Despite Pushing to $11,000, Here’s Why Bitcoin Could Soon Reverse

Bitcoin has been pressing higher despite weakness in the altcoin market. Seemingly rallying off strength in legacy markets, the leading cryptocurrency on Wednesday morning shot to a price just shy of $11,000.

As of this article’s writing, BTC trades for $10,970, far above the price points it was trading at just days ago.

While this price action is undoubtedly positive, there are some technical and on-chain signals suggesting a bearish reversal is nigh.

Related Reading: This European Crypto Exchange Was Just Hacked for $5 Million

Bitcoin Could Reverse as Key On-Chain Signal Flashes

Blockchain analytics firm Santiment posted the tweet seen below on September 16th. It shows that according to its data, there has been a “significant spike in idle BTC” changing hands, suggesting a long-term holder or “whale” is looking to use his coins.

While it is unclear what the user(s) plan to do with their coins, such on-chain shifts purportedly signal trend changes:

“With this latest $BTC token age consumed spike, the largest in nearly 5 months (since Apr 29th), we are at a very important moment with #Bitcoin on the cusp of breaking $11k again. This metric typically indicates an imminent price direction shift.”

With this latest $BTC token age consumed spike, the largest in nearly 5 months (since Apr 29th), we are at a very important moment with #Bitcoin on the cusp of breaking $11k again. This metric typically indicates an imminent price direction shift. https://t.co/lM9mVfRRrY https://t.co/burSeSLObF

— Santiment (@santimentfeed) September 16, 2020

Bitcoin reversing from current levels would mark a bearish reversal of the ongoing rally, not a continuation to the upside.

The sentiment put forth by Santiment is similar to that mentioned by a number of technical analysts.

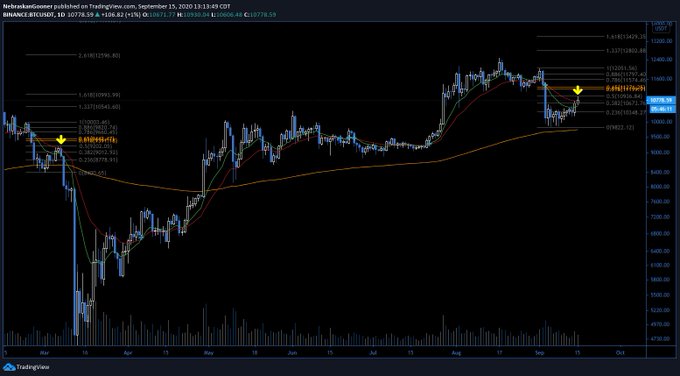

As reported by NewsBTC previously, analysts think that the ongoing BTC rally could end at $11,000-11,200. One trader cited the chart below, which shows that the region fits with his Fibonacci Retracement analysis; another pointed to the fact that BTC firmly bounced off $11,000-11,200 multiple times in August, suggesting it’s an important level to watch.

Chart of BTC's price action over the past few months from trader NebraskanGooner. Chart from TradingView.com

Related Reading: Here’s Why This Crypto CEO Thinks BTC Soon Hits $15,000

Long-Term On-Chain Trends Are Still Abundantly Positive

Short-term on-chain trends may signal caution for cryptocurrency traders. Investors, though, should not be as worried as long-term on-chain trends remain abundantly positive, suggesting a steady bull run is likely in the years ahead.

Blockchain data analytics firm CryptoQuant shared the table below on September 16th.

It shows that a swath of leading on-chain indicators — from metrics of miner health to exchange flows and stablecoins — signal it’s time to buy Bitcoin. Some indicators, such as ones focused on stablecoins, signal a “Strong Buy” for BTC, CryptoQuant indicates.

Long-term $BTC on-chain indicators look healthyhttps://t.co/VnrIVP3lDF pic.twitter.com/cfE73acVXh

— CryptoQuant (@cryptoquant_com) September 16, 2020

Related Reading: It’s “Logical” for Ethereum To Reject At Current Prices: Here’s Why

Featured image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Despite Pushing to $11,000, Here's Why Bitcoin Could Soon Reverse

OhNoCrypto

via https://www.ohnocrypto.com

Nick Chong, @KhareemSudlow