There’s a Bitfinex “Whale” Looking to Buy Bitcoin in the High-$8,000s

It’s been a tough past few days for Bitcoin.

After holding $9,300 for days on end, the cryptocurrency on Saturday slipped under $9,000. The leading cryptocurrency reached a local low of $8,840 on many leading spot and margin exchanges.

Many traders were caught off guard by this move to the downside.

At least $20 million worth of longs on BitMEX alone were liquidated during this drop. This adds to the approximately $50 million in longs liquidated across the past few days.

BTC position liquidation chart for BitMEX from crypto derivatives tracker Skew.com

Buyers seem to be stepping in, though, providing Bitcoin with a boost as it enters a crucial price region.

Bitcoin Whale Is Stepping In

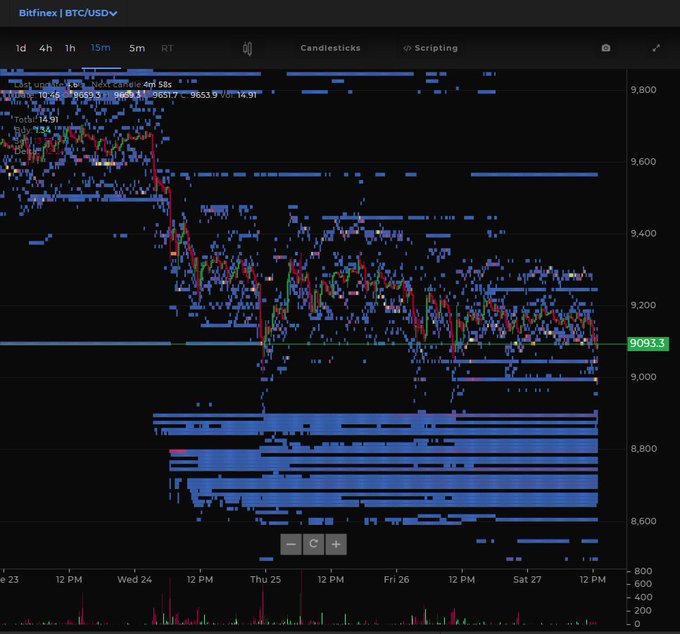

According to a crypto day trader, Bitfinex’s order book data shows that a big buyer (or buyers) is stepping in. He shared the image below to illustrate his point.

It shows that seemingly a single player or small group of players have stacked Bitcoin buy orders between $8,600 and $8,800. The orders are at such a size that the trader who shared the chart called the entity a “whale.”

Bitcoin price chart with order book dominance bands indicator shared by day trader "Jonny Moe" (@Jonnymoetrades on Twitter)

Bitfinex’s order book has a strong track record in predicting Bitcoin’s directionality.

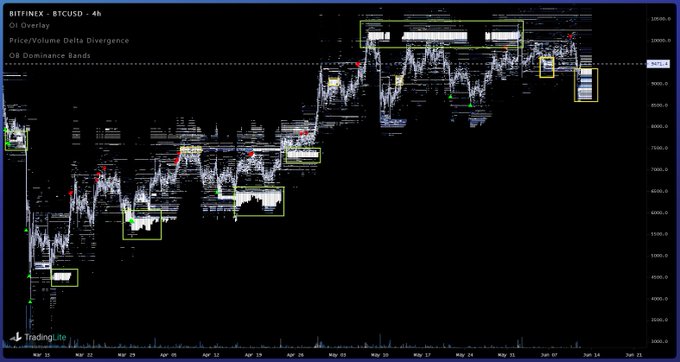

Below is a chart shared by another trader, but this time with a more macro view of BTC’s price in relation to the Bitfinex order book.

It shows that many of BTC’s rallies over recent months were preceded by strong buying support per Bitfinex’s order books. Also, each top around $10,000 was marked by strong selling support as per the order book.

This historical precedent suggests that BTC may manage to undergo a relief rally.

Will Eventually Revert to the Downside

Despite the order book data, not everyone is convinced the rally Bitcoin may see will be sustainable.

As reported by NewsBTC previously, on-chain analyst Cole Garner noted that BTC’s next “big” move is likely to be to the downside.

He backed this sentiment by citing the swelling sell-side pressure from miners, a bearish order book delta on Bitfinex, and institutions having a net short position through the CME’s Bitcoin futures.

This confluence, Garner explained, will result in Bitcoin dropping to the $7,800-8,200 range.

1/ I am massively bullish on #Bitcoin, but I think the next big move is likely down.@glassnode just reported the largest $BTC transfer from miners to exchanges in over a year. pic.twitter.com/Uwj4hHveyx

— Cole Garner (@ColeGarnerBTC) June 24, 2020

There is also a bearish technical case to be made.

Blockroots’ founder Josh Rager said last week that Bitcoin losing the support of the region around $9,000 could be followed to a drop to $8,500. The trader added that a move to $8,500 could make this summer “long” for bears, referencing the level’s importance.

“BTC’s range is clear. Current support that has been holding the past three weeks is the mid-range Break down here and price likely to see $8900 followed by $8500 range bottom,” Rager wrote.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt There's a Bitfinex "Whale" Looking to Buy Bitcoin in the High-$8,000s

OhNoCrypto

via https://www.ohnocrypto.com

Nick Chong, Khareem Sudlow