Data Snippet - Bitcoin fees triple after block reward halving

Bitcoin was designed to be a deflationary electronic cash system with a pre-programmed supply limit of 21 million bitcoins. The backbone of the network is a distributed ledger known as the blockchain. As transactions are broadcast across the network, they are collected into blocks.

At the same time, miners work to solve difficult proof-of-work. When a solution is found, a new block is created. In an effort to incentivize network participation, and distribute coins, each new block in the Bitcoin blockchain contains a reward. The incentive can also be funded with transaction fees. Miners rely on this combination of block rewards and fees to fund their operations.

TODAY WE’RE DIVING INTO BITCOIN MINERS REVENUE

To reduce the rate that new bitcoins are produced as the circulating supply approaches the 21 million limit, the bitcoin protocol reduces the number of new bitcoins in each new block by 50 percent every 210000 blocks, which is every 4 years.

INSIGHTS BREAKDOWN

- The block reward was halved on the on 11th May 2020, around 07:23 pm UTC, on the 630000th block.

- The reward went from 12.5 BTC to 6.25 BTC.

- The rate of inflation went from 3.82% to 3.72% p.a.

- On average 900 BTC will be distributed per day.

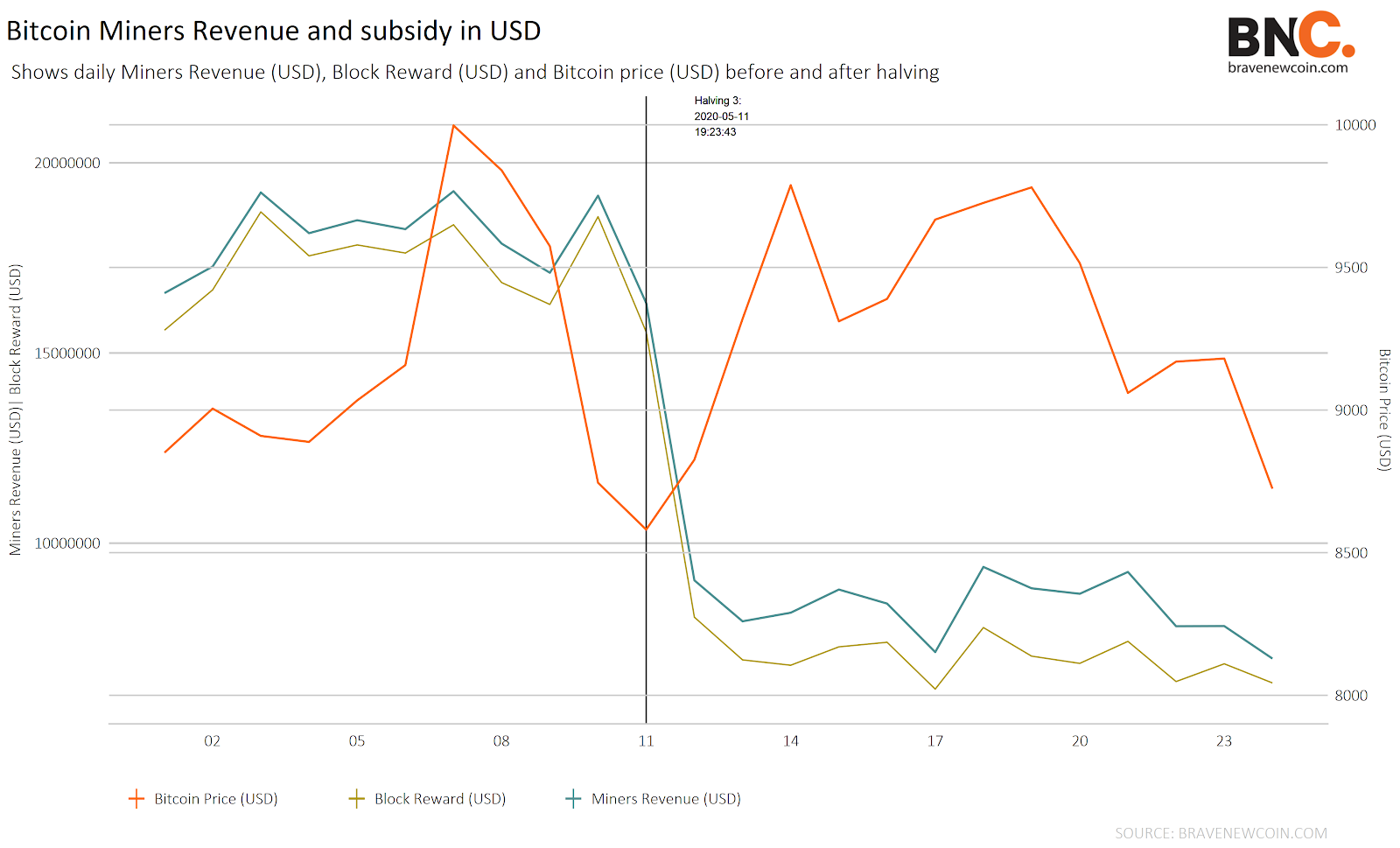

While the block reward dropped 50%, miner’s revenue dropped ~47%, from US$16.3 million USD on the 11th, to US$9.02 million USD on the 12th. The difference in the USD/BTC spot price softened the blow.

In March 2020, there was a huge drop in BTC/USD markets, bringing spot prices to ~US$5k, amid global turmoil during the COVID-19 pandemic. Miner’s revenue subsequently dropped to US$7 million, which was less than the recent post-halving earnings.

AVERAGE TRANSACTION FES

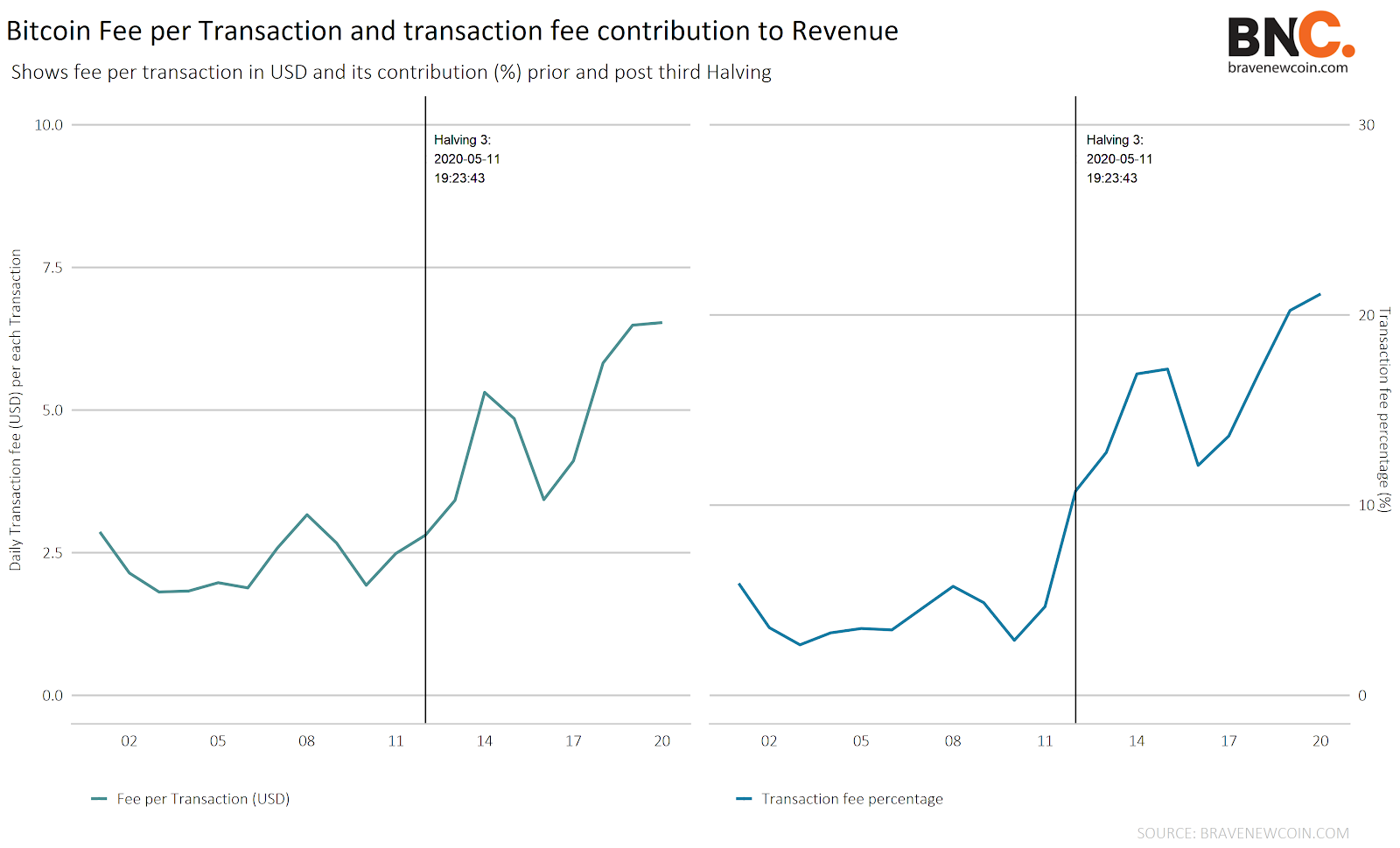

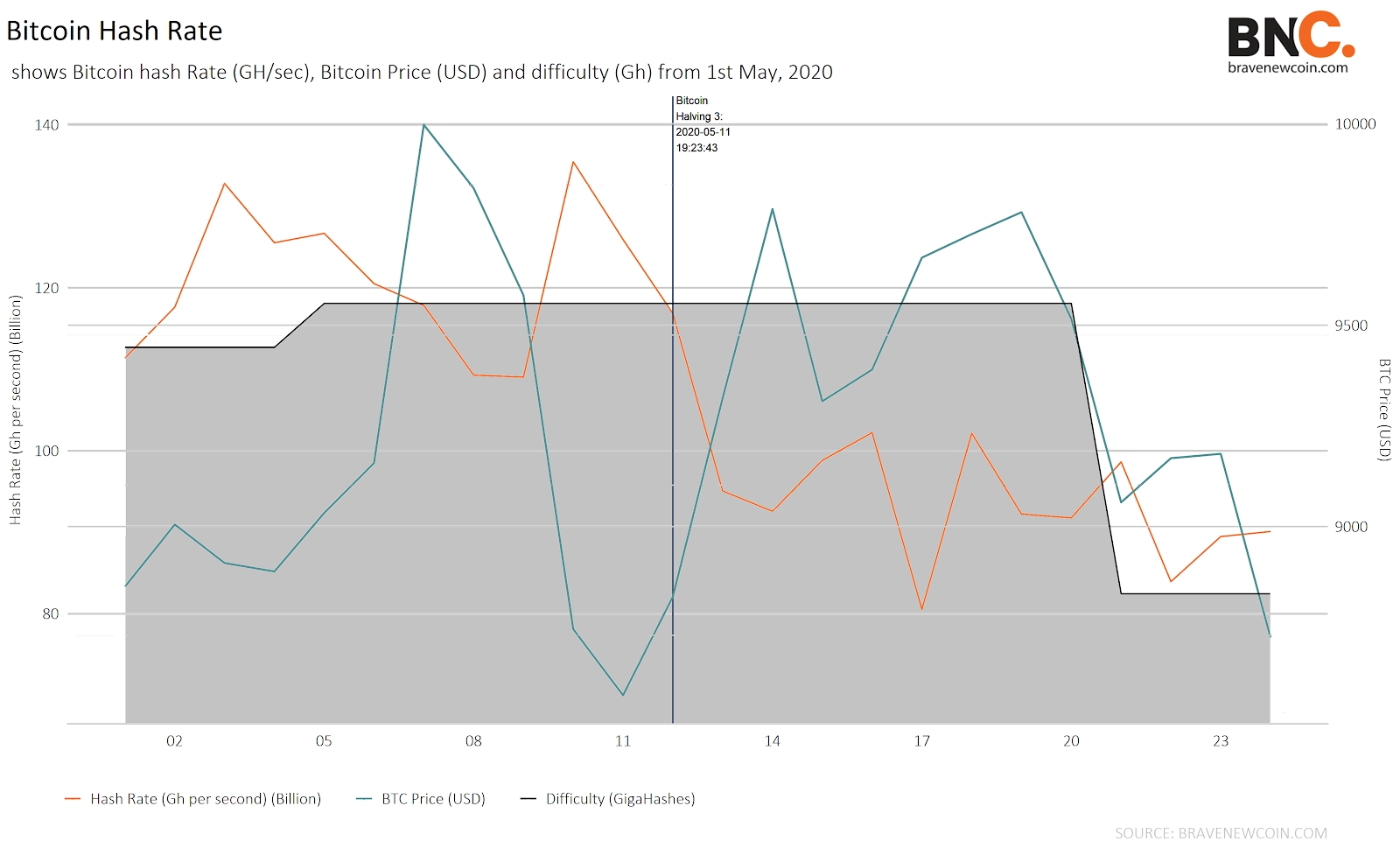

The below chart represents data from 1st May 2020 to 24th May 2020.

INSIGHTS BREAKDOWN

- There has been a consistent rise in transaction fees post halving.

- The average fee has increased from US$1.9 to US$6.5 within the past 10 days.

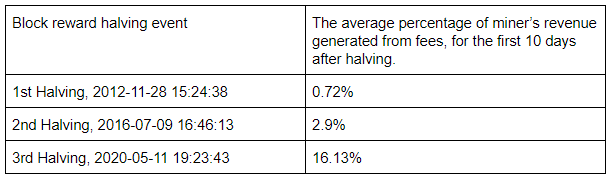

- Transaction fees contributed ~16.13% to the miner’s revenue over the past 10 days, on average, with the highest being 21% on 21st May 2020.

This is the first time in the history of the Bitcoin network that we have seen such a drastic increase in fees contributing to miners revenue, as a percentage, over the 10 days after a halving event.

LET’S LOOK INTO THE AVERAGE TRANSACTION FEE FOR BITCOIN AND ETHEREUM

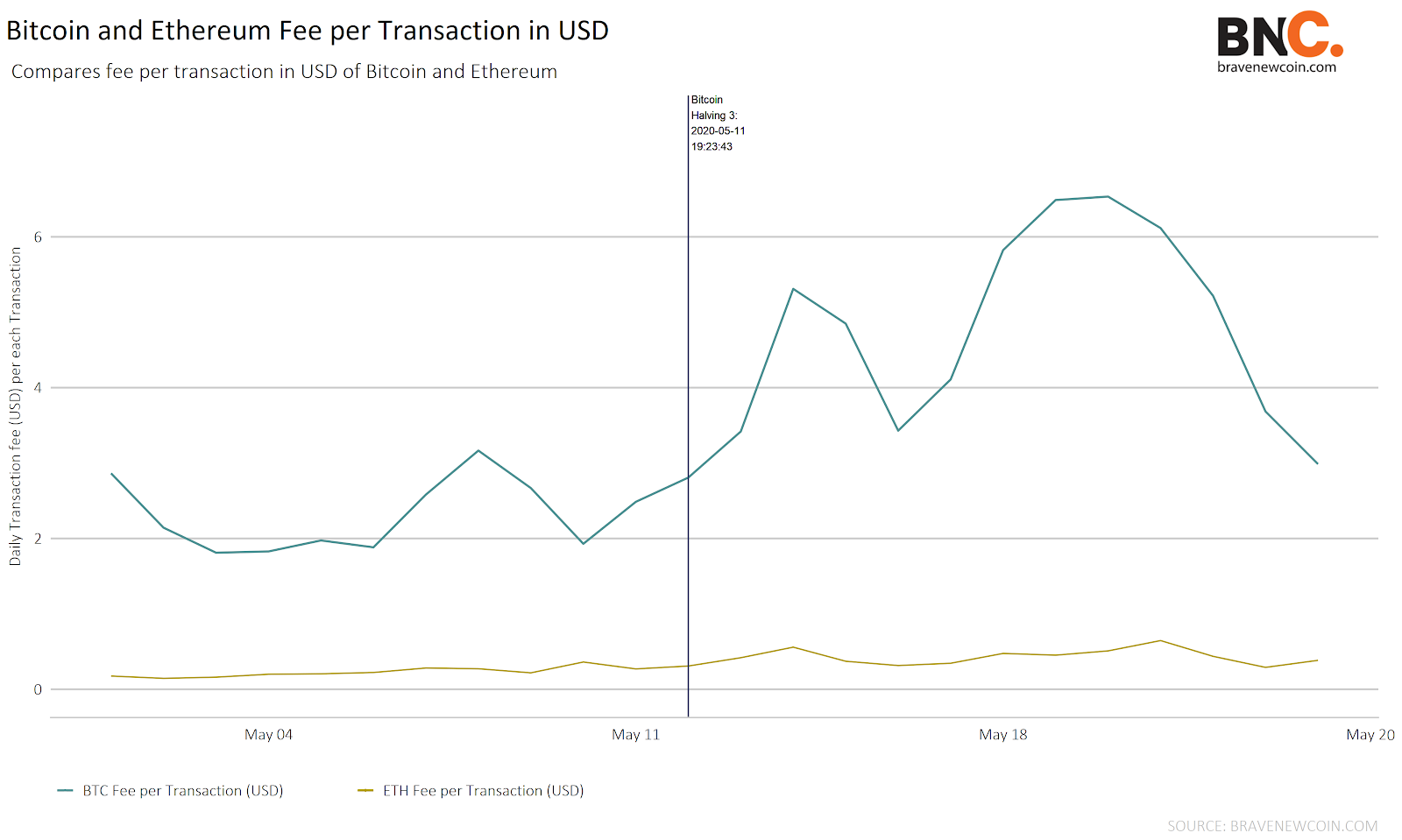

- The Bitcoin fee per transaction has increased drastically in 10 days.

- The average fee has grown by 162%.

Alongside the average transaction fee increase for Bitcoin, there has also been an increase in transaction fees on the Ethereum blockchain. The average Ethereum transaction fee has seen a 140% increase, from just over US$0.17 to US$0.64.

A QUICK PEEK AT THE BITCOIN HASH RATE AND DIFFICULTY

To compensate for increasing hardware speed and varying degrees of network participation over time, the proof-of-work difficulty is determined by a moving average, targeting an average of 6 blocks per hour. Bitcoin difficulty adjusts every 2,016 blocks, approximately every 14 days, to ensure that the block time between blocks remains to 10 minutes.

INSIGHTS BREAKDOWN

- As we can see from the above chart, the amount of computational power or hash rate, applied to the network has decreased by 28.5%.

- The average hash rate is 94 Billion gigahashes per second per day post halving.

- Because of the decreasing hashing power after the halving, there are only 120 blocks being generated every day, on average, which makes the average block time more than 12 minutes.

- Bitcoin’s proof-of-work difficulty recently decreased to 6%. The next difficulty adjustment is on schedule for the 3rd of June 2020.

OhNoCrypto

via https://www.ohnocrypto.com

Sumathi Pandi, Khareem Sudlow