Litecoin Price Analysis - Technicals remain bearish while fundamentals continue to stagnate

The Litecoin (LTC) spot price remains down over 50% since the block reward halving in August 2019, and down 88% from the record high set in December 2017. The LTC market cap is currently 7th on the BraveNewCoin market cap table at US$2.78 billion, with US$731 million in exchange-traded volume over the past 24 hours.

LTC is a Bitcoin (BTC) fork created by Charlie Lee in 2011. The network has a target block time of two minutes and 30 seconds, as opposed to 10 minutes for BTC. LTC also has a four-fold increase in the total supply, and uses a different Proof of Work consensus algorithm called Scrypt.

Charlie Lee is a former Google employee and the brother of Bobby Lee, CEO of the now-closed Chinese cryptocurrency exchange BTCC. Lee worked as an engineer at Coinbase from 2013 to 2017, where he was instrumental in spearheading the company's LTC listing.

Despite selling all of his personal LTC holdings in December 2017, Lee continues to be involved in the development process and attempts to increase adoption through the Litecoin Foundation, a non-profit registered in Singapore. The second-ever Litecoin summit occurred in Las Vegas at the end of October 2019, which was headlined by Ron Paul.

Seven recent partnerships established by the Foundation include; Cred, BlockFi, BitGo, Glory kickboxing, the Miami Dolphins professional football team, the San Diego Film Festival, and Flexa, which added LTC as a method of payment for its 39,000+ merchant network. Previous partnerships include the Bibox exchange and Ternio, which is set to issue a physical debit card allowing for direct cryptocurrency spending.

In October 2019, the Foundation released an unaudited financial statement showing net assets of US$570,000, after concerns were raised regarding the Foundation’s solvency. Lee added that “the Litecoin Foundation was started in 2017. Development happened before the foundation even existed. And development will happen even if the foundation runs out of money. This is a decentralized cryptocurrency after all.”

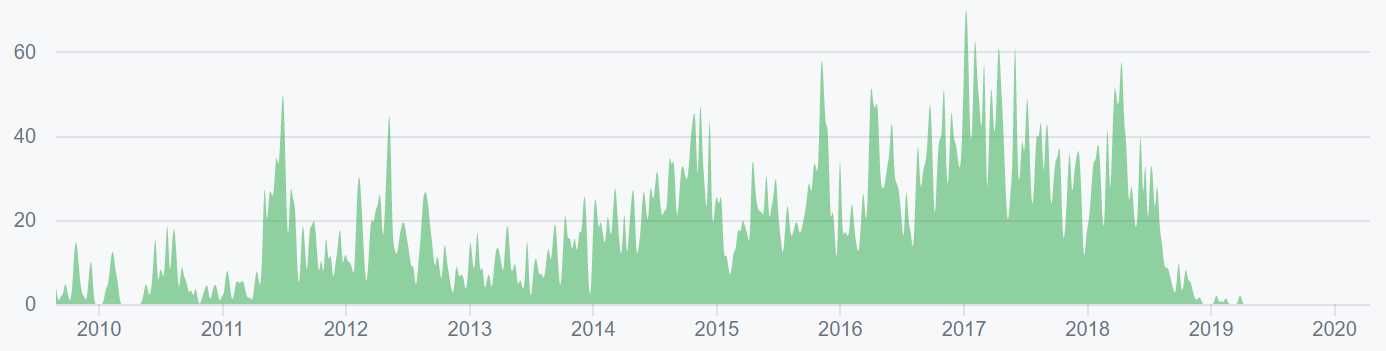

Turning to developer activity, the LTC project has 37 repos on GitHub. Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

In a tweet thread, Lee addressed the seemingly low level of development. He explained that the Litecoin project has only ever had a total of six core developers, who mainly merge BTC code changes into the LTC code. Adrian Gallagher is one of the core developers and works on a personal branch. These changes are only recorded on the main branch once they are finalized.

Over the past year, there have been virtually no commits in the main GitHub repo, litecoin-project/litecoin (shown below). Compared to previous years, 2019 and 2020 has seen a marked reduction in dev activity. However, Litecoin.com announced that Litecoin Core 0.18.1 entered the final stages of testing in October 2019.

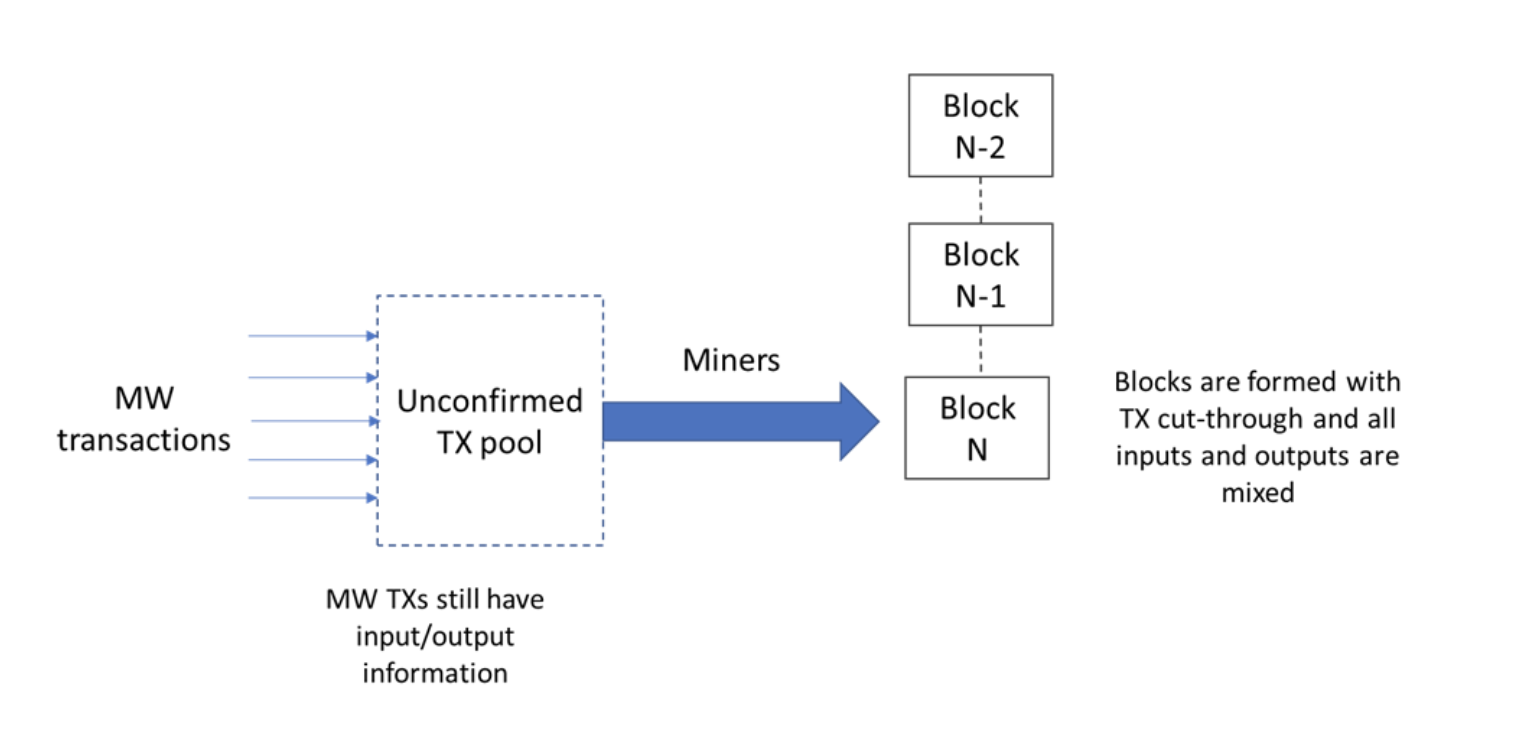

In October 2019, Litecoin Improvement Protocol (LIP) 2 and 3 were published, outlining Extension Blocks and MimbleWimble, respectively.

Extension Blocks (EB) are a type of sidechain first proposed by Bitcoin developer Johnson Lau in 2013, and allow for protocol variables that differ from the main chain. Therefore, EBs can have increased block sizes or bring increased programmability and privacy without the need for a hard fork of the entire chain. Each EB is only connected to the corresponding block from the main chain, as opposed to every other block in the main chain. Criticisms include decreased backward compatibility and decreased chain security.

MimbleWimble (MW) uses zero-knowledge proofs and a specific type of transaction mixing to obscure transaction details while still allowing for transaction verification. Adding MW through EBs allows for the opt-in use of transaction privacy on the LTC chain and brings increased coin fungibility. The soft fork will be activated one year from the day the implementation is released. Miners will be able to activate the change early with at least a 75% signaling threshold. A major criticism of private transactions revolves around an inability to audit the total coin supply, allowing for the possibility of phantom inflation.

In December, the Litecoin Foundation announced a fund to support the development of both EB and MW. The fund has a goal of raising US$72,000, to support developer David Burkett throughout the next year. The fund has currently collected 700 LTC and 0.1 BTC.

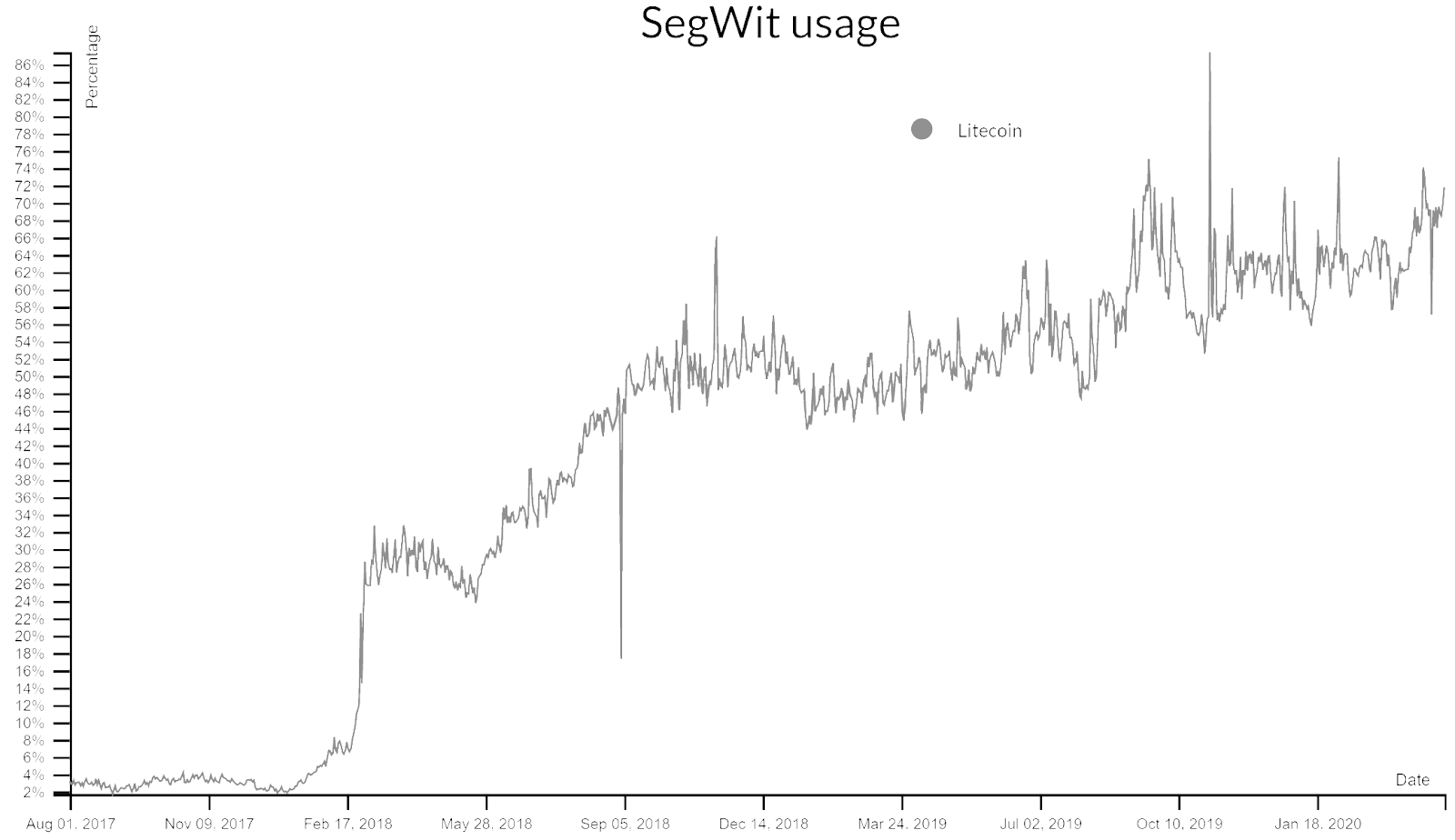

On the network side, LTC uses SegWit enabled addresses to both decrease individual transaction size and cost, as well as increase the maximum block size to more than 1MB. SegWit use has increased to over 70% in the past few months and also enables transactions to be used on the Lightning Network, a bi-directional, off-chain, hub-and-spoke payment channel. The LTC Lightning Network currently has 700 channels and the network capacity exceeds 165 LTC, or US$7,000.

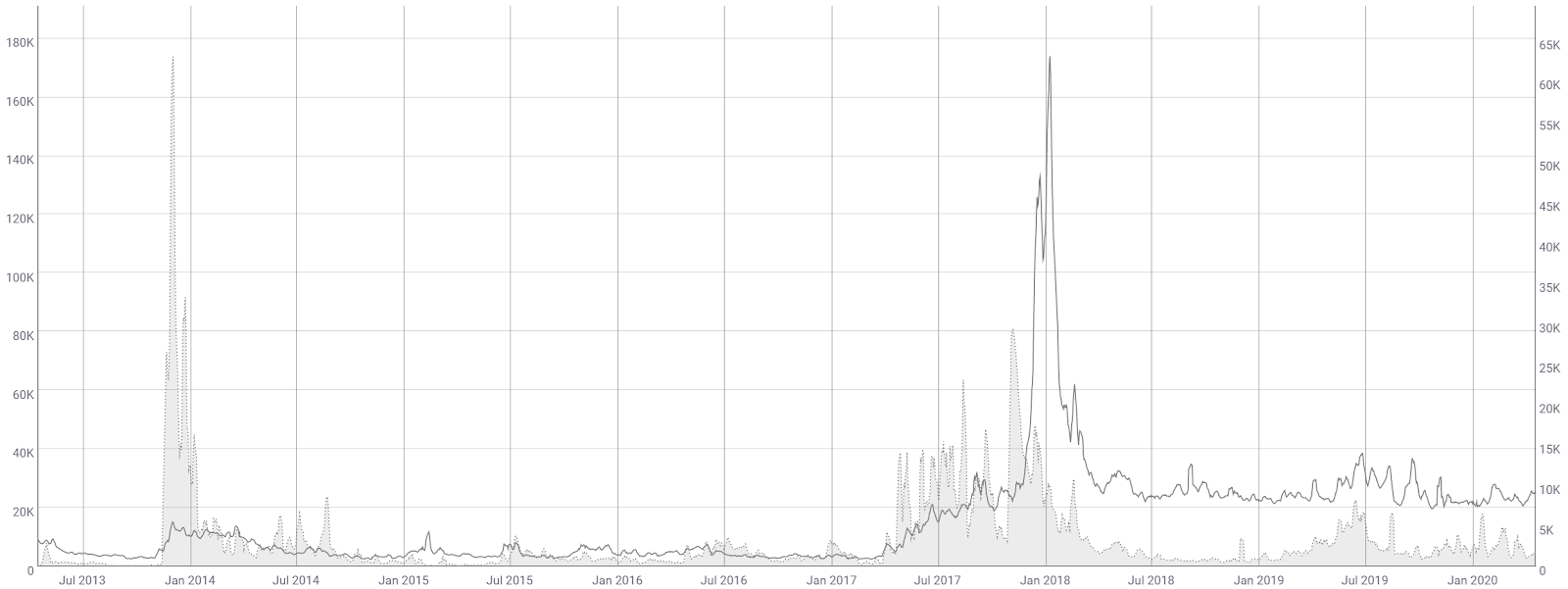

The number of LTC transactions per day (line, chart below) has ranged from 20,000 to 40,000 since March 2018. Transactions rose substantially in December 2017 and January 2018, which was most likely in response to the expensive and delayed transactions on the BTC network. There are currently less than 500 pending LTC transactions.

The average transaction value on the network (fill, chart below) fell dramatically throughout 2018. Average transaction values increased in early 2019 with an increase in LTC price. Over the past few months, any rise in average transaction value has corresponded with a rise in price. Average transaction values are currently US$1,400, down substantially from a high of ~US$30,000 in November 2017.

The network average block size (line, chart below) fell dramatically throughout 2018 and early 2019, and has also decreased since the block reward halving in August 2019. The current average holds around 12MB per block after spiking to nearly 25MB per block. Historically, the average block size still remains higher than at any point prior to June 2017.

The average transaction fee (fill, chart below) has fluctuated dramatically with block size, and is currently US$0.014, which is only 2.7% of the current BTC transaction fee. Fees spiked to nearly US$0.16 in May 2019, a multi-month high, along with the spike in transactions at that time. Litecoin Core v0.17.1, also released in May 2019, lowered the default minimum transaction fee to 0.0001 LTC/kB.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) is currently 71 and falling, near a multi-year low. NVT hit an all-time high of 171 in late-February. An NVT below 20 would likely indicate organic and sustained bull market conditions based on chain utility.

Inflection points in NVT can be leading indicators of a reversal in an asset’s value. An uptrend in NVT often suggests an asset is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite.

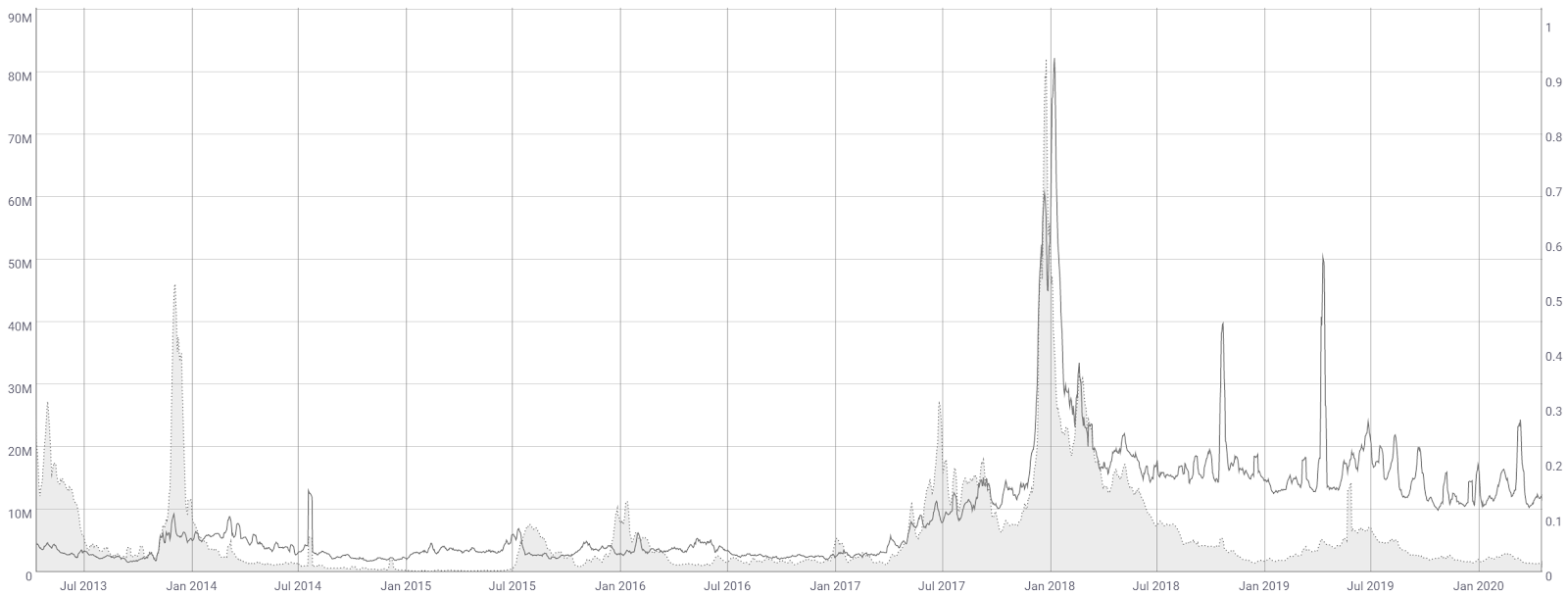

Active and unique addresses are important to consider when determining the fundamental value of the network based on Metcalfe's law. Monthly active addresses (MAAs) have declined since January 2018 (fill, chart below), holding near multi-year lows. MAAs remain well above historic levels prior to July 2017. However, LTC has far fewer MAAs than either BTC or ETH but over 10x more active addresses than Ripple (XRP).

The top 100 LTC addresses currently hold 42% of the available supply, compared to 15% for BTC, 33% for ETH, and 73% for XRP. Most of these top addresses are likely exchange holdings. In November 2018, Coinbase created 40 new LTC cold storage addresses, each containing 300,000 LTC.

Another crypto-native fundamental metric is the MVRV ratio, or the market cap divided by the realized cap. Realized cap approximates the value paid for all coins in existence by summing the market value of coins at the time they last moved on the blockchain.

Historically, periods of an MVRV less than 0.5 have represented oversold conditions, whereas periods of an MVRV greater than 2.5 have represented overbought conditions. Both instances of MVRV above 3.0 have represented all-time highs in price. Currently, MVRV is 0.60, nearing the historic buy zone.

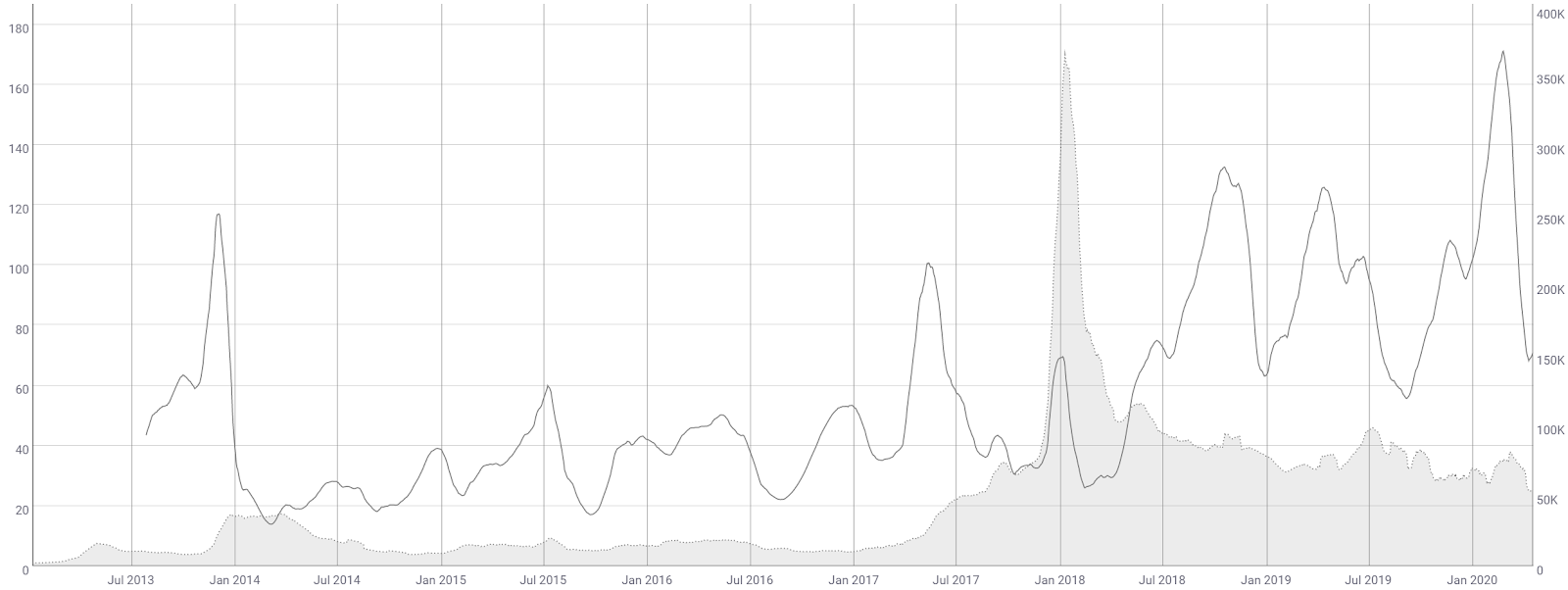

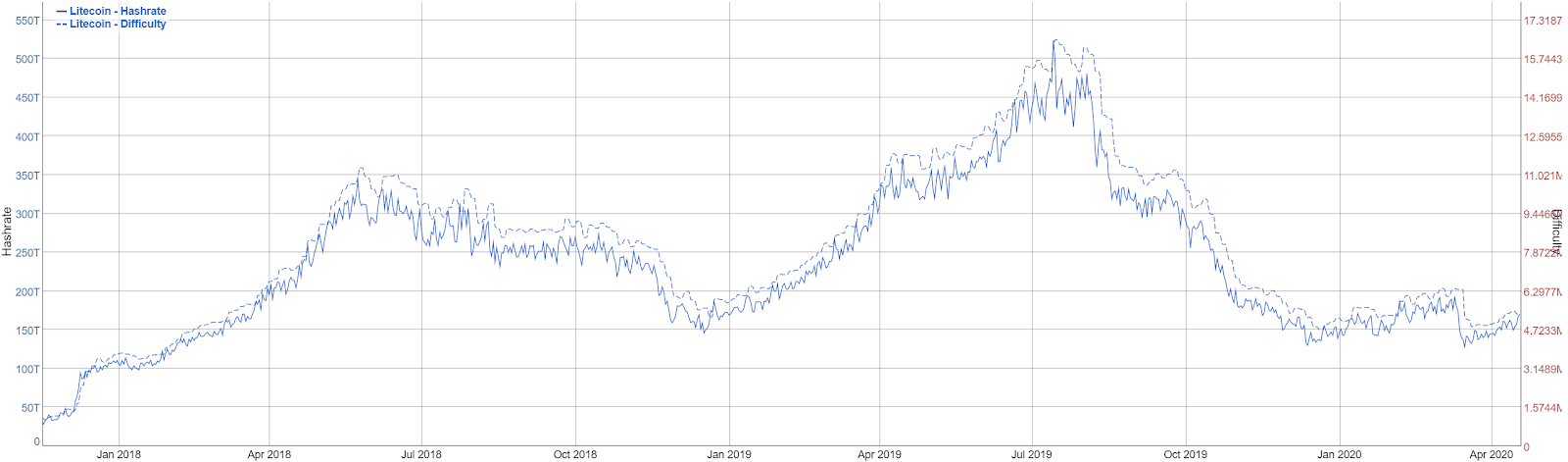

Since the block reward halving in early August, the hash rate has dropped by nearly 70%. Hash rate and difficulty rose substantially from mid-December 2018 to early August 2019, with both reaching record highs.

Of the 84 million LTC to ever exist, 77.18% have been mined. Inflation per year currently stands at 4.14% and is set to decrease to 1.80% after the next block reward halving in August 2023. The network currently has 1,545 active public nodes, most of which reside in the United States, Germany, and France. Only 51% of these nodes are running the latest version of Litecoin Core.

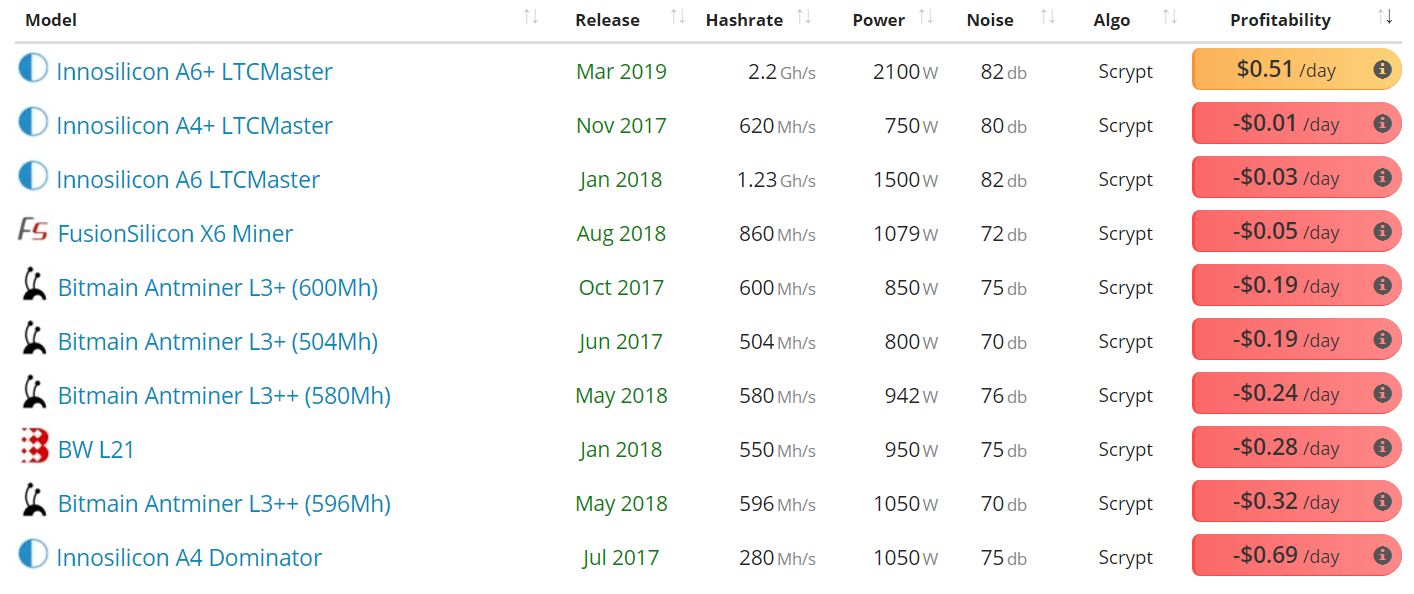

Mining profitability currently sits near all-time lows. Factors that influence mining profitability include; price, block times, difficulty, block reward, and transaction fees. Both price and difficulty have fallen dramatically since June.

Renewable energy sources around the world, including hydroelectric and geothermal power, bring electricity prices for most mining farms to US$0.04 cents/KWh or lower. Most Scrypt ASIC miners (shown below) are not profitable at an electricity cost of US$0.04 cents/kWh.

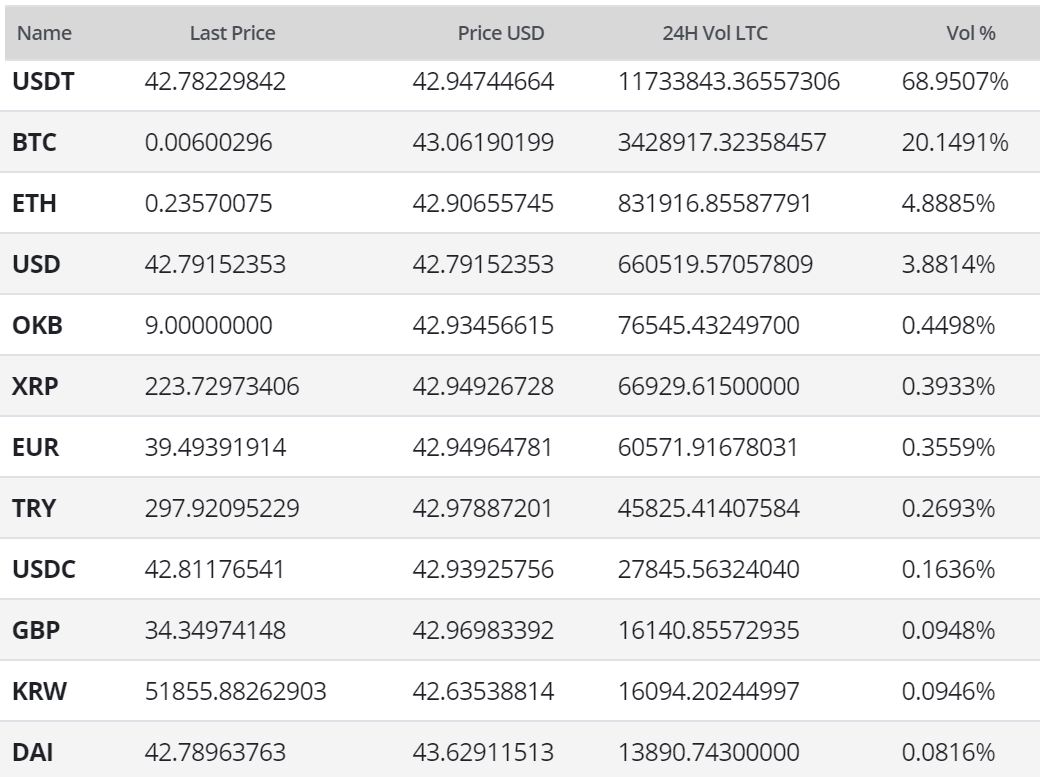

Exchange-traded volume during the past 24 hours has been predominantly led by the Tether (USDT) and Bitcoin (BTC) pairs on Binance, Huobi, and OKEx. The U.S. Dollar (USD) and Ethereum (ETH) pairs are also providing substantial but smaller volumes. The Korean Won (KRW) and Japanese Yen (JPY) pairs hold no premium over the USDT pair.

LTC has continued to gain exchange listings, custody solutions, and exposure over the past two years, including new LTC pairs on BitGo, Bittrex, BlockFi, Binance, Binance.US, BTSE, CMC markets, Coinbase, DragonEX, EscoDEX, FXCM, Gemini, Huobi, OKEx, Poloniex, SoFi, QuantaDEX, Voyager. This week, Binance loans added LTC as an option for collateral.

Last year, Litecoin.com also added a buy function with pairs in USD, EUR, and GBP, along with a logo redesign. The Litecoin Foundation released an updated version of the LoafWallet at the end of October.

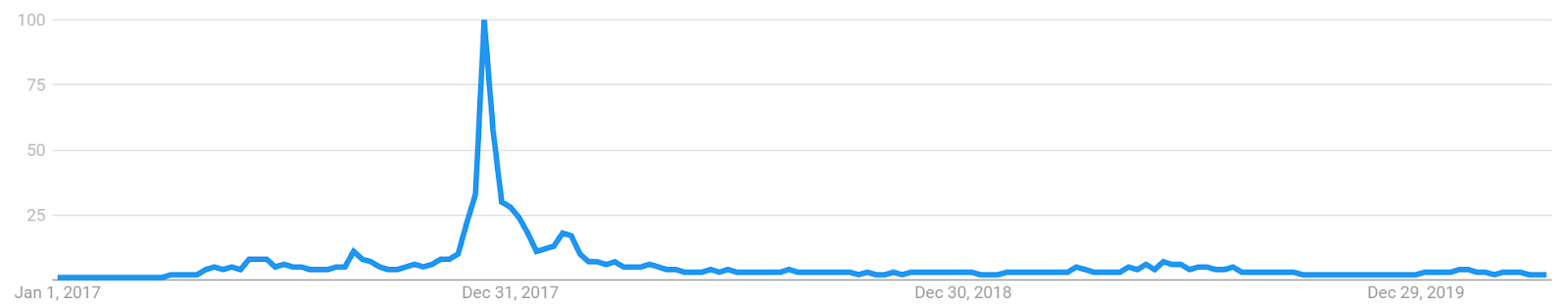

Worldwide Google Trends interest for the term "Litecoin" increased slightly in June 2018, but has since declined by an equal magnitude. Google Trends interest has not increased significantly over the past two years.

A slow rise in searches for "Litecoin" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the Google Trends data and Bitcoin price, while a 2017 study concluded that when the U.S. Google "Bitcoin" searches increase dramatically, Bitcoin price drops.

Technical Analysis

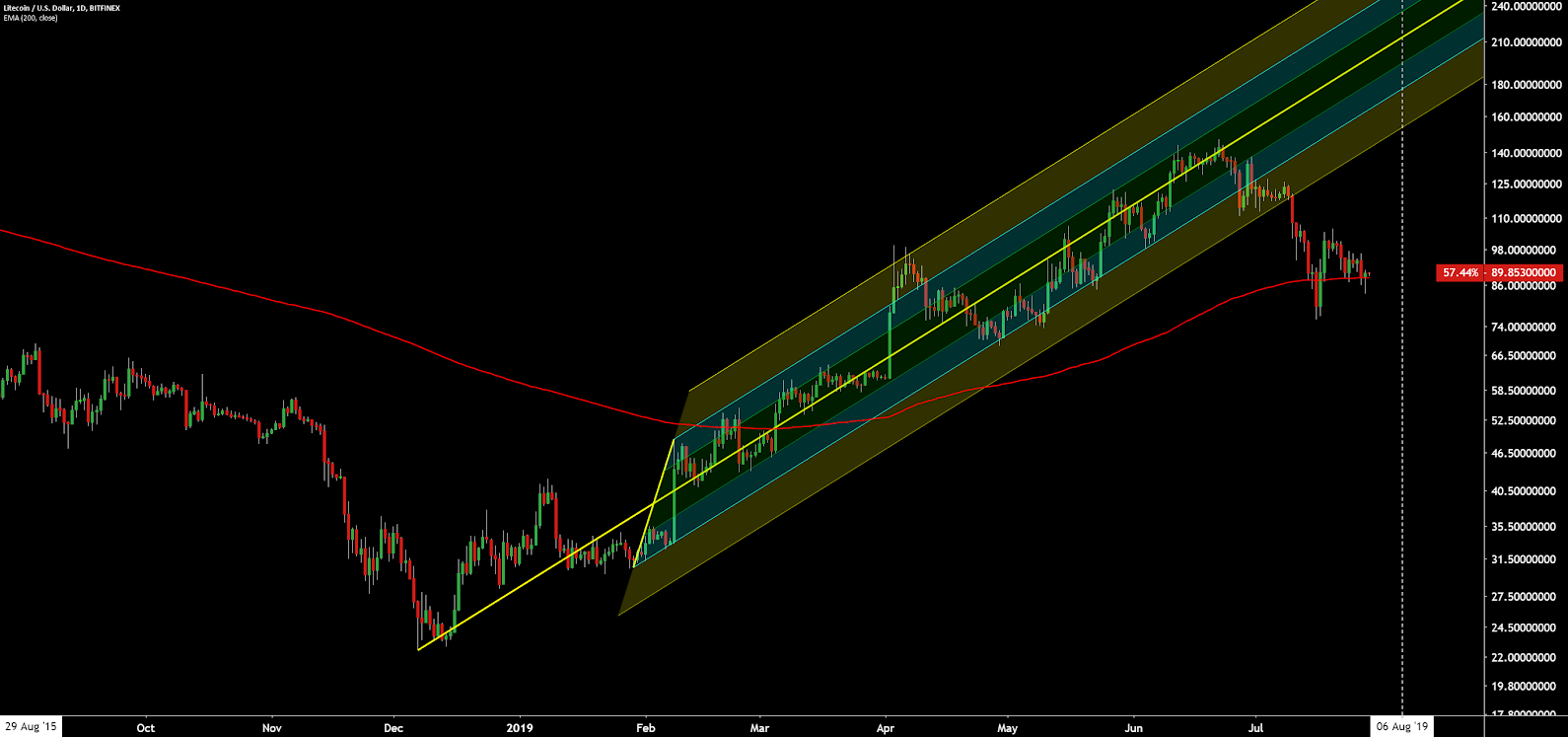

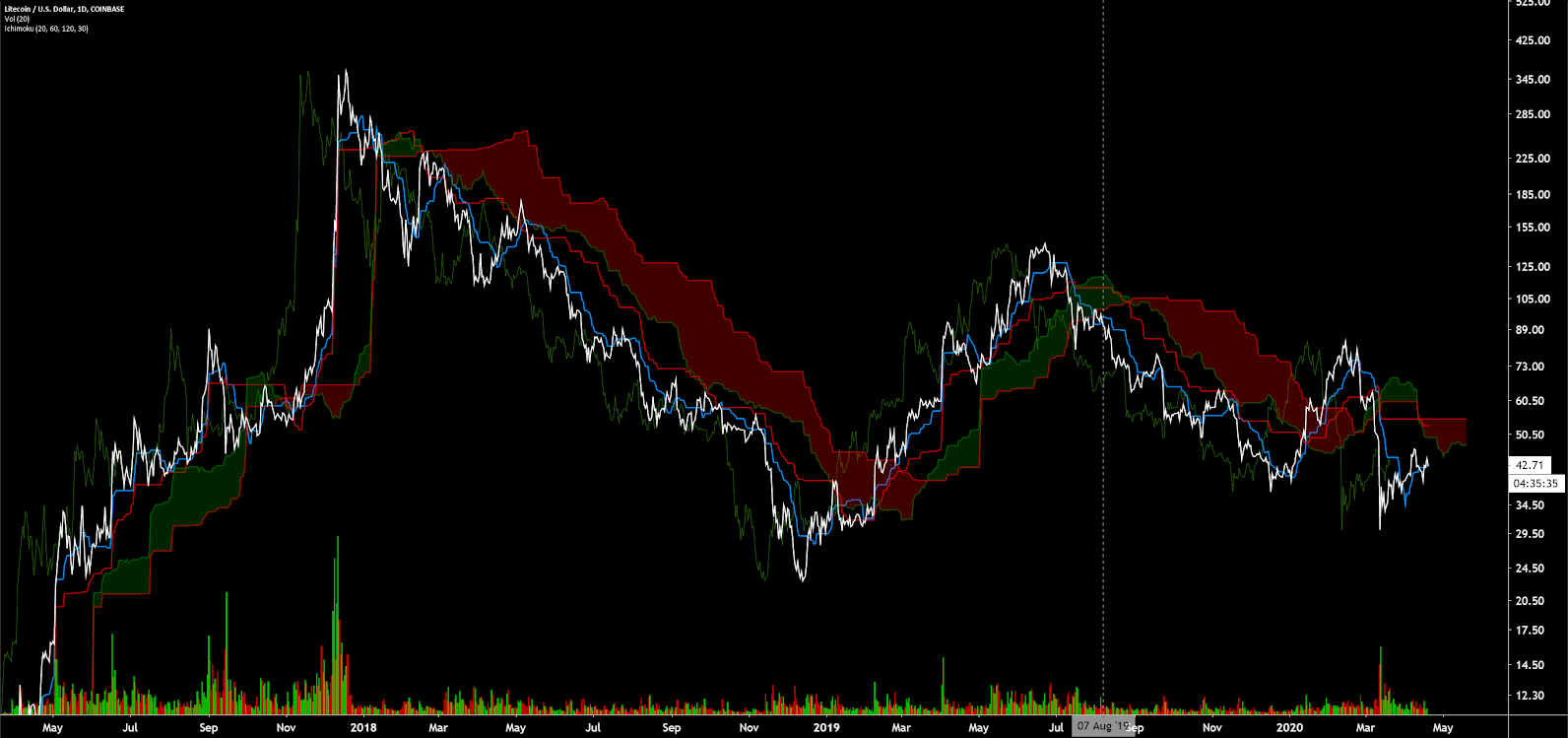

Last month, LTC saw the third-worst drop on record, which mirrors the wider crypto markets, with multi-year highs in daily volumes across most exchanges. A roadmap for potential trend changes can be deduced using Exponential Moving Averages, Volume Profile of the Visible Range, and the Ichimoku Cloud. Further background information on the technical indicators discussed below can be found here.

On the daily chart for the LTC/USD market, the 50-day Exponential Moving Average (EMA) and 200-day EMA remain bearishly crossed, ending a brief period of bull market conditions earlier this year. The previous bear trends beginning in 2018 and 2019 lasted 306 days and 168 days, respectively.

The 200-day EMA is now just below the current spot price, at US$55, and should act as resistance in the near term. The Volume Profile of the Visible Range (VPVR) currently shows resistance between the US$42-US$62 range and strong support between the US$28-US$32 range. There no active bullish or bearish divergences at this time

Open interest on Bitfinex for the LTC/USD pair is 88% long with longs increasing slightly over the past two weeks and shorts decreasing slightly in the same time period (top panel, chart below). A significant price movement downwards will result in an exaggerated move further, as the long positions will continue to unwind. This is known as a “long squeeze.” On March 30th and 31st, shorts held a greater percentage than longs and a short squeeze occurred shortly thereafter, sending the spot price quickly higher.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish; the spot price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and above the current spot price. The trend will remain bearish so long as the spot price remains below the Cloud. A long flat Kumo at US$55 should act as a magnet for price.

On the daily LTC/BTC chart, the spot price has historically been unable to maintain any position above 0.02 BTC but has closed above 0.005 since March 2017. The 50-day and 200-day EMAs failed to cross bullishly earlier this year, once the spot broke above the daily Cloud. The trend will remain bearish so long as price remains below the 200-day EMA and daily Cloud. Currently, the 200-day EMA and daily Cloud sit at 6,900 sats and 6,600 sats, respectively.

A high volume VPVR node, at 0.0088 BTC, should act as strong resistance on any further rise. There is virtually no VPVR support below 6,000 sats. Open interest on Bitfinex for the LTC/USD pair is 55% long. There are no active bullish or bearish divergences at this time.

Conclusion

Fundamentals show on-chain activity continuing to slow over the past two years. NVT recently made a new all-time high, suggesting decreased on-chain utility per market cap dollar compared to previous periods. MVRV, another inverse metric of economic utility, has now fallen near the historic buy zone. Hash rate reached a plateau leading into the August halving and experienced a nearly 70% reduction, with mining profitability sitting near all-time lows.

Developer activity on the main Github repo has been nearly non-existent over the past year, although a Litecoin Improvement Protocol for Extension Blocks and MimbleWimble was released at the end of last year. Together, these changes would allow for a soft fork enabling private transactions and increased coin fungibility. However, Extension Blocks and MimbleWimble could also introduce variable consensus rules with decreased chain security, as well as hidden inflation.

Technicals for both the LTC/USD and LTC/BTC pairs remain bearish after a historically negative day across all crypto markets on March 12th. A mean reversions to the 200-day EMA at US$55 and 6,900 sats, respectively, are likely over the next few weeks as long as price does not make lower lows. Strong volume support sits at US$40 for the LTC/USD pair whereas the LTC/BTC has virtually no historic volume support below the lows of 5,500-6,000 sats.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow