The Bitcoin Cash halving is here

Bitcoin Cash, the largest fork of the Bitcoin network, has experienced its first block reward halving since its inception in 2017. The native currency of the Bitcoin cash blockchain, BCH, is the 5th largest asset on Brave New Coin’s market cap table with a market capitalization of ~US$ 4,921,471,195.

The BCH block halving occurred at roughly 12:20 UTC on Wednesday when the chain reached block height 630,000. Reaching this height triggered a preset protocol feature that immediately reduced block rewards for miners from 12.5 Bitcoin Cash per block to 6.25 per block.

In the long run, existing BCH holders can look at the historic price effects of block reward halving events on the larger Bitcoin (BTC) chain for comfort. They have generally preceded periods of strong price gains as supply shrinks, and coins on the network become scarce.

A bullish halving argument is supported by the stock-to-flow model that is also used to assess the value of scarce precious metals like gold. Stock-to-flow is the number that we get when we divide the total stock by yearly production (flow). Post halving, the yearly production of BCH reduces, but its pre-set total stock (supply) of 21,000,000 BCH remains constant. This creates natural positive price pressure as BCH becomes more scarce and space on its chain becomes more limited.

The stock-to-flow model is only valid if assets on the Bitcoin Cash chain are considered to be ‘costly in their creation’. From PlanB’s original Modeling Bitcoin's Value with Scarcity medium post, “Bitcoin has unforgeable costliness, because it costs a lot of electricity to produce new bitcoins. Producing bitcoins cannot be easily faked. Note that this is different for fiat money and also for altcoins that have no supply cap, have no proof-of-work (PoW), have low hashrate, or have a small group of people or companies that can easily influence supply etc.”

This will be the Bitcoin Cash network’s first block reward halving and it is an unprecedented event for the forked chain. Whether existing tokens on the chain are able to retain long term value will depend on the future hashrate of the network, and if the demand to mine BCH is retained.

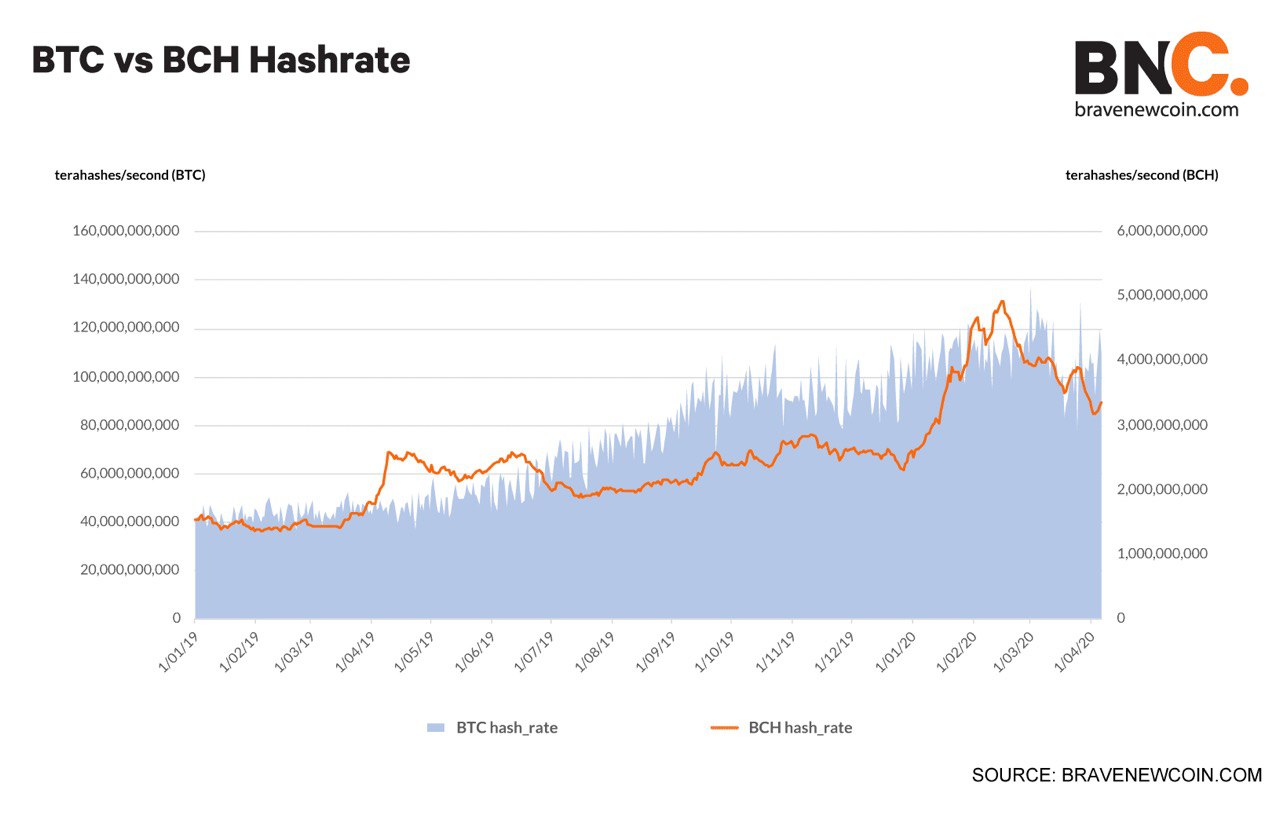

The mining profitability of BCH continues to shrink in comparison to that of the Bitcoin network. The electricity output of the Bitcoin Cash network is currently just 3.05% of the Bitcoin network, and this creates concerns around the security and value of the BCH network.

Since both chains are mined using the SHA-256 algorithm and miners can choose to mine either chain easily, there are some concerns around miners choosing to leave the BCH network for the BTC network. Since the 1st of March, the hashrate on Bitcoin Cash has been on a downward grind, dropping ~15.60%. The hashrate on the Bitcoin network has been volatile over this period but has picked up aggressively since the 25th of March.

For Bitcoin miners, the next few months represent a period of choices around the capital allocation of their mining resources. Bitcoin-SV, the third-largest fork, is also expected to have its block reward halving in the next 50 days. For miners, all three major SHA-256 chains will see a reduction in block rewards around the same period, and miners will have to allocate resources between the three chains depending on mining profitability. The Brave New Coin Bitcoin halving date predictor page suggests that the block reward halving for the Bitcoin network will occur between 12/05/2020 03:57 and 13/05/2020 07:58.

The USD value of block rewards on the Bitcoin Cash network has dropped from ~$2,611 to ~$842 over the last few days. Popular mining service provider F2pool reports that a wide range of mining equipment launched in 2018 and early 2019 is now generating negative daily profits mining the BCH network assuming an average electricity cost of $0.05 per kilowatt-hour (kWh). It says that even 2020 SHA-256 mining rigs struggle to mine the chain at an efficient margin.

The price of Bitcoin Cash (BCH) has fallen just ~1.25% in the last 30 days and risen ~20% in the last 7, outperforming a number of other large-cap assets. This suggests that there has been some demand to buy BCH on crypto exchanges over the last month.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow