Why New Highs May Be Imminent For Bitcoin if $16,150 is Reclaimed

Bitcoin has begun to slide lower over the past few days as selling pressure has tapered off at the $16,500 highs. The leading cryptocurrency currently trades for $15,900, a few percent below those highs but still situated above key support levels.

Analysts remain optimistic despite the downward-sloping price action. One trader says that if the cryptocurrency can move to new year-to-date highs and multi-year highs if it manages to close above $16,150 on a short-term basis.

That level has been important for the cryptocurrency over the past few days, marking local bottoms.

Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom

Bitcoin Could Move to $16,600 And Beyond if This Level Is Confirmed as Support

Bitcoin managing to flip $16,150 into a support level will likely mean the cryptocurrency pushes to new trend highs at $16,600 and beyond, a trader recently said.

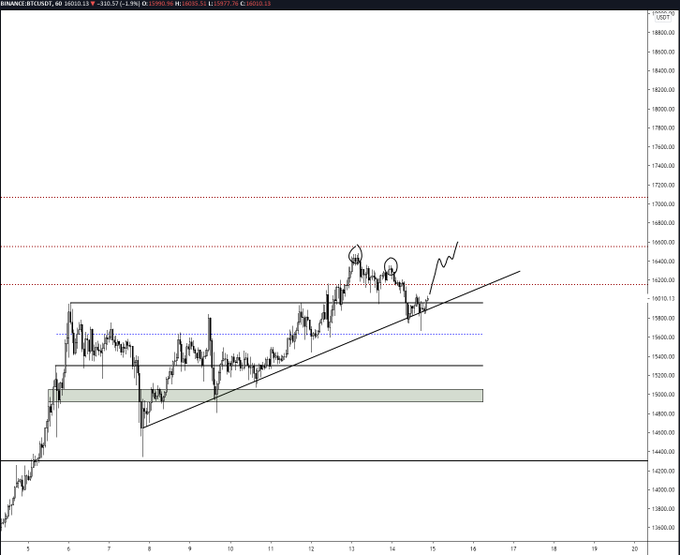

He shared the chart below recently, which shows that the level has been important for Bitcoin, marking two short-term bottoms over the past few days:

“$BTC – Highs are looking ripe for the taking. A move to $16.6k should take care of that. Further confirmation on a reclaim of $16,150.”

Chart of BTCs price action over the past 10 days with an analysis by crypto trader "UB" (@CryptoUB on Twitter). Source: BTCUSD from TradingView.com

Related Reading: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin

Long-Term Trend Positive for BTC

The long-term trend of Bitcoin remains positive as the fundamental trends still favor long-term growth. Robert Kiyosaki, the author and entrepreneur behind the book “Rich Dad Poor Dad,” recently said:

“Bitcoin boom beating gold and silver. What does that mean? It means you better buy as much as you can now. Train is moving. Dollar dying. Silver still affordable for everyone. As dollar crashes what counts is not price but how many coins of gold, silver, or Bitcoin you own.”

Tyler Winklevoss, CEO of Gemini and a Bitcoin billionaire has echoed this. Winklevoss thinks that the vast amount of money printing taking place due to the lockdowns will result in a rally in the price of gold and Bitcoin. He thinks that the leading cryptocurrency will outpace the precious metal due to it having arguably more scarce properties.

Winklevoss thinks that Bitcoin could hit $500,000 in this market cycle due to fundamental trends. This would give the cryptocurrency a market capitalization higher than that of gold.

Related Reading: 3 Bitcoin On-Chain Trends Show a Macro Bull Market Is Brewing

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Why New Highs May Be Imminent For Bitcoin if $16,150 is Reclaimed

OhNoCrypto

via https://www.ohnocrypto.com

Nick Chong, @KhareemSudlow