Data Snippet - Bitcoin price crash before the halving

The Bitcoin block reward halves every 210000 blocks, or roughly every 4 years. The current block reward is 6.25 BTC, having been reduced by 50 percent from the previous reward of 12.5 BTC. The current halving happened after 630000 successful executions on to the blockchain.

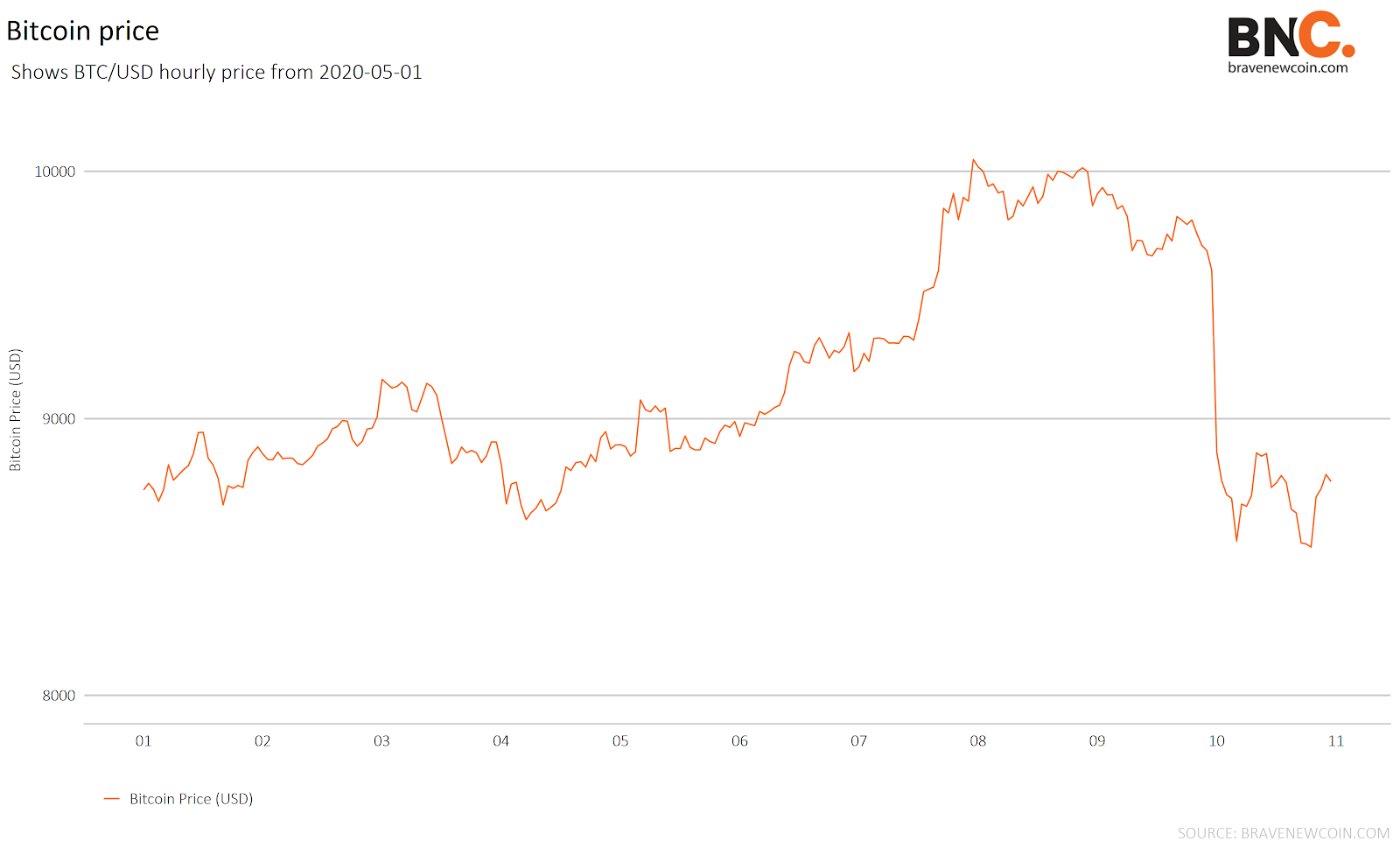

There was a US$1475 drop in the price of Bitcoin just one day before the halving. The spot price dipped ~11% on 10th May 2020, at 12 am UTC, dropping to US$8873 from the local high of US$10018 established on 8th May 2020.

LET’S LOOK INTO BITCOIN HOURLY USD/BTC PRICE CHART

The above graph is plotted using the hourly closing value of BNC’s Bitcoin Liquid Index.

Brave New Coin (BNC) generates 30 seconds interval Bitcoin Liquid Index and block-level OHLC data. The BNC Bitcoin Liquid Index (BLX) represents the fair value of Bitcoin and is based on trade and order book data sourced from the world’s most trusted and liquid trading platforms. The BLX is ideal for settlements and accurate spot pricing and is part of the Liquid Indices Program. alongside the Ethereum Liquid Index (ELX) and the XRP Liquid Index (XRPLX).

Looking into the impact of BTC price drop:

- When Bitcoin was is trading at a higher price point, miners are able to achieve healthier margins. However, as the price drops, only the newer generation, more efficient mining machines stay profitable.

- Mining efforts continued even after the price drop, albeit with a lot of fluctuations. The hash rate went up to 220 billion gigahashes per second on 10th May 2020 at 1 am UTC, the hour after the price crash, and then suddenly decreased to 75 Billion Giga hashes per second just 2 hours after the crash.

- The average block time remained relatively stable. It took an average of about 10.5 minutes for every block to relay on the 9th of May 2020, just before the price crash, and 9.5 minutes per block after the price crash.

- There was a slight decrease in the fee per transaction 6 hours of the price drop, and then it increased to approx US$3.5 a few hours before halving.

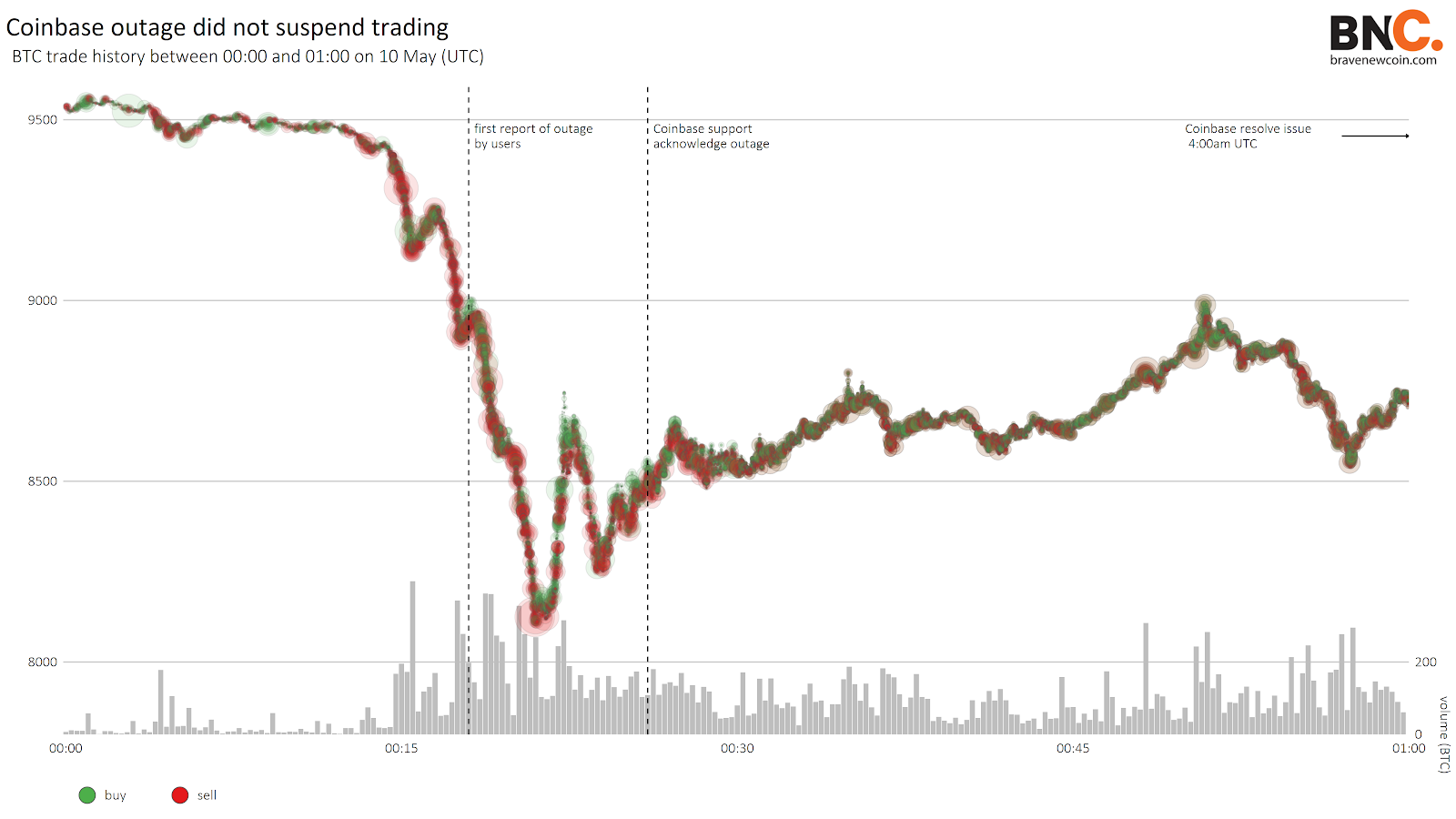

As soon as there was a drop in the price, the Coinbase website started to return a 502 status code 502 to users. News that the website was unavailable quickly circulated on social media. Trades continued to execute on the exchange during the website outage, which may have been existing trades on the platform, or trades submitted through the API.

- Volume increased around 00:15, as the price of bitcoin began to drop

- In spite of the website outage, trade volume remained elevated for a period of time

OhNoCrypto

via https://www.ohnocrypto.com

Sumathi Pandi, Khareem Sudlow