Chainlink (LINK) Breaking This Single Level Could Spark a Fresh Surge

Chainlink (LINK) started a sharp downside correction from the $19.93 high against the US Dollar. It is now trading above the $15.00 support and eyeing a fresh surge above $17.00.

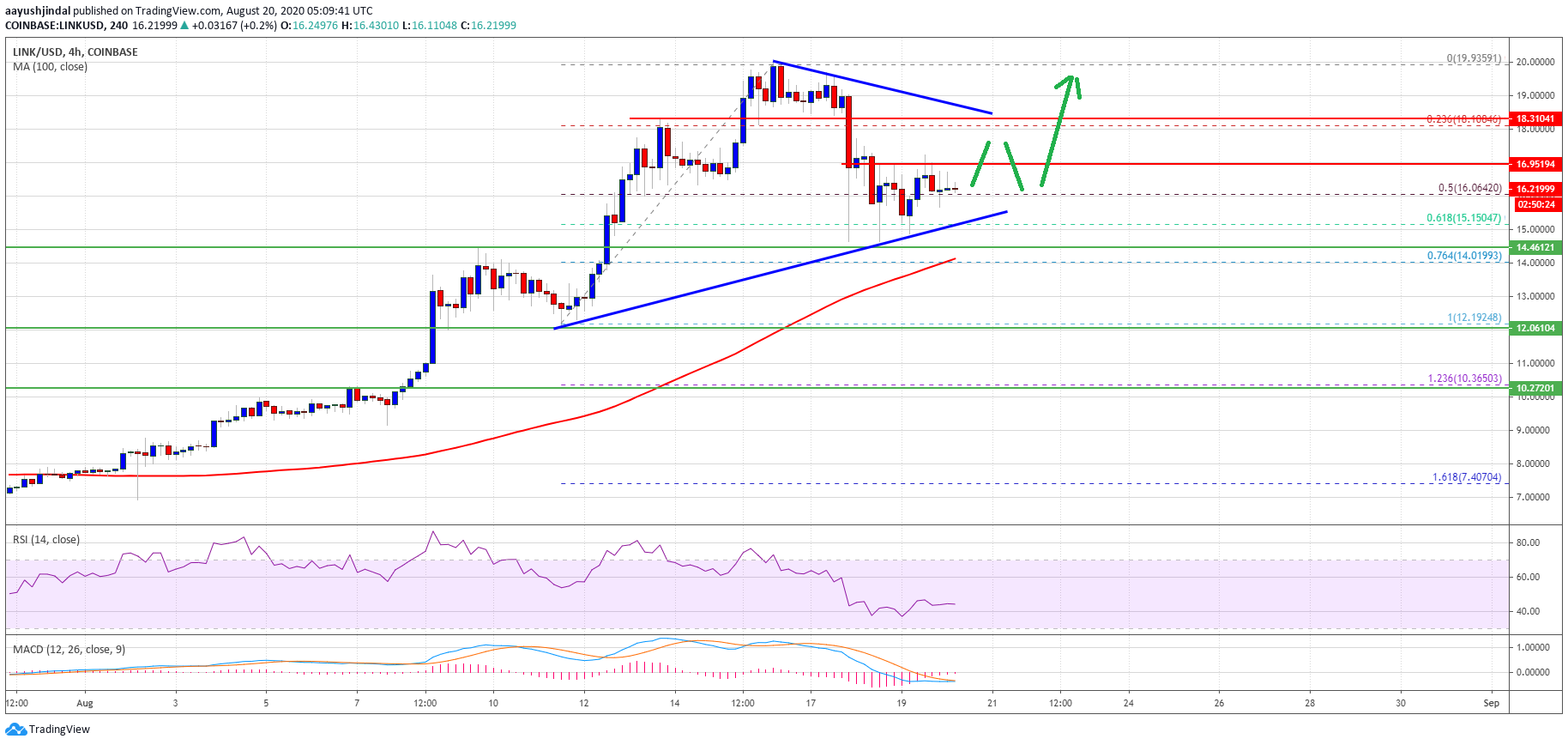

- Chainlink token price is trading above the key $15.00 support zone against the US dollar.

- The bulls are facing a couple of important hurdles near the $16.95 and $17.00 levels.

- There is a key bullish trend line forming with support near $15.40 on the 4-hours chart of the LINK/USD pair (data source from Kraken).

- The pair is likely to start a fresh surge once it clears the $17.00 resistance zone.

Chainlink (LINK) Showing Bullish Signs

After surging close to $20.00, chainlink (LINK) started a substantial downside correction against the US Dollar. LINK formed a new all-time high near $19.93 and declined below the $18.00 support zone.

The price broke the key $17.00 support zone to move into a short-term bearish zone. There was also a break below the 50% Fib retracement level of the upward move from the $12.19 swing low to $19.93 high.

However, the bulls were able to protect the $15.00 support zone and the price stayed well above the 100 simple moving average (4-hours). It seems like the 61.8% Fib retracement level of the upward move from the $12.19 swing low to $19.93 high is acting as a strong support.

LINK price above $16.000. Source: TradingView.com

The price is currently trading nicely above the $15.50 and $16.00 levels. There is also a key bullish trend line forming with support near $15.40 on the 4-hours chart of the LINK/USD pair.

On the upside, LINK price is facing a major hurdle near the $16.95 and $17.00 levels. If there is an upside break above $17.00, the price could test the next hurdle near $18.00 or a connecting bearish trend line forming with resistance near $18.30 on the same chart.

Dips Supported

On the downside, chainlink’s price is likely to find strong bids near the trend line support and $15.00. The next major support is near the $14.00 level and the 100 simple moving average (4-hours).

A downside break below the $14.000 support level could push the price into a bearish zone. In the stated case, the price could dive towards $12.00 or even $10.00.

Technical Indicators

4-hours MACD – The MACD for LINK/USD is about to move into the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for LINK/USD is still well below the 50 level.

Major Support Levels – $16.00, $15.80 and $15.00.

Major Resistance Levels – $17.00, $18.00 and $18.30.

OhNoCrypto

via https://www.ohnocrypto.com

Aayush Jindal, Khareem Sudlow