Data Snippet - Bitcoin transaction fee increase

#crypto #bitcoin

OhNoCrypto

via https://www.ohnocrypto.com

Sumathi Pandi, Khareem Sudlow

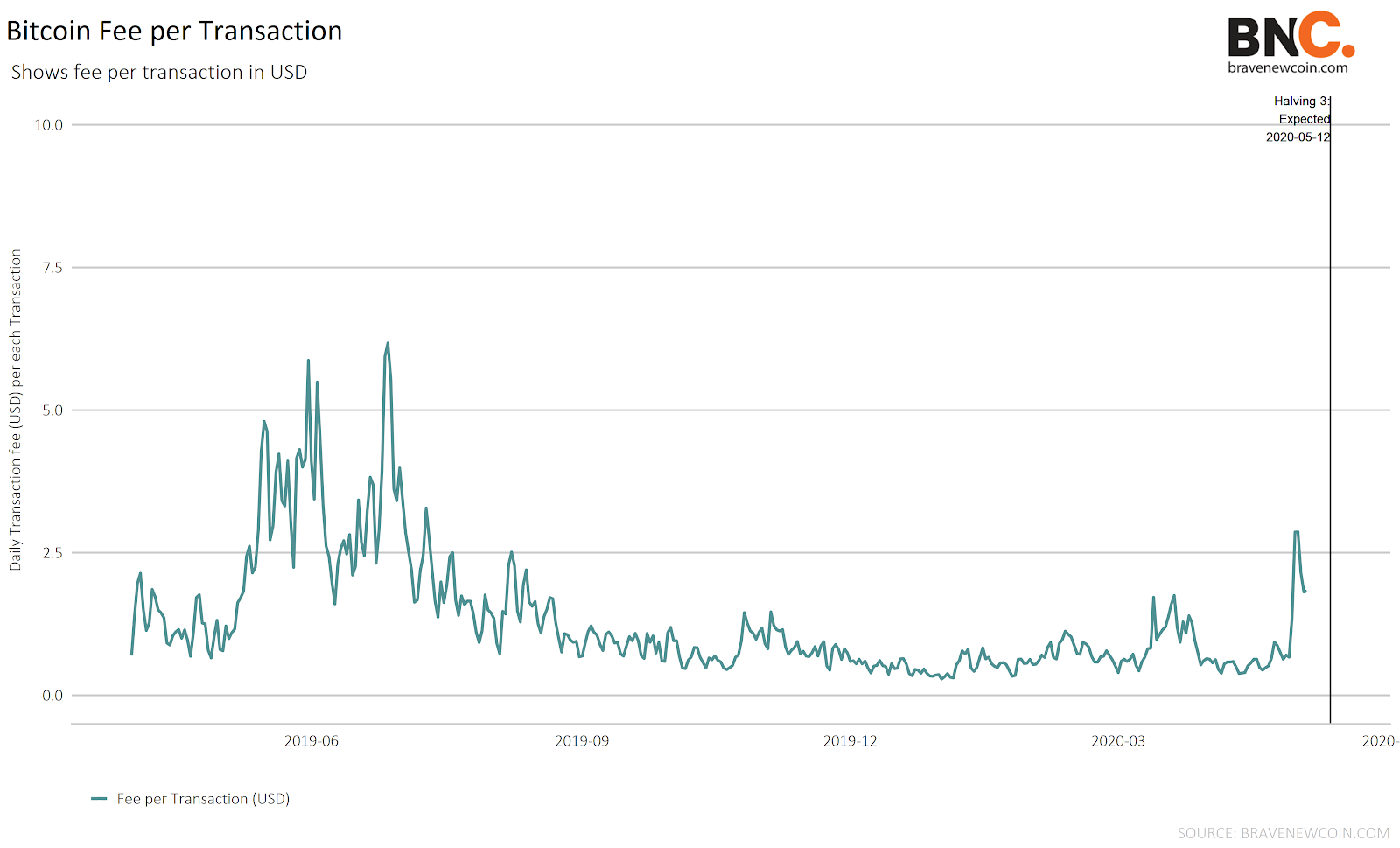

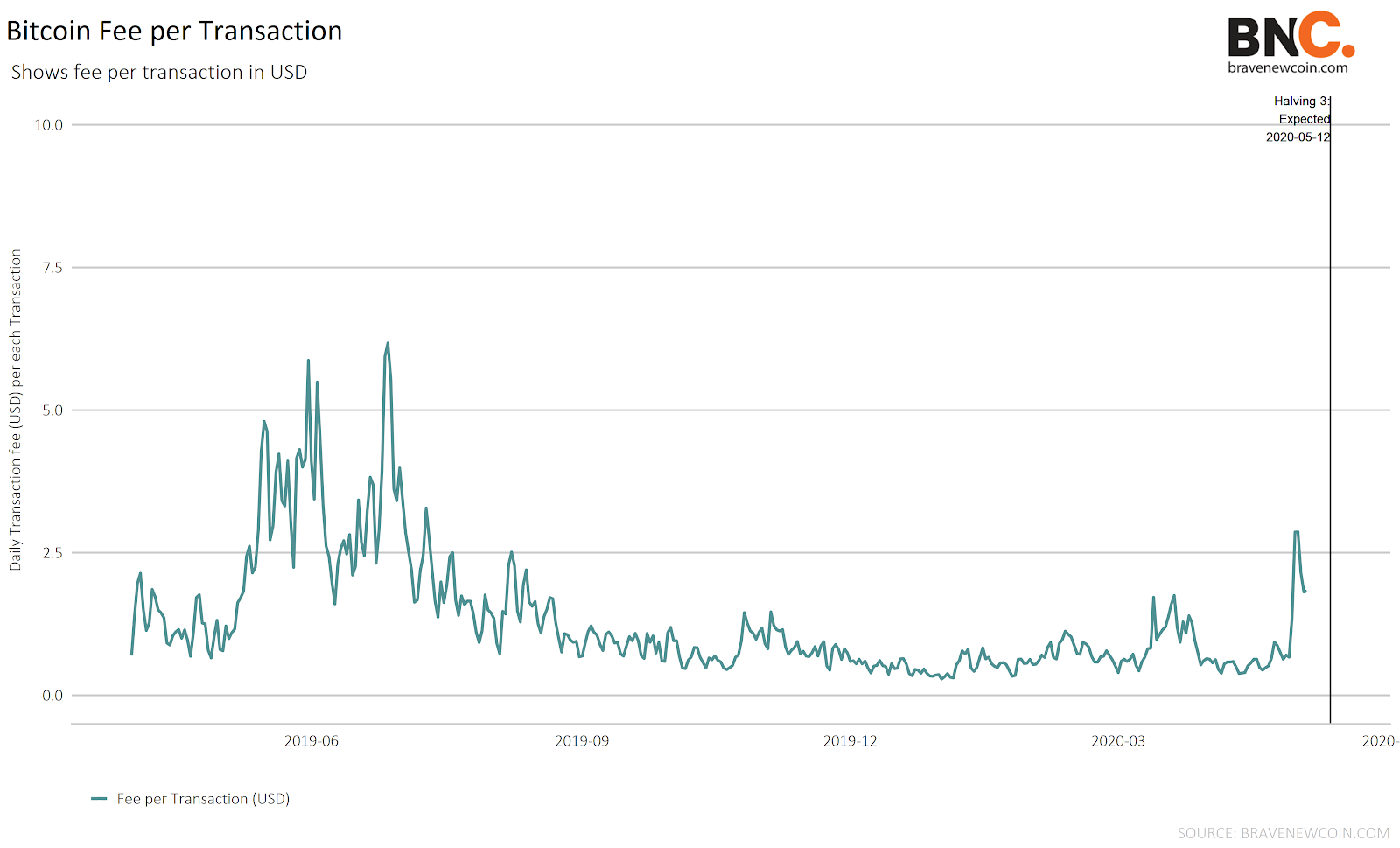

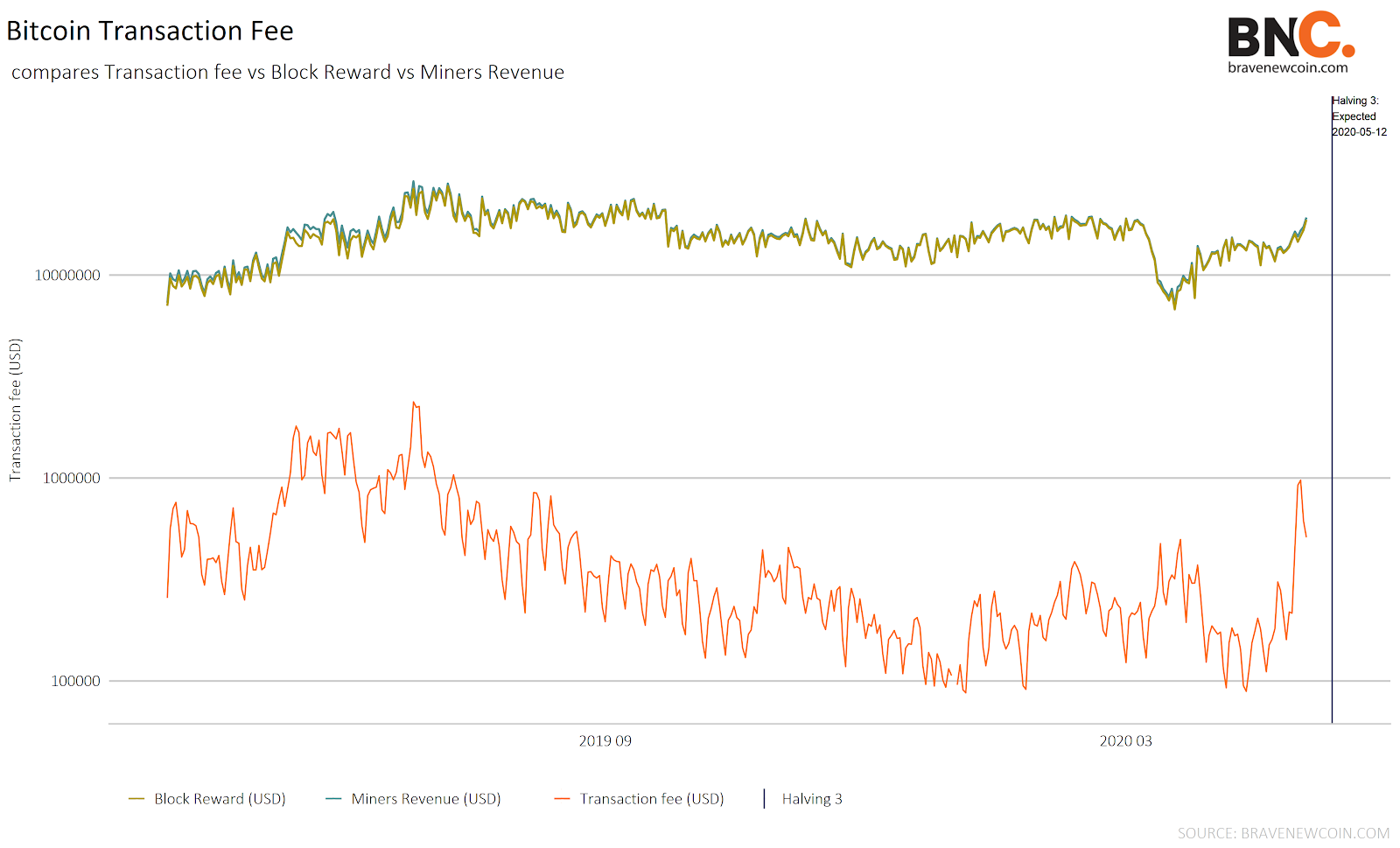

The average transaction fee reached US$2.86 on 30th April 2020 and stayed near that level through the 1st of May. This was the highest spike in fees over the past 9 months and accounted for ~5.9% of the total miner revenue over the two day period.

The transaction fee is based on the transaction size in bytes. The fee also depends on the number of outputs pulled from the previous transactions as inputs. These transaction fees and the block reward go to the block miner as revenue. The block reward is entered as a coinbase transaction in every block.

The upcoming halving will reduce the block reward from 12.5 BTC to 6.25 BTC. With the decrease in supply, and based on the previous two halvings, bitcoin spot prices would increase after a few months if demand remains the same.

We can also say that a decrease in the reward by 50 percent, miners would execute the transactions with higher fees to earn more revenue. However, if there aren’t that many transactions in the pool, miners will be left with no option other then pushing transactions with low fees, or turn to more profitable blockchain networks.

LET’S LOOK INTO BITCOIN AVERAGE TRANSACTION FEE OF THE LAST ONE YEAR

The transaction fee is based on the transaction size in bytes. The fee also depends on the number of outputs pulled from the previous transactions as inputs. These transaction fees and the block reward go to the block miner as revenue. The block reward is entered as a coinbase transaction in every block.

INSIGHTS BREAKDOWN

- In the middle of 2019, fees spiked to US$6.18, generating 1 million outputs from previous transactions in a day. The average transaction size was 485 bytes.

- However, transaction fees were on an average of about US$30 from 8th December 2017 to 21st January 2018, with a spike to US$54 on 22nd December 2017.

- Factors such as transaction fees depending on the transaction size, segwit transactions increasing the limit of block size by removing signature data, miners choice to select transaction with higher priority to higher fees per byte from mempool, use of the amount of computational power to find hashes also account to the surge in the transaction fee.

- We can also infer that as miners are using high hash power, they are aiming at higher fees to obtain.

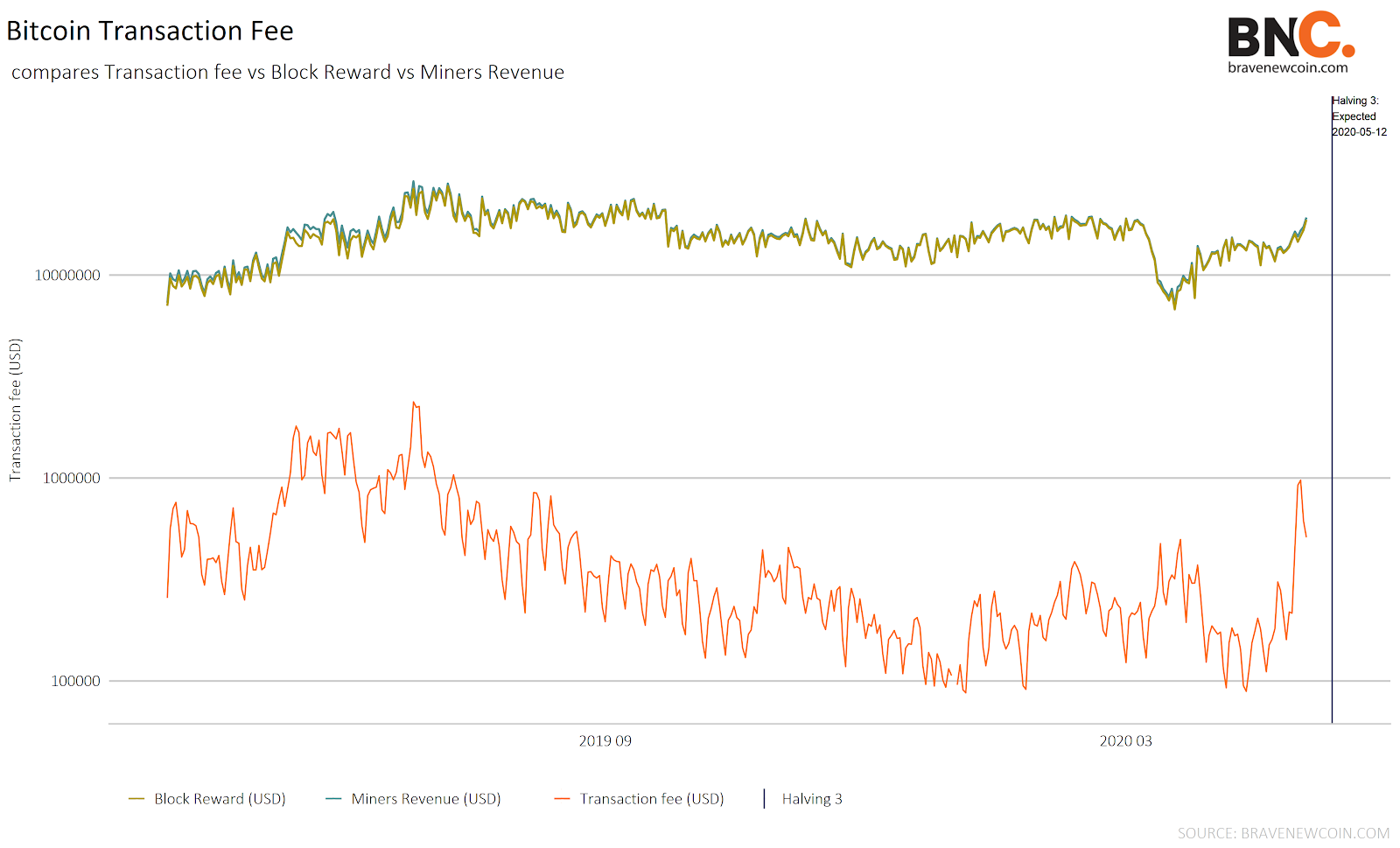

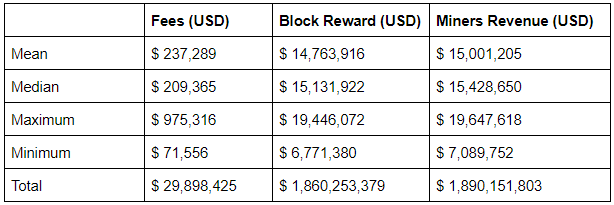

BITCOIN TOTAL TRANSACTION FEE VS TOTAL MINERS REVENUE VS BLOCK REWARD

The upcoming halving will reduce the block reward from 12.5 BTC to 6.25 BTC. With the decrease in supply, and based on the previous two halvings, bitcoin spot prices would increase after a few months if demand remains the same.

We can also say that a decrease in the reward by 50 percent, miners would execute the transactions with higher fees to earn more revenue. However, if there aren’t that many transactions in the pool, miners will be left with no option other then pushing transactions with low fees, or turn to more profitable blockchain networks.

Transaction fees vs block reward vs total miners revenue in 2020

OhNoCrypto

via https://www.ohnocrypto.com

Sumathi Pandi, Khareem Sudlow