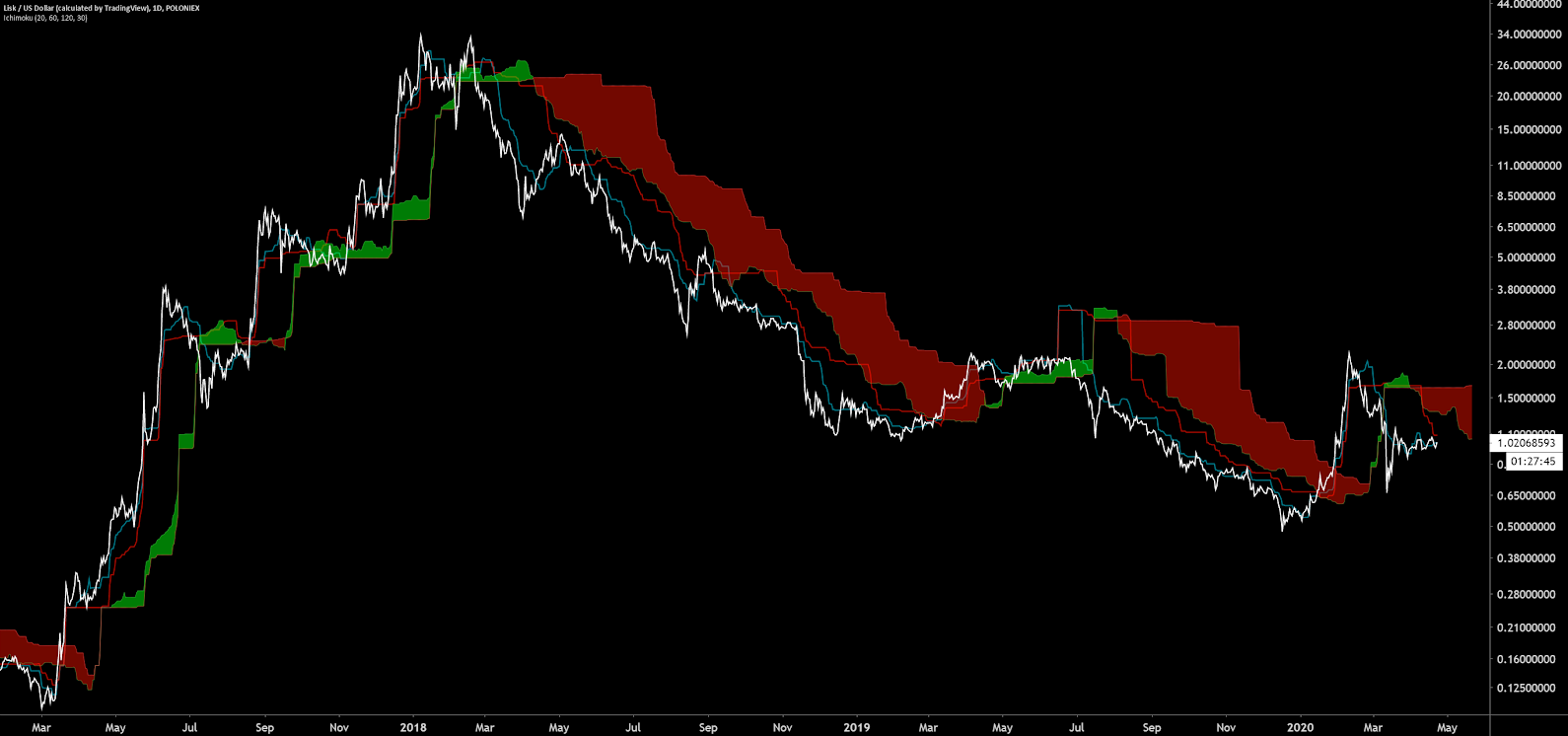

Last month, LSK/USD saw a 71% drawdown from the February local high, which mirrored the wider crypto markets. A roadmap for potential trend changes can be deduced using Exponential Moving Averages, pivots, Volume Profile of the Visible Range, and the Ichimoku Cloud. Further background information on the technical indicators discussed below can be found here.

On the daily chart for the LSK/USD pair, the 50-day Exponential Moving Average (EMA) and 200-day EMAs have essentially been bearishly crossed since the all-time high in 2018. Earlier this year, those key EMAs briefly crossed bullish but have again crossed bearish over the past week. Both EMAs sit just above the US$1.00 psychological resistance zone. Additionally, there are no active volume or RSI divergences at this time.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, are currently bearish; the spot price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and below price. Price action above the flat Kumo at US$1.66 will suggest the beginning of a bullish trend.

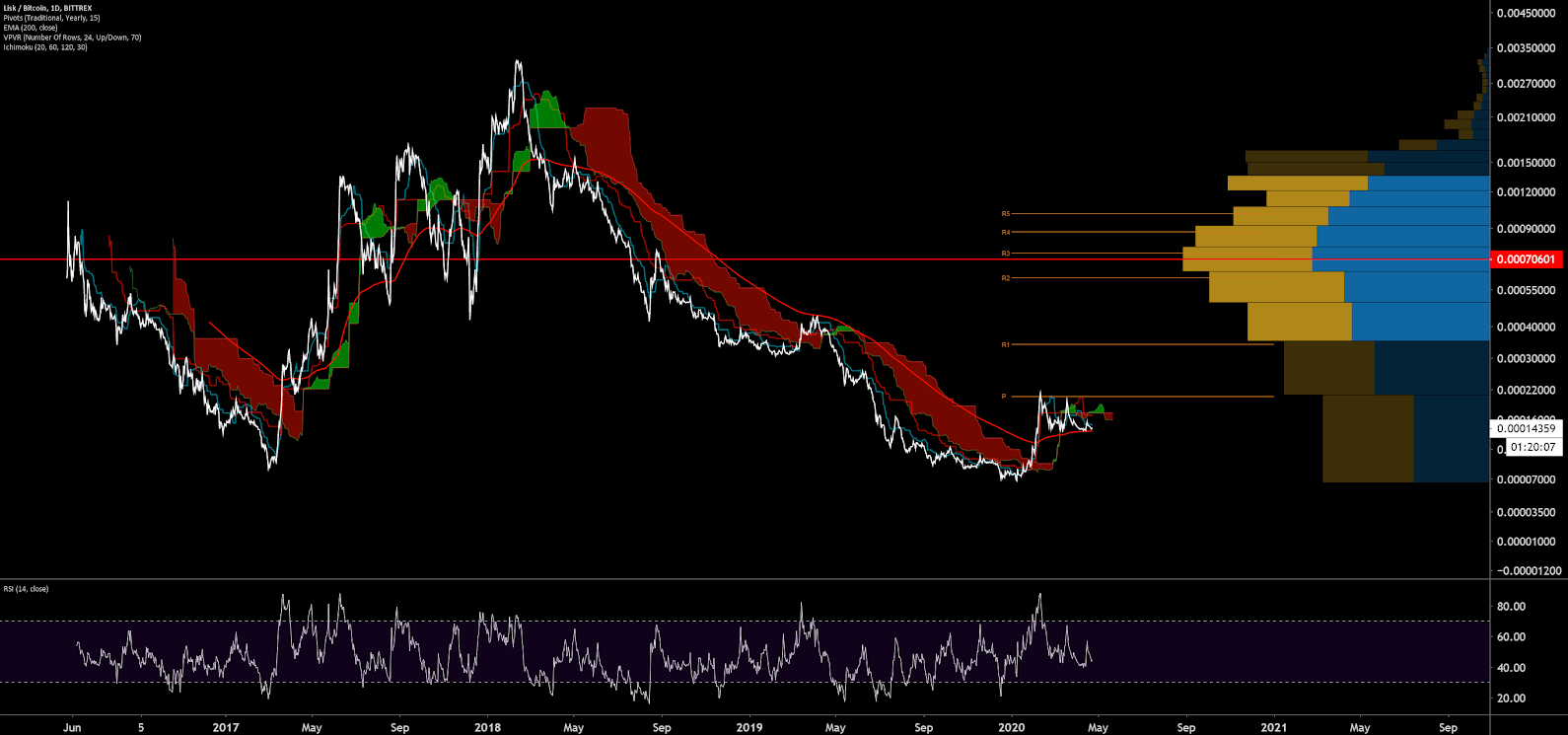

Lastly, on the LSK/BTC pair, the trend metrics give mixed signals as price sits above the 200-day EMA and below the daily Cloud. The trend will definitively flip bullish once the spot price is above the Cloud. Yearly pivot resistance sits at 20,000 sats with heavy VPVR resistance above 40,000 sats. Any lower lows in price with find support all the way down to 6,500 sats. Additionally, there are no active volume or RSI divergences at this time.

Conclusion

Fundamentals show little network use other than speculative demand with most of the network tokens owned by very few individuals. Increased token distribution and an improved dApp economy will increase organic demand but this is likely years away from reality. The Lisk team is well funded, based on their own report, and has an extensive roadmap going forward. With continued network development and improvements, Lisk may one day become a real competitor in the PoS blockchain space.

Technicals for both LSK/USD and LSK/BTC reveal bearish trend metrics. Although both pairs have shown declining volatility since mid-March, suggestive of a major move over the next two weeks. The upside target for LSK/USD is currently the flat Kumo at US$1.66. LSK/BTC is painting a possible bullish flag with a break north of 22,000 sats. If new exchange listings and staking availability are announced, LSK will likely respond bullishly.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow