Ripple Price Analysis - Jed McCaleb selling pressure continues

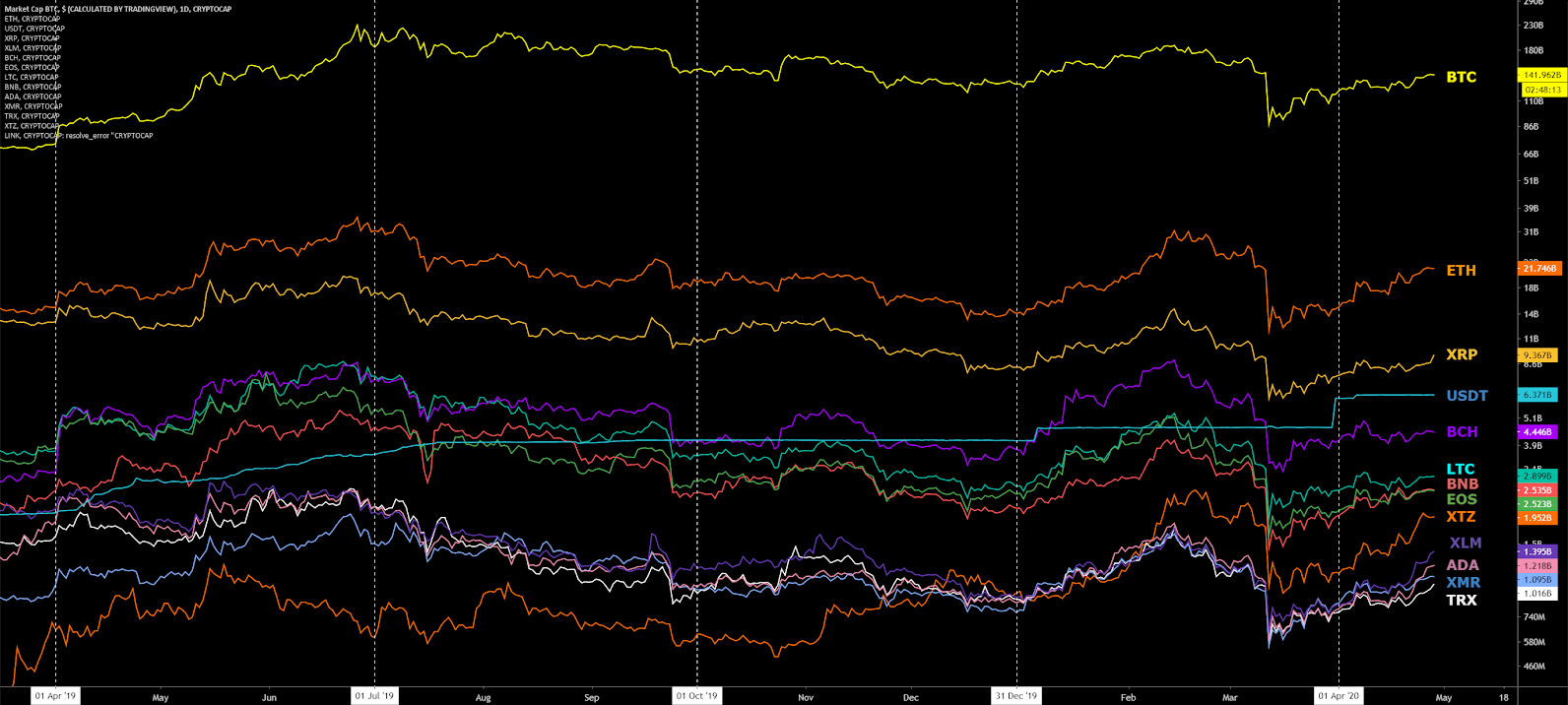

Ripple (XRP) is a payment protocol and network token which aims to compete with the banking protocol SWIFT. The crypto asset is currently down 95% from the all-time high established in January 2018. The XRP market cap stands at US$8.56 billion based on a 44.1 billion XRP circulating supply, with US$542 million in trade volume over the past 24 hours.

XRP was created in November 2012 by three founders; Arthur Britto, Chris Larsen, and Jed McCaleb, in collaboration with Ryan Fugger who began working on a payments protocol in 2004 called RipplePay. The project, which was closed source at that time, was incorporated under a new name, NewCoin, in September 2012. NewCoin rebranded to OpenCoin in October 2012 and then rebranded again, to Ripple Labs, in September 2013.

McCaleb resigned in May 2013, officially leaving the project in July 2013, and went on to create Stellar (XLM) in July 2014. McCaleb previously founded the MT GOX exchange, in 2010, which was sold to Mark Karpeles in March 2011.

McCaleb received a reported 5.3 billion XRP at the time of leaving Ripple, which he can sell restricted amounts of, based on a 2016 settlement that set yearly limits. On September 7th, 2019, he received a further 100 million XRP. As of February, McCaleb has sold over one billion XRP and holds a remaining 4.7 billion XRP, which suggests continued XRP token selling pressure for many months going forward.

Since 2015, Brad Garlinghouse has served as the Ripple Labs CEO, with David Schwartz serving as CTO since July 2018. Schwartz joined Ripple Labs in 2011 as Chief Cryptographer. In 2019, there were several new changes in Ripple Labs upper management.

- In January, Stuart Alderoty, who had previously worked at CIT Bank, HSBC, and American Express, joined Ripple as general counsel.

- In February, Cory Johnson, previously Chief Market Strategist, was removed from the Ripple website, with Ripple stating that "due to changes in market conditions, we've chosen to eliminate the role."

- In May, Breanne Madigan, former Goldman Sachs executive and former head of institutional sales and strategy at Blockchain.com became the head of global institutional markets at Ripple.

- In July, former head of Ripple Institutional Liquidity, Catherine Coley, was announced as the CEO of BAM Trading Services, the operator of Binance’s upcoming U.S. crypto exchange.

- In September, Ron Hammond, who also helped craft the Token Taxonomy Act, was announced as the new Manager of Government Relations.

- In October, Craig Phillips, who had previously held leadership roles at Morgan Stanley and BlackRock, joined the Ripple board of directors. Phillips also most recently served as Counselor to the United States Secretary of the Treasury, Steven Mnuchin.

- Earlier this year, head of XRP markets, Miguel Vias, left Ripple according to his LinkedIn account.

Initially, 100 billion XRP were minted by the founders, with 80% of that supply held by the currently branded Ripple Labs, which is also known as “Ripple.” In May 2015, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) determined that Ripple Labs was the “administrator” of the XRP tokens and levied the company with a fine of US$700,000 for failing to register as a money service business. In January, Garlinghouse also announced a Ripple IPO with equity will likely be held later this year.

The gorilla in the room for Ripple continues to be whether or not the XRP token represents an unregistered security. Ripple initially created, escrows, owns a majority of, and continues to control the majority flow of tokens. Ripple argues that the network is decentralized, the token does not represent shares of Ripple, and that the network would continue to exist if Ripple Labs did not. Several pending court cases, as well as any comments from the U.S. Securities and Exchange Commission (SEC), will clear any regulatory uncertainty surrounding the asset.

In a motion to dismiss an active case, the Ripple legal team argued that the plaintiff did not purchase tokens during the initial offering and did not purchase any from the defendants either. The motion stated, “purchasing XRP is not an ‘investment’ in Ripple; there is no common enterprise between Ripple and XRP purchasers; there was no promise that Ripple would help generate profits for XRP holders; and the XRP Ledger is decentralized.”

In January, Ripple again attempted a motion to dismiss a separate class-action lawsuit in the Northern District of California. Ripple’s lawyers argued the complaint exceeded the three-year deadline for filing a suit outlined in the Securities Act’s statute of repose. This motion to dismiss was denied on February 26th. The judge also determined Ripple did not violate California state law. As a result, claims of false advertising and personal liability against Garlinghouse were dismissed.

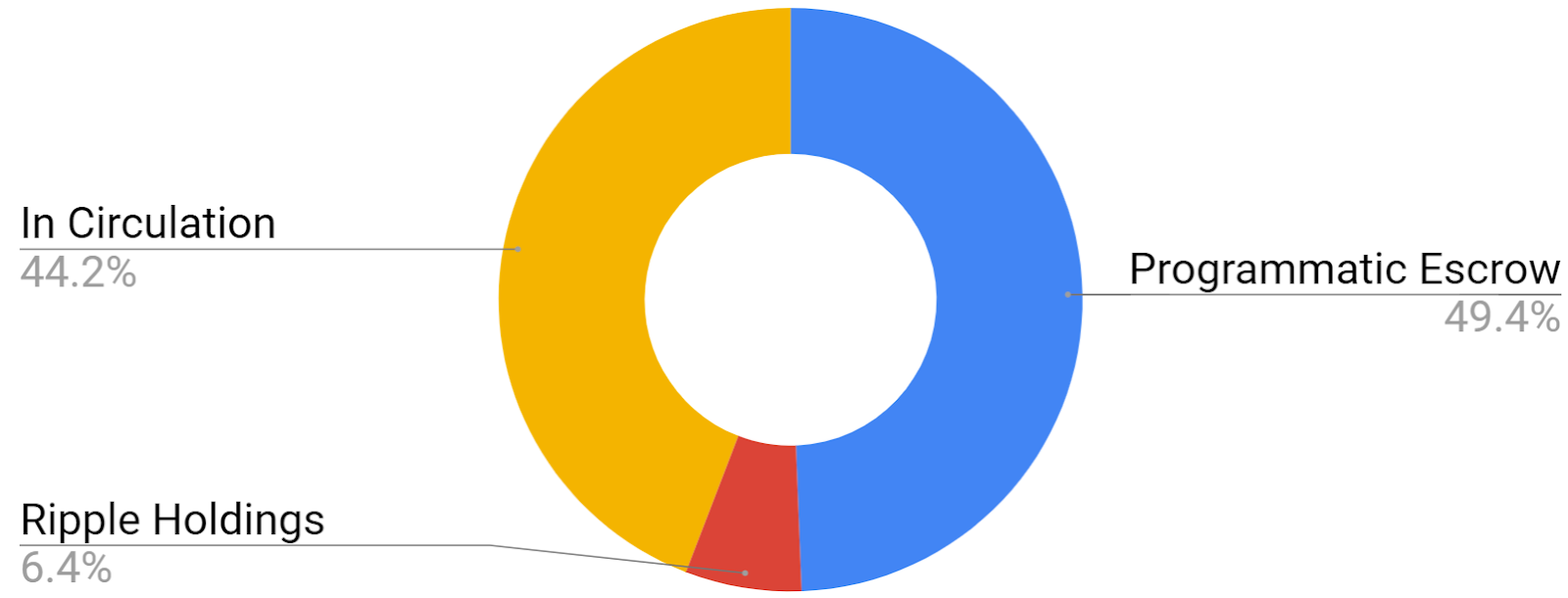

In December 2017, Ripple announced a programmatic escrow system for the 55 billion XRP held by the company at that time. One billion XRP are unlocked from escrow and offered for sale each month. Any unsold XRP is then placed back in escrow at the end of the month.

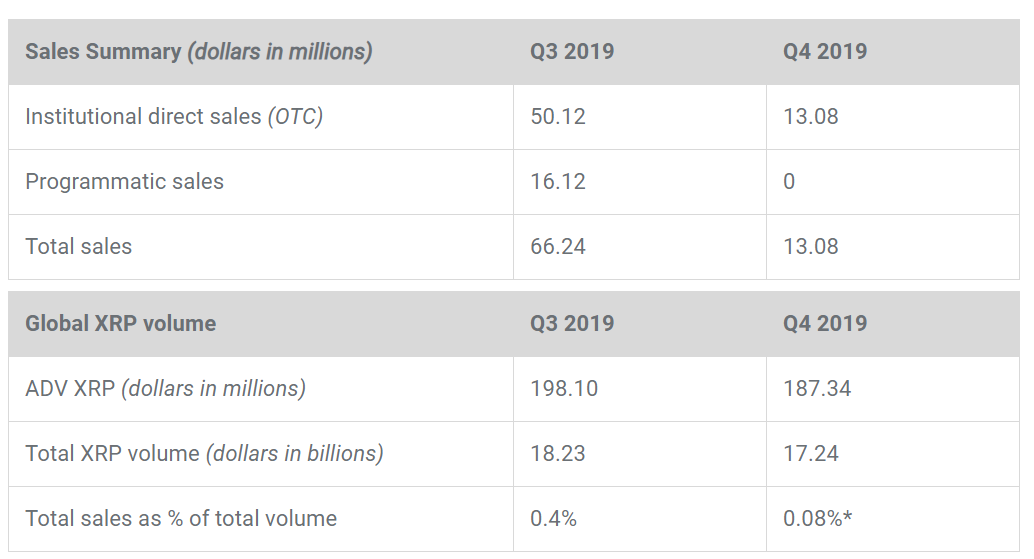

Ripple’s Q3 2019 report revealed 0.7 billion of the three billion XRP released from escrow over the quarter had been purchased on the open market, down from 0.9 billion sold in the previous quarter. Ripple’s Q2 report revealed that Ripple would be “substantially reducing future (programmatic) sales of XRP”, which are down to nearly 10% of the previous quarter. In December, Ripple also announced a US$200 million Series C funding round led by SBI Holdings and route 66 Ventures. The Q4 2019 report revealed zero in programmatic sales for the quarter. Earlier this year, Garlinghouse revealed, “we would not be profitable or cash flow positive [without selling XRP].”

The top 100 largest XRP accounts, excluding the 49.4 billion XRP currently in held escrow, hold 70.26% of the total circulating supply. Ripple holds a further 6.4 billion XRP, leaving 44.15 billion XRP in circulation.

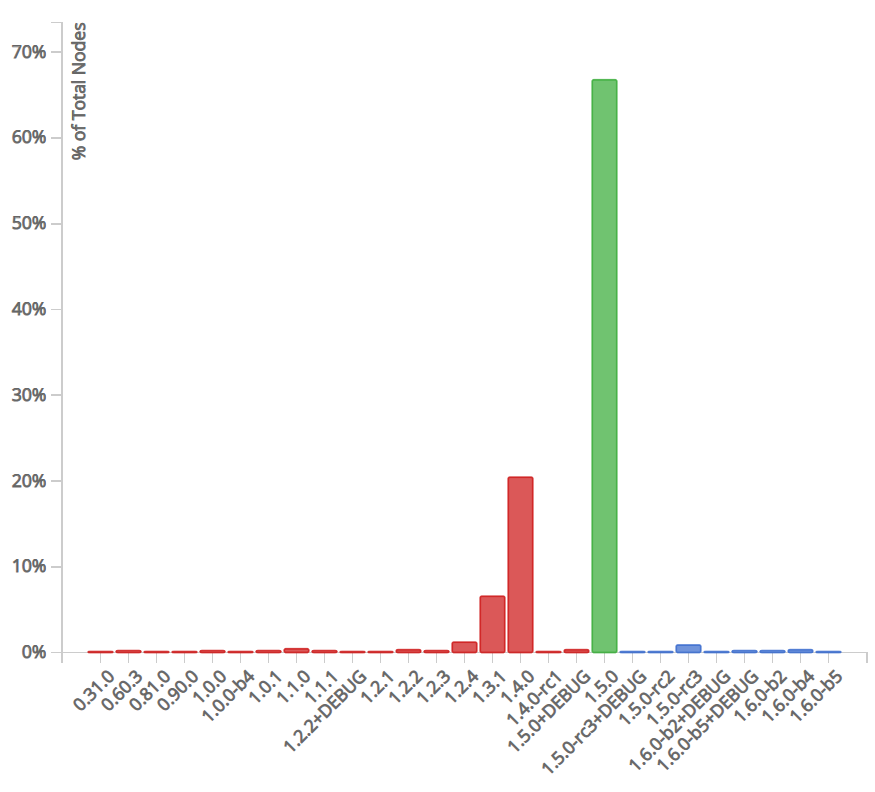

For consensus, the XRP network uses The Ripple Protocol Consensus Algorithm, which aggregates collectively-trusted subnetworks of nodes and validators. There are currently 915 public nodes with over 60% running the most recent software, version 1.5.0. The network also has 121 active validators, 71% of which are unverified and 15% are controlled by Ripple.

As of November 2018, a Ripple server required approximately 12GB of data storage per day and 8.4TB to store the full XRP ledger.** **However, a full node is not required to participate in the network, and nodes can prune the ledger to free disk space.

Ripple offers a suite of tools for enterprise and banking solutions, collectively known as RippleNet, including; xCurrent, xRapid, and xVia. xCurrent processes global bank to bank payments for customers and is analogous to SWIFT. xRapid, which went live in October 2018, sources on-demand liquidity through buying and selling XRP. xVia can be used to send unidirectional payments. Of the three tools, only xRapid requires the use of the XRP token. In October 2019, Ripple announced the services would now all connect through one RippleNet portal.

In Q1 2020, Ripple reported a 294% increase in RippleNet Usage. Earlier this month, SBI holdings also announced plans to integrate Ripple-powered MoneyTap with ATMs throughout Japan. Ripple is also hiring a product manager to direct a loan offer through RippleNet.

In July 2019, Ripple announced a US$30 million investment in MoneyGram, announcing a strategic partnership with RippleNet. Ripple agreed to provide a capital commitment to MoneyGram, enabling the company to draw up to US$50 million in exchange for equity over a two-year period. In November, Ripple invested a further US$20 million in MoneyGram, increasing Ripple’s stake in the company to about 10% and allowing for a further increase to 15% total stake in the future.

Ripple also has two other monetary arms to foster the growth of the ecosystem, a venture capital arm, and a university blockchain research initiative (UBRI).

The venture capital arm, Xpring, invests in, incubates, acquires, and provides grants to companies and projects run by proven entrepreneurs. In May 2019, Xpring invested in Agoric, a smart contract platform. Other public investments of Xpring include Dharma, Kava, XRPL Labs, Forte, and Bolt Labs. Recent investments include the Coinme ATM provider, the Logos Network, a self-custody startup Towo Labs, and a US$750,000 infusion to BRD wallet.

The UBRI has US$50 million in funding reserved for grassroots research and development related to XRP. In total, the UBRI consists of over 40 universities worldwide and the UBRI has helped launch over 100 active research projects on various topics.

Additionally, Rippleworks, a non-profit focused on funding social ventures, was created in 2015 by Chris Larsen and Doug Galen. Rippleworks has paired startups and technology experts with 80 different social ventures. In 2019, Larsen and his wife donated US$25 million in XRP tokens to San Francisco State University.

The external XRP protocol ecosystem includes Interledger, Coil, and Codius, all of which are related in terms of functions and development teams.

The Interledger Protocol (ILP) is capable of sending payments across different distributed and decentralized ledgers, and moves funds via intermediaries. In May 2019, Stronghold integrated with ILP to issue the Stronghold USD stablecoin.

Coil enables subscription-based donations for content monetization on the internet, without advertising or selling user data, and pays sites in real-time through a Web Monetization API. A similar micropayment system for content monetization is used by the Brave browser. Coil uses ILP and Stronghold USD to pay content creators. Earlier this month, senior Ripple developer Evan Schwartz left Ripple to join Coil.

Codius is a smart contract and smart program platform allowing for interoperability between blockchains. In November 2018, the Bill & Melinda Gates Foundation announced plans to use ILP and Coil, in conjunction with Mojaloop, to bring payments to the under and unbanked.

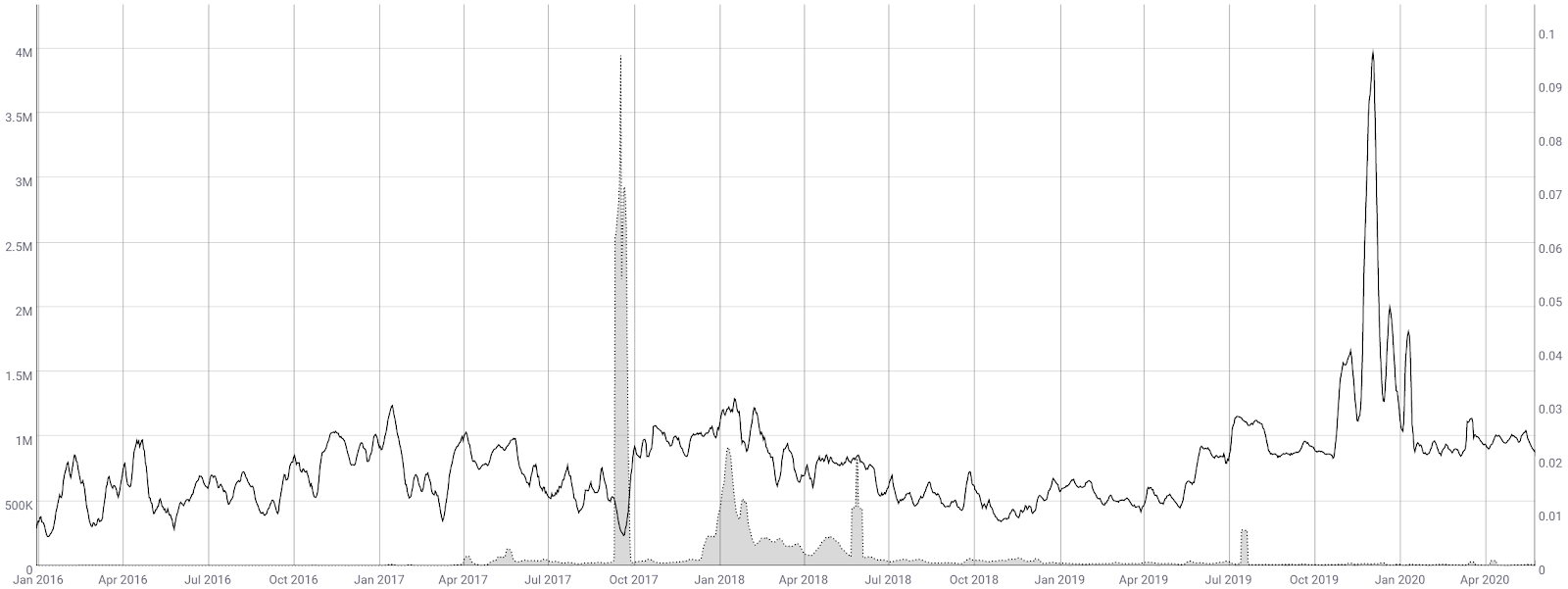

On the network side, transactions per day increased to nearly four million, late last year, a four-fold increase over the prior month. Most of these transactions were generated by the “Payment” and “OfferCreate” function, a transfer of value and a currency exchange facility, respectively. The spike in these transactions likely represent spam by attempting to send fake transactions.

Since January, transactions per day have decreased to the previous range and are now headed for multi-month lows. The average transaction fee (fill, chart below) remains US$0.00043, among the lowest of any cryptocurrency.

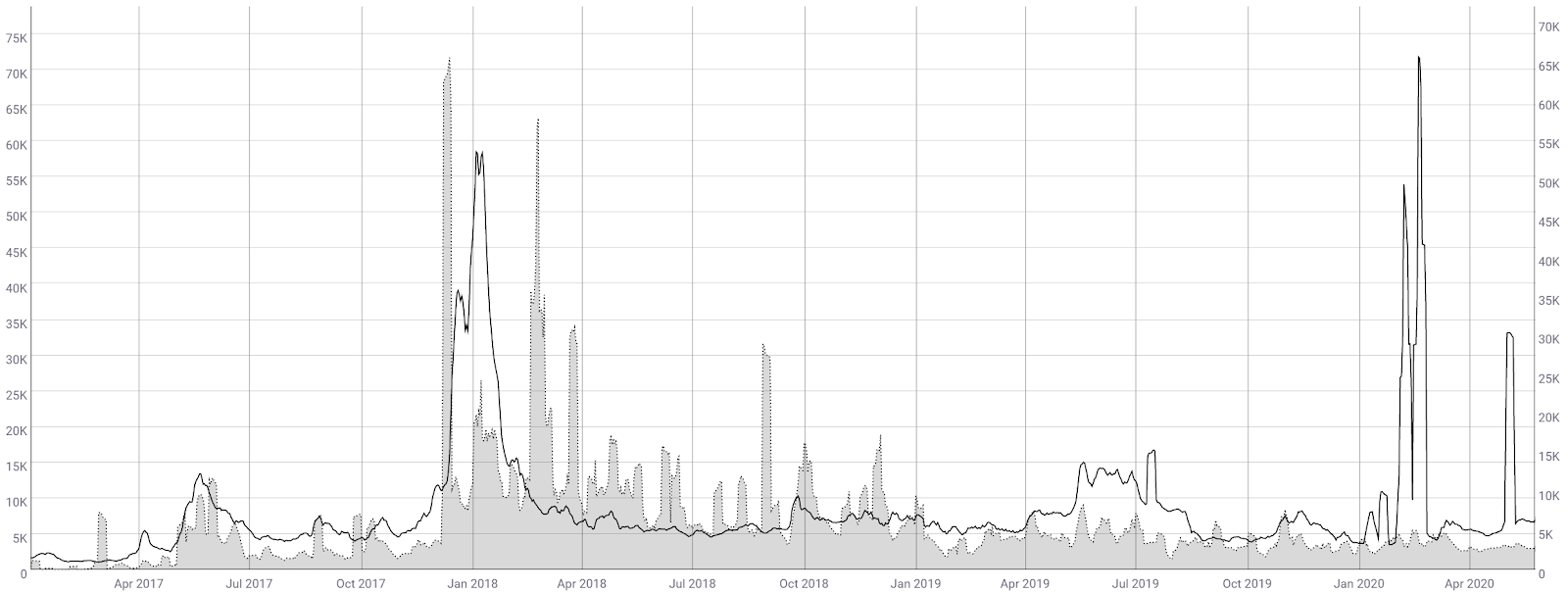

Weekly active addresses (WAA) have decreased substantially since January 2018 (line, chart below) but reached an 18-month high in mid-July 2019. The spike in WAA most recently was likely related to the spam attack on the network. A sustained uptick in active addresses should be seen as a bullish indicator, suggesting an increase in demand for the asset. The largest increases in WAA were in mid and late 2017, corresponding to large increases in price.

Average transaction values (fill, chart below) on the network have essentially held between US$1,200 and US$6,500 since March 2018. Due to monthly escrow transactions, these values are likely slightly higher than actual organic use. In December 2017, average transaction values reached US$65,000 when Ripple began the long term escrow for XRP.

The 30-day Kalichkin network value to estimated on-chain daily transaction ratio (NVT) is currently 135 and trending down (line, chart below). Escrow transactions or coin arbitrage on the XRP network will falsely skew NVT significantly lower. A sharp decline in NVT below 100 would suggest bullish price action, which last happened in December and January 2018.

Although NVT is difficult to compare between coins, which use different transaction types, the metric can be useful when comparing a network's relative utility over time. For example, XLM, which uses a similar network structure to XRP, currently has an NVT of 587.

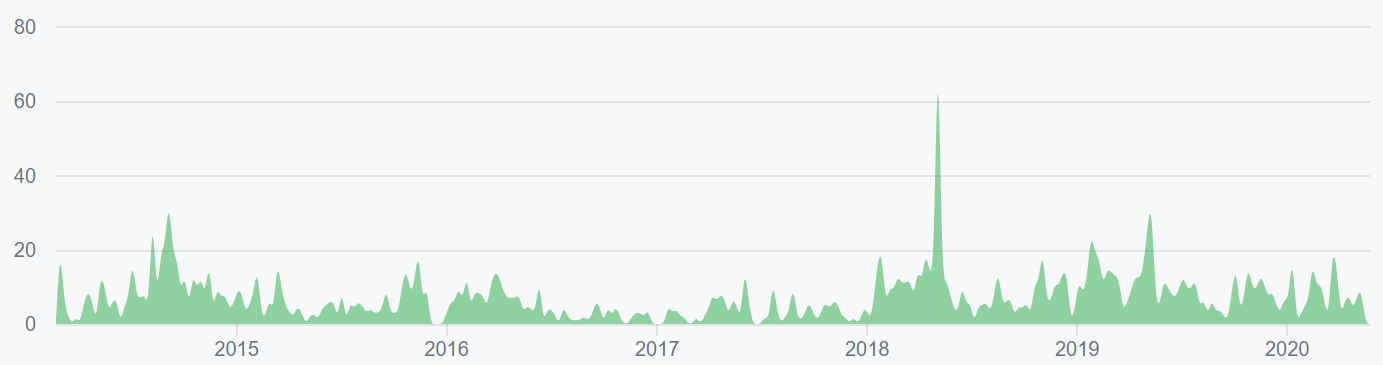

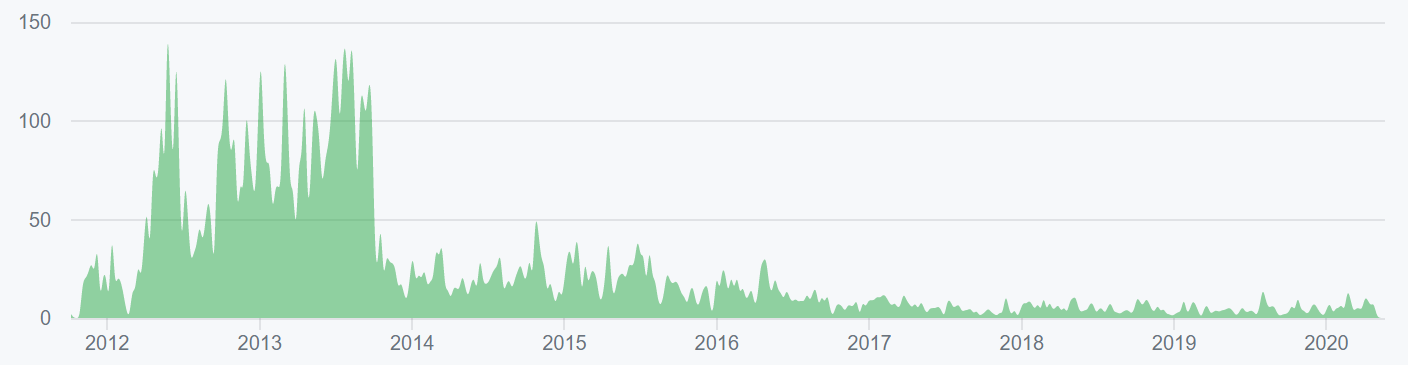

Turning to developer activity, the Ripple project has 77 Github repos with over a cumulative 258 commits over the past year from nearly 70 contributors. Rippled version 1.5.0 was released in March. Most of the XRP related commits occurred in the Ripple dev portal (top chart below) while the rippled repo has seen very few commits over the past few months (bottom chart below).

Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

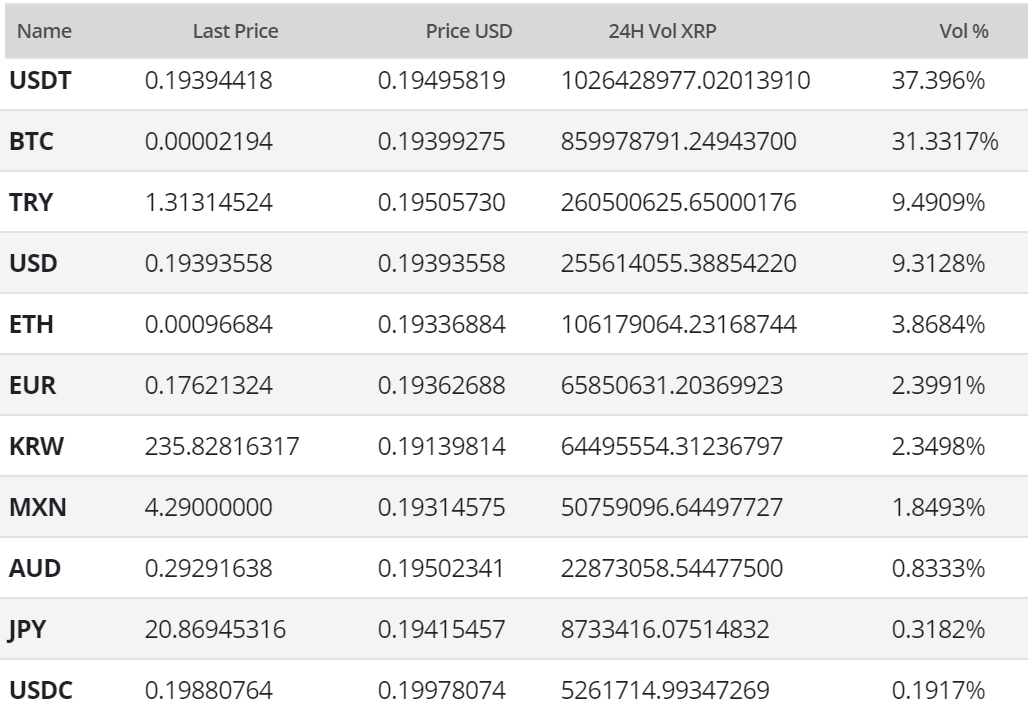

XRP exchange-traded volume over the past 24 hours has been led by the Tether (USDT) and Bitcoin (BTC) pairs. Exchange volume for XRP pairs is led by Binance and Huobi. Both the South Korean won (KRW) and Japanese Yen (JPY) markets have no premium over the USD pair.

XRP has seen a slurry of custody and exchange-related announcements since late 2018, including pairs on OKEx, Coinbene, KuCoin, Binance, Bitcoinus, BigOne, Biger, LykkeX, ProBit, BankCEX, Coinbase, Abra, Binance.US, and FXCM. Binance also issued the XRP-BF2 token on the Binance Chain, tradeable on the Binance DEX. XRP-BF2 is a pegged token backed 1:1 by XRP assets which tracks the value of the native asset of the XRP ledger.

In June 2019, two exchanges, Gatehub and Singapore’s Bittrue, were hacked for US$10 million and US$4.5 million in XRP, respectively. Both exchanges estimated that hackers managed to compromise around 100 user accounts. The Gatehub hack involved compromising XRP ledger wallets through the Gatehub API, whereas the Bittrue hack involved compromising Bittrue accounts through a review process vulnerability. Gatehub has essentially blamed the vulnerability on the XRP ledger and will not refund losses. Conversely, Bittrue plans to reimburse the stolen funds completely.

Additionally, in mid-July 2019, the Japanese exchange Bitpoint reported a hot and cold wallet hack of US$32 million involving BTC, LTC, ETH, and XRP. Remixpoint, the parent company of Bittrue, said it would compensate customers for the losses.

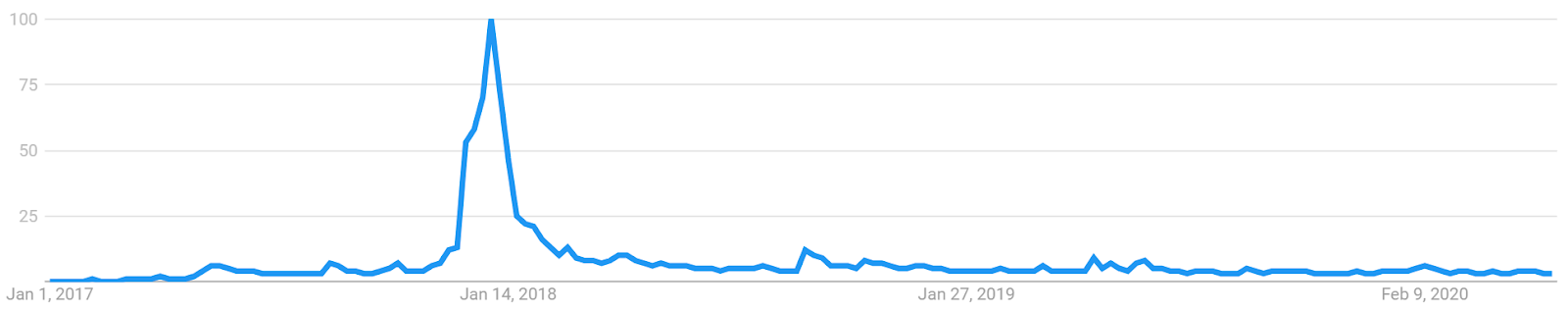

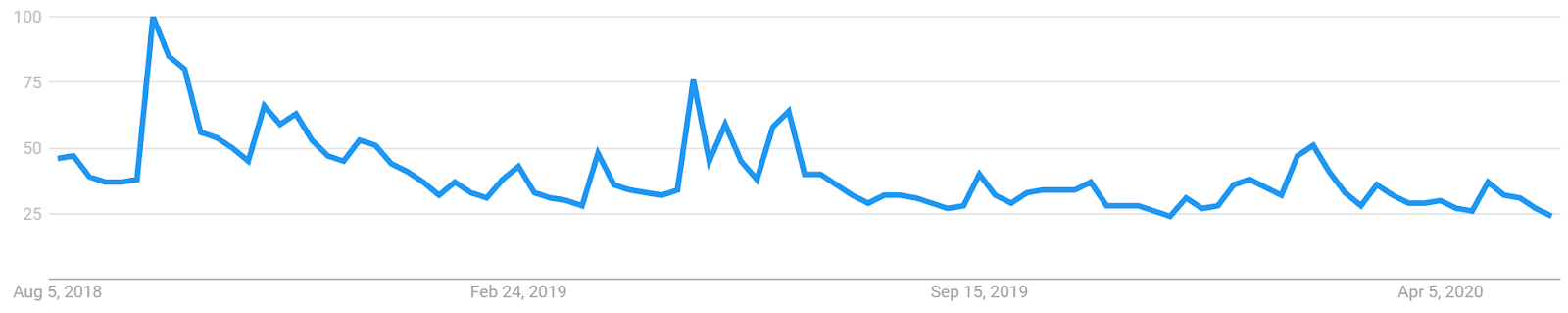

Aside from a brief period between December 2017 and February 2018, worldwide Google Trends data for the term "Ripple" has mostly been pinned to the floor. The increase in 2018 likely signaled a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "bitcoin" searches increase dramatically, bitcoin price drops.

Technical Analysis

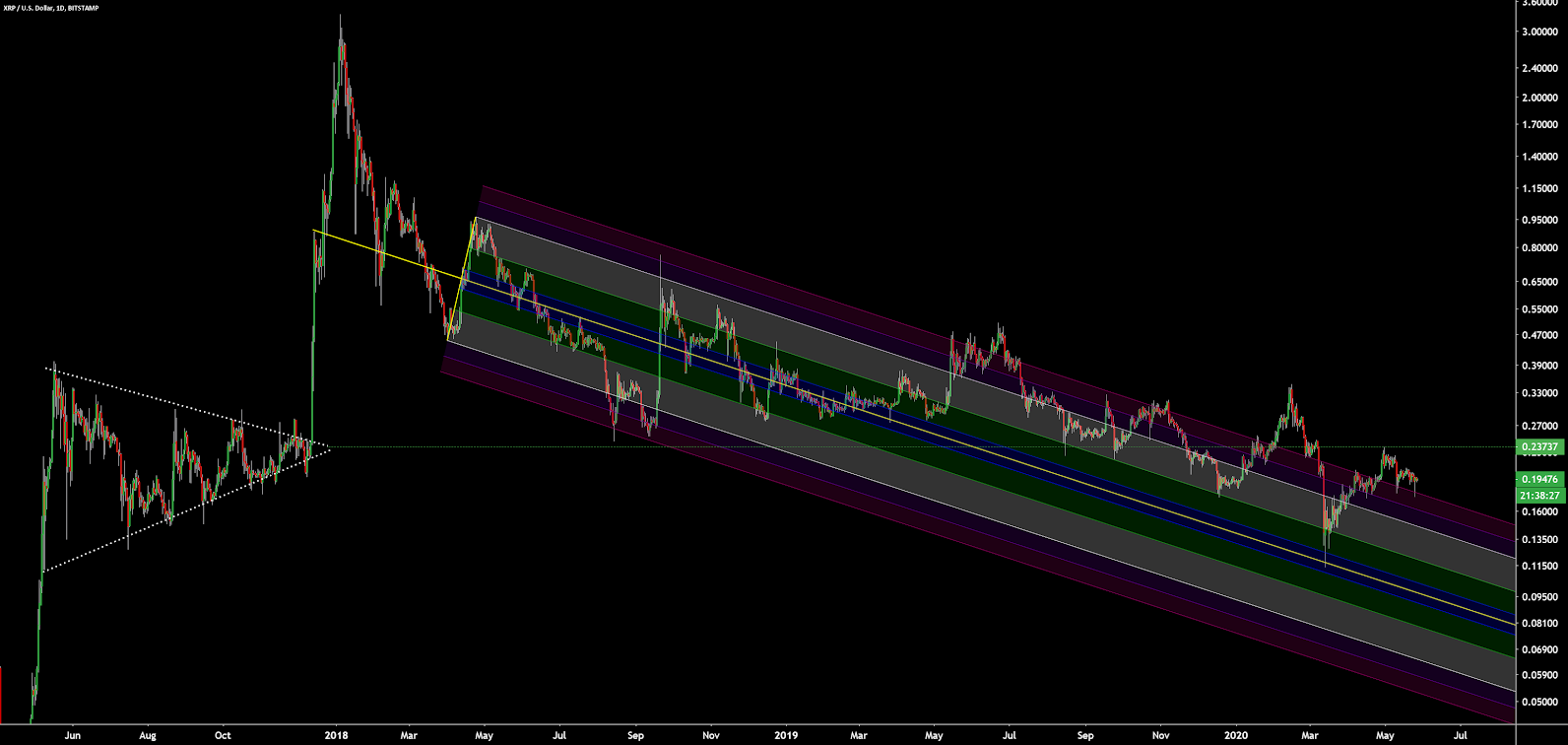

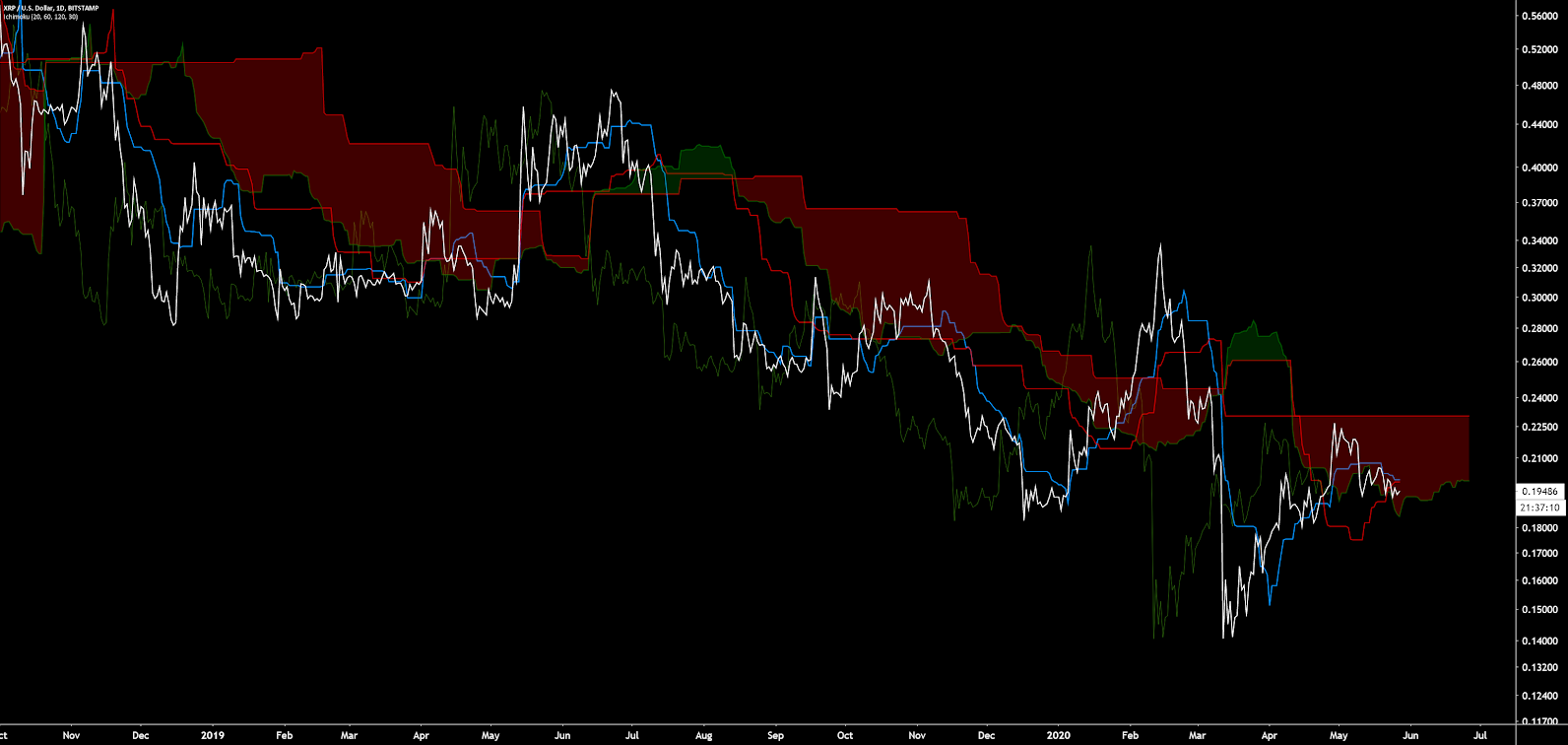

The XRP/USD spot price has now recovered nearly 50% of the March drop. To determine entry and exit points moving forward, Exponential Moving Averages, Volume Profile of the Visible Range, Pitchforks, and the Ichimoku Cloud can be used. Further background information on the technical analysis discussed below can be found here.

On the daily chart for the XRP/USD market, the 50-day and 200-day Exponential Moving Average (EMA) created a bullish cross on May 31st, with a Death Cross in mid-July. The 200-day EMA, at US$0.22, should now act as resistance. There are no active volume or RSI divergences at this time, however, volume has increased substantially over the past two months on Bitstamp and may represent a combination of capitulation and selling from Jed McCaleb.

Volume Profile of the Visible Range (VPVR, horizontal bars on the chart below) shows that most of the trading volume historically occurred near the US$0.20 zone on Bitstamp. The indicator also shows relatively little volume above US$0.50. Since September last year, the asset had been trading in a defined range between US$0.18 and US$0.53.

Long/short open interest (top panel, chart below) on Bitfinex is currently 81% long, with longs increasing slightly over the past month and shorts decreasing slightly in the same time period. A significant price movement downwards will result in an exaggerated move as the long positions will begin to unwind. This is known as a "long squeeze", which likely contributed to the drop on March 12th.

A potential bearish Pitch Fork (PF), with anchor points in December and April, encapsulates the range of the current downtrend. The spot price will continually attempt to return to the median line (yellow) throughout the duration of the trend, currently at US$0.098.

The lower bounds of support represent a buy zone whereas the upper bounds of the resistance represent a sell zone. The trend will remain bearish until the asset definitively breaches either zone. The upper bound is currently below spot price suggesting potential invalidation. Over the past year, the spot price has maintained its position above the upper-half of the PF. The lower bound support is currently US$0.0527.

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. Trades are typically opened when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish: the current spot price is inside of the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and below the spot price. The most prudent long entry will take place once the spot price is above the Cloud with a bullish TK cross, otherwise, the trend will likely remain bearish.

Lastly, on the daily XRP/BTC chart, trend metrics remain bearish. A bearish Kumo breakout occurred in February 2019, followed by a bearish 50/200EMA Death Cross in March 2019. Significant buying momentum is unlikely to return until price breaches the 200-day EMA, currently at 2,700 sats.

Over the past few months, the spot price has failed to complete a bullish Kumo breakout, which also suggests further bearish downside. VPVR also shows a significant volume resistance node from 2,800 sats to 5,000 sats. Yearly pivot horizontal resistance also stands at 5,000 sats with horizontal support at 100 sats. A high volume retest of the local low at 2,400 sats is likely so long as the spot price remains below the Cloud.

Conclusion

On-chain fundamentals for XRP are skewed due to both a recent spam attack on the network and the escrow rotation of sold and unsold XRP each month. Despite the numerous RippleNet partnerships and announcements over the past several years, including recent partnerships with SBI holdings in Japan, on-chain metrics do not show a sustained increase in activity. For many, regulatory clarity regarding the status of the XRP token as an unregistered securities offering by Ripple Labs is still needed. To further muddy the waters, Ripple also likely plans for an IPO in the near future.

Technicals for both the XRP/USD and XRP/BTC pairs are bearish. Both pairs remain below their respective 200-day EMA and daily Cloud resistance levels. Continued selling pressure by Jed McCaleb on Bitstamp may dampen any bullish rally in the short term and exacerbate any bearish rally. XRP/USD will need to breach the US$0.25 zone and the XRP/BTC pair will need to breach the 3,000 sat zone before any chance of an extended bullish rally.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow