Data Snippet- Bitcoin Unique Addresses

Unique addresses in the Bitcoin ecosystem are simply a possible destination for a bitcoin payment. One person can have many addresses. Best practice dictates that a unique address should be used for each transaction.

Most Bitcoin wallets today are Deterministic wallets, and have a user interface that makes it easy and safe to have many addresses. Most Bitcoin software and websites will also generate a brand new address each time you create an invoice or payment request.

It has been argued that the phrase "bitcoin address" was a bad name. A better name may have been "bitcoin invoice." With this in mind, the number of unique addresses is still an interesting metric to track over time, and provides some insights into network use.

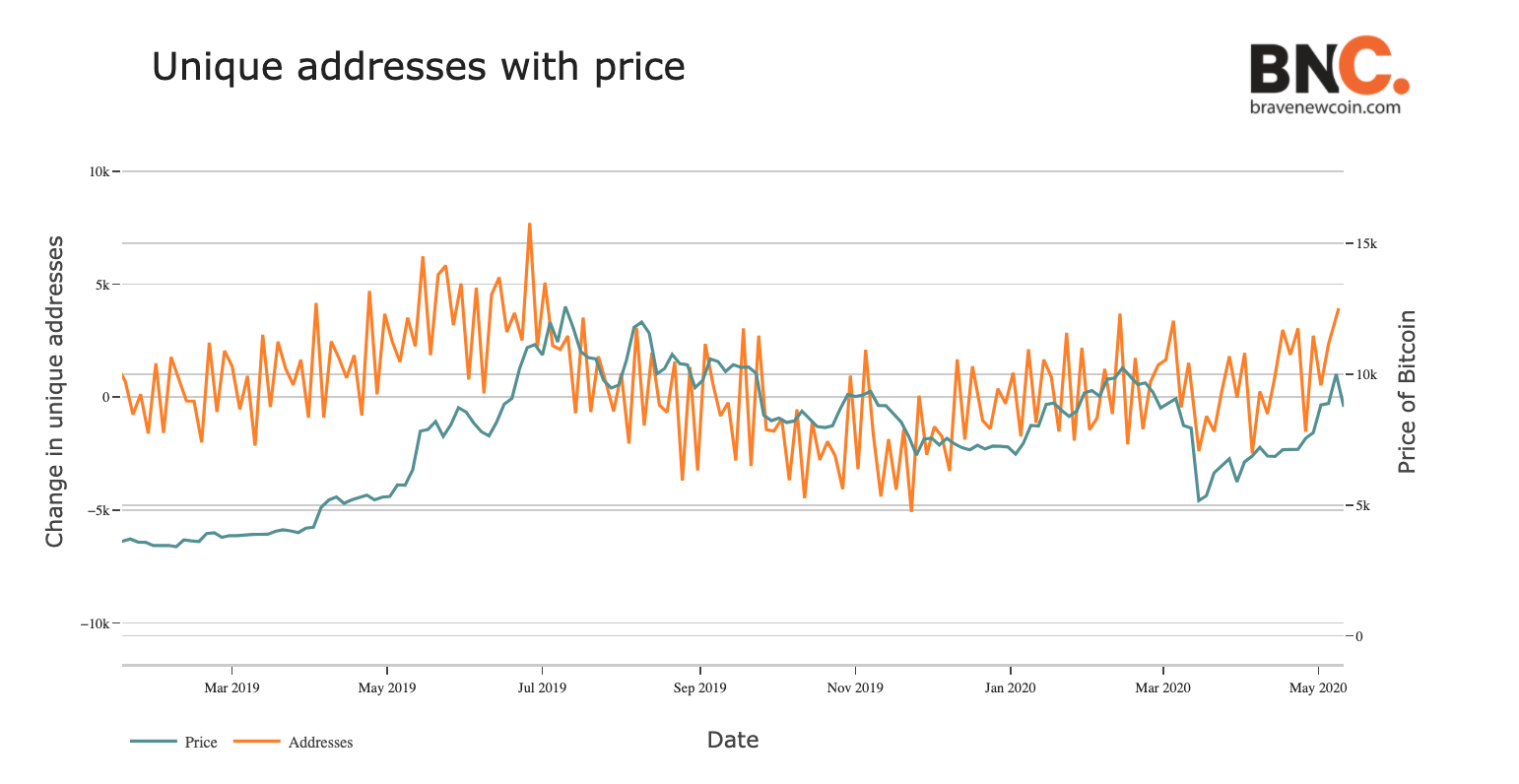

LOOKING INTO THE COMPARISON OF BITCOIN UNIQUE ADDRESSES AND PRICE

CHART FEATURES: Unique Addresses - The payment addresses represent the destination on the Bitcoin network. Price: The End Of Day closing value of BNC’s Bitcoin Liquid Index (BLX).

INSIGHTS: Looking at the above plot, we can observe the daily change in unique addresses and the price of Bitcoin moving together in a similar direction most of the time. An increase or decrease in the number of unique addresses generally happens when;

Fees are high, as people leave their Unspent Transaction Outputs (UTXOs) in multiple addresses as it can cost more in fees to move the balance than the address contains. Similarly, when fees are low, people or their wallets will consolidate funds into a single address.

When markets reach a bottom, fewer unique addresses are in use because people aren't requesting as many payments.

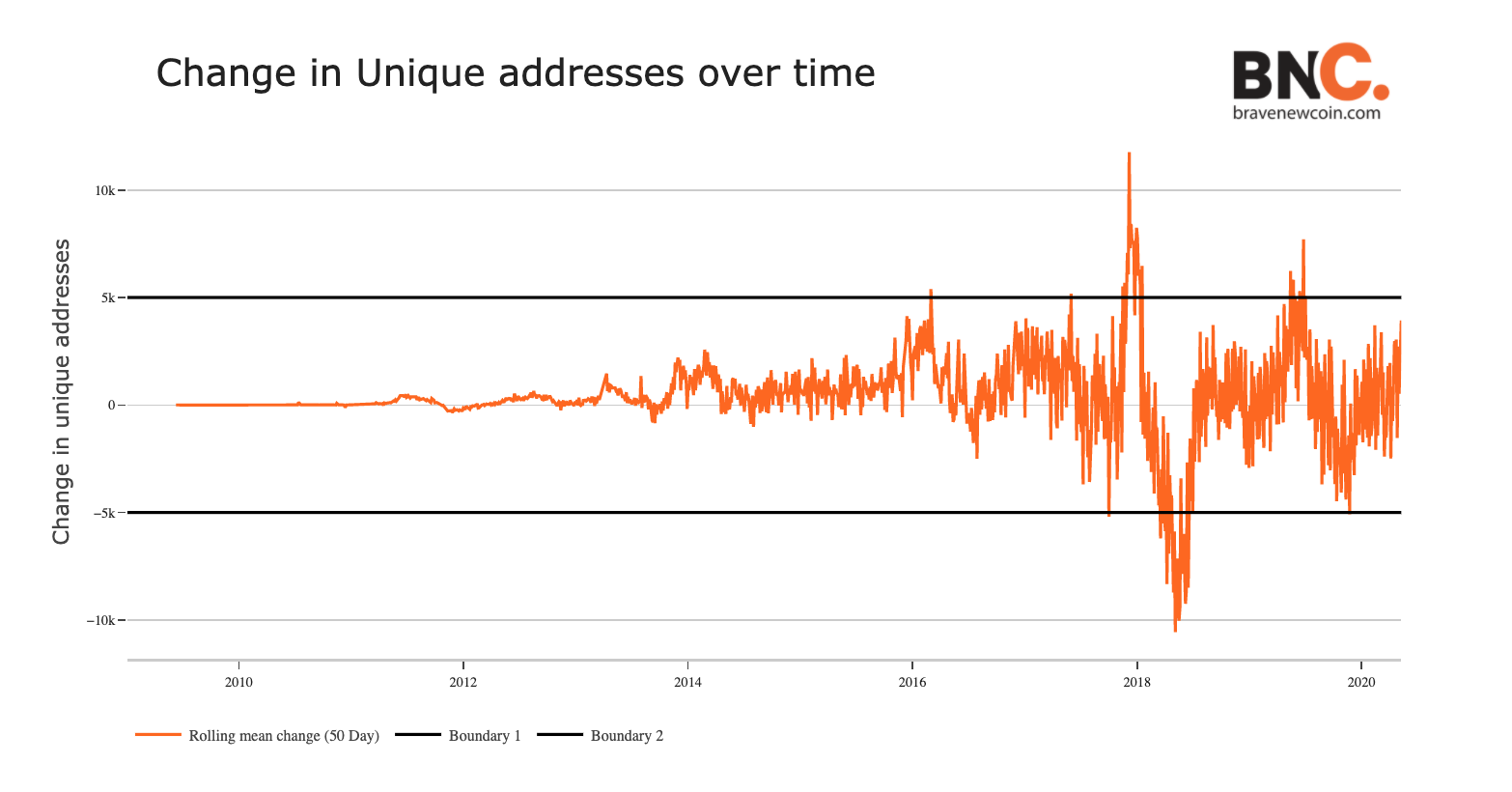

DAILY CHANGE IN UNIQUE ADDRESSES:

CHART FEATURES: The above chart shows the 50-Day Moving Average for the Daily change in Unique Addresses. The change in unique addresses per day is rarely more than +/- 5K.

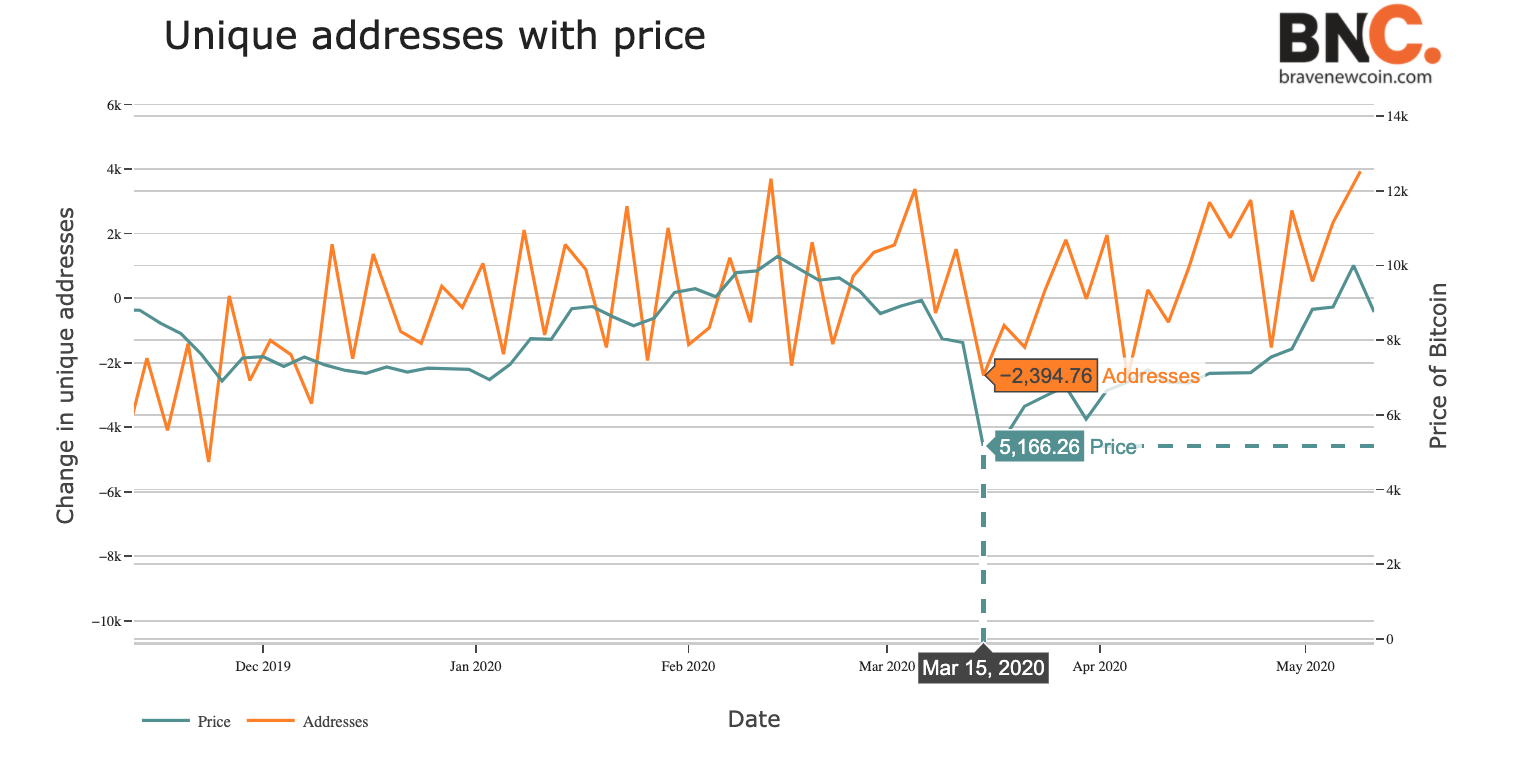

DEEP DIVING INTO THE STEADY INCREASE IN UNIQUE ADDRESSES

We can see that following the price crash of bitcoin on 15 March 2020, the daily change in the number of unique addresses increases in line with the spot price of the USD/BTC market.

TAKEAWAY

Looking at the previous plots we can see that the average daily change of unique addresses and price of BTC are correlated in their movement most of the time.

OhNoCrypto

via https://www.ohnocrypto.com

Ravi Teja, Khareem Sudlow