Crypto Market Forecast: 4th May

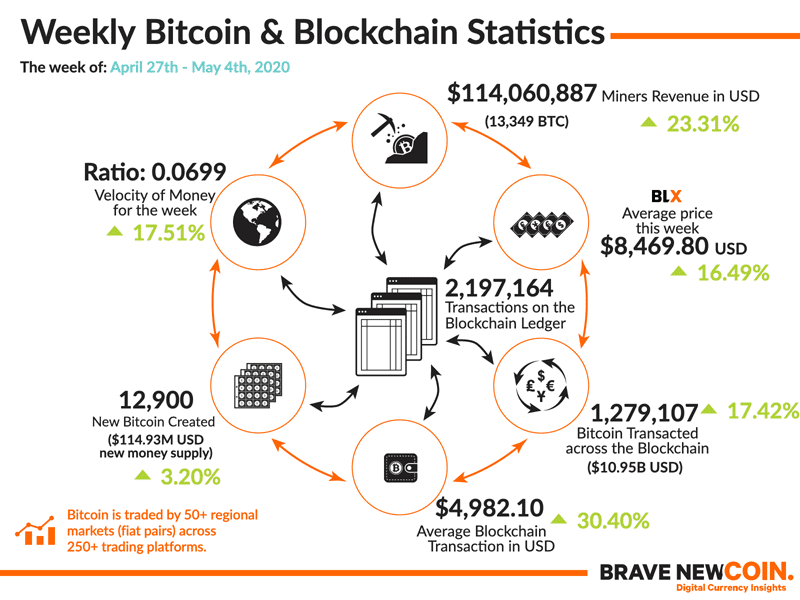

Digital Asset markets built on recent bull market gains, rising in value again over the last week. The USD spot price of the largest asset on Brave New Coin’s market cap table, Bitcoin (BTC), increased ~14%. The second and third assets on the table, Ethereum (ETH) and XRP (XRP), rose by ~5% and ~11% respectively. The overall market cap for crypto-assets increased by ~13%.

On the 30th of April, venture capital firm Andreessen Horowitz announced a raise of US$515 million for “Crypto Fund two,” their new blockchain venture fund. Investment areas of interest within the blockchain tech space include Next Generation Payments, Moden Store of Value, and Decentralized Finance.

In an interview with Fortune, the fund co-manager, Chris Dixon, suggested that Silicon Valley giants have a long-term interest in the blockchain. “It’s very rare that major, new computing paradigms come along, and we think this is on the scale of cloud and mobile for the Internet.” Some of A16z’s previous industry bets, like the Dfnity public blockchain, are expected to be released this year.

As part of the BNC Inquisitive VC series, Partner at Pantera Capital Paul Veradittakit noted the emergence of new competition for Crypto-specific VC firms since 2016. “Back then it was just Pantera, Digital Currency Group, and Blockchain Capital,“ Veradittakit states. “Now we have partners from the likes of Sequoia, Lightspeed, and Benchmark starting funds. The competition, the number of firms, and capital have really transformed quite a bit.”

In the short term, it continues to appear that Bitcoin and crypto markets have decoupled from legacy market price movements. The S&P 500 index slid by ~1% last week. Crypto markets continue to benefit from strong short term macro fundamental headwinds.

The Bitcoin network’s 4-year block reward halving is expected to occur between the 12th-13th of May. Bitcoin network fundamentals have performed bullishly in the lead up to the event. Additionally, There also appears to be a new purchasing demand for bitcoin materializing on US exchanges. Since the end of March, US Dollar denominated BTC markets have traded at a premium and observed stronger buy-side pressure.

The week ahead in Crypto

12th May- Bitcoin Block Reward Halving

Next Tuesday is the expected date of the upcoming 4-year block reward halving for the bitcoin network, when the number of new bitcoins that are created via the block reward is reduced by half. The next halving will be the third such event, and the current block reward of 12.5 bitcoins will reduce to 6.25 bitcoins. Hashrate has increased by ~31% in the lead up to the 2020 halving, meaning miners have increased block production in anticipation of the supply-side event.

It was a bullish week for large-cap assets in the Brave New Coin Market cap top 10, with many enjoying double-digit gains. Payment blockchain token XRP (XRP) was one of the week’s best performing assets. On April 30th, Ripple Labs published the Q1 XRP markets report. The report states that the Ripple On-Demand Liquidity (ODL) payments network observed a US dollar increase in transaction volume of 294%, when compared to the first quarter of 2020.

Bitcoin (BTC) markets performed bullishly over the last week, breaking past both the US$8000 and US$8,500 thresholds, ending the week near the US$9000 level. On April 30th, Brave New Coin analyst Josh Olszewicz suggested a bullish trend shift for the top three Crypto assets may be incoming. In the data snippet, Olszewicz points out that BTC, ETH, and, XRP have all historically had strong calendar second quarters. He also details a number of bullish technical indicators, including the “Golden Cross” of the 50 and 200-day price moving averages, and the current Ichimoku Cloud support and resistance levels.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow