Zcash Price Analysis - Transactions up, while active addresses reach new low

Zcash (ZEC) is a privacy-oriented fork of the Bitcoin protocol, currently ranked 27th on the Brave New Coin market cap table. The market cap currently stands at US$410 million with US$17 million traded in the past 24 hours. The ZEC spot price is down 95% from the all-time high set in January 2018.

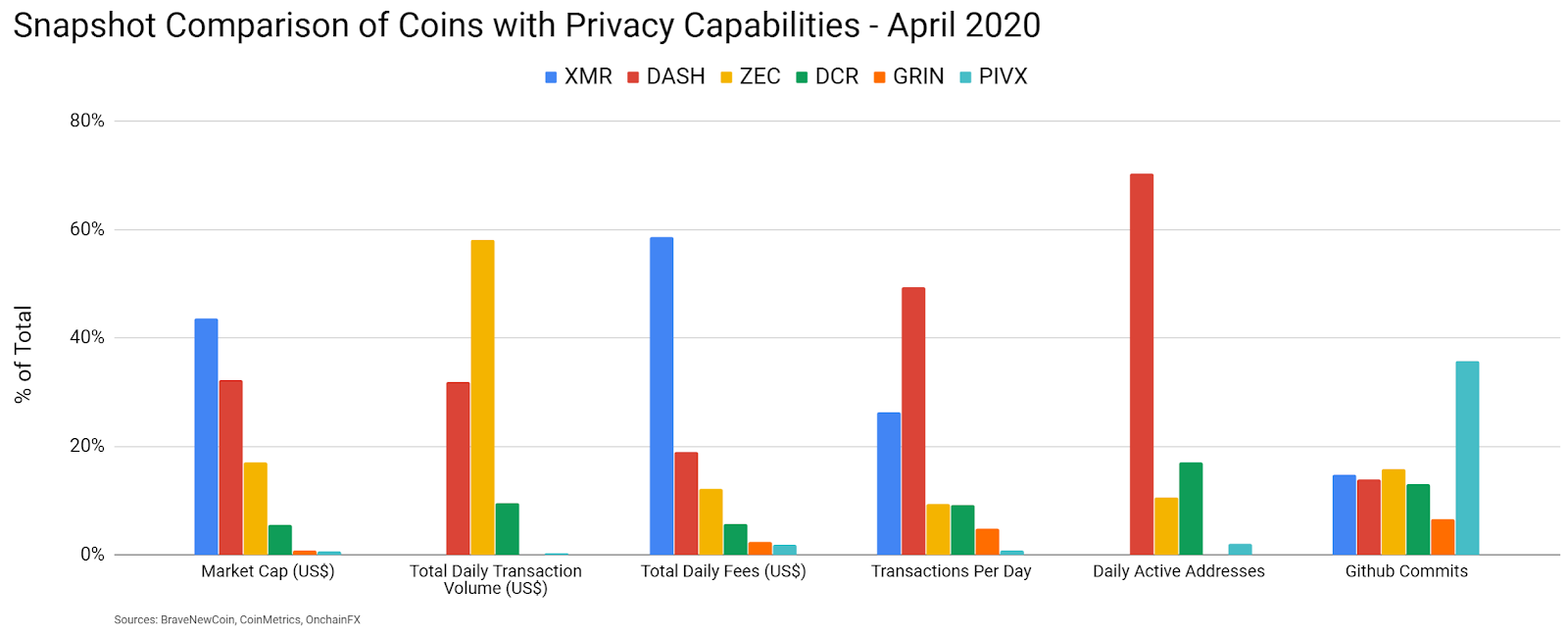

A quick comparison between coins with privacy capabilities shows that ZEC is leading the total daily transaction volume by a wide margin. Other coins with privacy features include Monero (XMR), DASH (DASH), Zcash (ZEC), Grin (GRIN), and PIVX (PIVX). However, both XMR and GRIN obscure blockchain transaction values and addresses.

The ZEC protocol is based on Zerocoin, which was developed in 2013 and later turned into Zerocash, with a difficulty adjustment algorithm adopted from DigiShield v3. The ZEC cryptocurrency went live in 2016 and trading began in late October 2016.

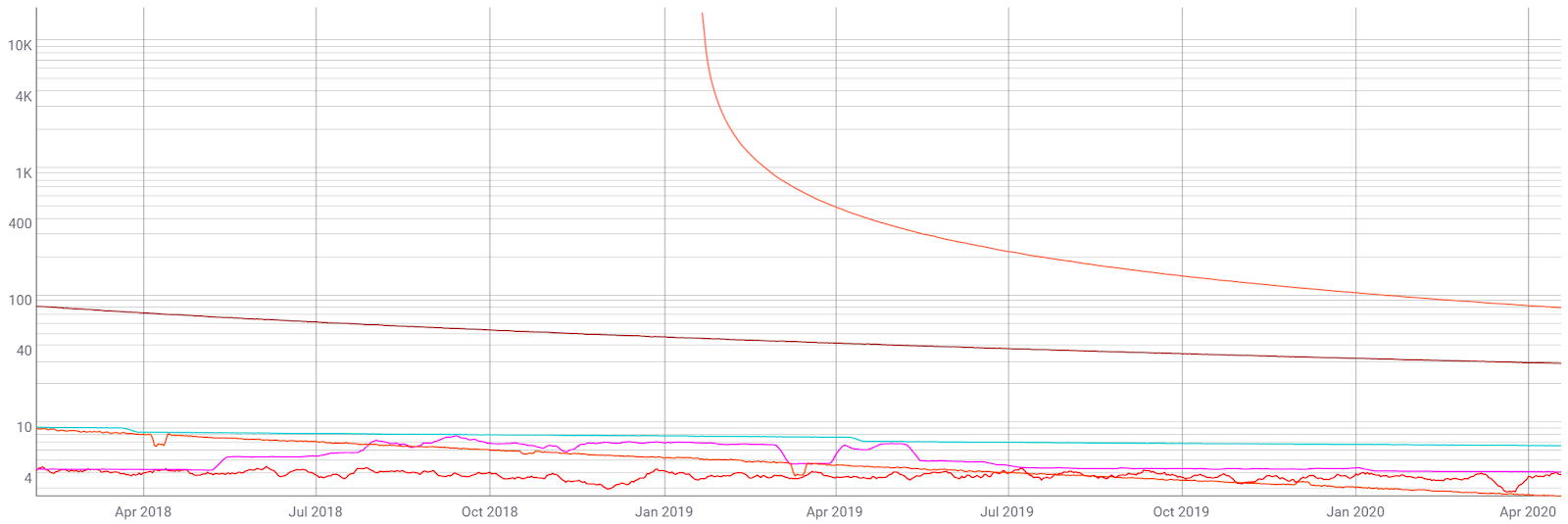

The total ZEC supply will grow to a final number of 21 million, with a current annual inflation rate of 29.24% (brown, chart below). The ZEC inflation rate is among the highest of any cryptocurrency. In contrast, Bitcoin (BTC), DASH, XMR, GRIN, and PIVX annual inflation rates are 3.91%, 6.58%, 2.63%, 80%, and 4.10%, respectively. ZEC block reward halving will occur in or around November 2020 at block 1,064,400, when the block reward will be reduced from 12.5 ZEC to 6.25 ZEC.

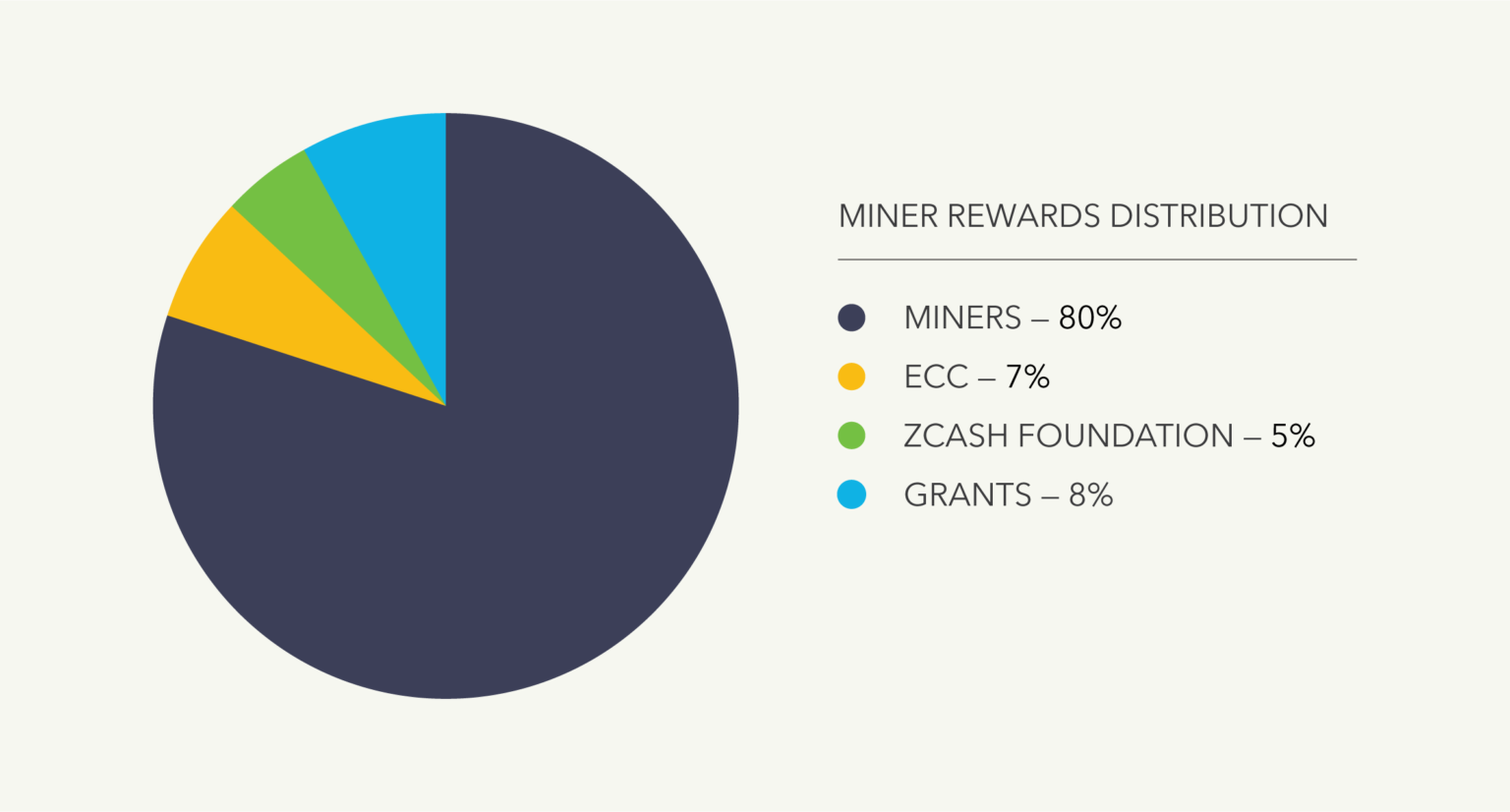

As opposed to the ICO model, ZEC uses a "Founders' Reward" for funding development. The Reward, which will eventually account for 10% of all minted ZEC, was initially agreed to be distributed as follows; 5.72% for founders, employees, and advisors, 1.65% to initial investors, 1.44% donated to the ZEC Foundation, and 1.19% to the Electric Coin Company, formerly the Zcash Company. The Reward is currently set to end after the block reward halving in November 2020. The Zcash Foundation also receives donations from members receiving the Reward.

In total, 20% of the mining rewards are distributed to founders or developers to promote the ZEC ecosystem. The ongoing incentive was designed to encourage a dedicated team to provide continual development for the project over several years.

According to a Q3 2019 transparency report, the Electric Coin Company (ECC) operated at a deficit of 30% in Q1 2019. In order for the ECC to maintain a balanced budget through 2020, the Founders' Reward and ZEC Foundation donation was reduced, or diluted, in order to increase ECC compensation. A Q4 2019 transparency report has not yet been released.

The ECC is led by founder and CEO Zooko Wilcox. The company constitutes what is described as “the creators and stewards of the Zcash currency.” Notable advisors included Bitcoin developer Gavin Andresen, Ethereum founder Vitalik Buterin, and Arthur Breitman from Tezos. Roger Ver was also one of the Zcash Company's initial investors. Last month, Andresen formally announced his departure as a technical advisor for ZEC.

The Zcash Foundation was created in February 2017, and is an independently operated 501(c)(3) “dedicated to building Internet payment and privacy infrastructure for the public good, primarily serving the users of the Zcash protocol and blockchain.” Current foundation members include Andrew Miller, Peter Van Valkenburgh, Amber Baldet, Matthew Green, and Ian Miers. Green and Miers were both part of the original ZEC founding team. According to a Q1 2020 report, the Foundation holds 101,000 ZEC, 42 BTC, and US$4 million.

Last year, the ECC and Zcash Foundation had been at odds regarding the ZEC trademark. The ECC announced the donation of the ZEC trademark to the Zcash Foundation in November 2019, with no strings attached. Under this new agreement, both parties must agree on any network upgrade intended to create a new consensus protocol for ZEC. If the parties ever disagree, and the disagreement cannot be resolved before activation of the network upgrade, the chain splits and neither implementation, neither the new fork nor the existing fork, can be called Zcash.

The trademark resolution occurred in the setting of Wilcox asking for further developer funding through a dev fund, currently set to expire this year. After a community sentiment poll in November, among the community advisory panel, ZEC forum and coin holders, the winning proposals included a 20% dev fund and significant funding for the ECC and Foundation. To contrast, both DASH and DCR allocate 10% of the total respective block rewards to fund development and operations.

The Zcash Foundation implemented several improvements to the ZEC ecosystem in the past year. In May, Zepio, a privacy-focused wallet which sends shielded transactions by default, was released. In June, a partnership with Parity Technologies to release a new software client, Zebra. Written in Rust, the open-source client is an alternative to zcashd and brings redundancy should zcashd fail. The client is also designed to detect problems related to the consensus mechanism and implementation-specific bugs. Ethereum (ETH) also has two clients, Parity and Geth, for similar reasons.

The Zcash Foundation also accepts grant proposals to fund privacy-oriented projects. In 2019, just over 1,000 ZEC, or US$40,000, was donated towards the Open Privacy Research Society, which promotes privacy-enhancing technologies. The non-profit group is currently working on Cwtch, a decentralized metadata-resistant messenger.

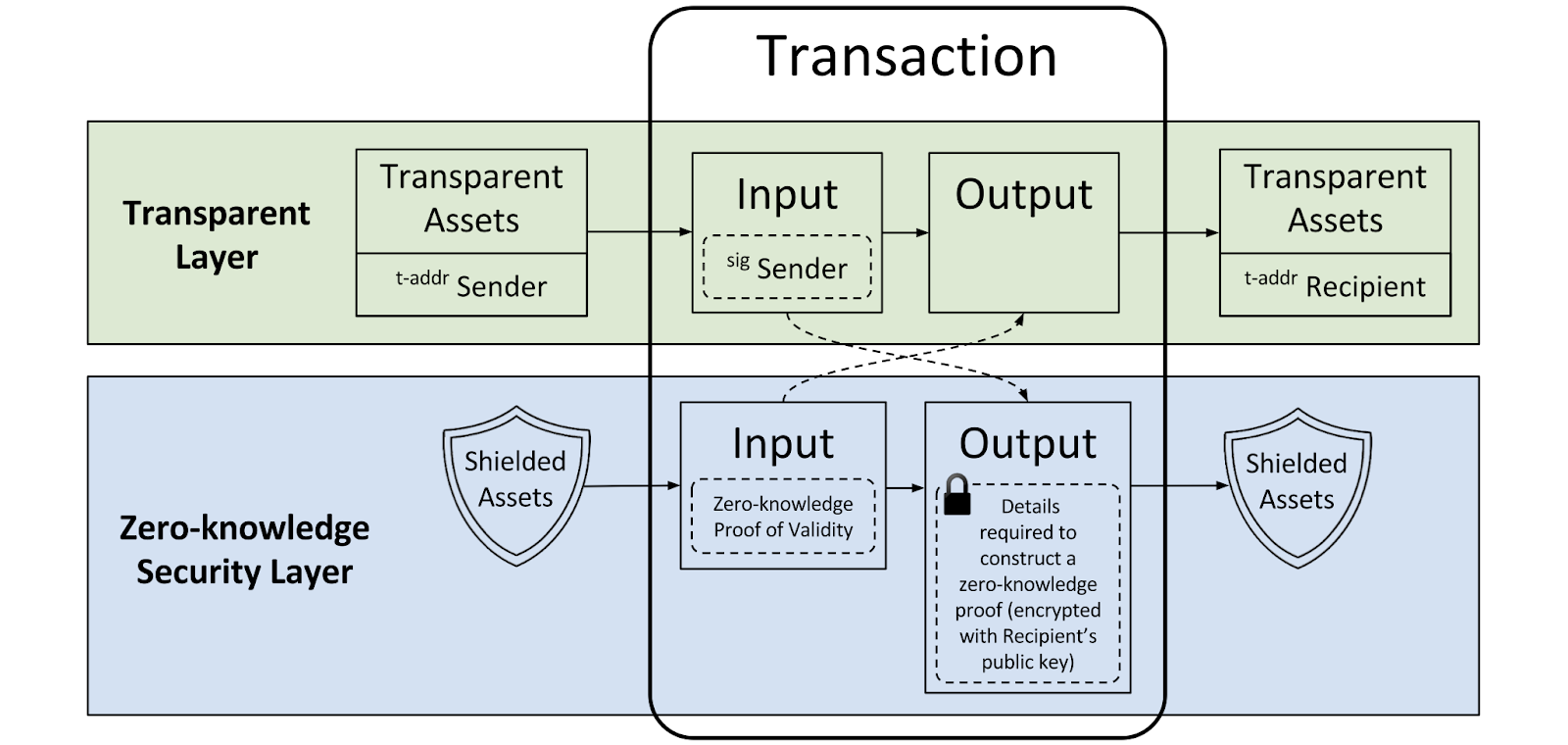

The ZEC protocol leverages zk-SNARKs, or Zero-Knowledge Succinct Non-Interactive Argument of Knowledge, which is based on zero-knowledge proofs. The protocol uses zk-SNARKs for optional privacy elements. ZEC addresses beginning with a "t" are transparent, and addresses that start with a "z" include privacy enhancements and are referred to these as "shielded addresses."

The ZEC protocol underwent two upgrades in 2018, “Overwinter” on June 26th, and “Sapling” on October 29th. Both upgrades were enacted through hard forks, and both enhanced transaction efficiency and scalability for shielded addresses.

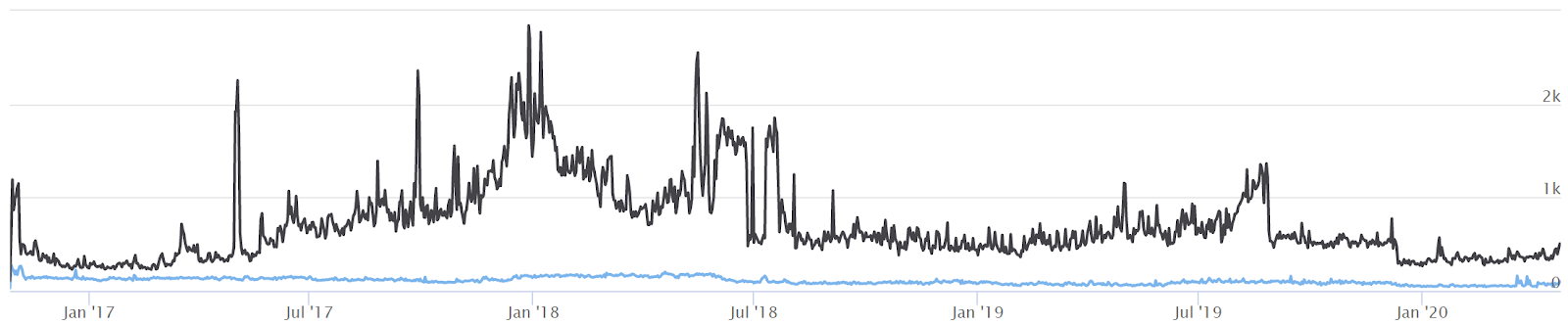

The Sapling upgrade has reduced the zk-SNARK proving time from 37 seconds to 2.3 seconds, and introduced zc (legacy shielded) and zs (Sapling shielded) addresses. The shielded transaction count continues to represent a small fraction of total transactions, currently around 16% (blue line, chart below).

The shielded pool would be much larger if exchanges did not disable the optional privacy functionality when sending ZEC. In December 2017, programmer jeffq discovered that shielded transactions on ZEC can be linked to non-shielded transactions unless both the sender and receiver were part of the “shielded pool” of anonymous transactions.

The most recent upgrade, “Blossom”, went live in December 2019 and included; shortening the target block times from 150 seconds to 75 seconds, a mempool size limit to prevent denial of service attacks, and discontinued backward compatibility with Sprout proofs to decrease the attack surface of the ZEC Codebase. The ECC also has some nascent plans to build a new chain with sharding and privacy by default. This process would also involve a chain migration, which is similar to the pending migration from ETH 1.0 to ETH 2.0.

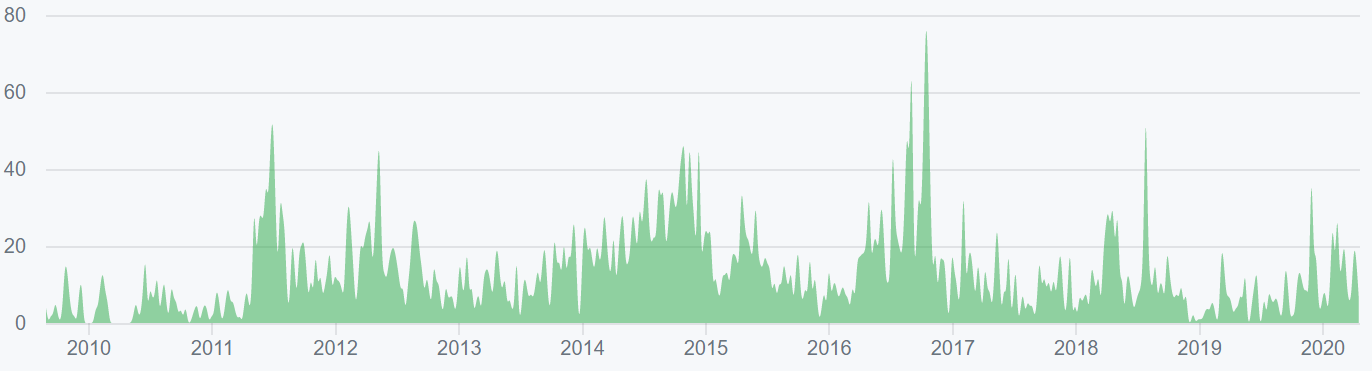

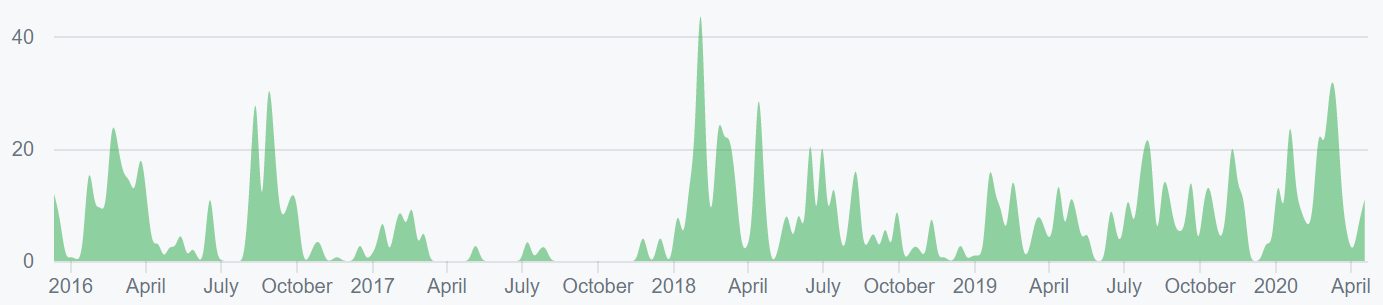

The ZEC project on Github has 19 repositories with 686 commits on the main repo in the past year (top chart, shown below). The Zcash Improvement Proposals repo (bottom chart, shown below) has also been fairly active over the past year. Both repos mainly consist of commits by developers Daira Hopwood and str4d. Zcashd v.2.1.1-1 was also released in February, which changed how nodes enforce timestamp requirements on block headers.

Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

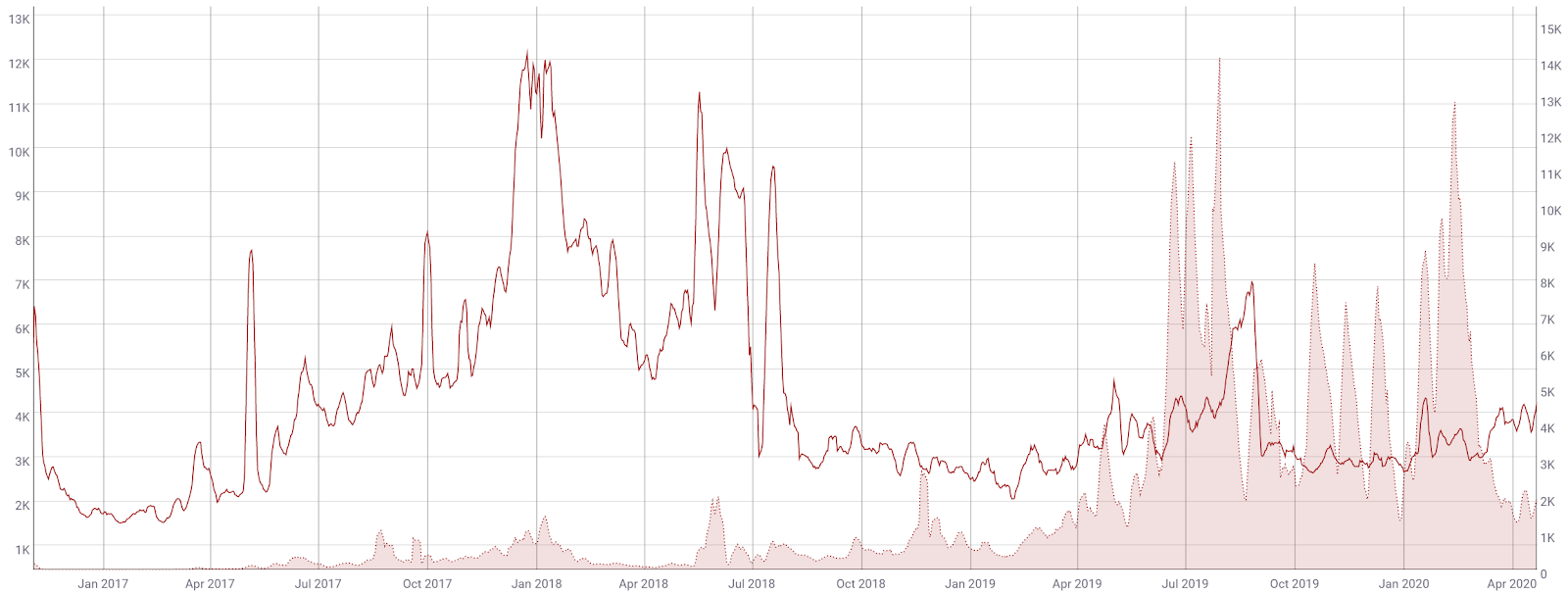

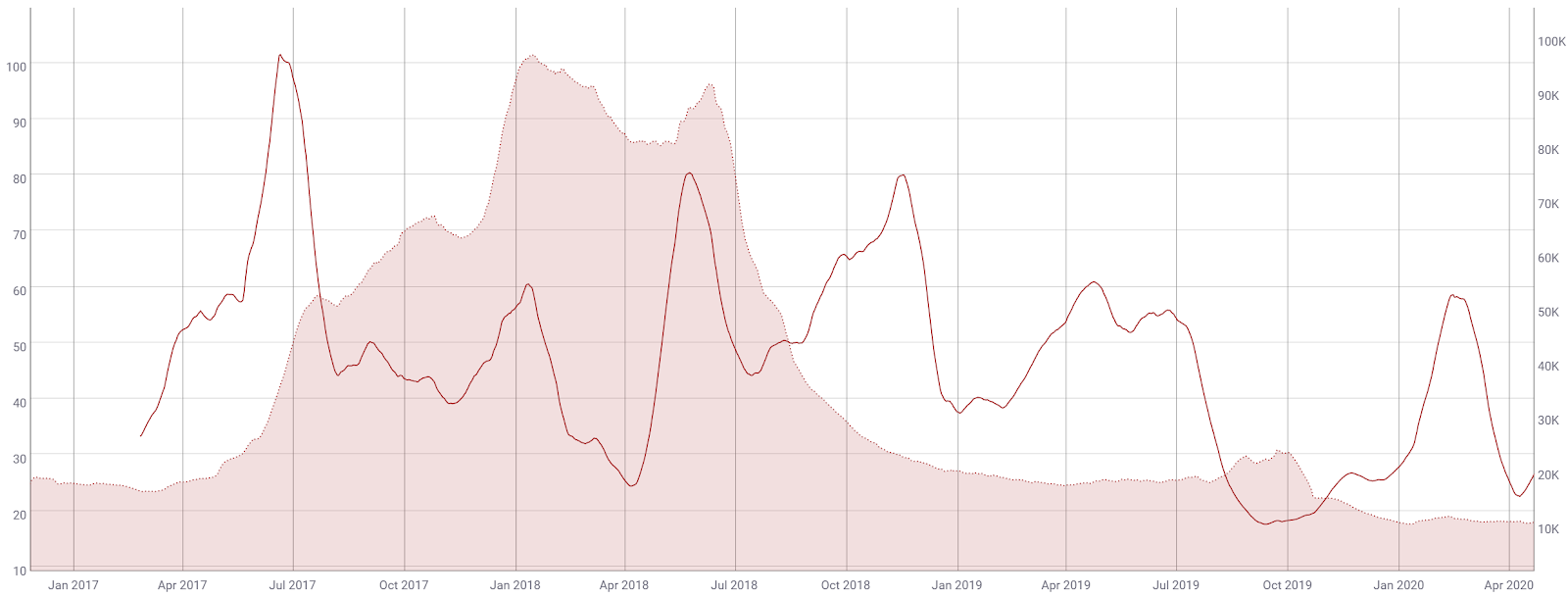

The total number of transactions per day on the network (line, chart below) has continued to rise since January, nearing multi-month highs. Transactions per day are, on average, down from levels seen in mid-2019 but above levels seen in late 2018. Average transaction values (fill, chart below) are currently US$2,000, up from an April 2018 low of US$62, and recently reached a new all-time high of nearly US$15,000.

The average daily block size (line, chart below) continues to sit at or near all-time lows in early 2020. Block size is a measure of both chain usage and a chain’s ability to scale. Average transaction fees (fill, chart below) have declined since June 2018, and are currently US$0.001. The Sapling upgrade reduced memory costs by 100x, which in turn now makes these transactions cheaper to send.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has dropped to historic lows following the price drop in mid-March. A clear downtrend in NVT suggests a coin is undervalued based on its economic activity and utility, which should be seen as a bullish price indicator, whereas an uptrend in NVT suggests the opposite. The 16% of shielded transactions on the chain are not included in this calculation, meaning the true NVT is likely slightly lower than the metric suggests.

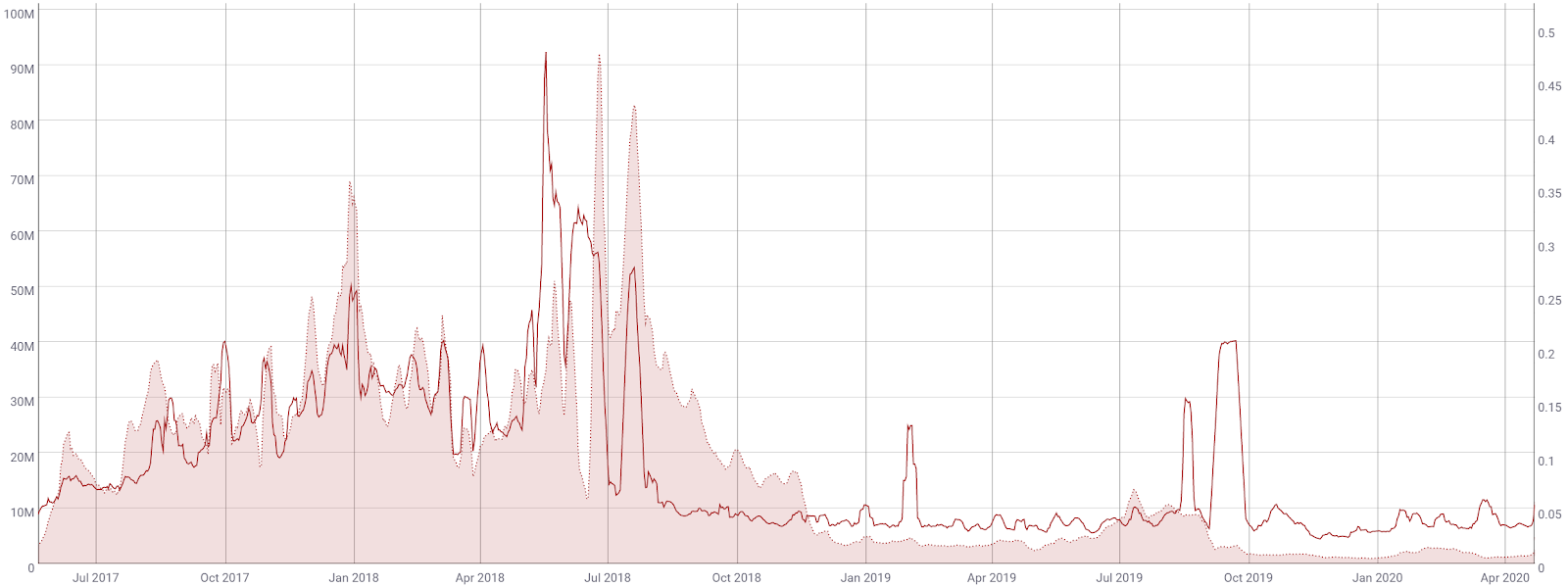

Monthly active addresses (MAA) have declined substantially from the January 2018 high of 96,000 to the current 11,000 (fill, chart below), now sitting at an all-time low. Active addresses are important to consider when determining the fundamental value of the network based on Metcalfe's law. ZEC has fewer MAAs than BTC, ETH, DASH, DCR, Litecoin (LTC), DOGE (DOGE), Bitcoin Cash (BCH), and Ethereum Classic (ETC).

The market cap divided by the realized cap (MVRV) is another crypto-native fundamental metric used to assess overbought or oversold conditions. Realized cap approximates the value paid for all coins in existence by summing the market value of coins at the time they last moved on the blockchain.

Historically, periods of an MVRV less than 0.4 have represented oversold conditions, whereas periods of an MVRV greater than 1.0 have represented overbought conditions. Of the MVRV levels above four since January 2013, all three have coincided with record highs in price. Currently, MVRV is 0.49 and rising, which is near the bottom of the range. This suggests bullish conditions following a drop below 0.40 in mid-March.

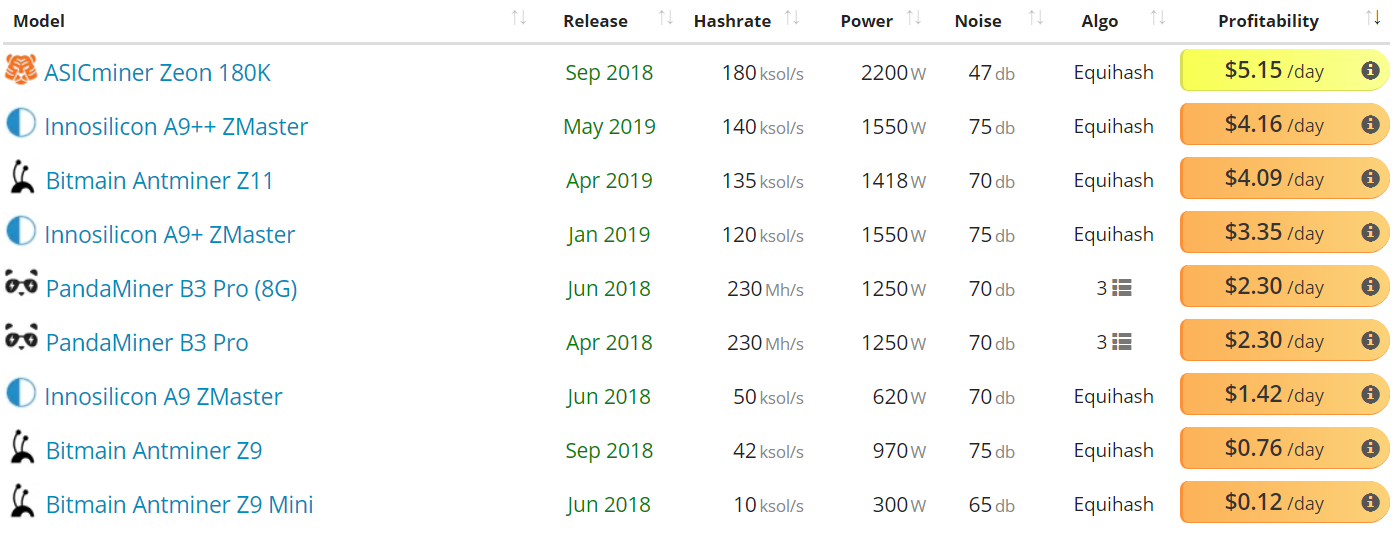

ZEC uses the Equihash Proof of Work (PoW) algorithm, which was originally thought to be ASIC-resistant. However, Bitmain developed ASIC miners for the Equihash algorithm, which first went live on the network in May 2018, and shipped broadly in June 2018. All available Equihash ASICs are currently profitable at US$0.04 per KWh (below).

In response to the rise in ASIC use on the chain, the ZF announced an initiative towards researching ASIC resistance on the chain and the ECC concluded that the “ultimate objective” is the broad inclusion of both hobbyists and professionals. The ZEC community voted and decided to discourage ASIC resistance as a priority and instead focus on currently unused PoW algorithms. Any future changes will need approval through the ZEC Improvement Proposal (ZIP) process.

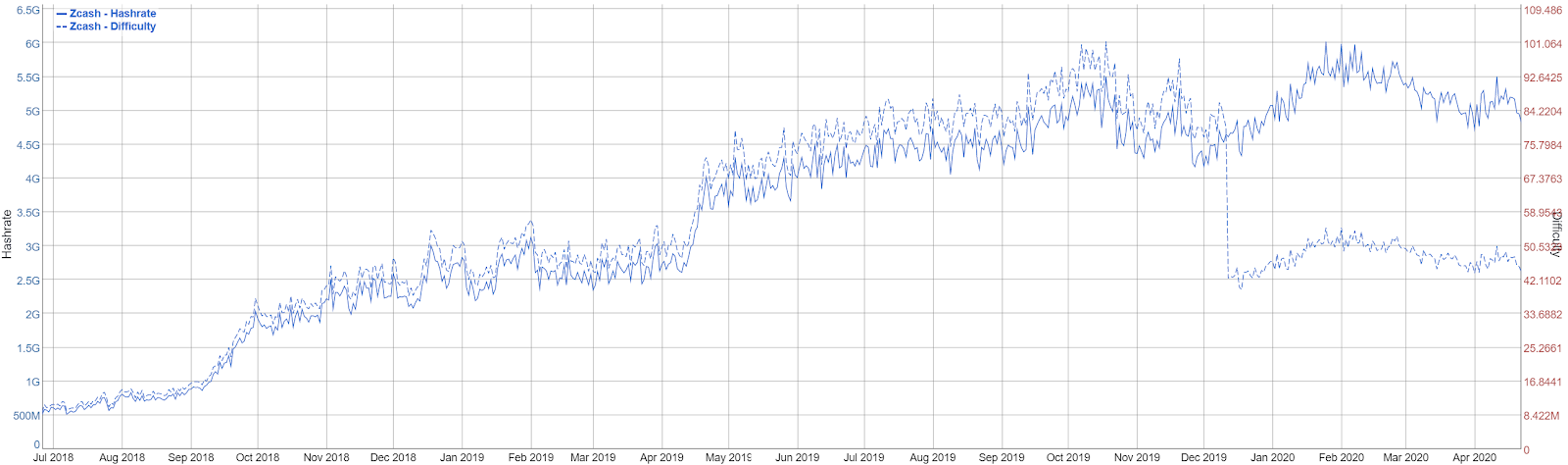

Hash rate and difficulty increased rapidly since April 2019, setting a new all-time high in mid-October. Since then, hash rate has plateaued, even as difficulty dropped significantly after the Blossom protocol upgrade.

The use of ASICs to mine a cryptocurrency can mean that the network becomes much less decentralized over time as the hardware continually squeezes out miners with less hashing power. While constant PoW adjustments decrease ASIC use substantially, the process may also lead to a different type of centralization through the need for constant node upgrades.

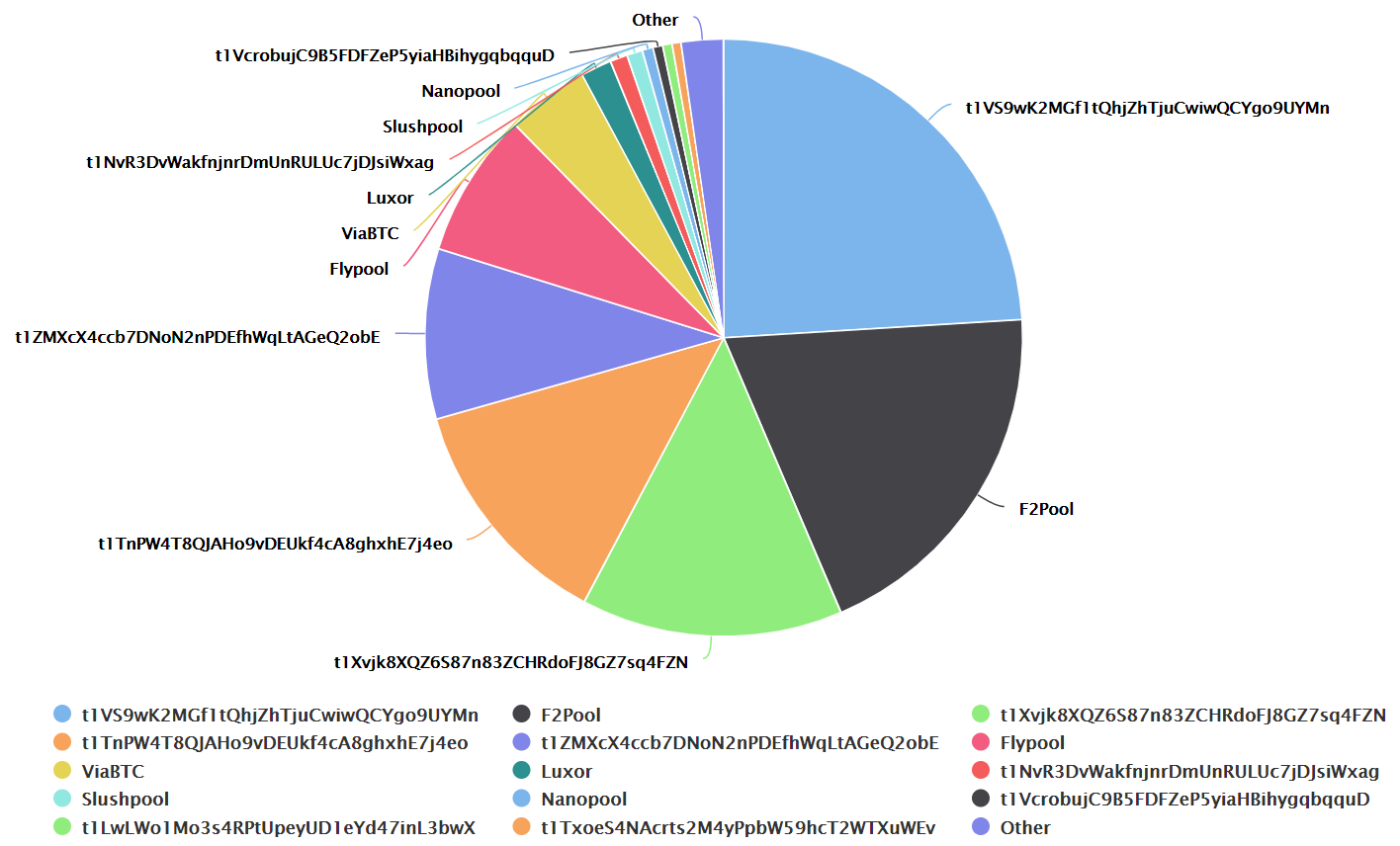

Over the past week, ZEC hash rate has been relatively distributed between most of the publicly available mining pools. F2Pool, Slushpool, Flypool, Luxor, ViaBTC, and Nanopool have accounted for 35% of the hash rate recently, with an unknown miner, t1VS9w, accounting for 24% of the network recently.

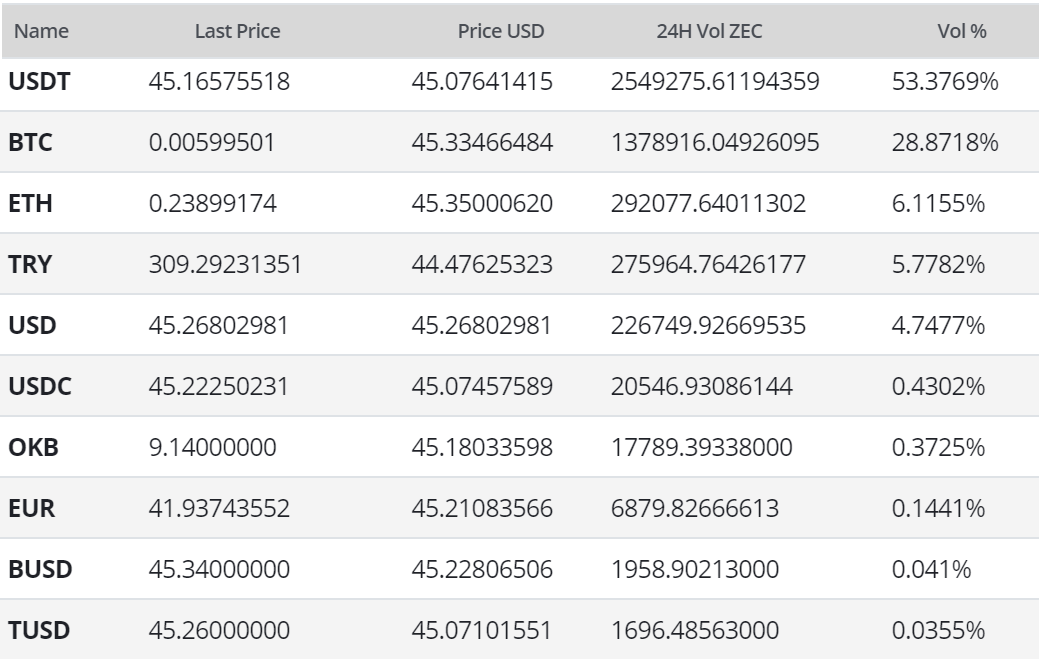

In the markets, ZEC exchange-traded volume over the past 24 hours has predominantly been led by Tether (USDT) and Bitcoin (BTC) pairs on Huobi, Binance, and OKEx.

ZEC has gained several exchange listings over the past three years, being added to; the Gemini exchange in May 2018, Bittrex in September 2018, Coinbase in December 2018, and eToro in early 2019. Binance also added several ZEC trading pairs in March 2019 as well as a 50x leverage ZEC/USDT perpetual futures contract in February. Binance.US listed a ZEC/USD pair in October 2019. OKEx launched ZEC/USDT and ZEC/BTC trading pairs in February. Bitstamp has also announced plans to potentially add ZEC in the near future. This week, Binance Savings added ZEC as a flexible deposit savings account with a 1% annual yield.

In June 2018, the U.S. Secret Service recommended the regulation of all privacy coins, including ZEC, Monero, and Dash. Japan's Financial Services Agency has already pressured exchanges to drop the same assets, citing criminal activity. Coincheck, one of the more popular Japanese exchanges, delisted all three coins in May 2018. In 2019, the UK-based CEX.io delisted ZEC and DASH due to banking pressures. Coinbase UK also delisted ZEC in 2019 for unknown reasons. Despite being approved by Coinbase customers in New York, the ability to send shielded transactions from Coinbase is currently disabled.

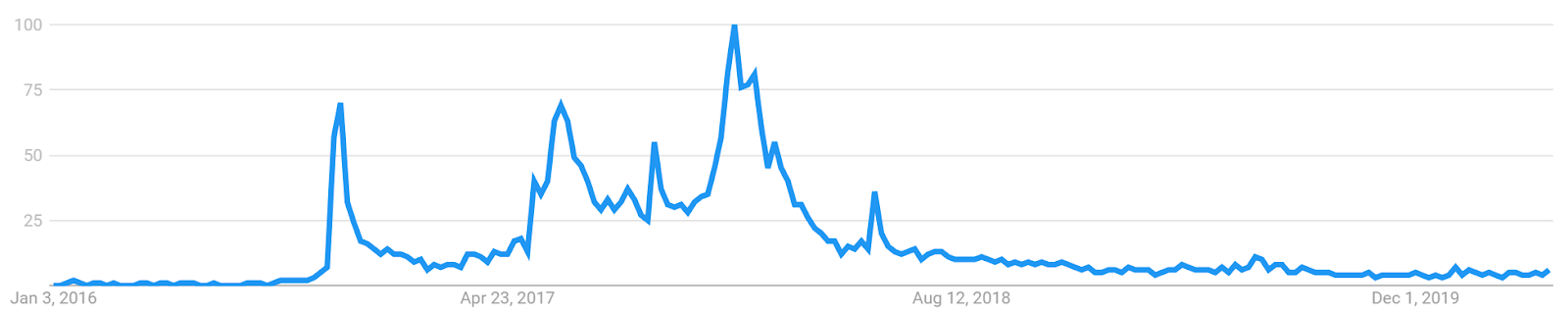

Worldwide Google Trends data for the term "zcash" has remained flat since July 2018, with a slight uptick in June 2019. A slow rise in searches for "zcash" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time.

Google Trends data has been found to have some correlation with crypto prices. A 2015 study found a strong correlation between the Google Trends data and BTC price, while a 2017 study concluded that when the U.S. Google "bitcoin" searches increased dramatically, BTC price dropped.

Technical Analysis

ZEC continues to highly correlate with most of the crypto market as a collective mean reversion attempt is completed. Any new bullish trend can be evaluated using exponential moving averages, volume, the Ichimoku Cloud, and pitchforks. Further background information on the technical indicators discussed below can be found here.

On the daily chart for the ZEC/USD pair, the 50-day Exponential Moving Average (EMA) and the 200-day EMA crossed bullish on February 4th, only the third such cross since trading inception for the pair. This Golden Cross was short-lived, with a Death Cross on March 15th.

Price is now above both key EMAs thanks to a marketwide mean reversion attempt after the 65% drop in mid-March. Further, the Volume Profile of the Visible Range (horizontal bars, chart below) suggests a large congestion node from US$47 to US$67.

Bitfinex open interest is 80% long (top panel, chart below), with the number of long positions changing very little since October and shorts spiking to all-time highs earlier this year. Over the past few weeks, shorts have remained flat. A significant price movement downwards will result in an exaggerated move as the long positions will begin to unwind. Additionally, there are no volume or RSI divergences at this time to suggest waning bullish momentum.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish; the spot price is inside of the Cloud, the Cloud is bearish, the TK cross is nearly bullish, and the Lagging Span is below the Cloud and above the current spot price. The trend will remain bearish so long as the spot price remains below the flat kumo at US$47.

Lastly, on the ZEC/BTC pair, trend metrics suggest a bullish trend as price sits above both the 200-day EMA and the daily Cloud. Price also sits just below the median line of a multi-year bearish pitchfork. Once the trend is defined, the spot price will continually attempt to return to the median line (yellow). Upside resistance for the pitchfork sits at 0.014 BTC, which matches VPVR resistance in that zone. Bitfinex open interest is currently 93% long, and there are no volume or RSI divergences at this time to suggest waning bullish momentum.

Conclusion

Controversy has surrounded ZEC \thanks to the Founders’ Reward, which replaced a traditional ICO. The purpose of the Reward was to continually pay those who were early investors in ZEC, as well as fund coin development and promote the ZEC ecosystem. The Reward accounts for 20% of the block reward, up to a maximum of 2.1 million ZEC, and ends after the first block reward halving in November 2020.

Based on community sentiment polling, a continued 20% block reward allocation towards ZEC development and ecosystem management will continue to occur past the halving later this year. Future protocol upgrades for ZEC potentially include changing the privacy mechanism to default and migrating the chain from Proof of Work to Proof of Stake.

The block reward funding allocation includes; 7% for the main ZEC developer, the Electric Coin Company (ECC), 5% for the Zcash Foundation, which supports the ecosystem through indirect ZEC development, such as wallets and nodes, or privacy-oriented grant proposals, and 8% towards independent grant proposals. This is in contrast to other coins with developer funds, like Dash and Decred, which allocate 10% of the total block reward to a developer treasury.

On-chain statistics show a slight rise in transactions per day over the past few weeks with an all-time low in active addresses. Even with the integration of Sapling, shielded addresses are only being utilized by 16% of transactions. NVT and MVRV, both an inverse measure of on-chain economic activity, lean bullish.

Technicals for ZEC/USD show a successful mean reversion attempt to the 50% retracement zone since the mid-March drop. Any further highs will initiate bull market conditions as price will then sit above both the 200-day EMA and the daily Cloud. Technicals for ZEC/BTC show a definitive bullish trend with price above both the 200-day EMA and the daily Cloud. However, ZEC/BTC sits within a multi-year bearish pitchfork with additional upside resistance before invalidation. Potential long-term upside targets for ZEC/USD and ZEC/BTC sit at the psychological zones of US$250 and 0.015 BTC, respectively.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow