Why Bitcoin's impact on Latin America's unbanked remains 'fairly limited'?

Over the years, while cryptocurrencies, namely Bitcoin has explored different use cases, one of the strongest narratives Bitcoin has been part of involves providing a financial avenue for the world’s unbanked population. This has been demonstrated in developing markets in which a substantial demographic continues to not have access to the country’s financial infrastructure or are victim to high-level corruption and failing fiat currencies. Bitcoin’s usage within many Latin American countries fit this narrative.

In a recent Q&A session, noted Bitcoin advocate Andreas Antonopoulos pointed out how the full set of benefits of cryptocurrencies like Bitcoin in many parts of Latin America are enjoyed only by a subset within the larger unbanked demographic. He pointed out that the impact of Bitcoin in many parts is ‘fairly limited’.

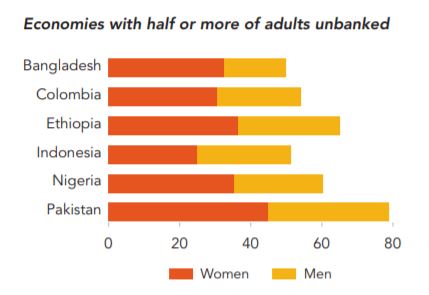

Source: Global Findex Report

According to the Global Findex Database, countries like Colombia have well over half of its population falling under this category and other countries within Latin America are not too far behind.

However, Antonopoulos highlighted how people over the age of 30 continue to perceive Bitcoin as a temporary solution whose value does not hold permanence. He said,

“Most of the people over 30 treated this [Bitcoin] as easy money that probably wasn’t going to be around for a while and with some suspicion and they immediately cashed it in. And converted it to Argentinian pesos or bought things with it as quickly as possible.”

Interestingly, the suspicion regarding whether or not Bitcoin is a safe solution for the older demographic is likely to rise as large-scale rapid digitization continues and as reports suggest, crime is also migrating to digital spaces and crypto. A recent report published by Intsights, read,

“Threat finance is evolving in Latin America as organized crime groups turn to cryptocurrency to launder large amounts of money and dive into the dark web to find hackers for hire. Latin American countries top the list of the world’s worst money laundering nations.”

Countries like Colombia in the past year had one of the highest deterioration in its AML score according to the Basal Institute on Governance.

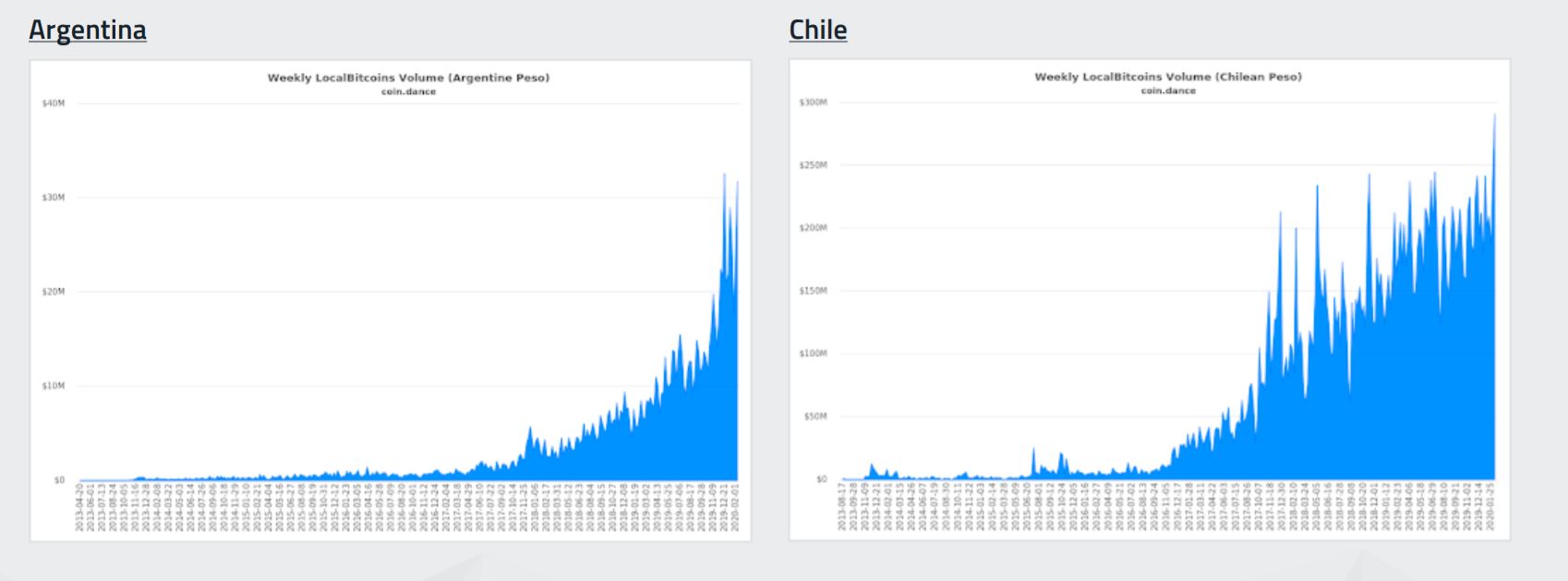

Source: Intsights

Many other countries like Argentina and Chile, while having seen growing adoption of Bitcoin usage, continue to perform extremely poorly when it comes to introducing strict laws that will prevent crypto from becoming a breeding ground for crime.

For certain demographics, such narratives further boost their suspicion and continue to hinder the adoption and use of Bitcoin, keeping them away from solutions that can alleviate and provide relief to their ‘unbanked’ status.

OhNoCrypto

via https://www.ohnocrypto.com

Jude Lopez, Khareem Sudlow