Coinbase December 2020 Market Maker Program

At Coinbase, we are on a mission to create an open financial system for the world. Over time, Coinbase has improved our exchange experience by offering clients access to a growing number of efficient cryptocurrency markets. A key reason we’re able to do so is the strong community of clients who act as “makers” of liquidity on our exchange. By instituting a Market Maker Program, we will begin rewarding participants for diversifying their activity across a wide set of trading pairs. This helps to further improve the Coinbase experience by creating an environment that increases the efficiency for any client to buy or sell from our markets.

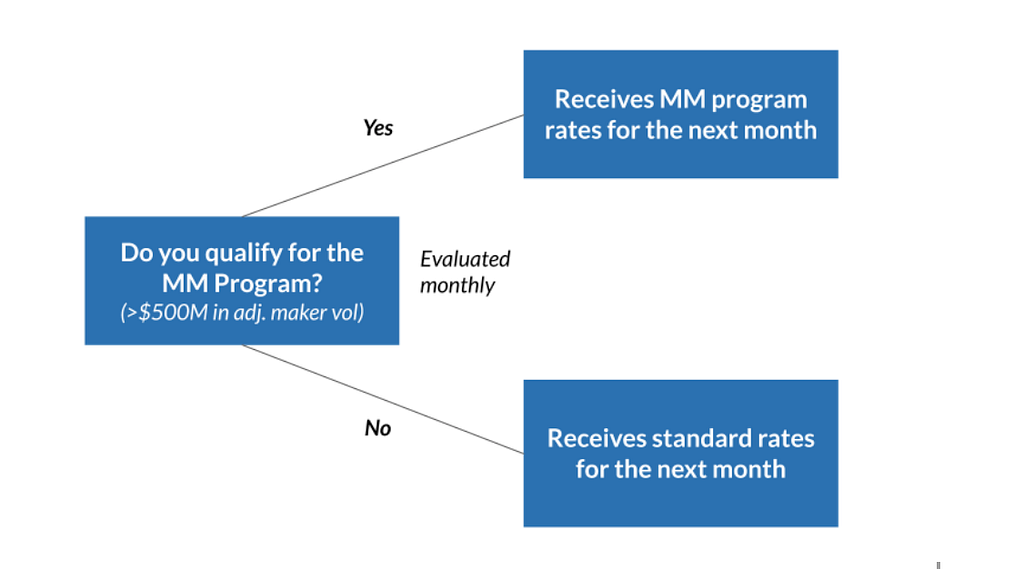

Our Program will reward qualifying exchange clients with access to new pricing tiers. To meet the requirements for our Market Maker Program, one must trade above a certain threshold in trailing 30 day adjusted maker volume score (“AMV”). Scores are calculated as of 00:00:00 UTC the last day of each month pursuant to that month’s AMV, and qualifying participants will have their trading fees accordingly starting the first day of the following month.

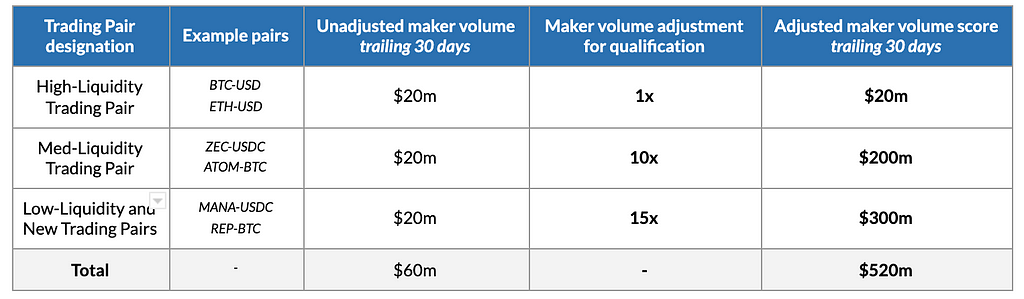

To qualify for the program in December 2020, the minimum the AMV is $500m. The AMV is defined as the sum of the following:

- 15x low-liquidity and new pair maker volumes

- 10x med-liquidity pair maker volumes

- 1x high-liquidity pair maker volumes

In the following illustrative example, a client trades $400m in total volume on a trailing 30 day basis, $60m of which is maker volume traded evenly across high, medium, and low liquidity trading pairs:

* Detail on which trading pairs are classified as low, med, or high-liquidity provided below

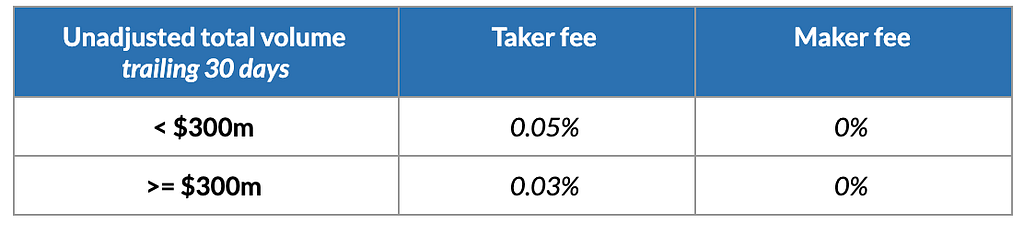

Those who qualify for the program will receive the following pricing structure until the next monthly reset based on their unadjusted total volume on a trailing 30 day basis:

In the example above, the client qualifies for the program with an AMV of $520m which is greater than the threshold of $500m. As a result of their qualification, the client will receive the Market Maker program rates for their total unadjusted volume of $400m (3 bps instead of 5 bps in taker fees offered on our standard rates).

The program is designed to offer rewards to participants including, but not limited to, top tier trading rates. If you qualify, your account will be updated, and you will be notified once new pricing rates go into effect. If you believe you may qualify for our Program, please contact mmprogram@coinbase.com for more information.

The structure of the program may change over time, and may include:

- Changes in the threshold adjusted maker volume score required for qualification

- Classification of which trading pairs are considered low, med, and high liquidity

- Associated multipliers for low, med, and high liquidity trading pairs in the adjusted maker volume score

- Additional eligibility criteria that effectively rewards clients for improving the liquidity offering of our exchange

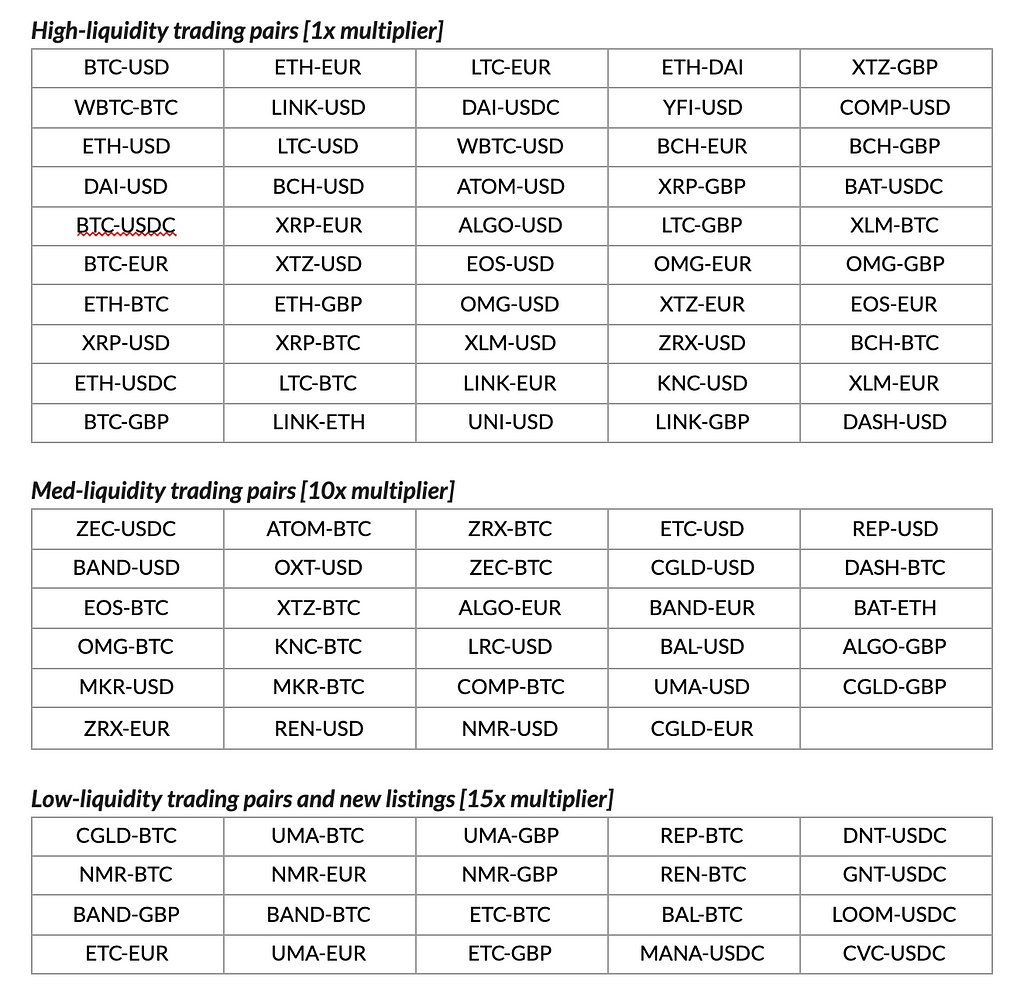

Classification of trading pairs by liquidity multiplier:

The below details the classification of high, medium, and low liquidity trading pairs and their relative multipliers for December 2020. The classification of each trading pair and their AMV multipliers are subject to change in the future.

Information contained in this blog post is subject to change.

Coinbase December 2020 Market Maker Program was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

OhNoCoinbase via https://www.ohnocrypto.com/ @Coinbase, @Khareem Sudlow